Table Of Contents

What Is A House Call?

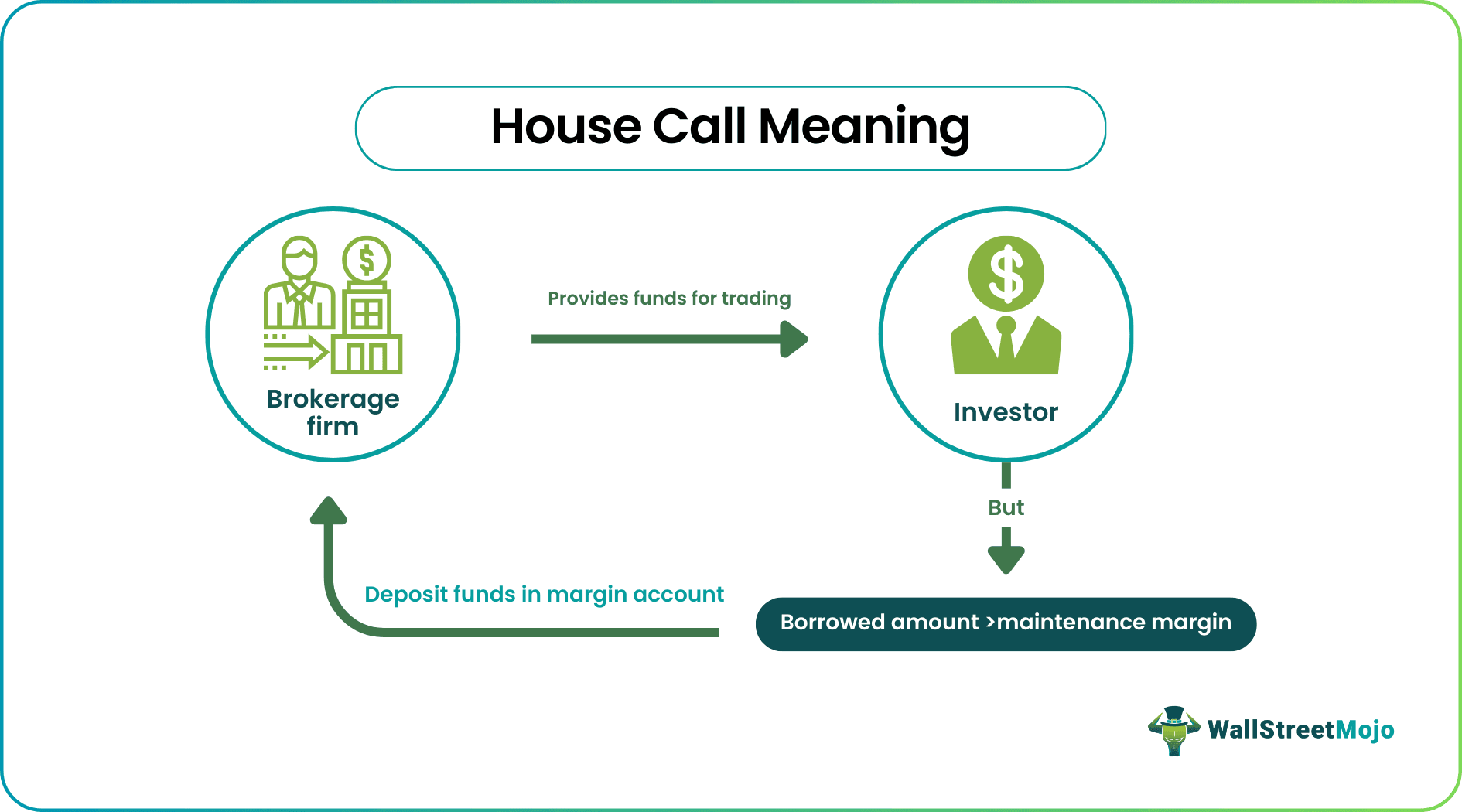

House call refers to a call where brokerage firms ask account holders or investors to deposit additional funds in the margin account as a backup in the event when the balance falls below the maintenance margin. Such a fund shortage typically arises when investors borrow excess amounts from the margin account to buy securities. The purpose of notifying account holders about adding funds to the margin account is to maintain the required balance.

Brokerage houses, banks, and depositors use the house call margin, a type of margin call, to offset shortfalls in cash or securities holdings. It alerts organizations and investors about funds falling below the maintenance margin. When the capital falls below the defined margin, and the account holder is unable to replenish it, the account is usually liquidated.

Table of contents

- What Is A House Call?

- House call states that investors must maintain adequate funds in their accounts to cover the borrowings initiated and used for trading purposes.

- It is triggered when a trader's owed (borrowed) money is more than the balance amount. As a result, a trader faces excess liability in such situations.

- According to FINRA, the house call rate for certain investments ranges between 30% and 100%. Investors can borrow up to 50% of the securities value from the brokerage firm.

- In case of non-payment by a trader or failure to replenish the account balance, the brokerage house or clearing house liquidates the equity or securities the investor holds.

House Call Explained

A house call is a lesser-known concept in margin trading. It typically asks customers to deposit a certain sum of money in the account whenever the balance falls below the maintenance margin. The application of this margin is usually seen in brokerage firms. Individuals who buy assets from leverage are required to maintain this margin. A house call ensures an account’s smooth functioning by complying with capital requirements. Thus, the chances of losses are reduced. Customers or investors must refill the account immediately when the need arises.

Brokerage firms usually decide the minimum requirements. They may adjust it from time to time based on trading requirements. However, one of the eligibility requirements states that it must be higher than the rate prescribed in Regulation T by the Federal Reserve Board. In addition, all the holdings, transactions, and securities must adhere to the relevant regulations. Also, brokerage firms may specify higher margin requirements for investors who trade in high-risk securities.

House call margins are usually seen in brokerage houses. Investors who wish to generate maximum or multiple returns buy extra shares using money from margin accounts. Like a credit facility, they borrow money from their broker-dealer account. These accounts show the liability or capacity of an investor to borrow funds. Apart from common shares, any loan for trading shares is included under this liability. So, if the share price increases, it generates profits for investors. In such cases, they can repay the money originally borrowed. In a bearish market, profits are usually low. However, investors still need to repay the sum they owe to brokerage firms. Hence, when borrowings exceed the account balance, the margin may fall, and a house call is triggered.

Investors must respond to a house call when the balance falls. They must either sell their assets to compensate for the amount borrowed or deposit enough funds in the account. It ensures the account has adequate funds over and above the money owed to the brokerage firm. If an account holder fails to meet the financial commitment, the brokerage house will liquidate their assets to recover the amount.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Requirements

Investors must meet certain requirements to be eligible to trade. Let us understand the requirements proposed by the Financial Industry Regulatory Authority (FINRA):

- The brokerage firm maintains a margin of at least 25% of the investor's investments as collateral. However, some brokerage firms ask for a margin between 30% and 40% based on the risks involved in trading. For example, the house call margin of Fidelity investments is between 30% and 100%. However, it must be met within five business days.

- Per Regulation T, a customer or borrower can borrow up to 50% of the purchase price of the securities. After that, they must maintain the balance until it touches the maintenance margin.

- On failure to repay or replenish the account, the brokerage house has the right to liquidate an investor's securities.

- The minimum maintenance margin level is 20% of the contract's current market price for securities futures contracts.

Examples

Let us look at some examples to understand the concept well:

Example #1

Suppose George is an investor who trades in the equity market frequently. The majority of his stocks belong to large-cap and mid-cap companies. To execute the trades, he collaborates with a brokerage firm. It allows George to borrow 30% of the trade amount. So, if he wants to buy $2500 worth of shares, the brokerage house will allow $1250 as debt. However, there are certain requirements for this account. As George majorly deals in higher amounts, he frequently borrows from the firm. As a result, in some time, the balance falls below the maintenance level (margin). The funds dropped to -20% ($1000 negative balance). In this case, a house call was made.

In such situations, George must deposit $1000 to become eligible again for credit borrowing. However, he only deposits $800 in response to the house call demanded by the firm. Therefore, the brokerage house sells $200 worth of shares George holds. Later, via sale, the firm recovers the remaining balance and balances the maintenance margin.

Example #2

According to a July 2023 article, the commodity cocoa registered a gain of 13.13% in the second quarter. Investors via Intercontinental Exchange (ICE) futures participated in these commodity trades. The maintenance margin on cocoa was $1430 per cocoa for a contract value of $33,390, slightly lower than the initial margin of 4.7%.

This sheds light on how the maintenance margin impacts trading decisions investors might make when an opportunity shows up. For higher contract values, brokerage houses need higher margins to offset potential losses during or after trading.

House Call vs Margin Call

House and margin calls are quite similar. However, certain minor differences are seen. Let us look at some points that highlight the differences between them.

| Basis | House Call | Margin Call |

|---|---|---|

| Meaning | The brokerage firm asks a trader to deposit money to close the gap created by borrowing excess money from the firm. | A margin call is the amount the broker requests to be deposited in the margin account. |

| Purpose | It ensures balance funds do not fall below the margin call. It also aims to set off losses. | It ensures the balance does not fall into the negative zone. |

| Rate (% or amount) | The house call ranges between 30% and 100% for certain investments. Some brokerage houses require traders to maintain a 30% to 40% margin amount. | According to FINRA, the minimum margin requirement is $2000 for margin trading. |

| Who determines? | The brokerage firms or clearinghouses determine the rate. However, it must be higher than the rate mentioned in Regulation T. | FINRA decides the margin call requirement. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Fed call refers to the rule requiring investors to contribute at least 50% of the sum required to buy securities. It is usually triggered when an account does not have the funds to meet the initial margin requirements. On the other hand, a house call is triggered when the maintenance margin falls below a specified level.

The only way to avoid house calls is to keep track of the funds in the margin account. If the balance declines, it indicates that fund replenishment is needed. However, the most important factor here is to monitor the borrowed amount and check how close it is to the maintenance margin. Any time the borrowed amount crosses the maintenance margin level, a house call is triggered.

House call has different meanings in finance and medicine. In finance, it refers to a demand made by brokerage firms, where a trader or investor is asked to add funds to the account held with the brokerage firm. A visit made by a doctor or nurse to a patient's house is called a house call in the medical profession.