Table Of Contents

What Is Hotelling's Theory?

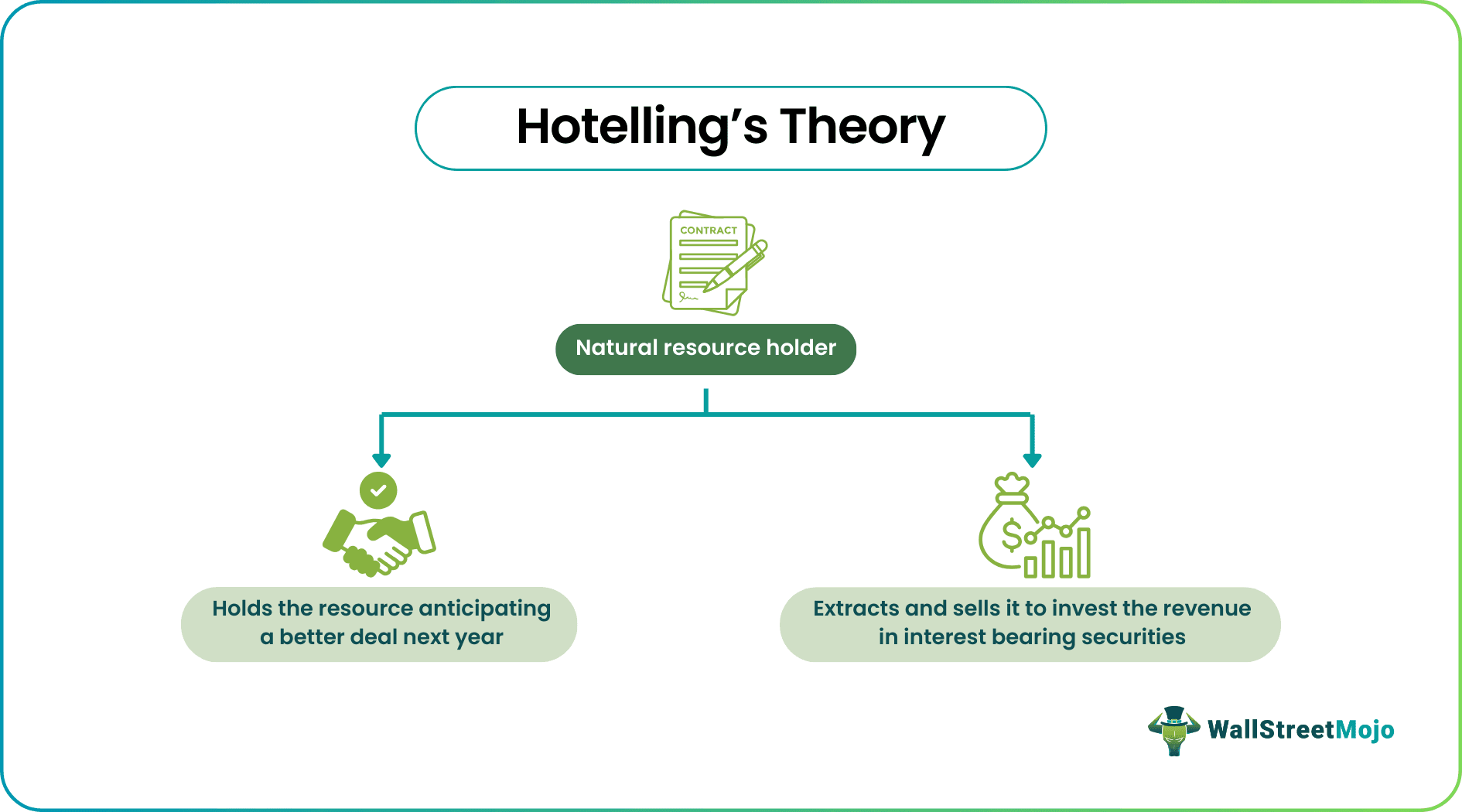

Hotelling's theory suggests that owners or producers of nonrenewable resources shall only produce the commodities when their revenue is equivalent or more compared to other financial instruments. The approach is also called Hotelling's rule. This theory aims to try and forecast the price of oil and other nonrenewable resources based on current interest rates.

The utility of the theory lies in predicting the future interest rates of oil and other nonrenewable resources based on the present market scenario. However, it is a simple theory that elaborates on the changing prices of nonrenewable resources. The whole concept is based on multiple assumptions, making it difficult for economists to employ it in the real world.

Table of contents

- What Is Hotelling's Theory?

- Hotelling's theory asserts that producers should only extract non-renewable resources when their revenue surpasses that of other financial instruments.

- Harold Hotelling, an American mathematician, introduced the concept, explaining the dramatic inflation of exhaustible resources.

- Moreover, the critical application of the Hotelling theory is to predict future oil prices. Which is based on recent past and current market interest rates.

- Many economists criticize the theory for being based on several assumptions. However, the prominent one would be that markets always remain efficient.

Hotelling's Theory Explained

Hotelling's theory states that when a holder or owner of exhaustible natural resources produces the required commodities, its revenue can surpass the earnings from other simple interest-bearing financial instruments. The gap between the marginal extraction costs and the market price of such nonrenewable resources is called scarcity rent. Thus, this can be achieved by emptying the stock of market resources. Besides, it is also understood as the net return from the sales of a natural resource in a perfectly competitive market.

Moreover, economists use this concept to forecast future prices of nonrenewable resources. Thus, more prominently, oil, and reference the current interest rates. As per Harold Hotelling, business owners can follow one simple rule. It is to keep the resources anticipating a better return or extract and sell them utilizing the profit as investments in interest offering securities and assets.

But for this to happen, Hotelling's r-percent growth rule describes that the rate of change of exhaustible resources must equal the interest rate implied by an extractor to discount the future. When the extraction costs are zero, the prices of the held or unmined resources are the same. Furthermore, Hotelling's theory suggests that firms will tend to position themselves as close to their competitors while maintaining a sufficient customer base.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

History

The theory was introduced by Harold Hotelling in 1931. He was a well-known American economic theorist and statistician. Moreover, he pursued the answers to the dramatic rise in nonrenewable resources and explained the supply variation of commodities. His prominent works include T-squared distribution and the principal component analysis used in statistics, finance, and computer science.

Moreover, the concept is based on the earlier works of Harold Hotelling on natural resources. The analysis was published in the Journal of Political Economy. Therefore, this analysis suggests that the resource owners have two options:

- Let go of the original resources and remain as physical assets or extract them.

- And to sell and use the earnings to invest in financial assets and instruments.

Assumptions

The assumptions of Hotelling's theory are -

- The market is always at an equilibrium, and no internal or external factor directly or indirectly influences the interest rates or market conditions.

- Hotelling theory believes that owners of non-renewable resources are only driven by profit and have no other motive.

- In his theory, Harold Hotelling suggests that there is a constant supply of exhaustible resources, and there will be no fluctuations in the supply in the future.

- Moreover, the theory declines the idea of technological advancement and innovation in the production of commodities.

- Another assumption is that the owner will continue producing a certain amount of resources yearly.

Examples

Here are two hypothetical examples of Hotelling's theory -

Example #1

Suppose Anthony is an oil mine owner, the spot price of one oil barrel is $99, and the annual interest is 9%. The market conditions suggest the prices will hike the following year and reach $117 per oil barrel. Anthony has yet to extract the oil. But if he decides, he will earn $99 for every oil barrel plus the interest rate of 9%, totaling $107.91 by the year's end.

But Anthony thinks long-term and is patient enough to wait for the following year. So, as per the market forecast, if the prices rose to $117, it would be wiser to make more profit. Hence, Anthony does so, and by the following year, the oil prices rise, and the interest rates also increase to 11%. Now Anthony sells it and earns $117 per oil barrel plus 11% interest which makes it $129.87.

Therefore, it expands on the effects of competition between supply and owner's production. However, in the real world, many other factors eventually influence the concept.

Example #2

Typically, a natural resource producer has two options: wait for a better deal or sell the extracted resource. Hence, considering the above example, suppose Anthony decides not to stay for next year and extracts and sells it; he also uses the revenue earnings to invest in the US treasury.

It is often observed that the price of oil and other exhaustible resources is highly volatile. Hence, they are highly inflated the following year, and Anthony loses the opportunity. Therefore, in the long term, the investment made by Anthony may become equivalent to the returns from the extraction and selling of natural resources. In both examples, Anthony follows the Hotelling rule of either leaving the help for a better time or extracting it and investing the revenue.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The problem with Hotelling's theory is that it is based on several assumptions, making it difficult for economists to employ the concept in any market practically. Since, the rule only applies to exhaustible resources and commodities, especially oil, because of high price volatility, which is not observed in most financial instruments.

There are three types of efficiencies - allocative, productive, and dynamic efficiency. Allocative efficiency makes sure that exhaustible natural resources are allocated for alternative uses. Hence, to maximize utilization, productive efficiency is to ensure that the resources are being produced at the lowest possible average cost, and dynamic efficiency is the amalgamation of both allocative and productive efficiency to improve the overall system of uses, adjustments, innovation, and investment.

Hotelling's theory in politics states that voters are most likely to vote for candidates with whom they have a matching thought process and share common motives. The political parties adjust their platform to the median of voters' demand, primarily done in a two-party system to increase the vote candidates can get from the public.