Table Of Contents

What Is Homemade Leverage?

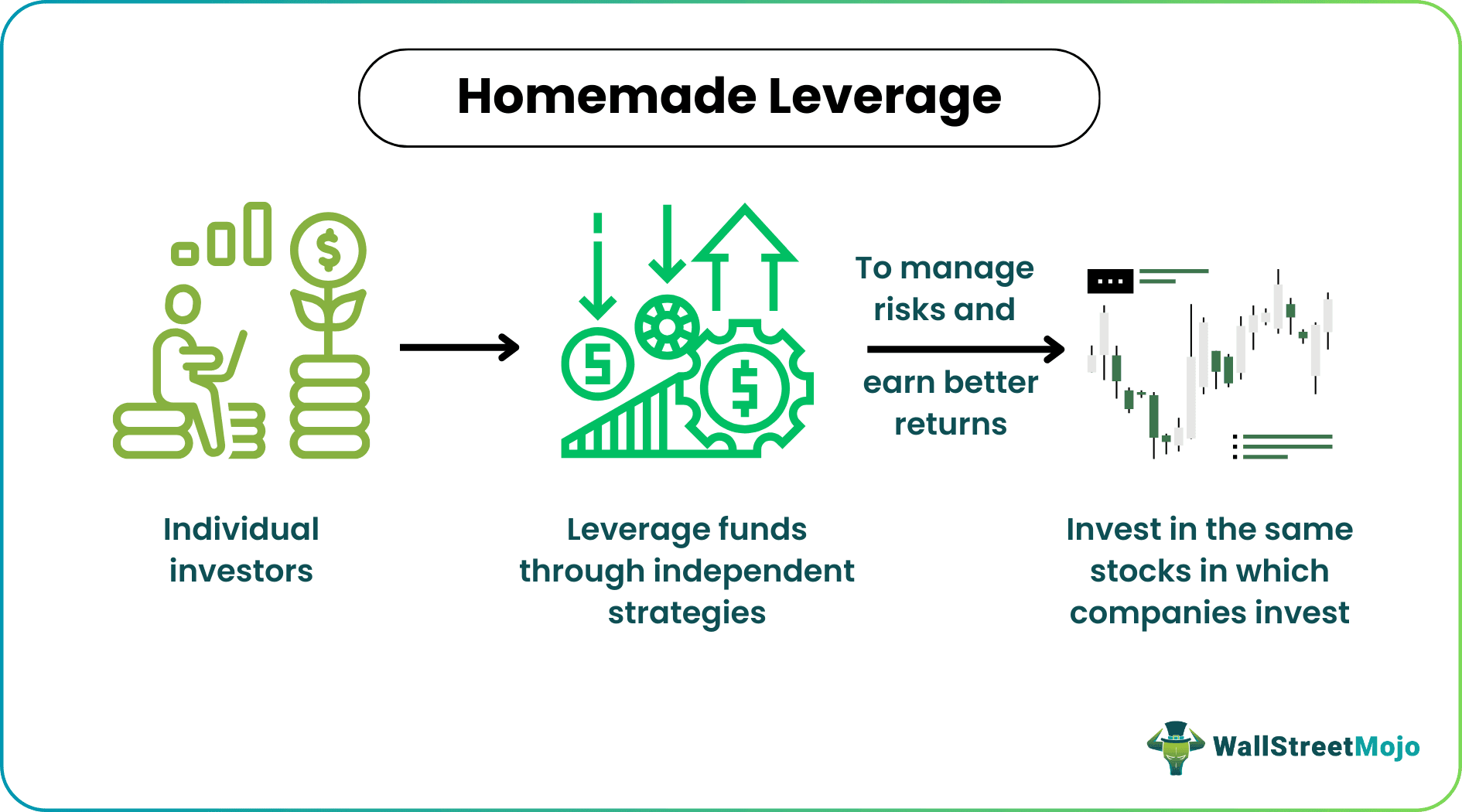

Homemade Leverage is the process of investors replicating corporate leverage ideas and strategies by borrowing on the same terms as the company they have invested in. If the price of levered corporations is high, investors borrow money from their accounts to purchase stock in unlevered companies. Based on the risk and return level an investor is comfortable with; they can adjust their exposure to a company’s stocks.

Individual investors use this technique to replicate the effects of leverage generally associated with borrowing while avoiding actual borrowing. It entails using personal assets and investment strategies to increase future profits or risk exposure in an investment portfolio. While homemade leverage can boost profit-making prospects, the risks are also higher.

Key Takeaways

- Homemade leverage strategy is a process where people reproduce corporate leverage ideas when they borrow (or lend) on the same terms as the company.

- Individual investors can increase their investment profits or risk or debt exposure by replicating the impacts of borrowing and leveraging it for higher payoffs.

- It can be accomplished through various investing strategies that require in-depth knowledge of the market dynamics and a certain familiarity with respect to drawing projections.

- Homemade leverage offers potential benefits, but it also carries increased risks, and individuals should carefully consider their risk tolerance levels and investment expertise before implementing such strategies.

How Does Homemade Leverage Work?

Homemade leverage is a technique of adjusting the risk-return proportion, helping shareholders introduce leverage into business and take a chance on riskier investments. Leverages are any strategy that involves borrowing money to make purchases while assuming that future earnings will be several times greater than the cost of borrowing.

In this case, investors borrow money at the same rate as the business. It is often associated with companies that do not have debts in their books of accounts or financial statements. Shareholders of such companies introduce debt by borrowing money to invest in such businesses. The concept forms the basis for the Sharpe ratio, the Capital Asset Pricing Model (CAPM), and the Modigliani-Miller Capital Structure Theory.

It is a method that investors use to enhance their exposure to a particular investment or asset class without using the typical leverage available through financial institutions. Individual investors can artificially change a business's leverage by taking out loans at the same interest rate as the corporation. This enables them to increase their portfolio's leverage and imitate the impact leverage can have on the company. Investors who want to invest in unleveraged companies but prefer the impacts of leverage might do so by incorporating leverage into their portfolios. This allows them to invest in an unleveraged company while artificially inducing the returns of a leveraged one.

Examples

Let us look at hypothetical examples to get an insight into the concept.

Example #1

Dan, a borrower, decides to apply homemade leverage. He is an amateur investor and is looking for a homemade leverage formula to estimate the risk associated with the investment. However, because homemade leverage uses various investing methods, it has no set formula. Hence, a homemade leverage formula or strategy can be employed depending on the discretion and judgment of individual investors and the chosen way of generating leverage or leveraging existing investments.

On learning this, Dan uses his available cash to buy stocks on margin. For this, he borrows money to increase his investment position and potentially magnify his gains or losses. He does this through a margin account, which is a common method retail investors use for trading. In this manner, Dan plans to benefit from homemade leverage (if he applies the right strategy).

Example #2

An experienced investor, Susan decided to use homemade leverage to take advantage of a real estate investment opportunity. She found a construction company that deals with real estate and planned to invest in it. To increase her returns, Susan decided to borrow money against the value of her existing investment portfolio rather than get a conventional mortgage.

She managed to get the money required for property purchase and improvements through homemade leverage without disturbing her other endeavors or paying exorbitant interest rates to lenders. Given her knowledge and confidence in the real estate sector, she believed that the potential rewards from company projects would offset the risks her homemade leverage strategy introduced.

Advantages And Disadvantages

Some advantages and disadvantages of homemade leverage have been discussed below:

Advantages

- Potentially higher returns: Homemade leverage might boost investment gains if used correctly.

- Flexibility and autonomy: People have more control over managing their leverage strategies and can modify them to fit their investment goals and risk tolerance levels.

- Benefits of taxation and interest deductions: Loans taken out for investments may qualify for a tax deduction for interest payments, which lowers the overall cost of borrowing. This tax benefit further enhances the advantages of the leverage, making it an appealing choice for some investors. Though these benefits are available, most investors do not prefer taking on new or additional loans. The idea is to generate value through investment strategizing.

Disadvantages

- Increased risk: Increasing the likelihood of profits also increases the likelihood of losses, which could be significant as the risks in this area are high.

- Lack of risk management competence: People may lack the expertise and experience of professionals operating in this domain, which increases the possibility of making unwise investment decisions.

- The effect on creditworthiness: An investor's creditworthiness may be impacted due to such leverage strategies. High debt burdens can damage credit ratings, making it challenging to get more funding or reduce interest rates on future loans. The due diligence process that lenders follow typically requires initiating hard inquiries, which reveals such endeavors and impacts credit history adversely.

Homemade Leverage vs Corporate Borrowing

The differences between both the concepts are given as follows:

| Key Points | Homemade Leverage | Corporate Borrowing |

|---|---|---|

| Definition | This strategy is used by individual investors to benefit from leverage, a strategy usually associated with borrowing without actually borrowing funds. | It is the practice of businesses or corporations borrowing money. Governments or individuals are not covered under this form of borrowing. |

| Source of capital | Personal funds (such as the existing portfolio) are used in homemade leveraging. | External capital from bond markets or banks is used in corporate borrowing. |

| Risk involved | It is usually riskier for an average retail investor. This is so because, unlike corporate debt, investor debt must be repaid individually by the borrower. | Corporate debt, secured by a company's assets and future cash flows, is comparatively less risky. |

| The amount involved | Homemade leverage is normally on a lower scale and used by individual investors. | Corporate borrowing often involves substantial money for business reasons. |

| Regulation | It is subject to fewer regulations. | Borrowing by corporations is subject to several rules and disclosure requirements. |