Table Of Contents

What is Home Mortgage Disclosure Act (HMDA)?

The Home Mortgage Disclosure Act (HMDA) is a provision in the U.S. statute that mandates financial institutions to report, maintain, and disclose loan information on mortgages. The data is used for consumer awareness and is modified to prevent privacy breaches of borrowers and applicants.

The regulation applies to banks, credit unions, savings institutions, and other financial institutions. It was aimed at providing data on public loans to assist financial institutions and public officials and identify patterns in lending. The reports include details on the loan, collateral, applicant, loan status, and denial reason. The data helps recognize discriminatory credit practices.

Key Takeaways

- The Home Mortgage Disclosure Act (HMDA) is a law that mandates lenders to disclose data publicly.

- The data reported includes demographic details, age, gender, loan terms, and denial reasons. There is information that is protected and modified to protect applicants' privacy.

- These include details such as the loan application date, the loan amount, the property value, and debt to income ratio. They are instead revealed in ranges or other manners.

- This prevents discriminatory practices, improves accountability of the financial institutions, and improves transparency and accountability in the market.

Home Mortgage Disclosure Act Explained

The Home Mortgage Disclosure Act is a law in the U.S. that mandates lenders share mortgage data to determine the occurrence of credit discriminatory practices. According to the law, mortgage lenders are required to gather, share, and maintain specific data regarding the applications they receive. They are also required to do the same for loans for purchasing, home improvement, and refinancing.

The regulation provides public data to assist in determining financial institutions' services in providing a community's housing needs. It assists public officials in distributing public sector investments to attract necessary private investments to areas that need financial aid. The regulation also helps identify prevailing discriminatory lending patterns.

It is a revelation of how lenders are serving the community's housing needs. Hence, the HMDA reporting shall contain details of the race, gender, income, and ethnicity of the applicants. Each of the details submitted helps in knowing the property and loan characteristics, demographics, and lender details. The reports also include information on loan-specific pricing rates and fee details. They additionally contain details on loan features, negative amortization features, and negative spreads. Furthermore, the data can reveal if there were pre-approvals and the amount of loans sold between institutions.

Data such as the applicant's credit score, name, date of application, and action taken are not publicly reported. This move is to safeguard the applicant’s privacy. Similarly, the loan amount, property value, and debt-to-income ratios are also modified into ranges to protect privacy.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

History

The HDMA Act was first enacted in 1975 and implemented by Regulation C of the Federal Reserve Board. The regulation was later transferred to the CFPB or the Consumer Financial Protection Bureau. In 1989, the Federal Reserve Board revised the regulation to amend rules in accordance with the FIRREA, or the Financial Institutions Reform, Recovery, and Enforcement Act.

The amendment expanded the home's coverage and included mortgage lenders who are not affiliated with holding companies or depository institutions. It mandates lenders to report home improvement loan applications and mortgage application purchases and originations; the requirement extends to lenders to identify borrower details such as race and income. Lenders shall identify the class of purchaser for loans on mortgages and explain their lending decisions. The institution must submit a loan application register to facilitate this arrangement. This allows institutions to log loan applications, purchases, and originations.

In 1991, the Federal Reserve Board was authorized to develop exemption standards for lenders of non depository mortgages. It was done through the Federal Deposit Insurance Corporation Improvement Act. In 1993, the Regulation was modified to accommodate the Housing and community development act of 1992. A later 1994 amendment made data available to the public. After that, many amendments were made to the act to accommodate the demands of the sector.

Purpose

The purpose of the Home Mortgage Disclosure Act of 1975 is given below.

- The primary purpose of the HDMA is to build a transparent environment in the residential mortgage market.

- It also protects borrowers from discriminatory practices.

- Fosters responsibility and accountability of financial institutions through mandated reporting.

Reporting Requirements

The following are some of the reports that are required to be disclosed under the Home Mortgage Disclosure Act of 1975.

- Information on borrowers' applicants, such as credit scores, the underwriting process, the debt-to-income ratio, etc. The reasons for a loan's denial are also required to be disclosed. Similarly, the application channel and the underwriting automated system results are also recorded.

- Information about the property, construction method used, value, lien property, the number of individual dwellings in the property, and the type of loan applied.

- Information on loan features, pricing information, duration of the loan, interest rates, and non-amortizing features.

- Unique identifier information such as loan originator identifier, property address, and legal entity identifier.

Examples

Let us look at some examples to understand the concept better.

Example #1 - A Hypothetical Example

Imagine a city ABC in the USA. Senior citizens have majorly occupied the city. One of the local banks has a reputation for denying loans to them due to their age factor. The bank feels as if it's a risk lending to them. Since HMDA requires reporting of loan status, the citizens demanded to look into it. It was found that the bank not only denied loans to senior citizens but also neglected the younger people who were of a different ethnicity. Through the data, the banks can be forced to mend their lending practices, be more accountable, and serve the community better. Denying senior citizens their right to borrow on a mortgage is not correct, and the reasons have to be stated under this law.

Example #2 - A Real-Life Example

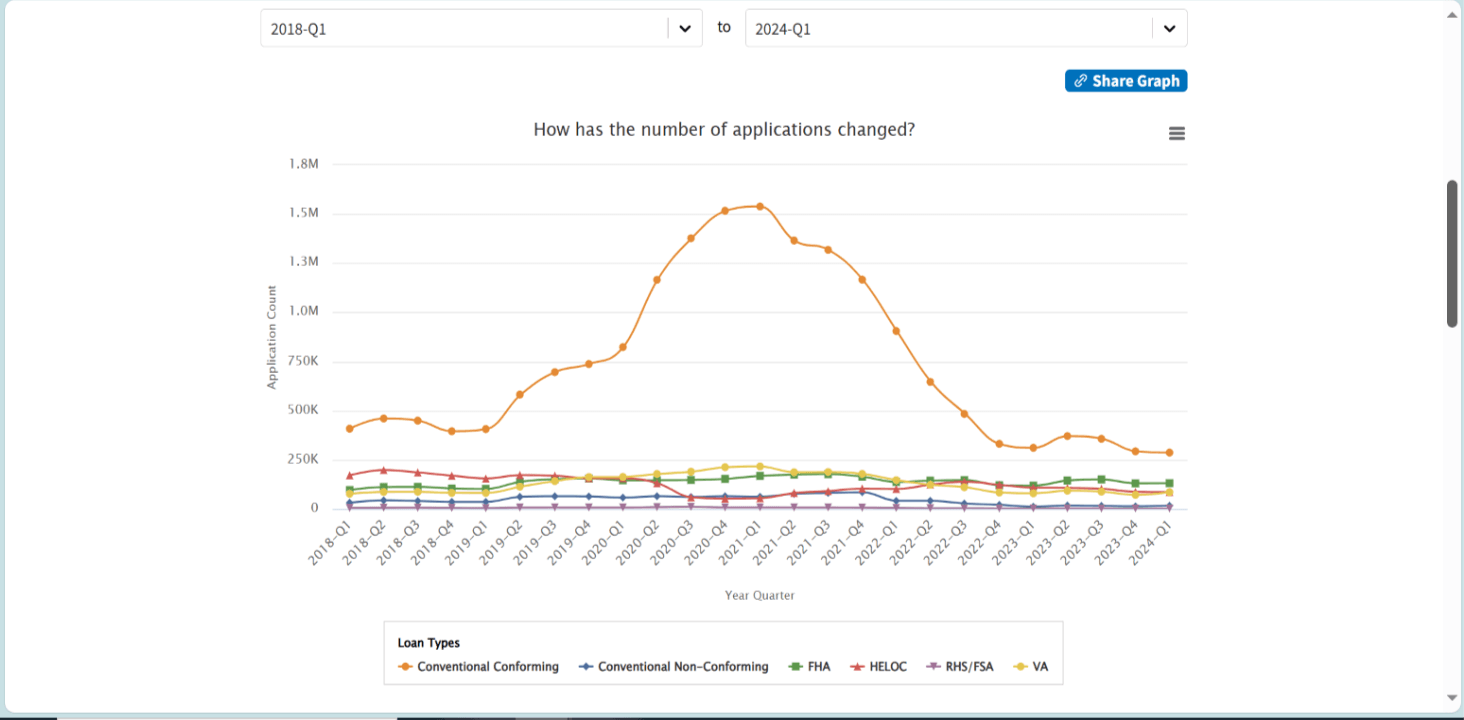

Data on US loan applications is given below.

The reporting data from quarter 1 of 2018 to quarter of 2024 shows the changes in the number of applications. The data talks about FHA or the Federal Housing Administration loan, the HELOC, or the home equity line of credit. It also includes data on RHSP/FSA, which translates to rural housing service or farm service agency loans and VA (veterans affairs) loans.

The graph shows increased levels of FHA and VA loans from when they started in 2018 and ended in 2024. At the same time, HELOC and RHS/FSA showed a decline during the first and last years of the period.

Importance

Some of the points that highlight the importance of HMDA are given below.

- It reveals information on whether lenders are meeting the community’s lending needs.

- It helps identify if discriminatory practices are being adopted in the lending process.

- It reveals if the community needs investments (both public and private) to revitalize the property market.

- Customers can make use of available public data to judge various financial institutions. Decisions can be based on pricing by age, credit decisions, etc.

- Lenders can use the data to understand the manner in which they operate and check for the scope of improvements.

- It helps lenders understand how their competitors are performing.

- It helps in improving lender’s accountability.

- It helps lenders understand the level of impact their service has on the community.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.