Table Of Contents

What is Holiday Pay?

Holiday Pay is a type of bonus for employees as they get paid with standard wages, even for a day off, such as Christmas or Thanksgiving, by the employer. It isn’t necessary to be paid. However, some employers may offer it as a reward for their workers' contribution to the company.

The most common way to calculate public holiday pay used by employers is to compensate employees based on a standard rate or a percentage of their regular salary or wages. The other end of the spectrum is where the company pays 1.5 times or twice the regular pay for working on a holiday.

How Does Holiday Pay Work?

Holiday pay is a reward for the employees as it enables them to receive wages even for the day off. The day off can be New Year’s Eve, Washington’s birthday, Thanksgiving Day, Christmas Day, Martin Luther King Jr.'s birthday, Labor Day, etc.

It is not required for the employer to pay for the days off, but still, some employers provide holiday pay to their employees as a reward for their toil and contribution to the company. Some employers also offer employees the opportunity to earn more by working on holidays.

Employers calculate based on one of the options according to the holiday pay laws. One of the most common methods opted by employers is to pay a certain percentage of the general salary or a fixed amount as a part of holiday pay. The exact details of such pay depend on a variety of factors, such as company policy, applicable labor laws, and employment contracts. Therefore, some companies might pay out a flat rate for all employees, while some might choose to customize public holiday pay based on seniority or job position.

In some cases, companies might offer double pay on holidays for employees who choose to work, recognizing and acknowledging the sacrifice of spending time with family and friends. Hence, irrespective of the type of compensation a company’s policy has in place, the employee needs to be aware of and negotiate the terms of this pay.

A clear communication between the management and employees ensures there are no misunderstandings and the work environment remains positive and productive.

How to Calculate?

The calculation is based on a lot of factors such as employment contract, company policy, and applicable holiday pay laws. Let us therefore understand how to calculate them in different scenarios through the discussion below.

For employees getting paid for the day off

The first step is to calculate the hourly pay for the employee. The last month’s salary and the number of hours worked in the last month can be taken as the base to calculate hourly pay. The hourly pay for the last month can be calculated by dividing the last month’s salary by the number of hours the employee worked.

Hourly Pay = Last Month's Salary as an Employee/Number of Hours Worked.

Once the worker's hourly pay is calculated, the next step is to calculate the number of hours not worked on a day off and then arrive at the pay based on such hours.

Holiday Pay = Hourly Pay × Number of Hours not Worked on day-off

Many companies normally pay their employees on day-offs without having to work them on the day off. The above calculation is for such companies or employers.

For employees getting rewarded for working on the day off

The worker can also get extra holiday pay by working on holidays for which they can earn double or pay time-and-a-half. Following are the steps to calculate it:

The first step of calculating holiday pay is finding a worker's normal pay per hour worked. The normal per hour pay can be found by dividing the last month's salary by the number of hours worked last month.

Normal Per Hour Pay = Last Month’s Salary/ Hours Worked Last Month.

The next step is to note the hours worked on the day off so that it can be calculated.

After you know the eligible hours, i.e., the hours worked on the day off and the hourly pay, holiday pay can be calculated. The pay for total eligible hours can be multiplied by 1.5 (time and a half) or 2 (double time) according to the employer or as agreed upon to get it as a reward.

Holiday Pay = Normal Per Hour Pay × Hours Worked on Day-Off × 1.5 or 2

Rules

The specific rules are governed by the respective state labor laws. Therefore, it is important to refer to the company policy and employment contract to have a clear understanding of the rules. However, let us discuss a few of the most common rules followed by companies through the points below.

- Eligibility: Employees must cross-check if they meet the eligibility criteria for such compensation. Typically, full-time employees are eligible but some companies also extend this luxury to part-time workers as well.

- Rate: Some companies compensate as per regular pay, while others pay a premium for working on a holiday, which is usually 1.5 times or double the usual pay. This depends from company to company or even job position-wise as well.

- Public Holidays: Public or recognized holidays like New Year’s, Christmas, and Independence Day mostly qualify for public holiday pay. However, some companies might offer special compensation for such holidays as well for employees who choose to work.

- Vesting and Accrual: Company-specific policies decide when the employee starts accruing holiday pay and when they can be fully vested to access this benefit.

- Communication: The communication of all pay and compensation-related information must be clear to the workforce. The communication must also include how it is calculated, when it is disbursed, and any additional perks, if applicable.

Examples

Now that we understand holiday pay laws and their intricacies let us understand their practicality through the examples below.

Example #1

In July 2019, Sam got $8,000 as his monthly salary in an automobile company. He worked for almost 6 hours a day there. In August 2019, there is a government holiday in the third week of the month, but the employer provides holiday pay to his employees on that particular day.

What shall be the value of holiday pay?

Solution

Let us calculate normal per-hour pay first. Before that, let us see how many work hours there are in the last month.

- Number of Work Hours in July 2019 = 31 days × 6 hours/day

- = 186 hours

Now,

Normal per hour pay = Last month’s salary/ Hours worked last month Holiday pay.

- Normal Per Hour Pay = 8,000/ 186

- = $43.01 Per Hour

Number of hours not worked on day-off = 6 hours

Therefore,

Holiday Pay = Hourly Pay × Number of Hours not Worked on day-off

- = 43.01× 6 = 258.06

Example #2

The Department of Labour and Employment (DOLE) in the Philippines issued a reminder to private sector employees, emphasizing adherence to wage payment guidelines outlined in Labour Advisory No. 26, series of 2023.

Employees not working on specified days would be entitled to receive 100% of their salary. Meanwhile, employees working would be eligible for a 200% payment of their regular salary for the initial eight hours of work.

For December 31, a "no work, no pay" policy will be implemented on December 31, 2023, unless a favorable company policy, practice, or collective bargaining agreement (CBA) grants payment on this special day.

Benefits

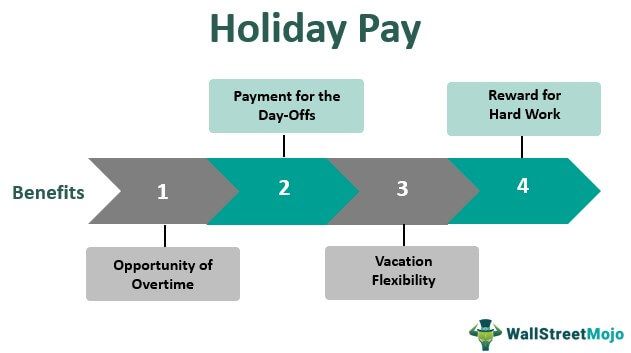

Let us understand the benefits of incorporating public holiday pay through the points below.

- The opportunity of Overtime: Employees can do overtime on the holidays, for which they can earn one-and-a-half or even double the normal pay rate.

- Payment for the Day-Offs: Employees will get paid even on the day off

- Vacation Flexibility: Employees can spend quality time with their families and go on vacations.

- The reward for Hard Work: Employees will get a reward for their hard work and consideration for the company in the form of holiday pay. It will encourage them to work with great enthusiasm.

Holiday Pay Vs Overtime

Let us understand the distinctions between holiday pay laws and overtime through the comparison below.

Holiday Pay

- It refers to the compensation provided for designated holidays for employees who are not working.

- It is typically put into action by recognized or public holidays irrespective of the number of hours worked for that week or month.

- Depending on the company policy, a standard or premium pay is provided to employees.

- Company policy decides if only full-time employees are eligible or even part-time ones are eligible.

- It is put into place to recognize and acknowledge employees' time away from work by providing a financial nudge.

Overtime

- This refers to the additional pay for hours worked beyond the regular working hours, typically 40 hours a week.

- Typically, the compensation is 1.5 times or double the regular pay.

- Barring the exemptions of job roles and salary ceilings, it is generally applicable to all non-exempt employees.

- It is incorporated to compensate employees for the extra efforts put in during the additional hours beyond the standard working hours.