Table Of Contents

What Is A Holdco?

Holdco, also known as a holding company, is an entity that holds a majority stake in subsidiary companies. Therefore, it can exert influence and the right to control its business activities. A Holdco may exist solely to gain control over and manage subsidiaries or conduct business activities along with controlling subsidiaries.

It allows the parent company to gain the right to influence its subsidiary company and control its business decisions. There are also disadvantages associated with holding companies, misuse of power, exploitation of subsidiaries, over-capitalization, etc. Therefore, companies must wisely choose and handle the rewards and repercussions of the decision to become a parent or subsidiary company.

Key Takeaways

- A Holdco, short for holding company, holds a majority stake in subsidiary companies, granting it influence and control over their business activities.

- Holdcos can be established primarily to acquire and maintain subsidiaries or conduct business activities while overseeing subsidiaries.

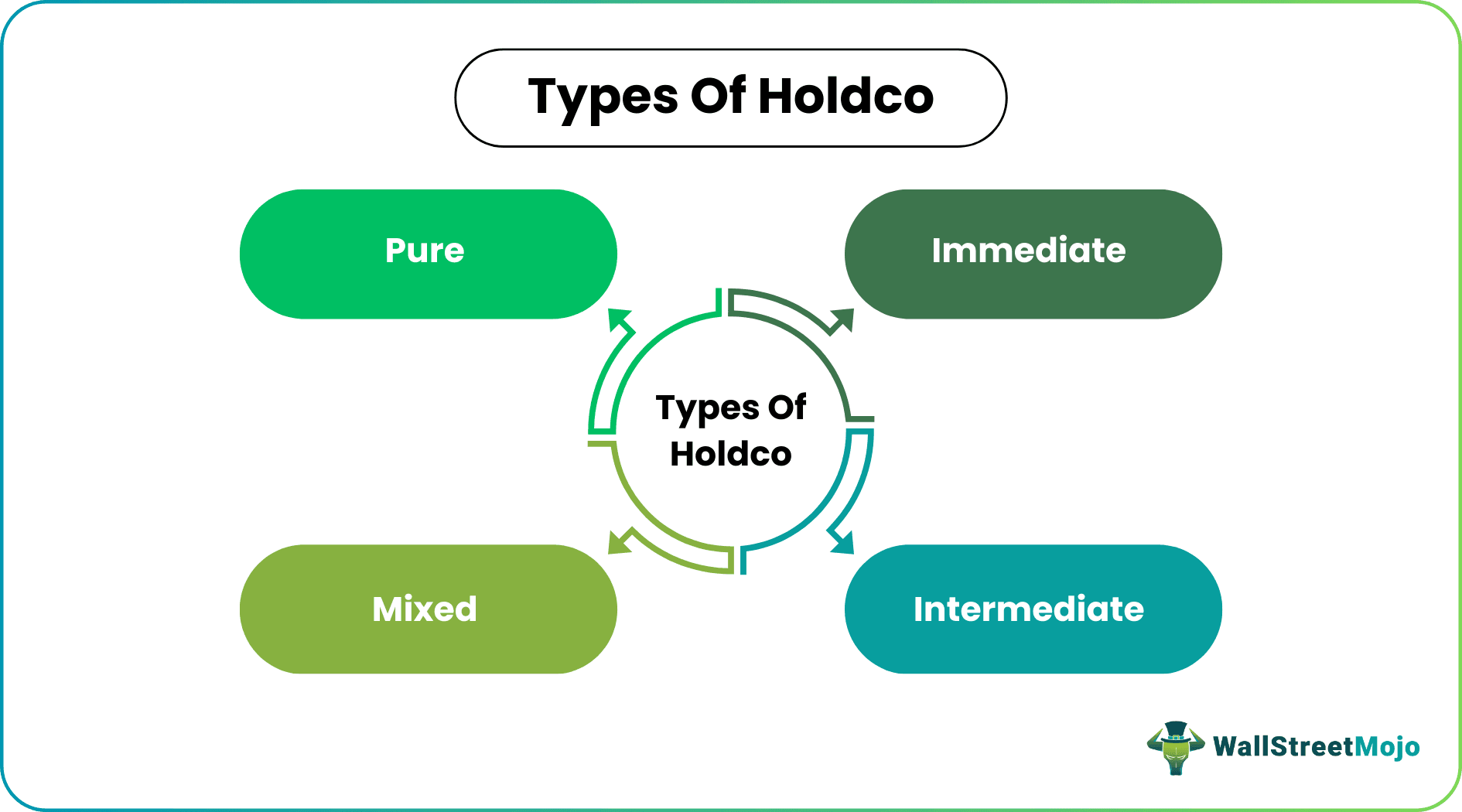

- Different types of holds include pure Holdco, mixed Holdco, immediate Holdco, and intermediate Holdco.

- The advantages of holds include ease of formation, access to significant capital, elimination of competition, risk avoidance, and potential tax benefits.

- The disadvantages of holds include potential misuse of power, risks of overcapitalization, exploitation of subsidiary companies, and the potential for creating private monopolies.

Holdco Explained

A Holdco or a holding company is an entity that purchases and owns shares in one or more entities. The stocks held is upto such extent that it is enough to influence or accomplish a control on the voting of shareholders in that company.

Reasons like tax optimization, ease of formation, large capital, avoidance of competition, asset protection, investment management, etc., are sufficient to define why entrepreneurs are opting to own shares in another company instead of a merger or consolidation these days.

Some of the important points of the Holdco include the following: -

For an entity to qualify as a holding company, it must hold over 50 percent of the stock (hedge funds, private equity funds, public stocks, etc.) in one or more entities or have appointed a majority of the directors for the other company.

Limited partnerships and limited liability entities are examples of subsidiary companies.

A subsidiary company whose shares are owned entirely by a holding company is WOS or a wholly-owned subsidiary.

Establishing Holdco is less expensive and less legally complicated than consolidation or merger.

A holding company is also known as a parent company.

The transactions between a holding company and its subsidiary are related party transactions. Accordingly, these transactions must comply with all the relevant restrictions on related party transactions.

Transactions between a holding company and its subsidiary are eligible for stamp duty relaxations.

The above-stated exemptions are not ordinarily available, and one can avail of the same only with the help of separate notifications.

Along with the above points is is also important to remember the fact that the type of investment or asset on which it can establish the control or influence are not only stocks but also Holdco debt, bonds, property ownership or anything which has a market value. However, compared to merger, this process is less complicated and expensive making it a widely used procedure.

Acquiring the shares give the Holdco the power to influence the working of another institution and also take decisions related to business operations. In spite of having various benefits and limitations, the process is gaining importance in the financial market.

Types

The types of holding companies are listed below: -

#1 - Pure

A Holdco solely formed to acquire stock in other entities is termed pure. Such a holding company is only engaged in developing stock in different companies and does not wish to participate in other commercial activities.

#2 - Mixed

A holding company acquiring stock in other entities and performing itsbusiness activities is vested with a mixed Holdco status. Hence, it is known as a holding-operating entity.

#3 - Immediate

A holding company that acts as a subsidiary company of another entity is an immediate holding company. Such a Holdco retains control or voting stock of other entities.

#4 - Intermediate

A holding company can be vested with an intermediate status if the same acts as a holding company of one company and a subsidiary of another company.

Structure

Let us try to understand the basic structure of this kind of company.

The Holdco is the organization that hold or has ownership of the equity of many companies which are its subsidiaries. It is like a legal entity and Holdco advisors are responsible fo the final ownership. But the control and ownership over the subsidiaries is limited to making decisions or retaining the managerial power. They cannot take part in daily operations or activities.

The assets or property owned can also be intangible like patent, trademark, etc. The Holdco also has the power to employ or fire managers from the subsidiaries who conduct the daily operations.

It has insurance facility and is protected against Holdco debt due to stakeholder’s claim in case of bankruptcy of the subsidiary. However, it has to bear the loss of capital or fall in the valuation of business in such cases. This strategy helps the Holdco to shield itself from legal or financial liability and also helps in reducing the total tax payable because it can divert its resources and to subsidiaries that are in different jurisdictions with lower tax rates.

Financing

Now let us study the Holdco financing procedure of such companies

The management of the company play an active role is making decisions regarding investment for the purpose of returns, growth and expansion of the business. They can either make arrangement of funds through borrowing from lenders and creditors or sell its equity shares to investors who will subscribe to the shares and provide funds.

Other methods of Holdco financing or raising money is collection of dividends that is paid out against shares of its subsidiaries. It may also provide other types of services to its subsidiaries in the form of back office activities or any kind of advisory services for betterment of operations of subsidiary companies.

Therefore we can see that a Holdco that has a mixed business can earn revenue or finance its own business through various means, which may be either from ots own business activities or outside sources.

Example

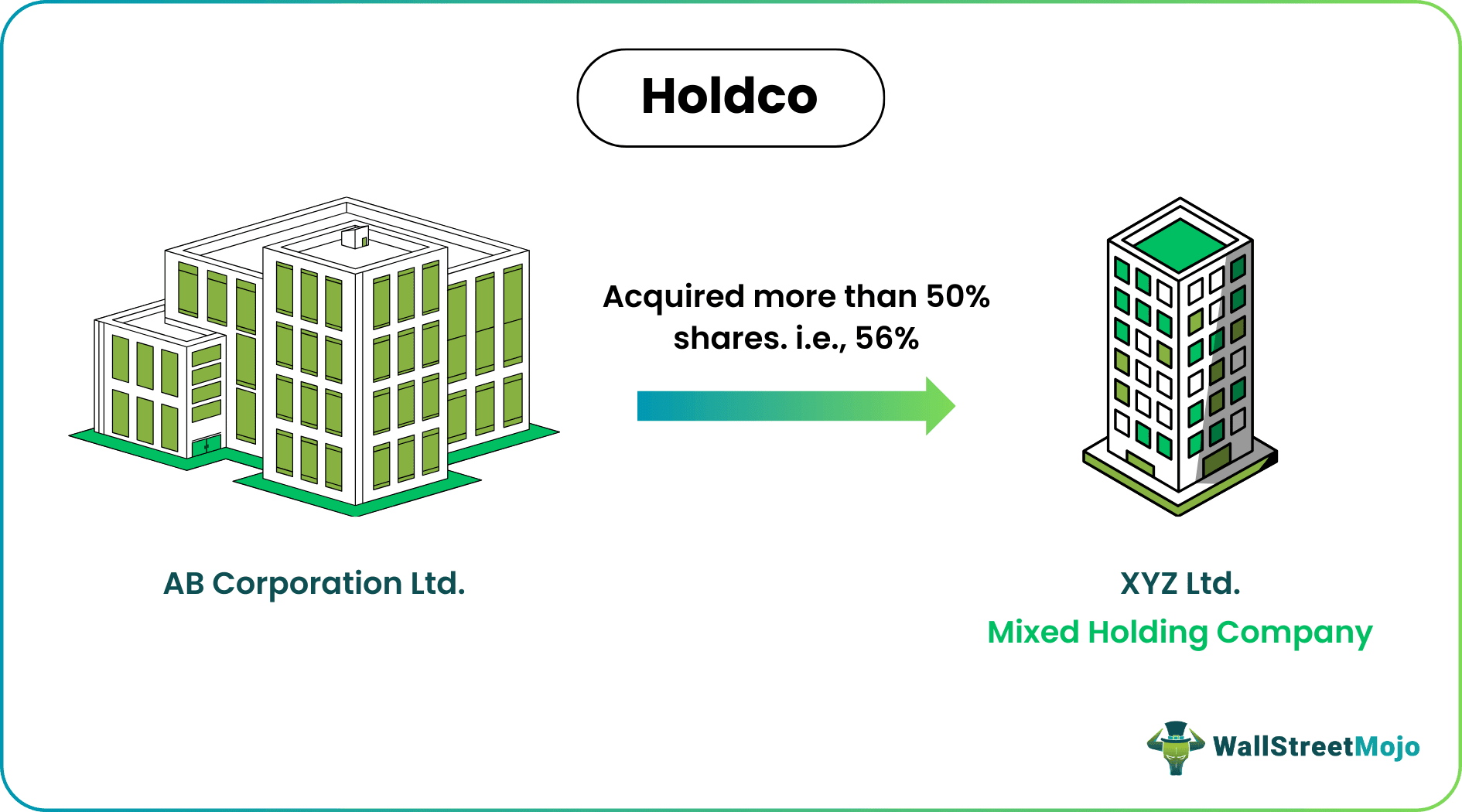

Let us discuss an example of Holdco.

XYZ Ltd. recently bought 56% AB Corporation Ltd. shares and continues its regular trading activities. Can XYZ Ltd. be affirmed with the status of a holding company? If yes, then what type of holding company?

Solution:

Any company may defer the status of a holding company if it acquires more than 50% of the shares of a subsidiary. From the above case, we can see that XYZ Ltd. has gained more than 50% shares, that is, 56% share of AB Corporation Ltd. Hence, the same can be deferred with the status of a holding company. XYZ Ltd. is a mixed holding company as it continues with its regular trading activities even after gaining control over AB Corporation Ltd.

Advantages

There are several different advantages of the Holdco as follows: -

- Easy to Form One: Forming a Holdco is easy. One can purchase the shares of the proposed subsidiary company from the open market without needing to take approval from its equity holders.

- Large Capital: When a holding company gains control over a subsidiary company, its financial resources Holdco debt are clubbed together and shown in the financial statements accordingly. It enhances the capital for both the parent and its subsidiary company.

- Elimination of Competition: The competition between a parent company and its subsidiary can eliminate if both of them are participants of one common industry.

- Maintenance of Secrecy: A holding company system's authority and decision-making get centralized. Hence, confidentiality does not get impacted at all.

- Avoidance of Risks: The risks and repercussions faced by a subsidiary company will have a negligible impact on the holding company, and it can even resell the stakes it has held in the subsidiary whenever it feels like it.

- Tax Effects: Holding companies that have acquired 80% or more of stocks in their subsidiary can file consolidated tax returns and avail of tax benefits.

Disadvantages

The different limitations and drawbacks of the Holdco include the following: -

- Misuse of Power: The members and Holdco advisors have a financial liability that is completely insignificant compared to their monetary powers. It may either lead to misuse of power or irresponsibility or both.

- Over Capitalization: The pooling of capital of both Holdco and its subsidiaries can also allow a company to suffer from overcapitalization. In such a scenario, the equity holders will not receive a fair return on investment.

- The Exploitation of Subsidiary Companies: The subsidiary companies might be forced to purchase products and services from the holding company at higher prices. The subsidiaries may also be compelled to sell their goods at a low price to Holdco. Whatever the case is, one cannot deny the exploitation of subsidiaries.

- Secret Monopoly: The creation of secret monopolies will prevent new companies from entering the industry and take every possible measure to eliminate competition. In such a market, the customers might also be charged unjust prices for goods and services.

It is important to understand the advantages and disadvantages of the concept so that the idea can be successfully used in situations where they can yield business by controlling the assets and properties of the subsidiary and also retain the power to manage and have a say in the operations of its with directly influencing the daily operation. The benefits and limitations will give an idea about how to use the process in a healthy way without any misuse or exploitation of resource.

Holdco Vs Opco(Operating Company)

A business can be structured and operated either in the form of holding company or as an operating company. However, there are some differences between them as follows:

- The former is responsible for overseeing the operations of the subsidiaries, which can be in various forms that will contribute towards growth, but the latter is responsible for directly handling the business operations or running the day-to-day business process.

- The activities of the Holdco holdings include making decisions for growth, expansion and investment which will have a direct influence of the daily operations and activities. The latter however includes activities like buying and selling of goods and services or is like an organization directly dealing with customers.

- From the above point it can be derived that the Holdco holdings works from behind where the latter is more customer facing and includes directly dealing with investors or other stakeholders.

- The former is like a tool that supports and contributes to the daily working of the latter so that the latter can carry out its work in a successful and smooth manner.

Thus, the above are some important differences between the two types of companies.