Table Of Contents

Hoarding Meaning

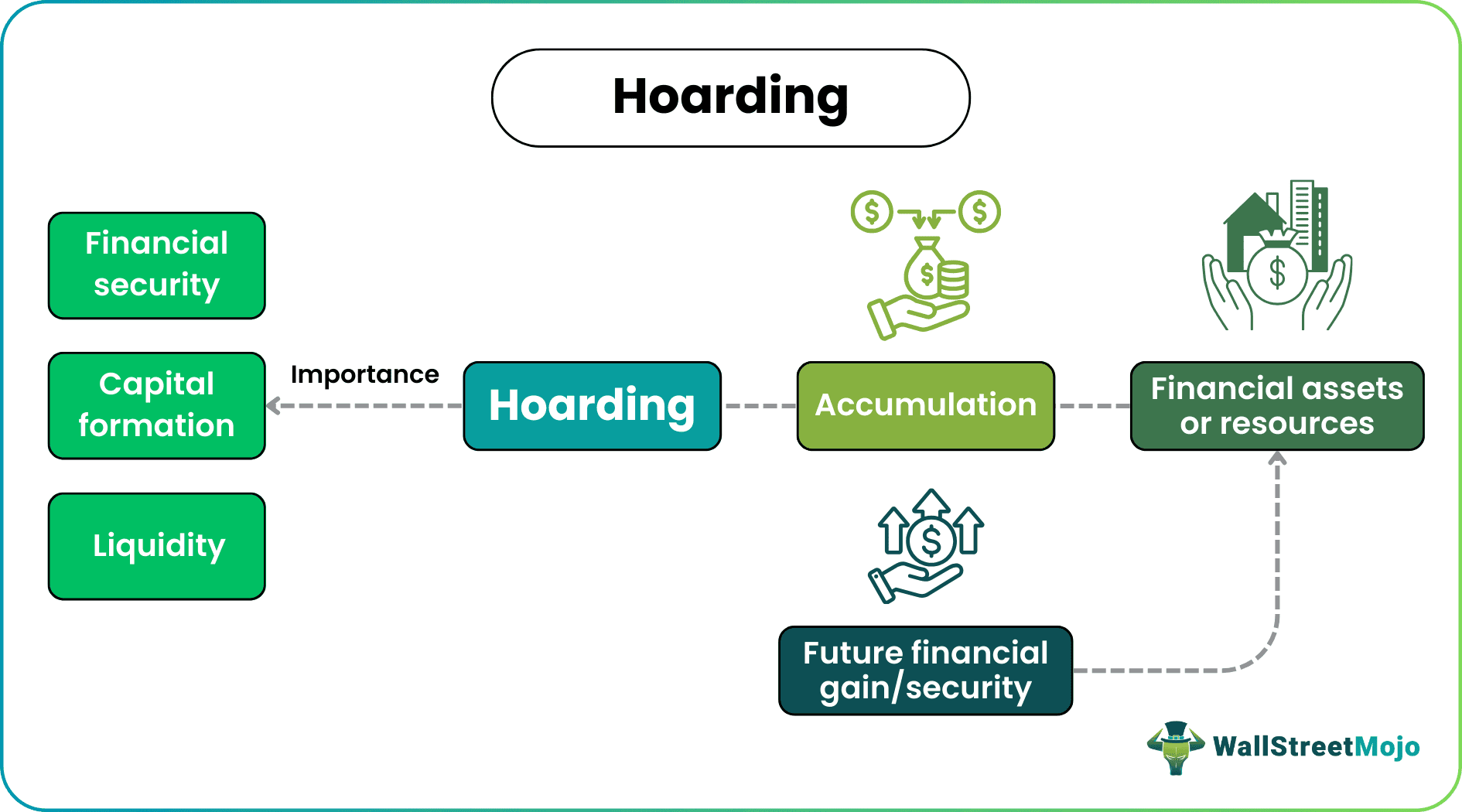

Hoarding, in the context of finance, refers to accumulating financial assets or resources without immediately deploying them for investment or consumption. Hoarding's purpose is to get a financial gain by hiked prices or provide a safety net for individuals and businesses.

It is important for individuals and businesses to accumulate as many resources as they can. The growth of many well-known enterprises can be attributed to strategic hoardings which end up benefitting them in the future. It allows organizations to pursue opportunities that might not have been feasible without a hoarded financial reserve.

Table of contents

- Hoarding Meaning

- Hoarding provides a cushion for emergencies and unexpected expenses, ensuring immediate access to funds without relying on loans or credit.

- It offers high liquidity and peace of mind, as hoarded resources are readily available, reducing financial stress during uncertain times.

- While hoarding preserves capital, it often yields minimal returns and is susceptible to inflation, potentially eroding purchasing power over time. Balancing hoarding with investments can optimize financial stability and growth.

- Hoarding in finance is a protective measure to facilitate future financial growth and stability.

Hoarding In Finance Explained

Hoarding in finance refers to accumulating financial assets or resources instead of immediately spending or investing them. Its importance lies in providing a financial safety net for unforeseen circumstances, ensuring there are readily available funds during emergencies or economic downturns.

Additionally, hoarding plays a crucial role in capital formation by enabling individuals and businesses to accumulate the necessary funds for future investments, and opportunities. This practice enables more confident decision-making and enhances financial stability, ultimately contributing to long-term financial well-being and growth.

Examples

Let us have a look at the examples to understand the concept better.

Example #1

As per a Bloomberg article, the increased natural gas prices in Europe during November 2023 create an attractive incentive to withhold supplies temporarily until colder temperatures arrive, potentially leading to higher profits. In particular, the futures contracts for November are approximately 10 euros more expensive per megawatt-hour compared to gas deliveries scheduled for the following month.

This significant price disparity between November and subsequent winter months presents a strategic opportunity for traders to retain liquefied natural gas on tanker vessels, strategically offloading it when colder weather sets in and boosts demand, thereby capitalizing on potentially higher market prices.

Example #2

As per an article by Outlook, Chimpzee has emerged as the latest cryptocurrency, garnering significant attention within the market. Seasoned investors are keen to hoard this environmentally conscious cryptocurrency at its presale price, anticipating substantial returns of up to 10 times their investment in 2023. The project's primary focus on wildlife conservation and climate action aligns with ethical concerns and promises attractive passive income opportunities for investors and users alike. Given these prospects, it appears prudent to accumulate Chimpzee tokens during the presale phase.

Crypto analysts further project that CHMPZ tokens could experience a remarkable increase of 8 to 13 times their initial value during the first phase of the token launch, largely fueled by the fear of missing out (FOMO) among investors.

Importance

Let us have a look at the importance of hoarding in finance:

- Financial Security: Hoarding creates a safety net that helps individuals and businesses handle unexpected expenses, emergencies, or economic downturns without financial distress.

- Liquidity: Having hoarded funds readily available ensures the availability of cash when needed, reducing reliance on loans or credit lines with associated interest costs.

- Capital Formation: Hoarding enables the accumulation of capital for future investments, business expansion, or seizing opportunities that require substantial financial resources.

- Risk Mitigation: It serves as a risk management strategy, reducing vulnerability to unforeseen financial setbacks and ensuring stability even during turbulent economic times.

- Confident Decision-Making: Hoarding empowers individuals and businesses to confidently make strategic financial decisions, knowing they have the resources to weather uncertainties.

- Long-Term Financial Well-Being: Over time, hoarding contributes to overall financial health, providing financial security and fostering a disciplined approach to money management.

- Flexibility: It allows for flexibility in adapting to changing circumstances, such as career changes, business pivots, or unexpected opportunities, as there's a financial cushion to fall back on.

Criticisms

Hoarding in finance, while having its merits, is not without its criticisms and potential drawbacks:

- Opportunity Cost: Critics argue that money or resources hoarded and left unused could have been invested in income-generating assets, potentially missing out on higher returns.

- Inflation Erosion: Hoarding cash in a low-interest environment may lead to the erosion of its real value over time due to inflation, resulting in decreased purchasing power.

- Lost Investment Potential: By keeping funds idle, individuals and businesses may miss out on opportunities to grow their wealth through productive investments, such as stocks, bonds, or real estate.

- Lack of Liquidity for Investments: Hoarding can tie up funds that could have been used for lucrative investments, limiting one's ability to capitalize on favorable market conditions.

- Limited Economic Growth: In a broader economic context, excessive hoarding on a large scale can lead to reduced capital circulation and economic stagnation, as money is not actively used to drive economic activity.

Hoarding vs Investing

Let us look at the comparison of hoarding and investing in various aspects:

| Parameters | Hoarding | Investing |

|---|---|---|

| Definition | Accumulating financial resources or assets without immediate use or investment. | Allocating funds with the expectation of generating income or capital appreciation. |

| Purpose | Financial security, liquidity, and capital preservation. | Wealth growth, income generation, and capital appreciation. |

| Returns | Typically offers minimal or no returns; may lose value due to inflation. | Offers the income potential (e.g., dividends), capital gains, and wealth accumulation over time. |

| Risk | Low risk, as resources, are kept safe and liquid. | Moderate to high risk, depending on the type of investments chosen (e.g., stocks carry higher risk than bonds). |

| Liquidity | High liquidity: Assets are readily available for emergencies or expenses. | Lower liquidity: Assets may take time to convert to cash without incurring losses. |

Frequently Asked Questions (FAQs)

Hoarding a substantial amount of cash can have drawbacks. Firstly, it typically offers minimal or no returns, and the value of hoarded money can erode over time due to inflation. Secondly, it may limit the ability to capitalize on investment opportunities that could yield higher returns. Additionally, excessive hoarding can result in missed economic growth potential if funds are not actively participating. To mitigate these drawbacks, it's advisable to diversify financial strategy by combining hoarding with strategic investments.

Finding the right balance between hoarding and investing depends on financial goals, risk tolerance, and time horizon. Start by creating an emergency fund with three to six months' living expenses for immediate needs. Once that's established, consider long-term goals, such as retirement or wealth accumulation. Allocate a portion of assets to investments that align with objectives and risk tolerance. A financial advisor can provide personalized guidance to help strike the appropriate balance and make informed decisions based on circumstances.

Hoarding assets typically involves keeping them in liquid forms like cash or precious metals, which often have fewer tax implications than investments. However, interest income earned on hoarded cash may still be subject to income taxes. Additionally, the real impact of hoarding on finances can be the potential loss of opportunities for tax-advantaged growth that certain investments, like retirement accounts or tax-efficient investments, can provide. It's essential to consult with a tax professional to understand the specific tax consequences of hoarding strategy and explore ways to optimize the tax situation.

Recommended Articles

This article has been a guide to Hoarding and its meaning. Here, we explain with its examples, importance, criticism, and comparison with investing. You may also find some useful articles here -