Table Of Contents

Hindsight Bias Definition

Hindsight bias is a psychological tendency, making the individual believe that they had correctly predicted the result of a past event after knowing the actual outcome. It is often referred to as the ‘I-knew-it-all-along’ phenomenon or ‘creeping determinism.’ It gives people the confidence to predict future events as well.

As a behavioral trait, hindsight is an excellent tool for planning the future. However, its reliability is questionable, as biases or prejudices usually influence it. It is tough for people to eliminate this tendency from their decision-making in various aspects of their lives, like sports, stock markets, business, etc.

Table of contents

- Hindsight Bias Definition

- Hindsight bias refers to people’s tendency to overrate their potential to predict the result of a past event in hindsight. It makes them believe that they could predict future events as well.

- It may mislead individuals into thinking that they have an exceptional intuition leading them to make irrational decisions. Such decisions might be beyond their risk-bearing capacity, and they might end up incurring huge losses financially and otherwise.

- A way to avoid hindsight bias in decision-making is to base it on data and not emotions. Intuitions may be wrong, but data, most likely, give the correct picture.

How Does It Work In Psychology?

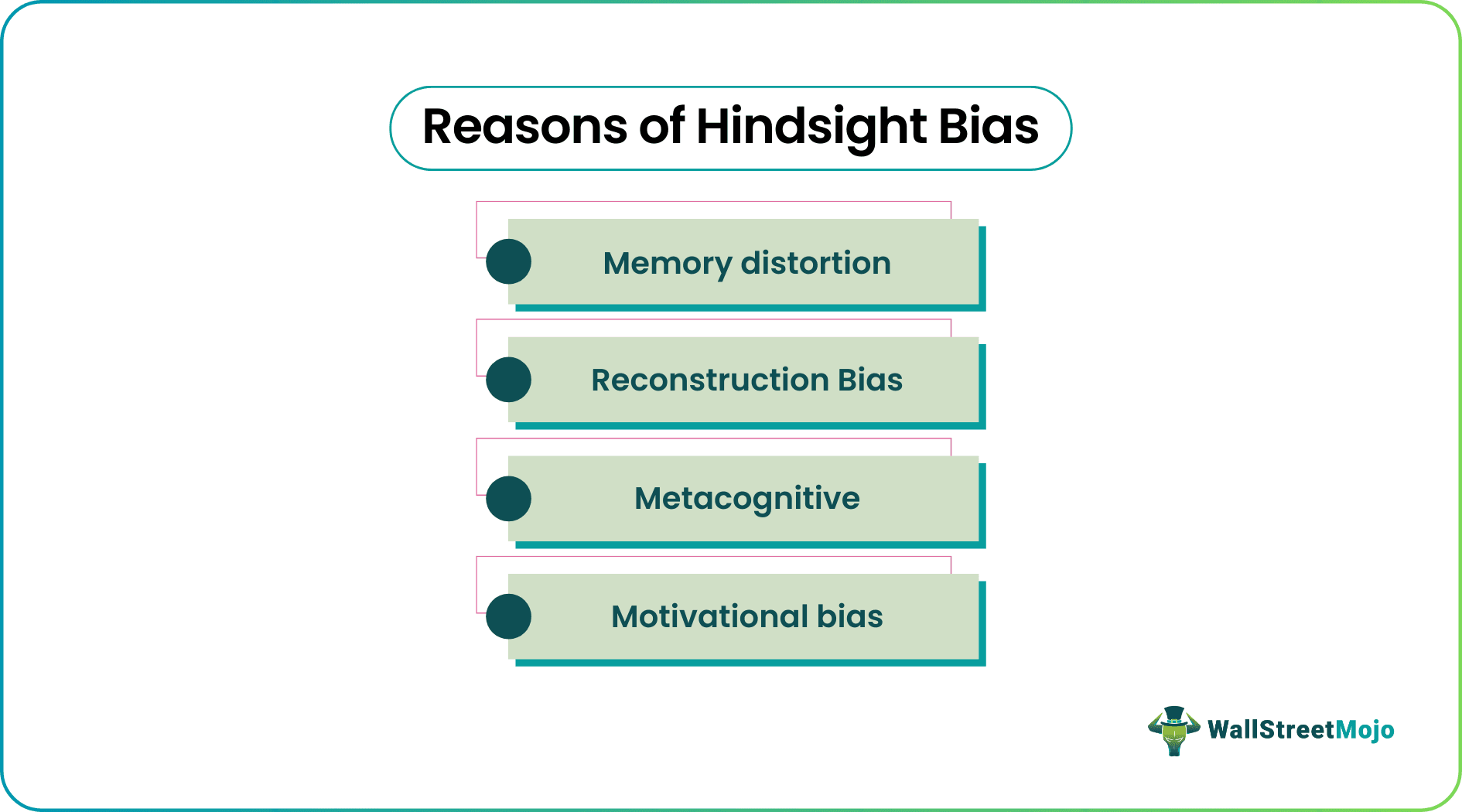

Hindsight bias originates from psychology, clouding a person’s decision-making ability to recall their prior expectations for an event after learning about its actual outcome. It happens because people tend to remember what they believe is true. However, that belief changes quickly after knowing the result of an event. It is when they begin claiming to have predicted the result. It may occur due to the following reasons:

- Distorted Memories – Distortion of memories of past events can cause people to believe that they correctly guessed the actual outcome.

- Reconstruction Bias – It arises when people attempt to reconstruct a story around the past event that leans toward the actual outcome.

- Metacognitive: This phenomenon occurs when individuals think of their past thoughts or events, becoming confused about their certainty.

- Motivational Bias - Motivational bias causes people to misremember their original judgments to look wiser than they are. People begin to perceive uncertain situations as predictable as a result of this.

According to research, hindsight bias in psychology changes the way people see the world. Also, it changes the way they see themselves in that world. As a result, they start trusting their instincts more, even if there is no data to support it.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Hindsight Bias In Investing

It is a common occurrence in stock markets. If investors purchase a stock and earn a good profit, they are more likely to fall prey to hindsight bias. Thus, it will force them to make more irrational decisions and ultimately cause them to incur huge losses.

Investors who have once lost a part of their wealth in the stock market tend to stay away from it. Eventually, they think that reinvesting may lead to the same result as this phenomenon adversely affects their decision-making capabilities. As a result, while some make baseless decisions, others refrain from making any decisive calls. In short, it causes them to feel frustrated or regretful about their actions.

This phenomenon has been observed in other fields too. For example, in politics, analysts and voters alike forget their pre-election predictions after a surprising election result and claim that they had anticipated the actual outcome all along.

In healthcare, diagnosing physicians often predicts patient outcomes after knowing their case. Likewise, on judgment day, lawyers usually claim to have known the verdict all along in legal settings.

It works in sports as well. A coach, a fan, or any other stakeholder may claim to have known the winner after the results are out.

How Does Hindsight Bias Work In A Business?

Though the concept of hindsight bias originates from psychology, it is an intrinsic part of behavioral economics, which studies the psychology behind the decision-making process.

A decision-maker has a massive responsibility of giving a viable direction to a business. The experience of the decision-maker, past data, and intuition should be the basis for arriving at crucial decisions. They should never rely entirely upon their gut feelings and always factor in the available data.

American economist Richard Thaler in his book explained the concept. Thaler stated that the concept has a lot of managerial significance as managers evaluate workplace decisions based on it, which is unfair to employees.

The phenomenon is inconsiderate to decision-makers as they also have to deal with the outcome bias. They are evaluated based on the result of their decisions. For example, they get little credit for good decisions that result in the desired outcome and too much blame for good choices with a bad outcome. It is because good decisions appear to be predictable in hindsight.

It is worth noting that a good decision may lead to a good or a bad outcome depending on circumstances. Therefore, the result of decisions should not be the criteria for judging decision-makers.

In an interview with McKinsey Quarterly, Thaler suggested that the phenomenon acts as a deterrent in getting employees to take risky projects. According to him, CEOs, in particular, aggravate this problem. Quarterly further noted that the management that understands the difference between a bad decision and a bad outcome always has the edge over its competitors.

Examples

Let us look at the following hindsight bias examples to understand the concept better:

Example #1

Scarlet watches a trailer of a movie before it releases. She might have different thoughts about the movie, like, ‘it might be a success, ‘it will be a hit or flop,’ or ‘it may go unnoticed.’

After release, if it becomes a blockbuster, Scarlet will believe that she knew it would be a success all along. However, it is evident here that hindsight bias gives her a distorted view of her past thoughts, clouding her judgment.

Example #2

The whole world condemned the Central Intelligence Agency (CIA) after September 11, 2001 attacks for being oblivious to facts. It is believed that the CIA obtained intelligence in June 2001 on Al-Qaeda conspiring a terrorist attack on the United States. However, the director of the CIA, George Tenet, informed the National Security Adviser instead of the U.S. President.

After the 9/11 attack, the executive editor of The Washington Post, Ben Bradlee, publicly condemned the CIA director of gross negligence. He stated in his column, “It seems to me elementary that if you’ve got the story that’s going to dominate history, you might as well go right to the president.”

It is a classic example of hindsight bias, wherein the editor overlooked the fact that Bradlee would have never thought that this piece of intelligence would change the course of U.S. history in a few months.

Example #3

The COVID-19 pandemic could also be associated with people falling prey to hindsight bias. As per an article in Forbes, former U.S. President Donald Trump exhibited clear signs of being influenced by this phenomenon. In February 2020, he denied coronavirus spread as a potential pandemic, but later in March 2020, he reversed his statement by stating that he knew it all along.

Hindsight Bias And Overconfidence

Hindsight bias negatively affects the decision-making capability of an individual. Thus, they might start taking shortcuts to the decision-making process. For example, instead of factoring in all the available data and the current circumstance, the individual would merely consider their intuition.

The positive outcomes of decisions taken under the influence of this phenomenon often lead to overconfidence. In this case, people do not remember wrong predictions. Instead, they use the actual outcome as the basis for their prediction about the event. As a result, they believe that they have exceptional foresight and rely on it and take unnecessary risks, jeopardizing their future. It also prevents them from understanding and learning from their mistakes.

Research by social scientist Kathleen Vohs identified overconfidence as an outcome of hindsight bias. According to her, timely and more frequent feedback before making a decision reduces this phenomenon.

An article published on the BBC website suggests that stereotypy in business results from hindsight bias. Stereotypy means business decisions are based solely on past decisions and their outcomes.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Question (FAQs)

Hindsight bias is a psychological phenomenon that causes people to believe they predicted the result of a prior event after learning the actual outcome. It is known as the 'I-knew-it-all-along’ phenomenon, giving people the confidence to forecast future events. People may experience it for several reasons: memory distortion, reconstruction bias, metacognition, and motivational bias. It is commonly seen in medical science, politics, sports, stock markets, business, etc.

Hindsight bias in decision making impairs a person's ability to recall earlier expectations for an event after learning about its actual outcome. People tend to remember what they perceive to be true. However, once the result of an event is known, that belief swiftly changes. At this point, they start claiming to have foreseen the outcome. Thus, instead of considering all available data and the current situation, the individual would depend solely on their intuition to make decisions.

Investors making profits or incurring losses are more prone to being swayed by hindsight bias. Hence, it compels them to make more irrational judgments. In other words, it makes them frustrated or remorseful about their choices. In business, critical decisions are made based on the decision-maker's experience, historical data, and intuition. Management that recognizes the difference between a bad decision and a terrible result always has an advantage over its competitors.