Table Of Contents

Highest And Best Use Definition

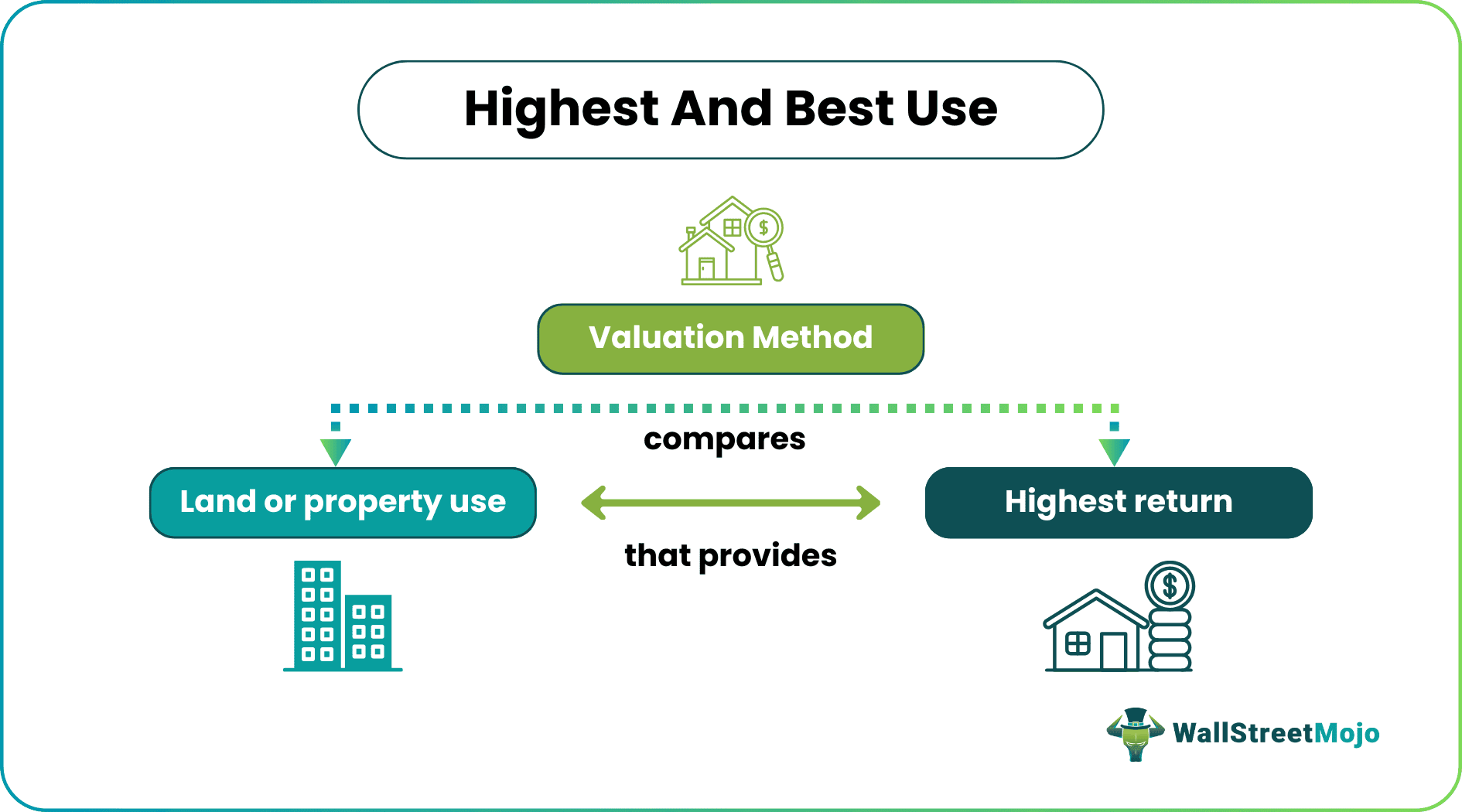

The Highest And Best Use in real estate is a valuation method determining the maximum land's return to its best use. The main purpose of this method is to use different tests and decide whether a piece of land can give the highest returns.

There are namely four tests used in the highest and best use analysis. It evaluates and analyzes the potential use of land to its value. This method is only applicable to non-financial assets. However, there might be differences between the highest and best use as improved.

Key Takeaways

- The highest and best use is a very popular practice in the real estate business that allows potential buyers to determine the land's value by comparing its usage to the highest return.

- Its origin dates back to the 20th century when economist Richard T. Ely proposed it in "Property and Contract in their Relations to the Distribution of Wealth."

- There are four tests: physically possible, legally permissible, financially feasible, and maximum productivity.

- The IFRS 13 regulates the fair value determination of such non-financial assets. It also considers the land value when improved or kept vacant.

Highest And Best Use Explained

The highest and best use valuation method has more application in real estate, where the parties determine the best use of the property that will yield higher returns. In short, they understand the relationship between returns and usage. So, a property with high usage will simultaneously lead to the highest value. Therefore, it is crucial for the firms as they can select the appropriate land for their operations.

The term was more prevalent in the 19th and 20th centuries. In 1916, American economist Richard Theodore Ely explained the concept in the book "Property and Contract in their Relations to the Distribution of Wealth." Later, it became an important concept in real estate. Buyers and sellers use the highest and best valuation method before purchasing the property.

Various factors influence the state and value of real estate. These include physical, legal, geographical, topographical, social, environmental, and utility. For example, if a buyer wants the land for office space, the chances of high yield improve instead of retail space. However, the situation differs during a vacancy.

The highest and best value improved, and vacancies will have different scenarios. The first situation, as vacant, reflects the full use of land, resulting in the land's value. In contrast, the highest and best value improved states that the improvements made in the land must justify its use. However, at times, the highest and best value of land is not the same as that of the site.

As per the IFRS 13 (International Financial Regulatory Standards), the firms must determine the fair value of non-financial assets. Thus, the physical, legal, and financial determinants must be considered while performing the highest and best value.

Tests

Let us look at the four tests of highest and best value analysis for better understanding:

- Physically Possible: The first test states that the land or the property must be physically ready to use. It means that the topography, climate, soil and surface must be suitable for usage. For example, whether the mountain terrain has the physical ability or not to construct roads.

- Legally Permissible: The second test defines that the land purchased must have legal permission to be used for commercial or personal purposes. It also includes zoning regulations that might restrict the use of land. For instance, if the property has natural vegetation, the government and other authorities might refrain from using the land.

- Financially Feasible: This test justifies the "highest and best use" concept. Buyers must consider whether a particular land will generate adequate revenue for the firm. Likewise, they must calculate the cash flows before undertaking any project. Thus, potential parties can use the discounting cash flow (DCF) model, Internal Rate of Return (IRR), or payback period to determine the highest return possible.

- Maximum Productivity: The fourth and last test determines whether a particular land will provide the highest return on par with the land's usage. In short, there must be optimum and full use of the property. The parties consider the Net present value (NPV) method to estimate if the cost incurred will yield the highest return.

Examples

Let us look at the examples of real estate's highest and best value to comprehend the concept better:

Example #1

Suppose Clerry wants to buy a retail space for her new venture. She plans to either use it for office space or a factory outlet. But she is still unclear whether the land deal is profitable or not. As a result, Clerry runs the highest and best value tests to determine its productivity.

If the business runs for an estimated period of 5 years, it can provide 7% returns. Therefore, the land might have a retail value of $1,200,000. However, if Clerry uses the same space for a factory outlet, the land value is $1,264,000.

In this case, the latter has the maximum and best use of the land. Therefore, using the property as a factory outlet will be beneficial. Alternatively, Clerry can set up her retail store for optimum utilization and save more on costs.

Example #2

Another example of the highest and best use is from Michigan, where legislation introduced in 2023 focuses on adopting the highest and best use method as an assessment standard. This is to challenge the "dark store theory" (compare a commercial property to a shuttered warehouse rather than an open store during evaluation for tax purposes) used in property tax assessments for big-box retailers like Walmart and Lowe's.

Based on vacant store comparisons, the dark store theory often reduces property taxes for retailers, impacting municipal budgets, and has been condemned as a tax evasion technique. This implies that adopting the highest and best-use method will help the governing body to extract favorable taxes.