Table Of Contents

What Is High-low Method Formula?

In cost accounting, the high-low method formula refers to the mathematical technique used to separate fixed and variable components that are otherwise part of the historical cost that is mixed, i.e., partially fixed and partially variable. The high-low method comprises the highest and the lowest level of activity and compares the total costs at each level.

The method is used in Accounting to separate fixes. Variable cost element from the historical cost that is a mixture of both fixed and variable cost and with the use of the high low formula per unit variable cost is measured by subtracting the cost of lowest activity from the cost of the highest activity and dividing the resultant amount from the difference of units of highest activity and the units of lowest activity.

High-Low Method Formula Explained

The high-low method used in analysis of costs that help in estimating the variable and fixed costs from a given data set of financial information. Using this formula, it is possible to estimate the costs individually but may not always provide actual estimate due to certain limitations.

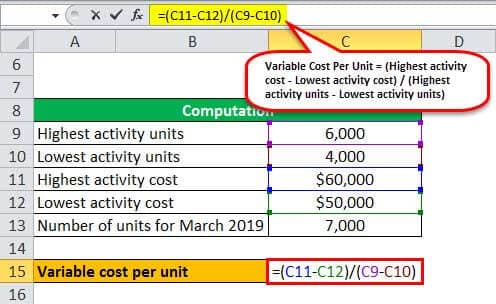

Under the formula for high low method, the variable cost per unit is calculated by initially deducting the lowest activity cost from the highest activity cost, then deducting the number of units at the lowest activity from that of the highest activity, and then dividing the former by the latter. Mathematically, it is represented as,

Variable Cost Per Unit = (Highest activity cost – Lowest activity cost) / (Highest activity units – Lowest activity units)

The fixed cost can be calculated once the variable cost per unit is determined. It is calculated by deducting the product of variable cost per unit and the highest activity units from the highest activity cost or by deducting the product of variable cost per unit and lowest activity units from the lowest activity cost.

Mathematically, it is represented as,

Fixed cost = Highest activity cost – (Variable cost per unit * Highest activity units)

or

Fixed cost = Lowest activity cost – (Variable cost per unit * Lowest activity units)

The formula for high low method is quite simple and easy to understand. However, there are more advanced methods available in the current scenario, like regression analysis, that may be more complex and involve more calculations, but they provide better estimations with higher level of accuracy. They are suitable for more complex cost structures and larger databases.

Calculation Of The High-low Method In Accounting

The high-low method formula accounting for the calculation of variable cost and fixed cost under the high-low method is derived by using the following steps:

Firstly, determine the highest and lowest activity units from the available costing chart.

Next, determine the corresponding cost of production at the level of the highest and level activity units.

Next, deduct the lowest activity cost from the highest activity cost to take out the fixed cost component such that the remaining variable component corresponds to the incremental number of units.

Variable cost component = Highest activity cost – Lowest activity cost

Next, for high-low method formula accounting the total number of units is calculated by deducting the number of units at the lowest activity from that of the highest activity.

The total number of units = Highest activity units – Lowest activity units.Next, the variable cost per unit is calculated by dividing the expression in step 3 by the expression in step 4, as shown above.

Next, the fixed cost is calculated either by deducting the product of variable cost per unit and the highest activity units from the highest activity cost or by deducting the product of variable cost per unit and lowest activity units from the lowest activity cost, as shown above.

The formula for the calculation of variable cost and fixed cost under the high-low method is derived by using the following steps:Firstly, determine the highest and lowest activity units from the available costing chart.

Next, determine the corresponding cost of production at the level of the highest and level activity units.

Next, deduct the lowest activity cost from the highest activity cost to take out the fixed cost component such that the remaining variable component corresponds to the incremental number of units.

Variable cost component = Highest activity cost – Lowest activity costNext, the total number of units is calculated by deducting the number of units at the lowest activity from that of the highest activity.

The total number of units = Highest activity units – Lowest activity units.Next, in the high-low method total cost formula the variable cost per unit is calculated by dividing the expression in step 3 by the expression in step 4, as shown above.

- Next, the fixed cost is calculated either by deducting the product of variable cost per unit and the highest activity units from the highest activity cost or by deducting the product of variable cost per unit and lowest activity units from the lowest activity cost, as shown above.

Example

Let us try to understand the concept of high-low method total cost formula with the help of some suitable examples.

Let us take the example of a company that wants to determine the expected factory overhead cost it will incur in the upcoming month. The factory overhead cost in the previous three months is as follows:

The company plans to produce 7,000 units in March 2019 on the back of buoyant market demand. Help the company accountant calculate the expected factory overhead cost in March 2019 using the high-low method.

Solution:

The following are the given data for the calculation of the high-low method.

Therefore, using the above information, variable cost per unit can be calculated as,

- Variable cost per unit = ($60,000 – $50,000) / (6,000 – 4,000)

Variable cost per unit will be-

- Variable cost per unit = $5 per unit

Now, the fixed cost can be calculated as,

- Fixed cost = $60,000 – ($5 * 6,000)

Fixed Cost will be -

- Fixed cost = $30,000

Therefore, the expected overhead cost for March 2019 for 7,000 units can be calculated as,

- Total cost = Fixed cost + Variable cost per unit * Number of units

- = $30,000 + $5 * 7,000

Expected Overhead Cost will be-

- Total Cost = $65,000

Therefore, the overhead cost is expected to be $65,000 for March 2019.

From all the above examples, we get a lot of clarity regarding the concept and how to calculate the same from data that we get in the financial statements. It is possible for the analysts and accountants to use this method effectively for determining both the fixed and variable cost component.

Relevance And Uses

Let us find out what are the uses of the concept in real world.

It is a very simple and easy way to divide the costs of the entity in a methodical manner, even if the information available is very less.

The calculation follows simple process and step, which is better than the other complex methods like least-square regression.

Understanding the concept of the high-low method is imperative because it is usually used in preparing the corporate budget. It is used in estimating the expected total cost at any given level of activity based on the assumption that past performance can be practically applied to project cost in the future. The underlying concept of the method is that the change in the total costs is the variable cost rate multiplied by the change in the number of units of activity.

Nevertheless, it has limitations, such as the high-low method assumes a linear relationship between cost and activity, which may be an oversimplification of cost behavior. Further, the process may be easy to understand, but the high-low method is not considered reliable because it ignores all the data except the two extreme ones.

In other words, it does not account for any influence of outliers which are the data that vary to a significant extent from the normal set of data. It also does not account for inflation, thus providing a very rough estimation.

In the actual scenarios, it is often possible to obtain the required information regarding the cost incurred by the entity at various levels, thus, providing enough data to calculate the variable and fixed cost separately and directly. Therefore, there is no need to use this method.