Table Of Contents

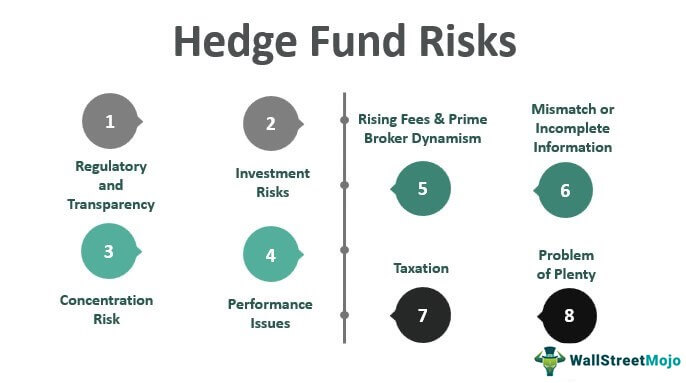

Hedge Fund Risks and Issues for Investors

The main reasons of investing in hedge funds is to diversify the funds and maximize the returns of the investors, but high returns comes with a cost of higher risk since hedge funds are invested in risky portfolios as well as derivatives which has inherent risk and market risk in it, which may either give huge returns to the investors or turn them into losses and investor may incur negative returns.

Table of contents

- The primary goals of investing in hedge funds are to diversify the investor's portfolio and increase returns. Still, these goals come at the expense of higher risk because hedge funds invest in risky portfolios and derivatives.

- They carry both inherent and market risk and can either result in enormous gains for investors or losses and negative returns.

- To prevent "Double Taxation" and the passing of profits and losses to investors, hedge funds are typically taxed as partnerships. The General Partner allocates these profits, losses, and deductions to the investors for the relevant fiscal year.

Explanation

Hedge funds appear to be a very lucrative proposition for investors with High Risk and High Return appetite. However, it does pose some challenges, especially for the investors investing Millions and Billions of Dollars. There are some inherent issues of hedge funds that have also increased significantly post the 2008 Financial crisis.

Hedge Fund Investors from most countries are required to be qualified investors who are assumed to be aware of the investment risks and accept these risks due to the potentially large returns available. Hedge Fund managers also employ comprehensive strategies of risk management for protecting the hedge fund investors, which is expected to be diligent since the hedge fund manager is also a significant stakeholder in the particular hedge fund. Funds may also appoint a “risk officer” who will assess and manage the risks but will not be involved in the Trading activities of the Fund or employing strategies such as formal portfolio risk models.

Video Explanation of Hedge Funds

#1 - Regulatory and Transparency

Hedge funds are private entities with relatively less public disclosure requirements. This, in turn, is perceived as a ‘lack of transparency’ in the immense interest of the community.

- Another common perception is that in comparison to various other financial investment managers[, the hedge fund managers are not subjected to regulatory oversight and rigid Registration requirements.

- Such features expose the funds to fraudulent activities, faulty operations, mismatch of handling the Fund in case of multiple managers, etc.

- There is a push by the U.S. Government and E.U. authorities to report additional information improving transparency, mostly post events such as the 2008 Financial crisis and the 2010 E.U. fall.

- Additionally, the influence of institutional investors is pressurizing the hedge funds to provide more information on Valuation Methodology, Positions, and Leverage exposures.

#2 - Investment Risks

Hedge funds share several risks as other investment classes are broadly classified as Liquidity Risk and Manager Risk. Liquidity refers to how quickly security can be converted into cash. Funds generally employ a lock-up period during which an investor cannot withdraw money or exit the Fund.

- This can block possible liquidity opportunities during the lock-up period, which can range from 1-3 years.

- Many such investments employ leverage techniques, which are the practice of purchasing assets based on borrowed money or using derivatives for obtaining market exposure over investors' capital.

- E.g., if a hedge fund has $1000 to purchase one share of Apple Inc. but the fund manager speculates the share price to rise to $1200 post the launch of its latest iPhone version. Based on this, it can leverage its position to borrow $9,000 from the share broker and, in totality, purchase ten shares for $10,000. It is a highly risky proposition since there is no limit on the upside or downside risks. On the one hand, if the share price touches $1200, the fund manager makes a total gain of $2000 (1200*10 = $12000 – Purchase price of $10,000). However, on the other hand, if the share price drops to $900, then the broker will give a margin call[ to the fund manager and sell all its ten shares to recover the $9000 loan offered. This will limit the loss for the hedge fund manager, whereby there will be no gain on a 10% dip in the market price of Apple shares.

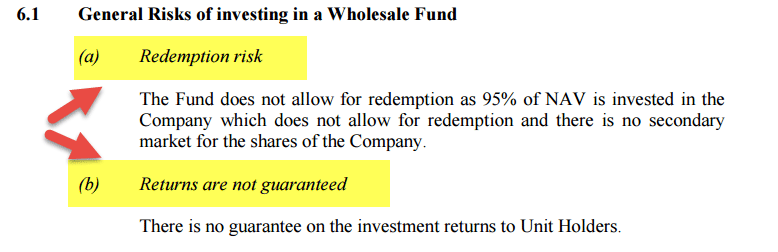

- Another massive risk for all hedge fund investors is the risk of losing their entire investment. The Offering Memorandum (Prospectus) of the hedge fund generally states that the investor should have the appetite of losing on the whole amount of investment in case of unforeseen circumstances without holding the hedge fund responsible.

source: rbh.com

Also, have a look at How Hedge funds work?

#3 - Concentration Risk

- This type of risk involves an excessive focus on a particular kind of strategy or investing in a restricted sector to enhance returns.

- Such risks can be conflicting for particular investors who expect vast diversification of funds to enhance returns in various sectors.

- E.g., the hedge fund investors may be having a defensive technique of investing the funds in the FMCG sector since this is an industry that will be operating continuously with a broad scope of expansion as per the changing customer requirements.

- However, if the macroeconomic conditions are dynamic like inflation challenges, high input costs, less consumer spending, in turn, will spur a downward spiral for the entire FMCG sector and hamper overall growth.

- If the hedge fund manager has put all the eggs in one basket, then the performance of the FMCG sector will be directly proportional to the performance of the Fund.

- On the contrary, if the funds have been diversified in multiple sectors like FMCG, Steel, Pharmaceuticals, Banking, etc., then a dip in the performance of one sector can be neutralized by the understanding of another industry.

- This will largely depend on the macroeconomic conditions of the region where the investments are being made and its future potential.

Useful Links on Hedge Fund

#4 - Performance Issues

Since the 2008 Financial crisis, the charm of the hedge fund industry is said to have waned out a bit. This is due to various factors related to interest rate formation, credit spreads, stock market volatility, leverage, and government intervention creating various hurdles that reduce opportunities for even the most skillful fund managers.

One area from where the hedge funds earn is by taking advantage of volatility and selling them. As per the below chart, the volatility index has been steadily declining downward since 2009, and it is hard to sell volatility since there is none to take advantage of.

- This deterioration in performance can be pinned to the overabundance of investors. The hedge fund investors have now become very cautious in their approach and opt to preserve their capital even in the worst of conditions.

- As the number of hedge funds has swelled, making it a $3 trillion industry, more investors are participating. Still, the overall performance has shrunk since more hedge fund managers have entered the market, reducing the effect of multiple strategies that were traditionally considered speculative.

- In such cases, the skills of a fund manager can carve a niche for themselves by beating various estimates and exceeding expectations of general market sentiment.

#5 - Rising Fees & Prime Broker Dynamism

Fund managers are now beginning to feel the effects of bank regulations, which have been strengthened post the 2008 financial crisis, especially the Basel III regulations.

- These updated rules require banks to hold more capital through a capitalization rate, which blocks money towards regulatory requirements, leverage constraints, and increasing focus on liquidity, impacting the capacity and economics of banks.

- It has also resulted in an evolving shift in how the Prime broker’s view hedge fund relationships.

- Prime brokers have started demanding higher fees from the hedge fund managers for providing their services, which in turn has an impact on the performance of the hedge fund and, in turn making them less lucrative in an already squeezing margin business.

- This has caused fund managers to evaluate how they obtain their financing or, if required, to make radical changes to their strategies.

- This has made the investors jittery, especially for those whose investments are in the “lock-up” period.

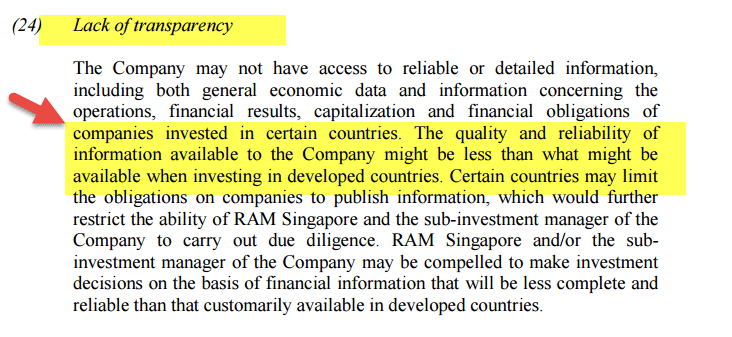

#6 - Mismatch or Incomplete Information

- The fund managers must reveal the performance of the Fund regularly. However, the results can be fabricated to match the directions of the fund manager since the offering documents are not reviewed or approved by the state or federal authorities.

- A hedge fund may have little or no operating history or performance and hence may use hypothetical measures of execution, which may not necessarily reflect the actual trading done by the manager or advisor.

- Hedge fund investors should do a careful vetting of the same and question possible discrepancies.

- E.g., a hedge fund could have a very complicated tax structure that may expose possible loopholes but not be understood by the typical investor.

- A fund manager may invest in P-Notes of the Indian stock market but routed through tax haven. However, the manager may make such an investment by making all tax payments misleading the investors.

- A hedge fund may not provide any transparency regarding its underlying investments (including sub-funds in a Fund of Funds structure) to the investors, which in turn will be difficult for the investors to monitor.

- Within this, there exists a possibility of getting the trades done through trading expertise and experience of third-party managers/advisors, the identity of which may not be disclosed to the investors.

#7 - Taxation

- Hedge funds are generally taxed as Partnerships to avoid instances of “Double Taxation” and the Profits and Losses being passed on to the investors.

- These gains, losses, and deductions are allocated to the investors for the respective fiscal year as determined by the General Partner.

- This is detrimental to the investors since they will be the ones to bear the tax liabilities and not the hedge fund.

- The Fund's tax returns are usually prepared by the accounting firm, which provides audit facilities to the hedge fund.

- Expenses are also passed on to the investors, depending on whether the hedge fund is a “Trader” or an “Investor” insecurities during the year. The difference in treatment may change every year, and the differences are:

- If the Fund is treated as a Trader, the investors may deduct their share of funds’ expenses,

- If the Fund is treated as an Investor, they may only deduct their share of funds’ expenses if that amount exceeds 2% of the investor’s Adjusted Gross Income.

- Additionally, investors may also require state or local income tax returns with the Federal tax returns.

- The drawback for the offshore investors, if not a tax-exempt, is that their Profits shall be credited net of all expenses and tax liabilities.

- For instance, the U.S. Government taxes all offshore profits at very high rates and imposes a non-deductible interest charge on taxes owed on any deferred income once the shares of the Fund are sold or distributed.

- In the case of dividends, a "With-holding tax" is also imposed on the offshore investors, which is generally in the range of 25%-30% depending on the country from where the investment is made and the taxation treaty shared with such nations.

- Hence, if for local investors, the tax liability would be in the range of 15%, for offshore such penalties can climb to as much as 35%.

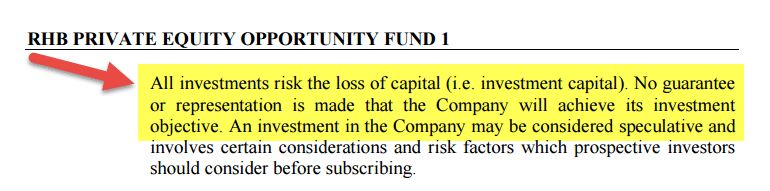

#8 - Problem of Plenty

Presently, the biggest problem faced by the hedge fund industry is the existence of far too many hedge funds.

- If an investor wants to multiply his investment and generate a continuous trend of positive alpha (returns above the risk-adjusted return, the hedge fund needs to be exceptional regularly.

- The issue for the hedge fund investors here is in which Fund they shall proceed with their investments.

- Most of the small hedge funds are currently struggling with the burden of additional costs being imposed along with Prime brokerage fees. As a result, for a fund to survive, it needs to have a good rise in its Assets under Management (AUM) to at least $500mm for countering the increasing costs and]risk appetite it needs to spur for earning large returns.

- A fund in such instances will need around three years to break even after it can earn profits and breach its high-water mark limit for charging Performance Fees.

Below is a sample table explaining the same for ABC Fund Ltd:

| Year | Assets Under Mgmt ($MM) | Performance | Gross Income – Mgmt Fees($MM)(Assumed @ 1.75%) | Gross Income – Performance ($MM)(Assumed) | Expense ($MM)(Assumed) | Profitability ($MM)(Performance Income minus Expense) |

|---|---|---|---|---|---|---|

| 1 | 50 | 12% | 0.875 | 1.05 | 2.625 | -1.575 |

| 2 | 100 | 12% | 1.750 | 2.10 | 2.625 | -0.525 |

| 3 | 200 | 12% | 3.50 | 4.20 | 3.50 | 0.70 |

| 4 | 500 | 12% | 8.75 | 10.50 | 5.0 | 5.50 |

From the above example, we can ascertain that as the Assets for the fund increases, so do the expenses. In this case, we are assuming the income to double every year, and only then can it break-even once it enters the third year with assets of $200MM. It is from here that the skills of the fund manager come into play and need to ensure that the returns are regularly increasing to attract the cream of the investors in an ever-increasing and competitive hedge fund industry.

Frequently Asked Questions (FAQs)

A hedge fund is an investment vehicle that pools together capital from various investors and uses sophisticated strategies to generate returns. Unlike traditional investment funds, hedge funds have greater flexibility regarding the types of investments they can make, including leveraging techniques and short-selling. Hedge funds also often target higher returns but may involve higher risks than traditional funds.

Hedge funds offer several advantages for investors seeking potentially higher returns. Firstly, hedge funds are managed by experienced professionals who employ active investment strategies and aim to outperform the market. Additionally, hedge funds can utilize diverse investment instruments and methods, such as derivatives and alternative assets, to generate returns in both rising and falling markets.

While hedge funds can offer attractive returns, they also come with certain risks. One critical risk is the potential for investment losses. Hedge funds often employ complex strategies, which may involve higher risk levels than traditional investments. Additionally, hedge funds may have limited liquidity, meaning investors may need more time to withdraw their investments on short notice easily.

Recommended Articles

This has been a guide to Hedge Fund Risks. Here we discuss hedge fund risks and issues for investors, such as lack of transparency, performance issues, taxation, incomplete information etc. You can learn more about it from the following articles -