Why Health Insurance is Essential for Senior Citizens: Key Benefits Explained

Table of Contents

Introduction

Insurance is a necessity in today's lives. We all know that, in fact, many of us already have medical insurance for ourselves and our children. We understand that life has a strong uncertainty factor linked to it, and health is our true wealth. Whether we try to take care of it or not, we like to keep it insured.

However, many people make the common mistake of not insuring elderly family members. From a simple perspective, they need it more than us. After all, as individuals grow older, they become more prone to diseases, illnesses, accidents, and unfortunate medical emergencies. Tending to all of these can be really expensive. This is why, in this article we will elaborately talk about not only the importance of health insurance for senior citizens but the key benefits of it.

Key Benefits

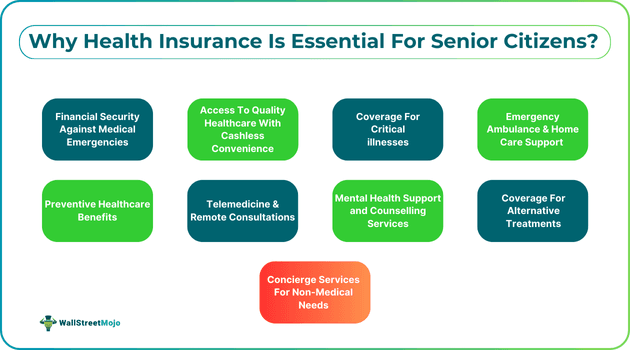

Here are the top nine benefits of health insurance for senior citizens:

#1 - Financial Security Against Medical Emergencies

This goes without saying: every senior family member or an older person that we know as friends, family or relatives is more likely to face medical emergencies compared to a younger person. With time, the body's important organs start to lose their functions; bones become weak, and the vision deteriorates. Needless to say, elderly people even become dependent on others and have to go for tests and treatments. Moreover, they have to take medicines separately. A decent medical insurance policy can help them cover all such bills and keep them financially stable.

#2 - Access To Quality Healthcare With Cashless Convenience

With an increase in innovation and accessibility, insurance companies can now partner with big hospitals and healthcare providers. As a result, when it comes to health insurance for senior citizens, the insured person can get access to treatment and services at these network hospitals.

Moreover, the policyholder can often reap the benefits of free to discounted healthcare products because they are clients of the partnered insurance company. With the right insurance policy, meeting healthcare expenses, like hospital fees and getting access to facilities like cashless claim settlement, world-class amenities, and quality healthcare becomes possible. These features enable insured elderly people to receive top-notch treatment while avoiding a financial crunch.

#3 - Coverage For Critical Illnesses

Senior citizens are more likely to suffer from serious diseases or critical illnesses that involve trials and treatments for months. Combatting such severe health conditions can be expensive. The top health insurance providers today provide coverage for most critical illnesses through specific policies.

It may sound insignificant at first, but purchasing medical coverage for seniors in your family can save you substantial funds. Moreover, it can help avoid the significant financial stress associated with such illnesses and ensure that the elders receive the best healthcare services at the top hospitals.

#4 - Emergency Ambulance Services & Home Care Support

When you get health insurance for senior citizens you can avail of a set of services that come in handy and would have been difficult to get access to without the insurance policy. One of the most effective of them is the emergency ambulance service. By choosing this service, In case of an unfortunate incident, you can take your elders to the hospital without any delay. Another important service is home care support. It allows you to set up the necessary medical equipment at home for elders if prescribed by doctors.

#5 - Preventive Healthcare Benefits

In a nutshell, preventive healthcare benefits in health insurance include free health checkups all around the year, pharmacy concessions, free doctor consultations, and discounts on costly treatments, tests, trials and dental services. With all these covered, a senior citizen can be taken for regular checkups, and doctors can help them identify early signs of any diseases or deficiencies upon which they can act early and take good preventive care. This whole aspect of health insurance for senior citizens or any individual is based on the fact that prevention is better than cure.

#6 - Telemedicine And Remote Consultations

Telemedicine is not a new concept at all. In fact, it was developed in the 1980s. As the name suggests, remote consultation is a general practice and a sub-form of telemedicine. It refers to the exchange of information between the patient and the general practitioner when they are both located at different places. This whole process was introduced to offer healthcare to patients who lived in remote areas.

Now, with health insurance, if a senior citizen finds it difficult to visit a doctor, they avail of telemedicine and remote consultation services, and get financial coverage for the same.

#7 - Mental Health Support And Counselling Services

In addition to offering financial coverage for a range of diseases and illnesses, health insurance policies can cover the costs incurred for mental health support and counseling services availed of by senior citizens. Most people don't know about this because either they never bought insurance or never really cared to explore the full benefits of the policy. There is a wide range of counseling, therapy, and mental health support facilities that you can opt for senior citizens in your family.

#8 - Coverage For Alternative Treatments

First, let us understand what alternative treatments are. These treatments refer to therapies, tests, treatments and medical practices that lie outside the scope of conventional Western medicine. These include holistic and unique approaches and serve as alternative treatments for patients who cannot find Western medicine helpful. The best part is that many medical insurance providers cover alternative treatment expenses.

Some simple examples of such treatments are Homeopathy, Naturopathy, Yoga, Ayurveda, and so on. When you plan to buy insurance for your senior citizens, you can check if the policy offers this coverage. An elderly health protection plan with financial coverage for these alternative treatments improves accessibility and offers broader treatment options.

#9 - Concierge Services For Non-Medical Needs

Concierge service involves individuals offering personal assistance in fulfilling different types of requirements for a price. Nowadays, Senior citizen insurance benefits include coverage for concierge services availed for non-medical needs as well. Concierge services may include pet care, arranging transportation, running errands, planning itineraries, and delivering flowers and parcels.

Note that there are different types of concierge services, such as medicine, hotel, travel, shopping and lifestyle concierge services. At the time of buying an insurance policy, one may check if the insurance provider is offering this feature or not. Typically, the availability of this benefit varies across health insurance providers and policies.

Final Thoughts

The bottom line is that health insurance is a vital requirement for all individuals, especially senior citizens, given their vulnerability to diseases and illnesses. If there are any senior citizens at your home, you should get them insured with any of the top health insurance policies available in the market.

Make sure to remember the key benefits discussed above and check which ones the insurer is offering when buying a policy. We expect that you will consider all the benefits and buy a health insurance plan for senior citizens that suits all the medical requirements of your loved ones.