Table Of Contents

What Is The Hart-Scott-Rodino Act (HSR)?

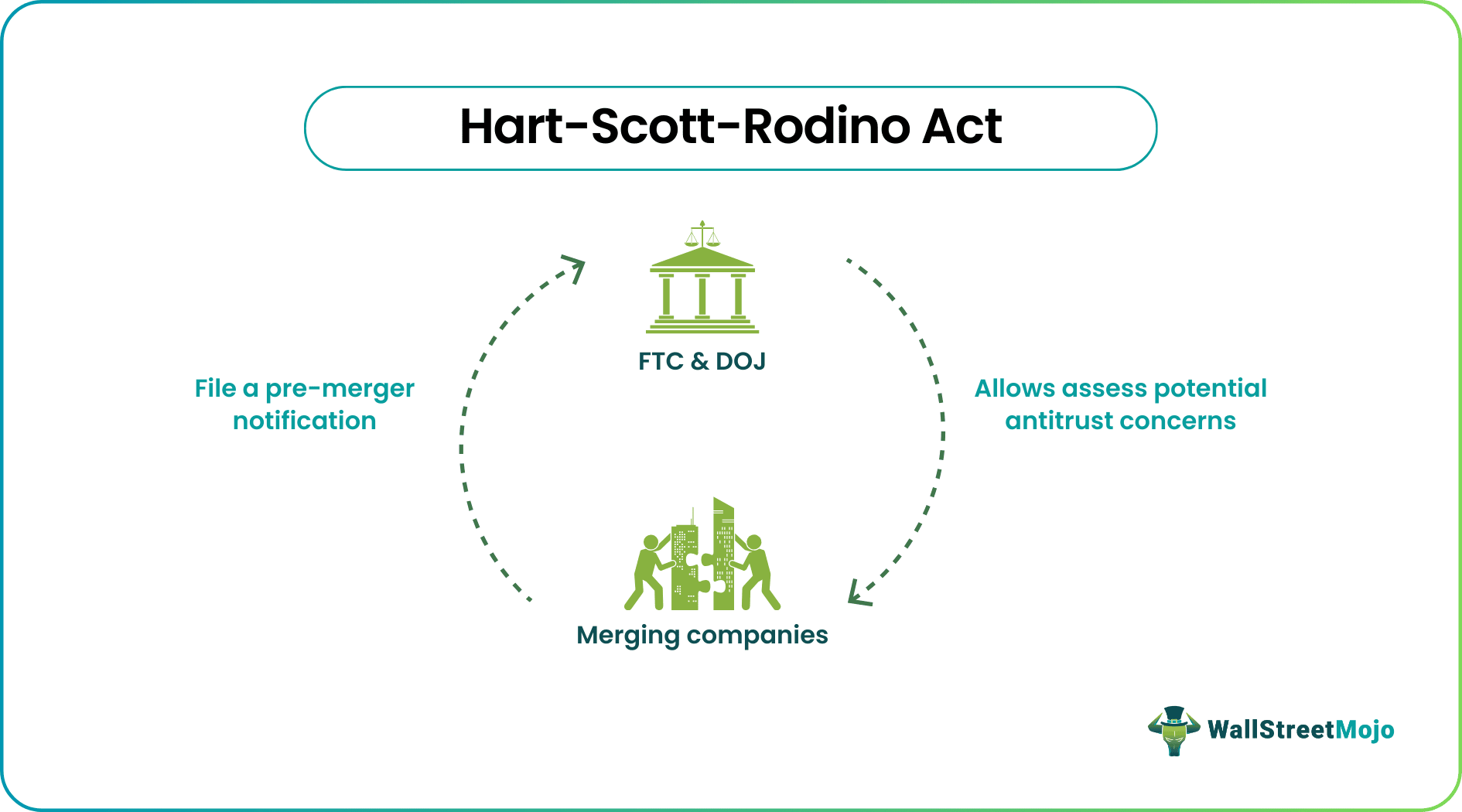

The Hart-Scott-Rodino Act (HSR) is a United States federal law enacted in 1976 to provide the Federal Trade Commission (FTC) and the Department of Justice (DOJ) with information and time to review and evaluate potentially anticompetitive mergers and acquisitions before they are completed. It is officially known as the Hart-Scott-Rodino Antitrust Improvements Act.

The act aims to avert antitrust issues and protect competition in the marketplace. It achieves this through a mandatory pre-merger notification process, which requires parties involved in specific transactions to submit information about their proposed merger or acquisition to the FTC and DOJ for review. In addition, the law applies to transactions that meet particular size thresholds.

Table of Contents

- What is the Hart-Scott-Rodino Act (HSR)?

- The HSR Act requires parties involved in particular mergers and acquisitions to file a pre-merger notification with the Federal Trade Commission (FTC) and the Department of Justice (DOJ). The purpose is to provide the agencies with information about the transaction and allow them to assess potential antitrust concerns.

- After filing the HSR notification, a waiting period begins during which the FTC and DOJ review the proposed transaction.

- The HSR Act's filing requirements are based on size thresholds, considering the parties' size and the transaction's value. Accordingly, parties must file if their marketing meets or exceeds the applicable thresholds.

- Violations of the HSR Act can result in several penalties.

Hart-Scott-Rodino Act Explained

The Hart-Scott-Rodino Act (HSR) significantly impacts the regulation of mergers and acquisitions in the United States(US). However, its implementation and effectiveness have drawn criticism over the years.

The HSR Act was enacted in 1976 as a response to concerns about the increasing concentration of economic power and the potential adverse effects of large mergers on competition. It introduced a mandatory pre-merger notification process, requiring companies to notify the Federal Trade Commission (FTC) and the Department of Justice (DOJ) about their proposed mergers and acquisitions if they meet certain size thresholds.

Theoretically, the HSR Act aims to identify potentially anticompetitive transactions and allow the FTC and DOJ to review them before completion. The waiting period allows these agencies to investigate and take necessary actions to protect competition and consumers.

However, the HSR Act has faced criticism on several fronts. One complaint is that the Act's size thresholds, which trigger the notification requirement, must catch up with economic changes. Many more minor mergers and acquisitions that may still have significant competitive implications escape the scrutiny of the FTC and DOJ.

#1 - Pre-Merger Filing Thresholds

Pre-merger filing thresholds are the criteria that determine whether parties involved in a merger or acquisition must submit a pre-merger notification under the Hart-Scott-Rodino Act (HSR). These thresholds are set by the Federal Trade Commission (FTC) and the Department of Justice (DOJ).

The HSR Act requires companies to file a notification with the FTC and DOJ if the transaction meets specific criteria related to the parties' size and the transaction's value. The filing thresholds serve as a way to identify potentially significant mergers and acquisitions that may have antitrust implications and warrant further review.

There are two primary components of the pre-merger filing thresholds:

- Size-of-Persons Test: This threshold considers the total annual net sales or assets of the parties involved in the transaction. Suppose the acquiring person (or group of persons) or the acquired person (or group of persons) has annual net sales or total assets that exceed a specified amount.

- Size-of-Transaction Test: This threshold considers the transaction's total value. If the marketing involves the acquisition of assets or voting securities and the total value exceeds a certain amount, the size-of-transaction threshold is met.

The specific dollar amounts for the filing thresholds are adjusted annually based on Gross National Product (GNP) changes. The FTC publishes the updated entries in the Federal Register.

#2 - Pre-Merger Tests

In the context of antitrust regulation and the Hart-Scott-Rodino Act (HSR), pre-merger tests refer to the analytical frameworks used by the Federal Trade Commission (FTC) and the Department of Justice (DOJ) to assess the potential competitive implications of a proposed merger or acquisition.

When parties submit a pre-merger notification under the HSR Act, the FTC and DOJ comprehensively analyze whether the transaction may harm competition and violate antitrust acts. These analyses involve various tests and criteria to evaluate the potential anticompetitive effects of the merger or acquisition.

The specific pre-merger tests used may vary depending on the particular circumstances of the transaction and the relevant industry. Some of these tests include:

- Market Definition: The agencies assess the relevant product and geographic markets affected by the merger. This involves defining the specific goods or services and the geographic area where the competition occurs. The definition helps determine the market concentration and assess the potential impact on competition.

- Market Concentration: The agencies examine the level of market concentration resulting from the merger. They calculate market shares of the merging parties and other competitors to assess whether the transaction would significantly increase engagement. Higher market concentration raises concerns about reduced competition and potential anticompetitive effects.

- Entry Barriers: The agencies evaluate the barriers to entry for new competitors in the relevant market. High obstacles, such as significant capital requirements, proprietary technologies, or regulatory hurdles, can limit competition and raise concerns about the merger's impact.

- Potential Competitive Effects: The agencies analyze the possible effects of the merger on competition. They consider factors such as price increases, reduced innovation, decreased product variety, and the likelihood of coordinated behavior in the market. If the merger is likely to harm competition, it may be subject to further scrutiny or challenged by the agencies.

- Efficiencies and Procompetitive Effects: The agencies also consider potential efficiencies and procompetitive benefits that may result from the merger. If the transaction is likely to generate significant cost savings, improved product offerings, or increased innovation that outweigh potential anticompetitive effects, it may be viewed more favorably.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Common HSR Violations

Common violations of the Hart-Scott-Rodino Act (HSR) involve non-compliance with the pre-merger notification and waiting period requirements and violations related to the accuracy and completeness of the information provided in the notification filings. Some of the common HSR violations include:

- Failure to File: Parties involved in a merger or acquisition meeting the size thresholds must file a pre-merger notification with the Federal Trade Commission (FTC) and the Department of Justice (DOJ) and observe the waiting period before completing the transaction. Failure to file when required is a violation of the HSR Act.

- Early Consummation: The HSR Act prohibits completing a covered transaction before the expiration or termination of the waiting period. Early consummation violates the Act, where parties close the transaction before receiving clearance from the FTC and DOJ.

- Incomplete or Inaccurate Filings: Parties provide complete and accurate information in their HSR notification filings. Providing false or misleading information, omitting required information, or failing to provide additional information can attract penalties.

- Failure to Comply with Second Requests: If the FTC or DOJ issues a second request for additional information, parties must comply. Failure to provide the requested information can lead to HSR violations.

- Gun-Jumping: Gun-jumping refers to actions taken by parties before the completion of a transaction. It may affect competition or control over the target company. Examples include coordination of pricing or other competitive behavior between the merging parties. This also includes exercising control over the target's operations before obtaining regulatory approval.

- Improper Use of Exemptions: The HSR Act provides certain exemptions and filing thresholds based on the nature of the transaction. Parties may attempt to improperly claim exemptions or manipulate the transaction structure to avoid or circumvent HSR requirements.

- Non-Compliance with Civil Investigative Demands (CIDs): The FTC and DOJ have the authority to issue civil investigative demands (CIDs). This is to obtain information and conduct investigations. Failure to comply with these demands or provide requested documents or testimony can result in HSR violations.

Penalties

Violations of the Hart-Scott-Rodino Act (HSR) can result in significant penalties. The penalties aim to deter non-compliance and ensure the enforcement of the HSR Act's requirements. The penalties can take various forms, including:

- Civil Penalties: The agencies have the authority to seek civil penalties for violations of the HSR Act. As of the knowledge cutoff in September 2021, the maximum civil penalty for an HSR violation is $43,280 daily. The exact penalty amount may depend on the violation's nature, severity, the transaction's size, and the party's conduct.

- Injunctive Relief: Besides civil penalties, the FTC and DOJ may seek injunctive relief in court to prevent the consummation of a merger or acquisition. This can involve seeking an injunction to halt the transaction or require divestitures of assets. In case the agencies determine that the transaction would substantially lessen competition.

- The unwinding of Transactions: If a violation is after the completion of the transaction, the agencies may take steps to unwind the transaction. This involves requiring the parties to reverse the completed merger or acquisition and restore the market to its pre-transaction state. However, developing a transaction can be complex and disruptive, and parties may also face additional costs and legal consequences.

- Corrective Measures and Compliance Orders: In cases of HSR violations, the agencies may require parties to take corrective measures. This is to address the breach and ensure compliance with the HSR Act. This may involve providing additional information, resubmitting a corrected notification filing, or taking other actions specified by the agencies.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQ)

Certain transactions may be exempt from the HSR Act's notification requirements. For example, exemptions exist for certain acquisitions, such as small transactions, foreign asset purchases, or voting securities below a certain threshold.

The waiting period under the HSR Act is typically 30 days from the filing date, although it can be subject to extension under certain circumstances. During this period, the FTC and DOJ review the transaction and assess its potential impact on competition.

Yes, the HSR Act can be enforced retroactively. For example, suppose the FTC or DOJ discovers that a covered transaction was consummated without filing or waiting for the required period. In that case, they can take enforcement action against the parties involved, even if the violation occurred in the past.