Table Of Contents

What Is A Hard Money Loan?

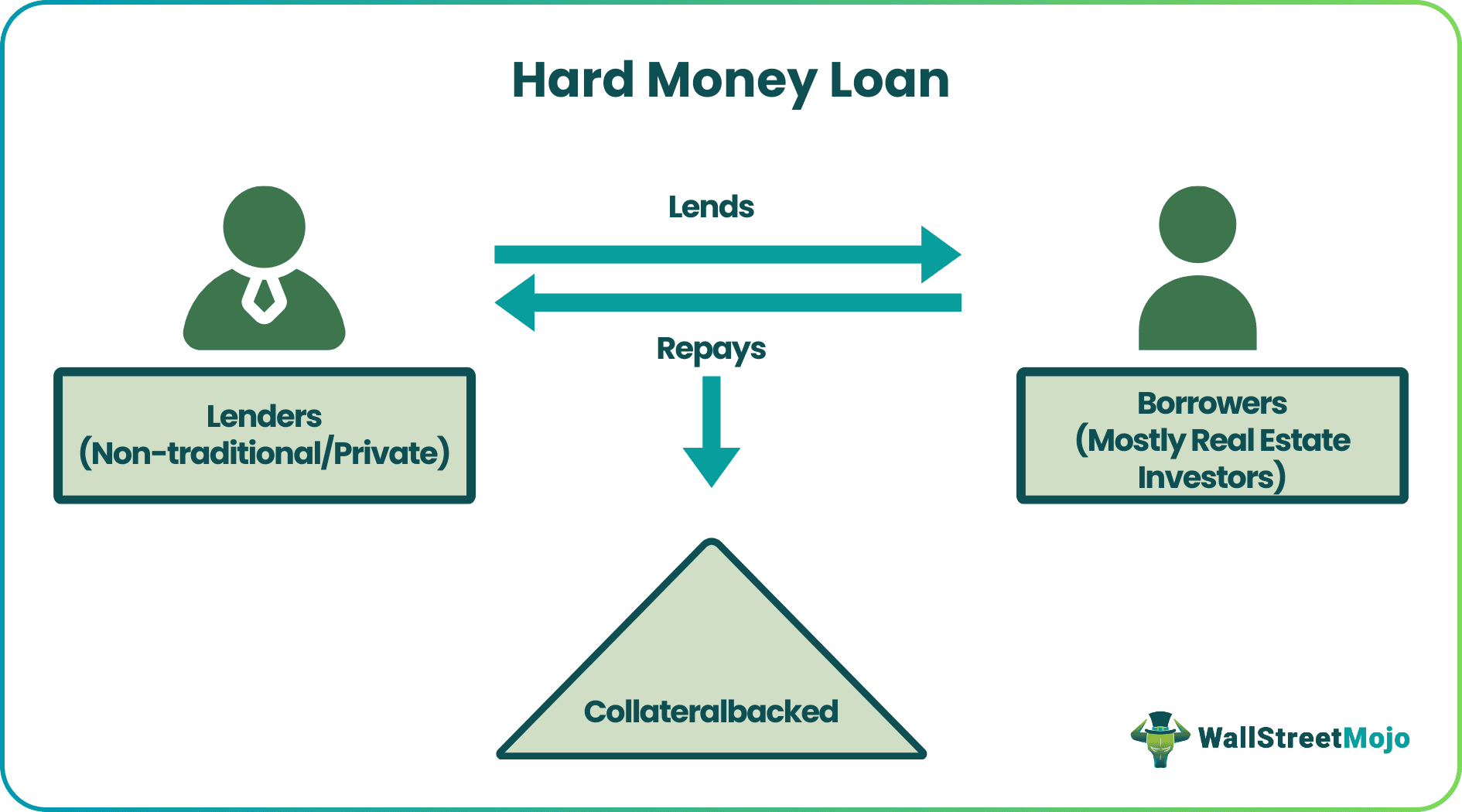

A hard money loan refers to the finances obtained from a non-banking institution or a private lender against collateral. Borrowers mostly refrain from opting for this security-backed option, but they end up choosing it as a last resort to tackle immediate or short-term fund requirements. It is, however, commonly opted for by people investing in real estate.

A hard money loan calculator does not work as per the creditworthiness of the borrowers. Instead, the eligibility and amount are decided per the property's condition and cost to back the finance. Hence, people with poor credit but sufficient asset ownership get easy approval for these loans.

Key Takeaways

- A hard money loan is financing provided to real estate investors by non-banking institutions or private lenders. It doesn't require much credit scrutiny as it is backed by collateral.

- The investors prefer it since the loan is provided quickly, say within a week, compared to traditional ones, taking approximately 1 to 2 months for disbursal.

- No investigation of the investor's credit history, source of income, or income history is required.

- The finance may be rejected for the property with a lower value against the valuation done by the investor.

How Does A Hard Money Loan Work?

A hard money loan is opted for when individuals or firms are left with no other way of obtaining funds. In such scenarios, borrowers prefer taking up finances for short-term against collateral, and once they are financially stable, they opt for a traditional financing option. In short, this loan option bridges the gap between the purchase and resale of the property.

The job of a real estate investor is to identify a suitable property, purchase it, make repairs or renovations as required, and increase its market value for resale. Investors usually face financing issues at the time of property purchase, requiring quick finance to make the property saleable immediately.

Traditional bankers do not lend hard money since the loan to value ratio (LTV ratio) may be high to over 75%. Thus, those who invest in real estate choose private players to finance their projects. Real estate property acts as collateral for lenders in such situations. The lender is not concerned with the income or credit history of the investor since it is a short-term loan.

Investors trying to compete with multiple competitive bids must choose the hard money option, which helps them get the deal quickly. The ones with a bad credit history, who have higher chances of rejection from traditional bankers, can also use the hard money to ensure quick disbursal without issues and inquiries. Also, this alternative works well for new investors in the market who hardly have a healthy income history. Further, the investors can lower their part of the investment in real estate, which ensures their exposure to lower risk.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Requirements

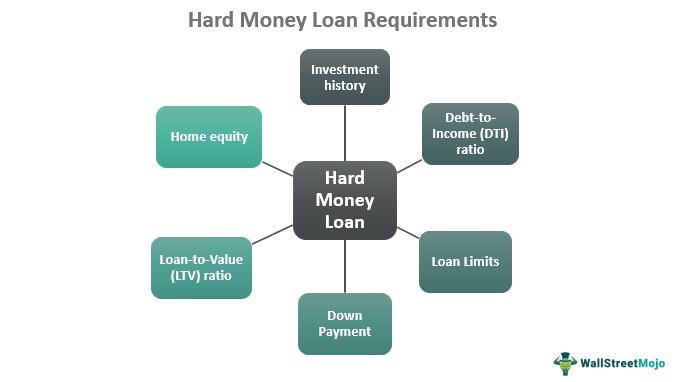

As this loan is collateral-based, borrowers must possess a property to obtain a loan against the same. Thus, having home equity is the first requirement. The next is the debt-to-income (DTI) ratio, which reveals the ability of the hard money borrower to repay the loan. The higher the ratio, the lower the capability of the borrowers to repay as it depicts the amount of debt for the individual or entity is higher than their income.

Next on the list is the LTV ratio, which specifies the amount of loan that lenders are likely to sanction. It is calculated by dividing the loan amount by the value of property to be given as collateral security. A higher LTV means a higher amount financed by the lender and vice-versa. Normally, the traditional bankers offer 75% of the value as a loan, while the private players offer an LTV of more than 75%.

The hard money loan rates are fixed based on the possible purchase price of a property after it is ready for sale. Sometimes, the amount received in return might not be enough to repay lenders at the end of the tenure. Thus, lenders ask for a down payment from the borrowers so that the latter work on protecting the extra amount they invest from their end.

Along with the above hard money loan requirements, the amount borrowers need and the extent to which lenders can allow the finance are important factors to consider. Plus, the investment history of the real estate investor obtaining the fund for investing in property plays a vital role as it helps lenders check the borrowers' trustworthiness.

Example

Let us consider the example below to understand the hard money loan definition better:

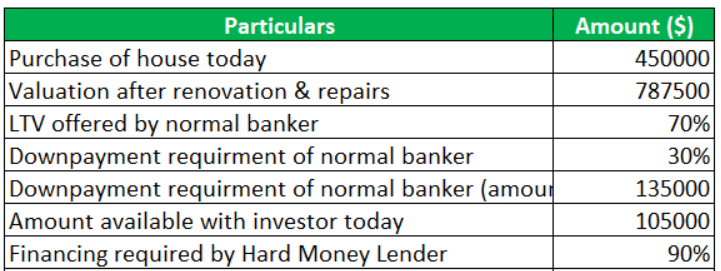

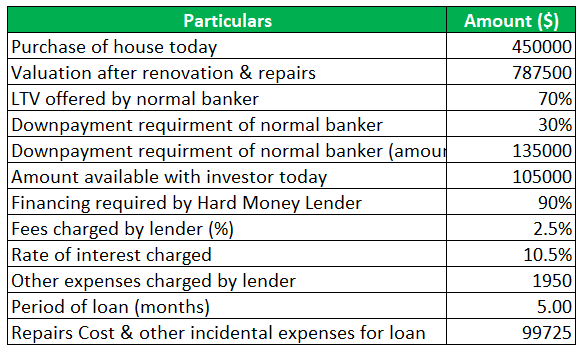

A real estate investor comes across the property and decides to invest. First, however, the person explores the normal traditional loan option and hard money alternative. The details gathered were as follows:

For Traditional Loan

For Hard Money Finance

Observations

- In this case, the amount that normal bankers offer is only 70% compared to hard money lenders. Further, the amount of down payment required for hard money alternative is lower.

- The investor can manage repairs and incidental expenses within their savings.

- Within the total span of 5 months, the investor can easily plan for repairs and renovation.

- The return for the investor is handsome within the specified period.

Hard Money Loan vs Mortgage

Hard money and mortgage loan are two confusing terms with different purposes to fulfill. The former helps expand a business, while the other is a loan that lets home seekers buy a house. Hard money finance is used when real estate investors have a property to be worked on and renovated for further sale. This adds to the business of the borrower.

For example, Stella owns a used residential property, which is not in sound condition anymore. She plans to relocate for work purposes and hence opts for a hard money fund to renovate the house for quick resale. She uses the finance to help the property retain its original charm. Looking for a residence near his office, Mark comes across Stella's renovated house and decides to buy it. He applies for a mortgage loan to buy the property. This is how both the terms differ in their use.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.