Table Of Contents

Hanging Man Candlestick Meaning

Hanging man or hangman candlestick refers to a bearish single-candlestick formation found at the topmost point of an uptrend. Traders utilize this pattern in the trend direction of pattern changes. It also signals the trend reversal of the market as soon as the bull appears to lose its momentum. It aims to indicate a potential bearish reversal in the market.

It simply issues warnings about the end of existing market momentum instead of predicting an immediate trend reversal. Hence, traders must start preparing for imminent trend direction change. Pictorially it gets represented as a hangman with an equal, open, closed, high-priced, and a long-legged shadow beneath a short body.

Table Of Contents

- Hanging Man Candlestick Meaning

- A hanging man candlestick pattern forms during an uptrend at the far end of the phenomenon where security's opening, high, and closing prices are equal.

- It signals a market trend reversal in combination with another hanging candlestick pattern formed just after the first one.

- The traders can target their asset for a short position in the middle of the first hanging candle stick and the next hanging candlestick formations.

- The hanging man candlestick pattern means the market has turned bullish, whereas the hammer candlestick pattern indicates a bearish market.

Hanging Man Candlestick Pattern Explained

The hanging man candlestick means a single-formation candlestick representing the endpoint of the existing uptrend momentum of the market, looking like a man hanged to death. It signals a weak bull and strong bear presence in the market at the far end of an uptrend. It forms whenever the security prices get pushed to the maximum that can't get pushed any further.

The small body of the hangman candlestick indicates that opening and closing prices stood quite close to each other. One can see the absence of an upper shadow and a long bottom shadow. Such a unique pattern allows day traders to square their position to enter a short position.

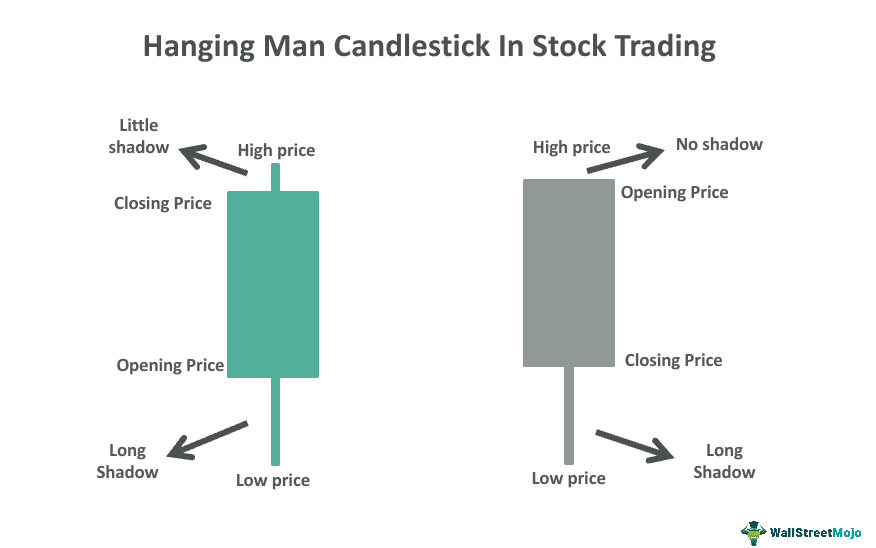

Traders must keep an eye for these criteria before classifying any pattern as a hanging man candlestick in an uptrend:

- First, the upper shadow must be either absent or very little.

- Next, the lower leg should be double the length of the body.

- Finally, the upper side of the candle must contain the actual body.

To get it explained better, let us study the image:

From the above figure, it gets clear that:

- Hanging man has little or no upper shadow

- The lower shadow has double the size of its body

- Closing, high, and opening price becomes the same

Moreover, an inverted hanging man candlestick formed gets called a hammer candlestick.

Hanging Man Candlestick Pattern Explained

The hanging man candlestick means a single-formation candlestick representing the endpoint of the existing uptrend momentum of the market, looking like a man hanged to death. It signals a weak bull and strong bear presence in the market at the far end of an uptrend. It forms whenever the security prices get pushed to the maximum that can't get pushed any further.

The small body of the hangman candlestick indicates that opening and closing prices stood quite close to each other. One can see the absence of an upper shadow and a long bottom shadow. Such a unique pattern allows traders to square their position to enter a short position.

Traders must keep an eye for these criteria before classifying any pattern as a hanging man candlestick in an uptrend:

- The upper shadow must be either absent or very little.

- Moreover, the lower leg has double the length of the body.

- Finally, the upper side of the candle must contain the actual body.

To get it explained better, let us study the image above:

From the above figure, it gets clear that:

- Hanging man has little or no upper shadow

- The lower shadow has double the size of its body

- Closing, high, and opening price becomes the same

Moreover, an inverted hanging man candlestick formed gets called a hammer candlestick.

Interpretation

One can understand how to read or interpret this pattern by looking at the chart below.

The second-last candlestick in the above chart is a hanging man pattern. One can identify it because of the candlestick’s lower shadow, which is almost two times longer than the body, and its appearance following an uptrend. This long wick or shadow denotes significant selling pressure after the open as the bears push the price downward.

Although the bulls or buyers in the market drove the price up later, it is a sign that the bulls are starting to lose control, and a potential bearish reversal is forthcoming. The bearish candlestick after the hanging man confirms the chart pattern and validates the trend reversal signal. As mentioned in the chart, individuals may consider placing a short sell below the bearish candlestick’s low to make significant financial gains when the downside move materializes.

One can look at similar charts on TradingView to understand the concept better.

How To Trade A Hanging Man Candlestick?

Hanging man candlesticks could be traded by identifying the pattern and then taking advantage of the characteristics. First of all, a long lower shadow of a candlestick pattern marks the entry of sellers into the market. It is a thumb rule that long lower shadows perform better than hangmen with shorter lower shadows. The color of the hangman candlestick can be either red or green.

A red bearish hangman forms when the high and the opening price gets the same. A green bearish hangman forms when the high and closing prices change. The red bearish hangman is considered a stronger bearish signal of the two. Moreover, the rule of two applies to it, just like with other candles. It means that the signal sent by one bearish hanging candlestick gets confirmed only when another bearish candle is formed either on the same day or the next.

Furthermore, the next bearish hanging candlestick and a broken support trendline earmark the most positive signal for going short to the traders. Besides these signals, traders must see an increase in the trading volume of securities while the hanging pattern forms. Therefore, as a result of the bearish hanging candlestick signals, traders may enter the short position only:

- At closing hanging candlestick price or;

- At opening hanging candlestick price

Finally, the hanging candlestick's highest point is the best point for a trader to place a stop-loss.

Example

To understand the topic better, let's study a hanging man candlestick pattern example.

Let us look at the chart of firm X in the figure above. It explains the hanging man candlestick pattern quite clearly. A bear forms at the top of the uptrend (A), where the gap up (B) forms. The body's lower leg or shadow (C) is twice the length of the main body. Traders find the hanging candlestick's real bearish body (D) favorable. The short position taken by the traders gets confirmed by the appearance of the second bearish hanging candlestick (E).

Hanging Man vs Hammer Candlestick Pattern

| Hanging Man Pattern | Hammer Candlestick Pattern |

|---|---|

| It appears that the market has turned to become an uptrend. | It appears that the market has turned to become downtrend. |

| It always occurs at the top of the uptrend. | It always occurs at the bottom end of the downtrend. |

| It signals a bullish or bearish reversal market. | It signals a bearish or bullish reversal market. |

| It appears to look like a hanging man. | It appears to look like a hammer. |

| It consists of a single candle formation. | It has candles in its pattern. |

| It gets known as market peak or resistance. | It gets known as a market peak or support place. |

| It acts as an exit point for traders. | It acts as an entry point for traders. |

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

A hanging candlestick means the final point of an uptrend where the closing, high, and opening prices become the same, forming a candlestick pattern in the shape of a hanging man. Two subsequent hanging candlestick signals for a bearish reversal trend of the market that traders use as a point to choose the spot for their securities trading.

The hanging man candlestick is a bearish reversal pattern. The trend has to be upward for the same to occur. It occurs at the very top of an uptrend.

Hanging man means the same in stocks and other financial instruments traded at markets – the point at which the market tends to go for a bearish reversal. This pattern indicates a weakness in the price movement, giving the traders a chance to prepare for the incoming trend changes.

Recommended Articles

This article has been a guide to Hanging Man Candlestick Pattern and its meaning. We compare it with hammer candlesticks pattern and explain how to trade it and its example. You may also find some useful articles here -