Table Of Contents

Hammering Meaning

Hammering refers to the mass selling of stocks believed to be overvalued in financial markets. The sale is rapid, usually triggered by an unexpected event considered detrimental to the company’s brand image. It is often a result of negative market sentiments. This mass selling invariably affects the stock price adversely.

Institutional investors may attempt to profit from an unexpected event if they believe the stock mispricing is temporary. This strategy involves leveraging the tendency of stock prices to decline in response to sudden or dramatic events believed to adversely affect a company’s reputation. Stock analysts consider several variables, including the regulatory environment, to determine a new stock price objectively.

Table of contents

- Hammering Meaning

- Hammering in the financial market refers to the mass selling of stocks considered overvalued. The sale is rapid, usually triggered by an unexpected event.

- It is often a result of negative market sentiments, and mass selling typically affects the stock price adversely.

- Some investors may use tactics like diversification or spread their investments over several equities and securities to lower or manage the impact of hammering.

- At the same time, some investors may wait for such an opportunity to take advantage of the steep price drop. They may purchase stocks at negligible costs and sell them at higher rates later.

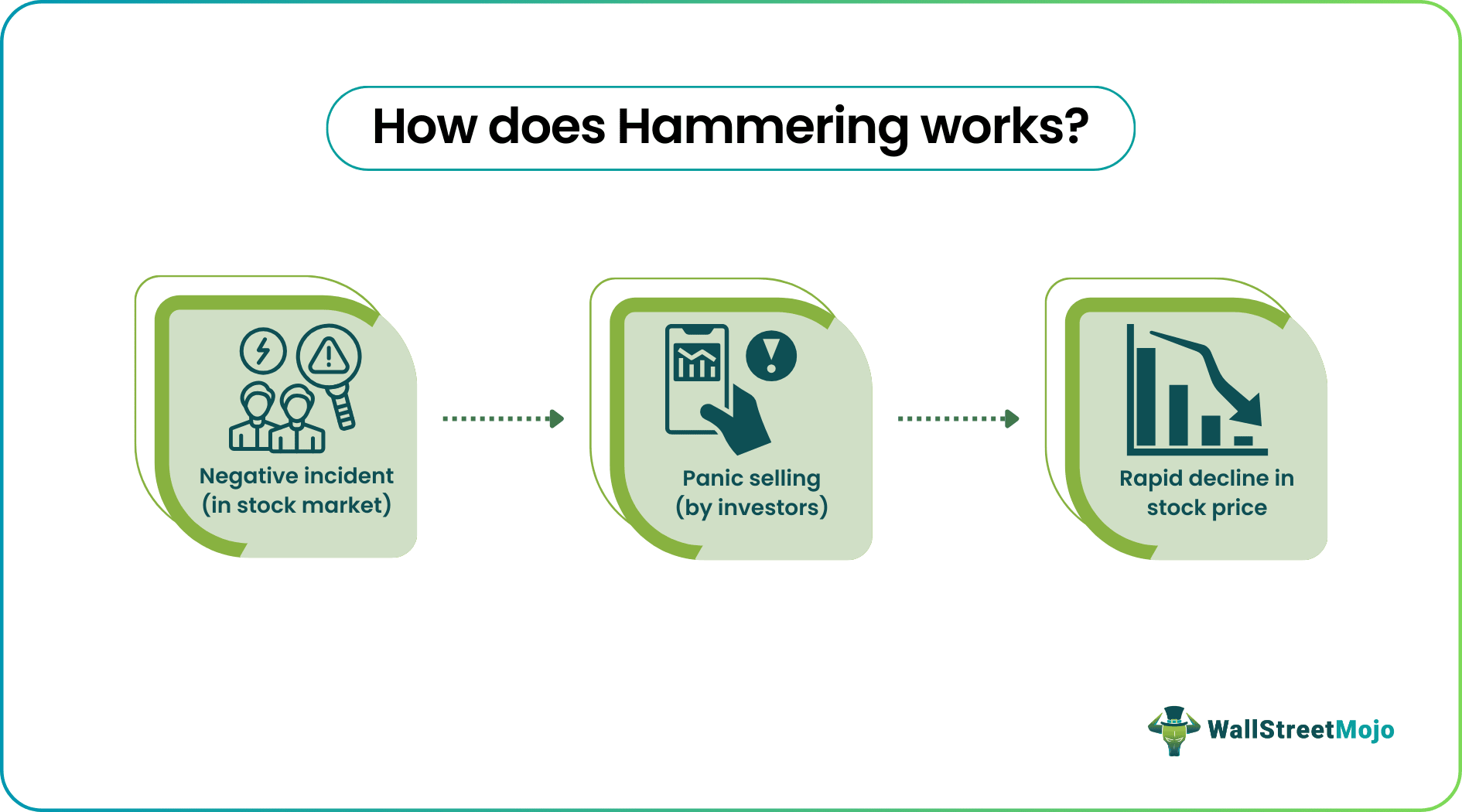

How Does Hammering Work?

Hammering in finance describes a scenario in which a stock is subjected to persistent selling pressure, which lowers its price. It can result from various events, such as unexpected unfavorable news that affects a stock price, called asteroid events, short selling, market manipulation by influential investors, etc.

Hammering may occur when well-known institutions, investors, or hedge funds quickly sell stocks or securities in large numbers, which causes other investors to panic and try to rid themselves of their existing positions. This may cause prices to spiral downward, which could be accelerated by short selling. It allows investors to profit from a stock's loss by betting against its price.

Some investors may use tactics like diversification or spread their investments over several equities and securities to mitigate the effects of hammering. To further reduce possible losses in the event of hammering, some investors may also employ stop-loss orders. These orders enable investors to exit their positions before suffering large losses by automatically selling securities when their price drops below a certain level. At the same time, there may be investors who wait for such an opportunity to take advantage of the steep price drops. They purchase stocks at very low costs and sell them at higher rates.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Let us study a few examples and understand the term in greater detail.

Example #1

Assume ABC Ltd. is a pharmaceutical company, and the company’s stock has been doing well for the past month. This is because the company developed a new drug to cure headaches, which has been well-received by the general public due to its effectiveness. However, after further clinical studies, the drug is found to have high levels of lead content. This unsavory news, unfortunately, gets leaked to the media.

The sudden disclosure of the presence of toxic chemicals in the drug creates panic among investors, who want to sell their positions before stock prices drop. The company's stock price suffers due to selling pressure, causing a sharp drop. The selling pressure on other pharmaceutical industry stocks and financial instruments can increase due to this fall, creating a domino effect.

Example #2

The dot-com bubble was one of the most significant incidents in global financial market history. It was also known as the internet bubble in the late 1990s and early 2000s. During this period, there was a boom in investment in Internet services and technological companies. The stock prices of these companies had skyrocketed and attracted more and more investment until it turned into a bubble waiting to burst.

Due to the large investment in these businesses, their stock values reached unprecedented highs. However, investors started selling their shares in large numbers after it became evident that many of these businesses were not profitable and had few chances for long-term growth and sustainability. This selling pressure set off a downward trend in stock prices. It led to the failure of many dot-com businesses and the destruction of billions of dollars worth of investor value.

Importance

Hammering can have a serious effect that goes much beyond the asset or security being sold. As a result, other stocks and assets may face selling pressure, creating a volatile market environment. Due to this, investors may become hesitant to invest, or they may decide to withdraw their funds from the market as part of risk management to prevent financial losses.

Some investors may view this as an opportunity to identify and buy cheap assets. These investors conduct fundamental analysis as security prices fall to evaluate whether the sell-off was excessive and buy such assets at a discount. In this way, hammering can trigger a market recovery in the long run, re-establishing market growth and stabilizing price levels.

Furthermore, hammering can have a wider impact on the economy, as it can cause a decrease in the currency value of the country to which the affected stocks or securities belong. This is due to the possibility that investors may also sell off their currency holdings when they sell their shares, which can decrease the currency value. The fluctuations in currency value can result in higher import costs and export competitiveness, which will likely have far greater economic effects.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

A hammering sell-off is a rapid drop in a specific investment's price due to widespread investor selling. It can worry investors if they hold positions in an asset whose price is plummeting, given the loss they might incur in such situations.

Hammering is repeatedly applying selling pressure to a security or asset, which results in a sharp price decrease. Reversing refers to a situation in which a security or asset experiences a major change in direction, often moving from a downward trend to an upward one.

Investors may gauge the market conditions and benefit from a hammering event by purchasing the impacted investment or asset at a lower price in the hope that its value will rise again in the future.

Rapid price decline, large-scale sale of stocks, panic selling, a broad economic impact, decreased investor confidence, and negative market sentiment are characteristics of a hammering event.