Table Of Contents

Gun Jumping Meaning

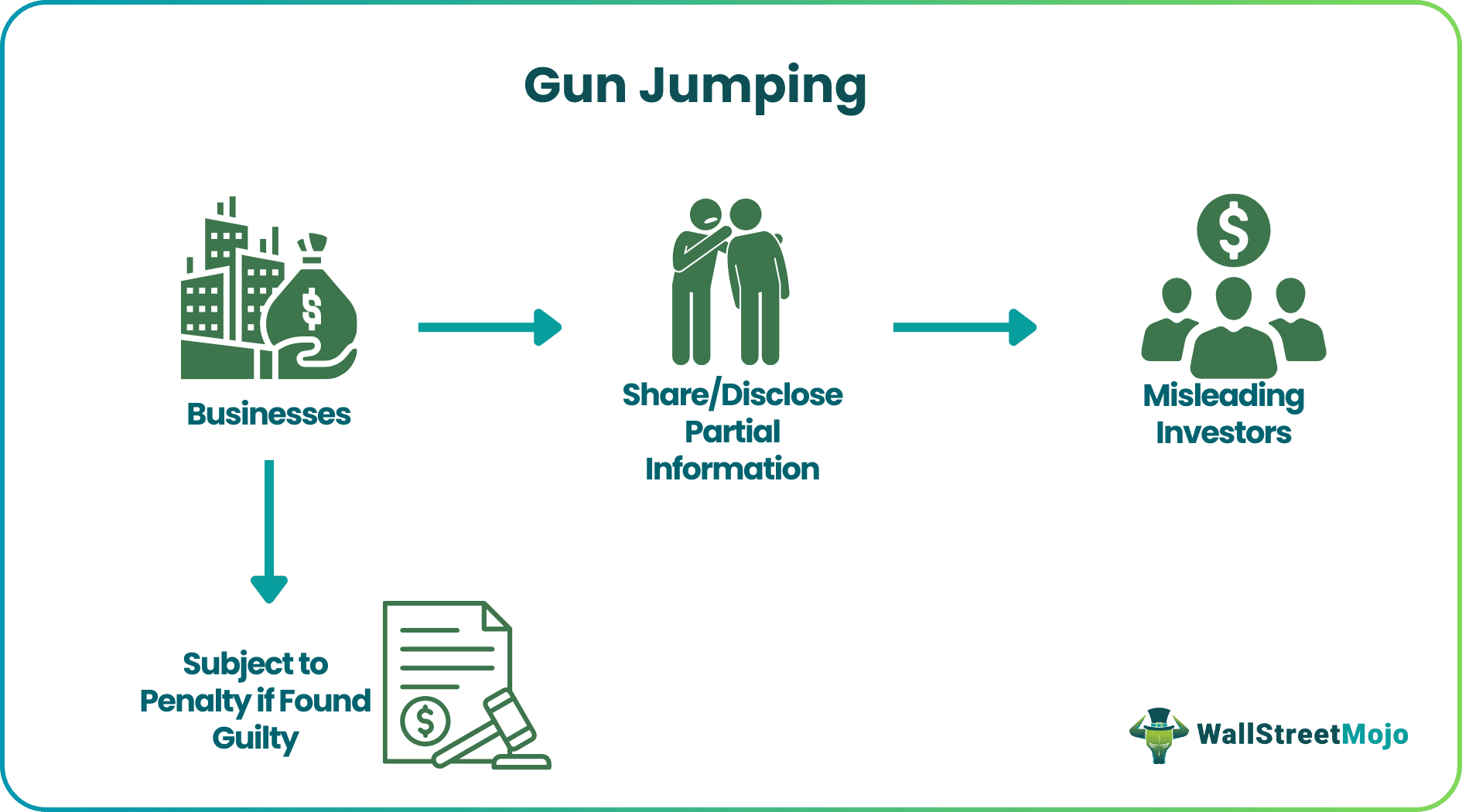

Gun Jumping refers to a scenario where businesses violate the rules and regulations for pursuing mergers and initial public offerings (IPOs) by acting or sharing selective information without public disclosure. Securities boards and antitrust agencies are present to monitor, seek, penalize, and maintain compliance in this regard.

Investors and other market analysts must make decisions based on the information approved by the Securities and Exchange Commission (SEC), not on undisclosed and disseminated information the company keeps to itself. The rule encourages transparency, equal footing, and information access. If found guilty, the company’s IPO gets delayed, along with other penalties.

Table of contents

- Gun Jumping Meaning

- Gun jumping is the unlawful practice of sharing or acting on private information to take advantage of investing advantages in IPOs and mergers.

- Well-defined penalties vary depending on the situation, from monetary penalties to delays and reviews of the initial public offerings.

- The law states that parties must notify each other of merger-related transactions, which must be done under mandatory observation and merger control laws.

- It is derived from the Sherman Act of 1890 and the HSR Act of 1976 combined.

Gun Jumping Explained

Gun jumping involves sharing partial details or using private and sensitive business information for personal advantages or to gain unfair profits. Simply put, it is an unlawful practice where businesses or individuals skip essential steps and roadblocks to gain an unfair advantage in mergers, acquisitions, and IPOs.

When doing business, every operation has a defined line of process and a streamlined way of approval and accordance. When companies try to skip them for their benefit, the act is called gun jumping and the firm is considered jumping the gun. In the United States, any company looking forward to listing it on the stock market must oblige the SEC to ensure proper approval.

The Jumpstart Our Business Startups (JOBS) Act demands that companies make timely revisions to the gun jumping rules and test the interest of institutional investors before buying their stock. The mergers and acquisitions (M&A) that occur based on incomplete disclosures may lead to legal actions and civil or criminal enforcement of antitrust laws. Without rules, investors are likely to take unfair advantage of inside information, and companies might engage in anti-competitive behavior. Both the US and EU describe two types of gun-jumping.

- Substantive Gun Jumping - This occurs when merging businesses coordinate themselves by sharing critical information before the approval or closing of a transaction. The Competition Act 2002 prohibits impermissible joint conduct, also known as gun-jumping, under the competition law.

- Procedural Gun Jumping - Conversely, it happens when the merging parties default on notifying the competition authorities or antitrust agencies about the transactions. The content is done without mandatory observation and is more in the context of control and knowledge than prohibition.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Let us consider the following instances to understand the concept better:

Example #1

Apart from mergers, gun-jumping is a commonly stated term in IPOs, and its rules dictate the procedure to be followed. Suppose Ethan runs a social networking platform. The app has thousands of users, and usage and traffic are increasing rapidly. He chooses to go public with his social networking business and gain an unfair advantage by selling some of his securities to his investors before registering them with the SEC. As a result, his company faced legal actions, penalties, and delays in the IPO by the SEC, thereby damaging the company's reputation.

Under the SEC laws, there is a proper process that Ethan had to go through with appropriate documentation and other aspects. Section 5 of the Securities Act of 1933 dictates the rules of registration and approval.

Example #2

In 2021, Altice, a renowned French telecommunication and mass media company in Europe, faced gun-jumping fines by the European General Court of €124.5 million ($136 million approx.). The penalty was reduced by 5%, but it remained the highest antitrust fine for premature action.

After observing the transaction violation and code of conduct that triggered the gun-jumping enforcement risk, they made the decision. It elaborates on carefully reviewing of transactional documents. However, authorities have previously imposed such fines. For example, they fined Canon, the famous Japanese photography company, €28 million ($30 million approx.) in 2019.

Risks

Gun jumping has the following risks associated with it:

- The federal government may charge companies with civil and criminal acts.

- Sensitive and private information gets leaked.

- Investors taking unfair advantage of inside information and making a profit from the stock market may also lead to stock manipulation.

- Companies can forge documents or skip legal processes to merge with other businesses and draft biased merger agreements.

- Having no rules makes business operations prone to antitrust risks and monetary losses.

- People observe no presence of law and order, and they act uncivilized without having any authority to monitor or penalize them.

- It gives birth to financial crimes, and companies incur huge losses.

- Attaining no transparency and equal footing regarding information and data.

How To Prevent It?

Gun jumping is mainly observed in IPOs and mergers. The steps taken to prevent this are as follows:

- The companies should only integrate their businesses after Hart-Scott-Rodino (HSR) clearance.

- Correctly monitoring and stopping sensitive information sharing and significant transaction leakage is a must.

- The information generally holds data regarding clients, product innovation, strategic and marketing plans, financial data, prices, and costs. Such data must be primarily secured.

- A company must not interfere with the operations of the other party involved in the merger or acquisition.

- Submit merger agreements with transaction records to antitrust agencies for review to avoid potential gun-jumping scenarios.

- Companies must strictly follow SEC procedures and documentation to ensure that they do not overlook any steps when launching an IPO.

- The council ought to review the party's agreement for provisions on benefit transfer and authority between parties.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The term comes from sports and athletics; it is a metaphor for the race; typically, an official starter fires a gun to signal the start of a race. The scenario of gun-jumping or jumping the gun is when a runner starts running before the gunfire (signal).

There are civil penalties of up to $16,000 per day for HSR Act violations for companies found guilty. The antitrust agencies that engage in gun-jumping are then required to prevent future occurrences of the same and to require the party to maintain an antitrust compliance program and to have a government employee monitor compliance. In many cases, the businesses are asked to submit and are disgorged from any profit they obtain from the violations.

The general gun jumping rules in context with the mergers are:

- Neither firm can exercise control over the other.

- Cannot exchange sensitive information.

- The companies must separately conduct transactions until they close the merger. They must follow the same rules before the closure, considering them a legal requirement.