Table Of Contents

Formula to Calculate Gross Sales

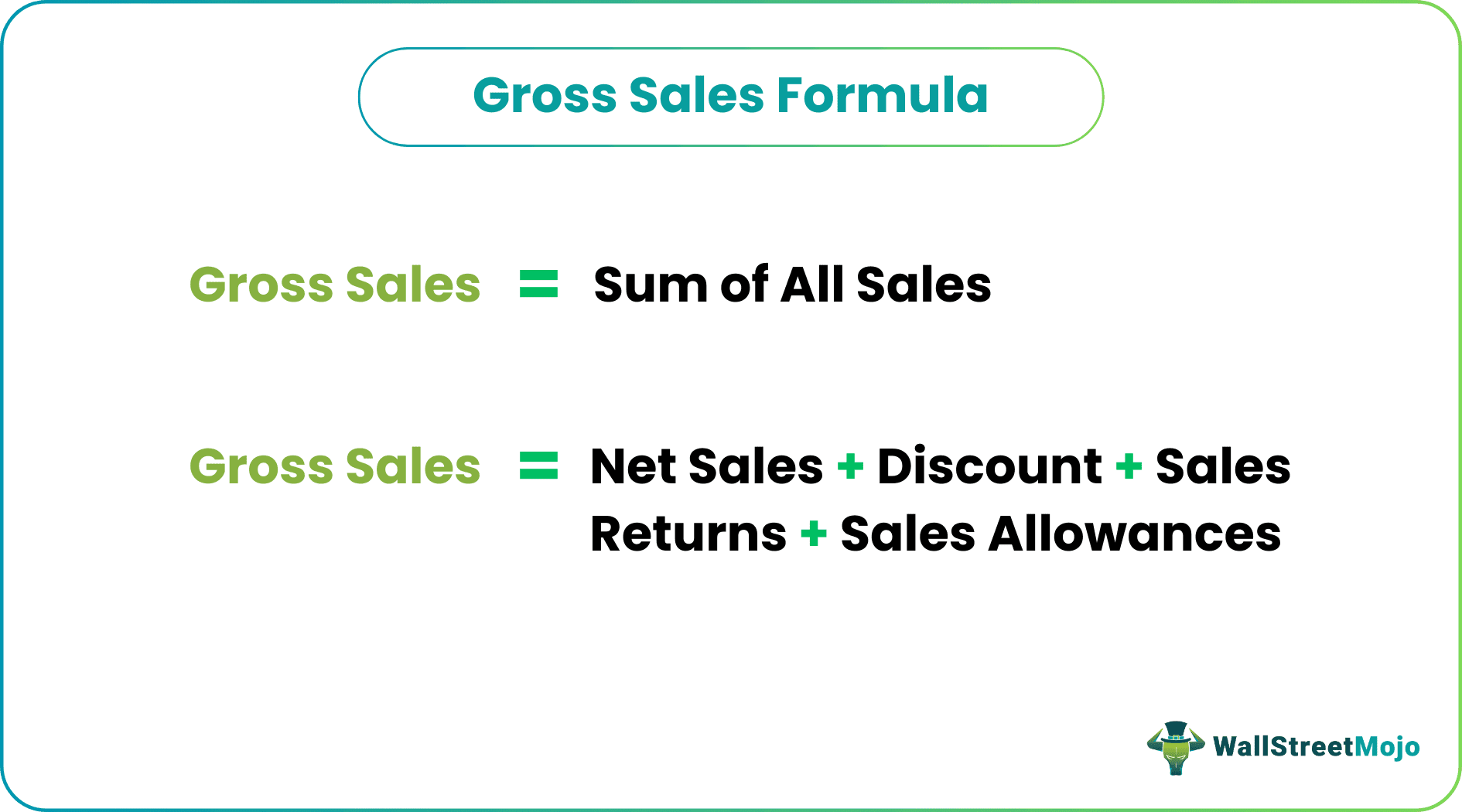

Gross sales refer to the overall sales of the company. It is the figure obtained before deducting discounts and sales returns from customers. All the sales invoices are aggregated to arrive at the gross sales figure. The formula to calculate gross sales is below –

Gross Sales = Sum of all Sales

Key Takeaways

- Gross sales are the total sales made by the business. It is the amount before discounts and customer refunds on purchases have been subtracted.

- To calculate gross sales, all sales invoices are added together.

- Gross sales are not a reliable indicator of a company's profitability.

- Nonetheless, there is a good possibility that a rise in gross sales will also raise the company's level of profits. This might not always be the case, though.

- If it is plotted on a trend line, it is extremely helpful. In some circumstances, the gap between gross and net sales may widen.

Step by Step Calculation of Gross Sales

Gross sales can be calculated by adding together all the sales invoices.

In certain cases, we have the net sales figure. In such a case, gross sales can be calculated by adding certain items.

The steps for arriving at the gross sales if net sales are given are:

There are certain discounts on the goods sold. Add these discounts to the net sales figure. For instance, let us assume a discount is $20, and the net sales figure is $80. In such a case, gross sales are $80+$20 = $100.

Next, find out the value of sales returns, which is the value of the merchandise returned. Add that to net sales.

Find out the value of sales allowances. Sales allowance is the amount of discount available on sales due to minor defects. Add this value to net sales.

Gross Sales = Net Sales + Discount + Sales returns + Sales allowances

Revenue vs Sales Explained in Video

Examples

Example #1

Candies Inc. is a sweet shop selling chocolates and candies. It carries out certain sales in January. The owner of the shop wants accounting to be up-to-date. He wants you to calculate the gross sales based on these invoices given:

| Invoice value | Amount (in $) |

|---|---|

| 523 | 15 |

| 524 | 20 |

| 525 | 15 |

| 526 | 25 |

| 527 | 45 |

| 528 | 35 |

| 529 | 55 |

Solution:

We simply have to add the value of all the invoices to arrive at the gross sales figure:

- Gross Sales = $15 + $20 + $15 + $25 + 45 + $35 + $55

Calculation of Gross Sales will be -

- Gross Sales = $210

Hence, gross sales for January are $210.

Example #2

Patrick Inc. is a shoe store. Therefore, you are required to calculate the gross sales from the below details:

Invoice 489 - The net sales were $400. However, a $100 discount was given on the said invoice.

Invoice 490 – The net sales after the return of goods were $45. $5 of goods were returned.

Invoice 491 – A shoe had a small defect. After the allowance was given, the total amount paid by the customer was $60. An allowance of $10 was given to the customer for the defect.

Solution:

First, we will calculate gross sales for each invoice. Then we’ll calculate the total gross sales.

Gross sales (Invoice 489)

- Gross sales (Invoice 489) = Net Sales + Discount

- = $400 + $100

- = $500

Gross sales (Invoice 490)

- Gross sales (Invoice 490) = Net sales + Sales Return

- = $45 + $5

- = $50

Gross sales (Invoice 491)

- Gross sales (Invoice 491) = Net sales + Allowance

- = $60 + $10

- = $70

Now the total gross sales will be -

- Total Gross Sales = $500 + $50 + $70

- = $620

Therefore, the total sales are $620.

Example #3

Trump Inc. is a company selling cloth. It gives you the following sales data for December using this calculate the gross sales:

Invoice 78 – The net sales are $45. It has given a 10% discount.

Invoice 79 – After a discount of 20%, the net sales were $80.

Invoice 80 – After a discount of 10%, the net sales were $90.

Solution:

Gross Sales (Invoice 78)

- Gross Sales (Invoice 78) = $45 * 100/90

- = $50

Gross Sales (Invoice 79)

- Gross Sales (Invoice 79) = $80 * 100/80

- = $100

Gross Sales (Invoice 80)

- Gross Sales (Invoice 80) = $90 * 100/90

- = $100

Total Gross Sales of Trump Inc. for December will be –

- Total Gross Sales = $50 +$100 +$100

- = $250

Total Gross Sales for December are $250

Example #4

Clinton Inc. is a dealer selling furniture. It makes certain sales in January. It has the policy of giving a discount of 10% on the sales if payment is made within ten days of the date of the sale. The net sales for January are $ 95,000. Payment before ten days is made on 50% of the gross sales. Calculate the number of gross sales.

Solution:

Let the total gross sales for January be $100 (Assumption).

If the payment on 50% of the gross sales is made before 10 days, then the gross sales whose payment is made early are $50 (50% * $ 100)

Discount = 10% * $50

= $5

Net Sales (on which discount is given) = $50 - $5

= $45

The total net sales amount on which discount is not given would be the same as the gross sales amount, which is $50

- Total Net Sales = $50 + $45

- = $95

Thus, assuming gross sales of $100, net sales are $95. We have to calculate the gross sales given net sales of $95,000.

- Actual Gross Sales = $95,000*100/95

- = $1,00,000

Thus, the total gross sales are $1,00,000.

Gross Sales Formula - Example #5

The net sales of Brickworks Inc. were $80,000. A discount of 20% was given on gross sales. Calculate gross sales.

Solution:

Let us assume that gross sales are $100. If a discount of 20% is given, then we have to calculate the net sales.

Step 1: Insert the formula in Cell B6 to get the net sales given the assumption.

Step 2: Insert the formula =B7*B3/B5 in cell B8.

So, the actual gross sale would be $100,000.

Relevance and Use

Gross sales do not state the level of profitability of a business. But, there is a high chance that an increase in gross sales increases the level of profits of the business. However, this may not always be the case.

Gross sales give the total amount of money obtained from sales. It helps in calculating ratios such as gross profit margin. An analyst can also plot the difference between gross sales and net sales. It is especially useful when plotted on a trend line. In certain cases, there may be an increasing difference between gross sales and net sales over time. For example, it may be an indicator of quality problems – there may be a high amount of goods returned due to which there may be an increasing difference.