Table Of Contents

Gross Rental Income Meaning

Gross Rental Income is the total rental income generated by a property before deducting any expenses. Its purpose is to provide a measure of the property's revenue-generating potential, allowing investors to assess the property's initial return on investment without factoring in operating expenses.

It holds significance as it forms a fundamental component of a property's real estate proforma, which serves as a forecast outlining anticipated income and expenses throughout the investment's duration before factoring in various expenses such as property management fees, maintenance costs, and taxes.

Table of contents

- Gross Rental Income Meaning

- The gross rental income refers to the total revenue generated from renting out a property and it includes all rental payments received from tenants and any additional income related to the property.

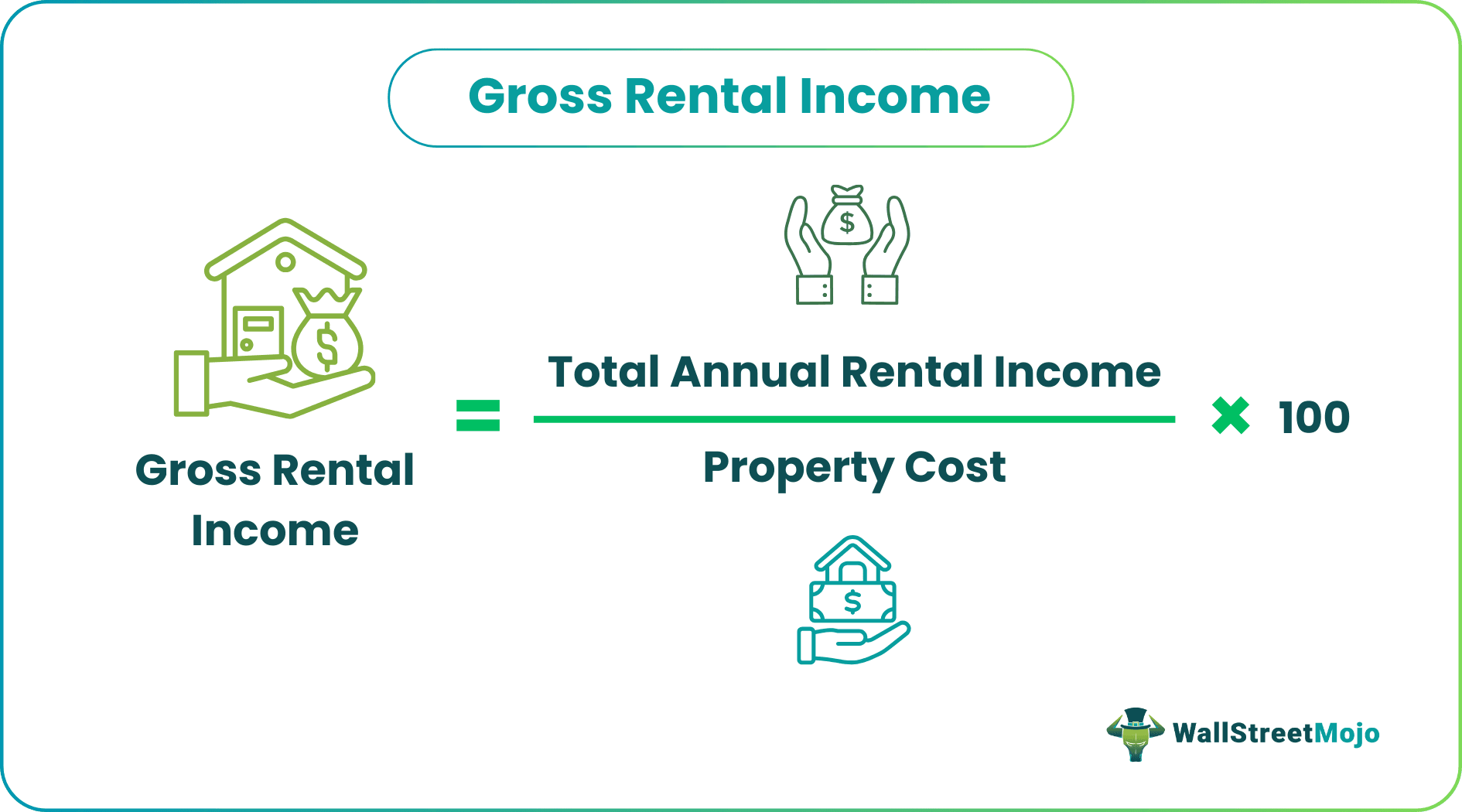

- It is calculated as Gross Rental Yield = (Total Annual Rental Income / Property Cost) ×100.

- This metric serves as a valuable tool for assessing potential returns on investment and comparing different property opportunities.

- It represents the total income generated by a property from renting out its units or space before any deductions. Meanwhile, net rental income accounts for all expenses and deductions, providing a more accurate measure of the property's profitability.

Gross Rental Income Explained

Gross rental income refers to the total income derived from renting out properties before any deductions for expenses such as insurance, maintenance, taxes, homeowner association fees, or advertising costs. It encompasses all rental payments received, including income from renting out individual rooms or multiple units within a property.

For landlords or property owners, gross rent revenue represents the total amount of money collected from tenants or occupants, irrespective of the property's size, type, or number of units rented. This figure serves as a critical metric for evaluating the property's income-generating potential.

By calculating gross rent revenue, landlords can gauge the total rental income their properties generate over a specific period, whether monthly, quarterly, or annually. As a result, it provides an essential baseline for assessing the property's financial performance and potential profitability.

Gross rental yield serves as a quick method for initial property investment analysis. It helps investors assess if the potential return on a property investment meets their minimum return threshold. A higher rental yield indicates more significant potential income and return on the investment, while a lower yield suggests the opposite. However, since it doesn't account for operating expenses, further analysis is necessary before making investment decisions.

How To Calculate?

The calculation of the gross rental yield is as follows:

- Determine the total annual rental income

- Divide the total annual rental income by the property cost

- Convert into a percentage by multiplying by 100

Thus, the gross rental yield formula is,

Gross Rental Income= (Total Annual Rental Income / Property Cost)×100

This formula represents the ratio between the total annual rental income generated by the property and the cost of the property, expressed as a percentage.

Examples

Take a look at some examples to understand the concept better:

Examples #1

In a hypothetical scenario, suppose an individual owns a rental property and receives $1,500 in monthly rent from tenants, along with an additional $100 per month from parking fees. Over a year, the total annual rental income would be calculated as follows:

Total Gross Rental Income = (Monthly rent*12+ parking fees*12)

Thus,

1,500*12 + 100*12 = $19,200

Assuming the property's cost is $200,000, the gross rental yield can be calculated using the formula:

GRI= * 100

GRI= * 100 = 9.6%

Therefore, in the above example, the gross rental yield for the property is 9.6%.

Example #2

Consider a property owner who owns a commercial building with multiple retail spaces. Each retail space is leased to different businesses, generating varying amounts of rent. The property owner also earns additional income from parking fees charged to customers who use the building's parking lot.

In this scenario, the property owner collects rent from each retail tenant and parking fees from customers. The total amount of money received from all rental sources before deducting any expenses such as taxes, maintenance, or insurance is considered the total gross rental income for the commercial property.

This example demonstrates how gross rental yield can encompass income from various sources within a property, such as rent from tenants and additional revenue streams like parking fees, providing a comprehensive view of the property's income-generating potential before accounting for any expenses.

Gross Rental Income vs Net Rental Income

The difference between gross rental and net rental income is as follows:

| Gross Rental Income | Net Rental Income |

|---|---|

| It refers to the total amount of money received from renting out a property before deducting any expenses. | The net rental income refers to the income generated from renting out a property after deducting all operating expenses and other deductions. |

| This income includes all rental payments from tenants and any related income generated by the property, such as parking fees or laundry facilities. | It involves subtracting various expenses from the gross rental yield, such as property management fees, maintenance costs, property taxes, insurance, vacancies, utilities, and mortgage payments. |

Frequently Asked Questions (FAQs)

Gross potential rental income refers to the maximum amount of rental income a property could generate if all units or spaces were occupied and rented out at their highest achievable rental rates. It represents the total income potential of the property without factoring in any vacancies or loss of rental income due to unoccupied units or discounted rental rates.

It includes all revenue generated from renting out a property, encompassing various sources of rental payments and related income. The base rent paid by tenants occupying the property, as well as any additional income from amenities such as parking fees, laundry facilities, storage rentals, or other ancillary services provided to tenants, are all included in this income.

The gross rental income does not consider the following:

• Maintenance, repairs, property taxes, or other related costs.

• Non-rental income, such as parking fees and food facility charges.

• Fluctuation in rental rates over time.

Recommended Articles

This article has been a guide to Gross Rental Income and its meaning. We explain how to calculate it with examples, & comparison with net rental income. You may also find some useful articles here -