Table Of Contents

What Is Gross Income Formula?

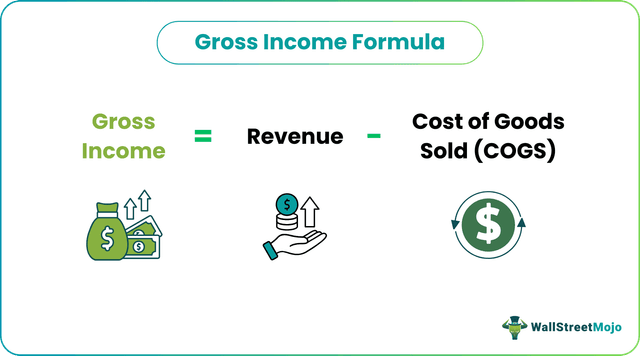

Gross income is used for individuals and businesses. For individuals, it is calculated as total income earned before any deductions and taxes. It includes income from all sources, including rent, dividends, interest, etc., whereas, for a business, it is calculated as the revenue earned from goods and services minus the cost of goods sold.

It is considered to be a very important financial metric. It is commonly used for various purposes like the tax calculation or evaluation of the financial capacity and strength of the business and individual before accounting for the deductions that have to be made from it. The company's financial statement is a good source of data for making this calculation.

Gross Income Formula Explained

The gross imcome formula is a method used for calculating the the total income earned in case of both individual or business before taking into account any taxes or deductions. The income sources considered in this case of formula of gross income may from employment, property, interest, dividends, or any form of services.

It can also be refered to as the gross profit formula and is calculated from the financial data accumulated from the statement of profit and loss, from which the cost of goods sold is deducted.

Lenders and creditor also use this calculation before extending loans to borrowers who may be individuals or corporates because it gives an idea about the earning capacity of the borrower and as such, their creditworthiness or the financial strength to pay back the loan. This reduces the change of default and the probability of the lenders incurring a bad debt.

It gives an idea about the financial performance of the business based on the type of goods and services they deal with. The management can use this data to assess whether type of products they are dealing with is really able to give the return that can be expected from it. Thus, in simple words, the company is able to assess the viability of the business operations and production process in future using the adjusted gross income formula

The formula will involve less complexity and data collection in the case of individuals but more number and complex data for corporates due to their higher scale of operations. They will require some more complicated calculations, which will help them to understand whether the present operation is leading and guiding the company towards success or failure.

How To Calculate?

Now let us understand the formula of gross income in details and how it will be used successfully to make the calculation, step-by-step.

Gross Income Formula (individual) = Sum of income from all sources earned by individual

- To do the calculation for an individual, use the following steps:

- Step 1: Find out all the sources of income like salary, dividends, rent, etc.

- Step 2: Aggregate all these sources of income obtained in the first step: Gross Income = Salary + Rent + Dividends + Interest + All Other Sources of Income

Gross Income Formula (Business) = Total Revenue – Cost of Goods Sold

- To calculate it for a business, the following steps should be followed:

- Step 1: Find out the total revenue of the business

- Step 2: Find out the cost of goods sold for the business

- Step 3: Calculate using the formula: Gross Income = Total Revenue – Cost of Goods Sold

Revenue vs Income Explained in Video

Examples

Let us try to understand the concept of adjusted gross income formula with the help of some suitable examples.

Example #1

Mr. Albert is an employee in a manufacturing concern. His annual salary is $1,20,000. He has no other income. Find out his gross income per month.

Solution

- Annual Salary: 120000

Per Month

=120000/12 = 10,000

Example #2

Mathews Smith is an employee with several sources of income. He works in a factory manufacturing consumer products. He works for 40 hours a week. His hourly wage is $10. Assume that there are 52 weeks in a year. Also, he holds some shares. As a result, he gets an annual dividend income of $1,000.

Besides, his annual income includes rent of $4,000 and interest on a savings bank account of $1,000. He pays income taxes of $500 in the year. Calculate the annual gross annual income of Mathews Smith.

Solution

Use the below-given data for calculation

- Number of Hours in a Week: 40

- Hourly Wage: 10

- Number of Weeks: 52

- Dividend Income: 1000

- Rent: 4000

- Interest on Savings Bank Account: 1000

Total Salary Income

- = 40 * 10 * 52

- Total Salary Income = 20,800

Therefore, the calculation is as follows,

= 20,800 + 1,000 + 4,000 + 1,000

Note: Gross Income is obtained before deductions of any taxes. Hence, income taxes of $500 are not deducted while calculating it.

Example #3

Grriggles Inc. is engaged in the manufacturing of shoes. The company's Chief Financial Officer (CFO) digs into the financials and obtains certain data. Its gross revenue is $1,00,000. Also, it incurs the following expenses:

- Direct Labor: 10000

- Raw Material Cost: 20000

- Packaging: 5000

- Transportation Costs: 6000

- Revenue: 100000

Calculate the gross income for Griggles Inc. from the above information.

Solution

Calculation of Cost of Goods Sold

- = 10,000 + 20,000 + 5,000 + 6,000

- Cost of Goods Sold = 41,000

Therefore, the calculation is as follows,

- = $1,00,000 – 41,000 = 59,000.

The above examples give us a clear idea about the various situations where the formula can be used and how the financial data can be interpreted for using in the annual gross income formula for calculation purpose. The examples identify scenarios related to both individual and corporates for whom the method may be used successfully to calculate the gross income.

Gross Income Formula In Excel (with Excel Template)

Fortune Inc. is carrying on the business of manufacturing chocolates. It gives you the following information: Calculate the gross income from the above details.

- Gross Revenue: 60000

- Cost of Raw Material: 10000

- Electricity for Factory: 5000

- Direct Labor: 3000

- Depreciation of Equipment: 2000

Solution

Step 1

Aggregate all the expenses about the cost of goods sold. Then, insert the formula =SUM(B4: B7) in cell B8.

Step 2

Press Enter to get the Result

Step 3

Insert the formula =B3-B8 in cell B9.

Step 4

Press Enter to get the Result

Relevance And Uses

Gross income for an individual can be found in the financial records. It can also be found in the tax returns filed by the individual. Lenders use annual gross income formula to determine whether a person qualifies for a loan. Generally, the loan is approved when gross income exceeds a certain amount. Generally, lenders will sanction a loan amount only up to a certain proportion of this income.

Gross income for a business can be found out from the financial statements of the organization. While calculating it, care needs to be taken that only the items about the cost of goods sold are reduced from the effective gross income formula. It is important to note that all expenses are not deducted while calculating the gross income.

The difference between gross and net income for a business needs to be found. If the difference is very high, the organization is incurring significant indirect expenses. In such a case, it should undertake corrective action to reduce these expenses. A control system would help for this purpose. The control system involves budgeting expenses and then determining the reasons for the differences between budgeted and actual expenses. Then, remedial action should be carried out to ensure that expenses are controlled in the future.

Generally, the gross income is calculated as a proportion of its revenue. It is known as 'gross margin.' Gross margin is one of the indicators of the profitability of an enterprise.

Gross Income Formula Vs Net Income Formula

Both the above are important and useful financial concept that the management and individual investors or stakeholders use to evaluate the financial strength of the business. However, there are some important differences between them, as follows;

- The former is the formula used to calculate the revenue generated by the business before any deductions are made, whereas the latter is the revenue that remains in the business after any deductions.

- The former takes into account the income generated from sources like interest, dividend, wage, salary rent etc whereas the latter takes into account all the income earned for the former and the also account for all the cost associated with those income earned.

- As it can be derived from the above point, the effective gross income formula does not account for any deduction whereas the latter accounts for costs like income tax, any withholdings and social security contribution in case of individuals and operating or production cost, salaries, taxes, etc in case of businesses.

Thus, from the above differences it may be concluded that even though both the metrics are used for evaluation of profitability, the net income formula is a better option because it gives a more accurate picture of the financial condition of the business by accounting for the costs and expenses. So the management is able to make better planning with the actual available fund saved and arrange for investment in projects for the purpose of growth and expansion.