Table Of Contents

Gross Income Meaning

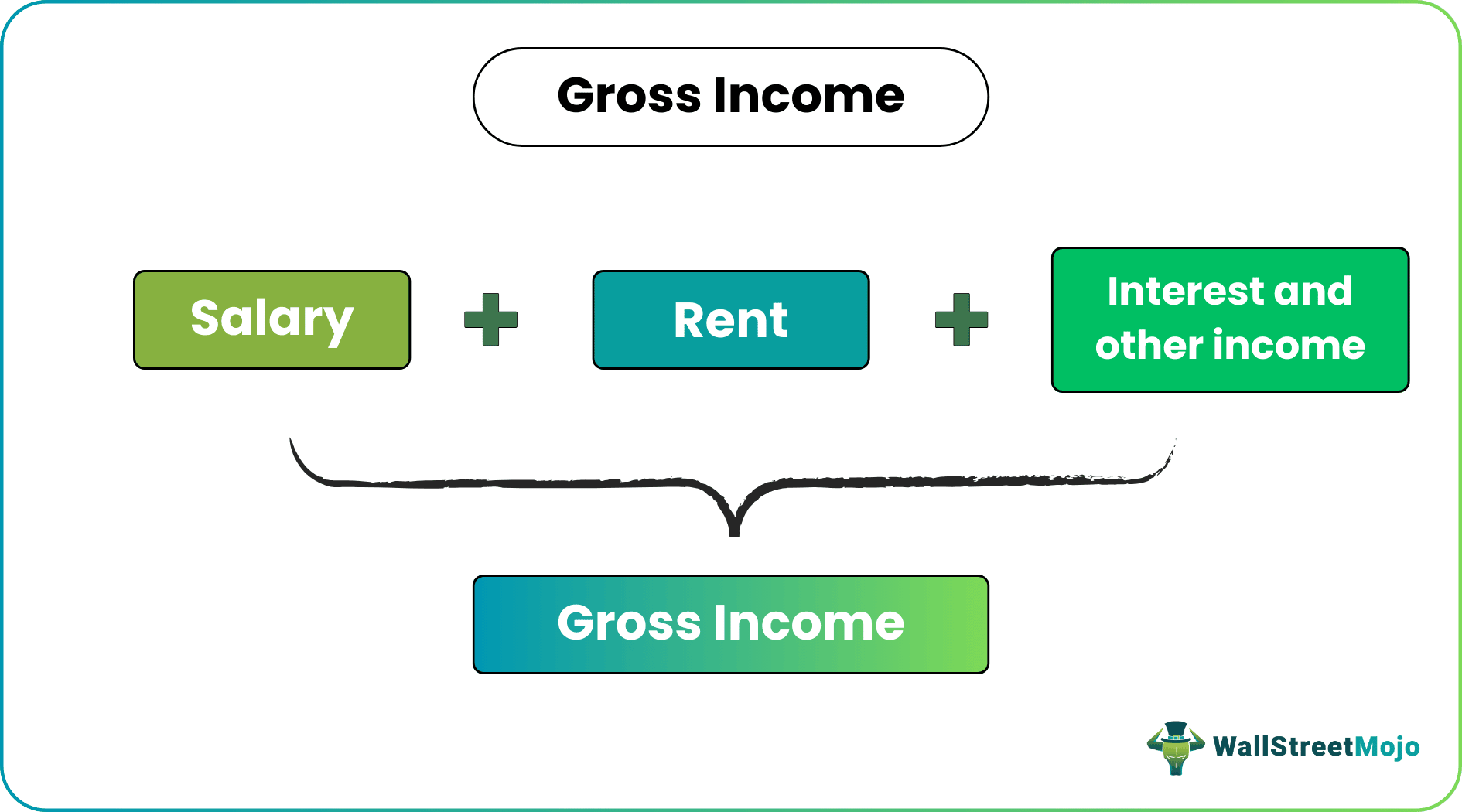

Gross income is the total remuneration of an entity before deductions and taxes. This includes salary, rent, and interest. Therefore, the gross profit of an organization is calculated by deducting the cost of goods sold from its sales revenue. After deductions and adjustments, an individual or a business finds its net income.

The annual gross income is an important metric used by lenders. Before sanctioning personal, auto, or mortgage loans, lenders screen applicants' debt to income (DTI) ratios. Gross earnings represent the financial health of a firm. This metric is also important for computing the taxable income of an individual.

Key Takeaways

- Gross income or gross earnings is the aggregate earnings of an individual before taxes; this includes salary, interest, commission, rent, profit, dividends, and capital gains.

- For a company, it refers to the gross profit generated by a business from the sale of goods or services.

- When a firm’s gross profit is calculated, all non-operating expenses are excluded. Only production-linked expenses are taken into consideration.

- Gross earnings are an important metric in financial analysis. It is used for analyzing a firm's financial condition, operational efficiency, and profitability. Gross earnings assure lenders and landlords that the borrower can repay the credit.

Gross Income Explained

Gross income is the same as gross profit, gross earnings, or taxable income. However, the metric has different contexts for individuals and organizations. It is the gross total of an individual's earnings in each period before acknowledging deductions and taxes. This is inclusive of salary, commission, rent, interests, and dividends.

This metric is crucial for computing the taxable income of an individual. First, the adjusted gross income (AGI) is determined. AGI is computed by subtracting above-the-line deductions from gross earnings. Then, various below-the-line deductions are made from the AGI to acquire the taxable income. This includes exemptions and rebates, if any. Further, employers intimate, The Internal Revenue System (IRS) of their employees' income details. Employers file a W-2 form, i.e., the Wage and Tax Statement Form.

Investors and stakeholders assume that if a firm is turning a profit, it must be running efficiently. This is why gross earning is an indicator of a company's profitability. It is an essential factor that stakeholders use to judge a firm's performance.

Formula

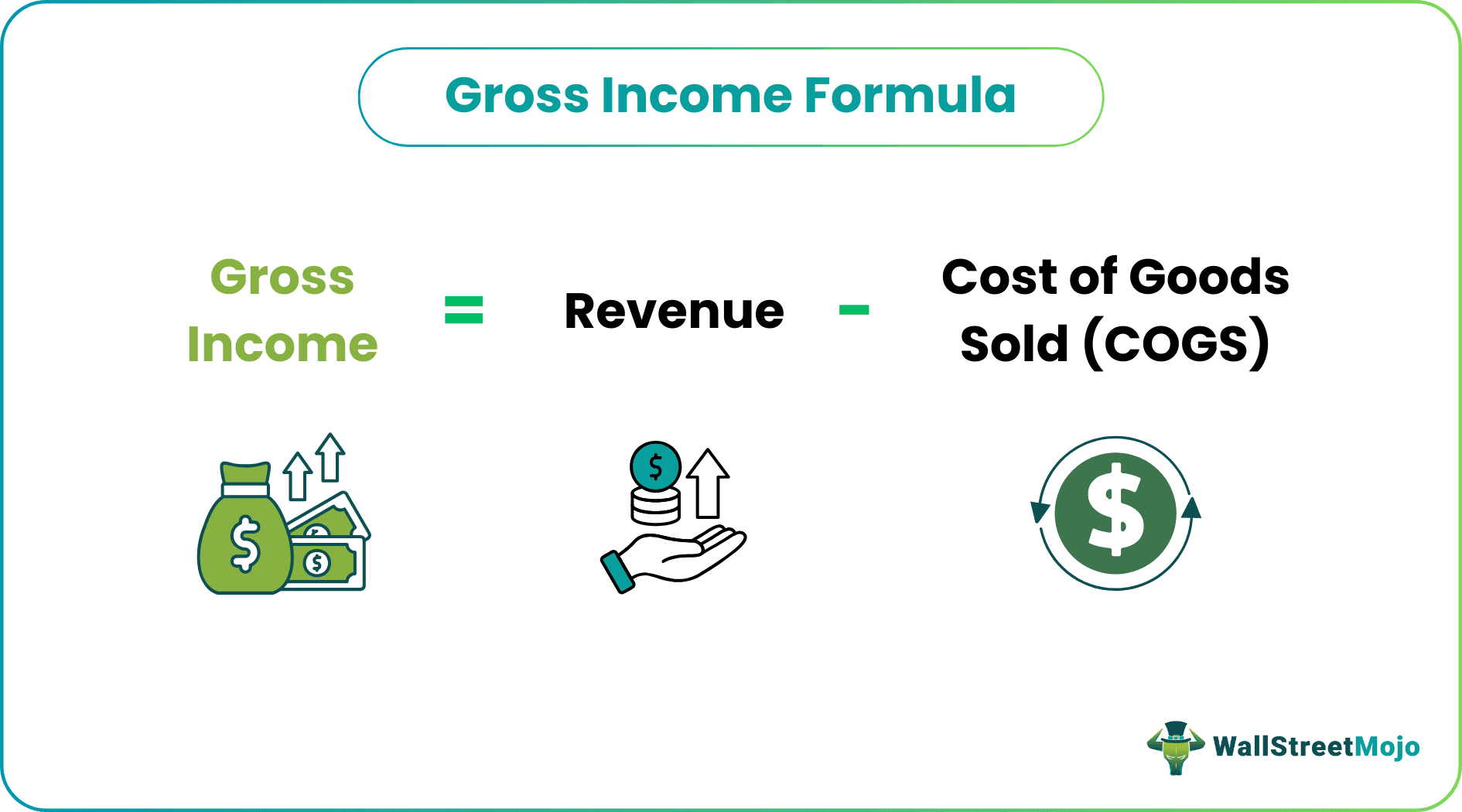

The formula for calculating and making gross income adjustments vary for individuals and firms. Let us understand the formulae for both these entities through the detailed explanation below.

For Individuals:

Gross Income = Salary + Interest + Dividends + Rent

For Companies:

Gross Income = Revenue - Cost of Goods Sold

Revenue vs Income Explained in Video

How To Calculate?

To calculate the annual gross income, it is important to determine the basic factors such as the basic income streams and expenses, after which, the methods explained below can be used to calculated using the formula.

For Individuals:

The gross earnings can be evaluated by aggregating the following components:

- Salary or Wages: It is the total pay offered by an employer to an individual. If such compensation is allowed hourly or daily, it is termed as wages.

- Rent: Gross earnings also include rental earnings from residential or commercial properties

- Dividends: The dividends on preference shares and bonds are also considered as income.

- Interest: The interest received on deposits and loans is considered a part of gross earnings.

- Capital Gain or Loss: The profit or loss made by an individual on the sale of capital assets or property comes under gross earnings. This includes houses, land, buildings, and valuables.

- Income from Other Sources: All other means of earnings also come under gross earnings. These include pensions, alimony, prizes, lotteries, and gifts.

For Companies:

The gross profit of companies can be calculated by reducing the cost of goods sold from the entity's revenue.

- Revenue: It is the total sales proceeds that a company generates in a given period.

- Cost of Goods Sold: COGS refers to the direct cost incurred for the production of goods. It includes the cost of materials, labor, packaging, and freight.

Both these components are found on a firm's income statement. All the non-operating expenses are excluded, and only production-linked expenses are considered during computation. Non-operating expenses are the expenses that are not related to the principal activities of a business. They are usually stated on the company's income statement.

Examples

Let us understand the concept of gross income adjustments and its other intricate details with the help of a couple of examples.

Example #1

A company engaged in the sale of motor parts earned a revenue of $10,000 during the year. The company incurs the following expenses during the year.

Solution:

Given,

- Raw Material Cost: $3,000

- Labor Wages: $4,000

- Sales Commission: $500

Calculation of Cost of Goods Sold can be done as follows.

COGS formula = Raw Material + Labor Cost + Sales Commission

= $3,000 + $4,000 + $500

= $7,500

Calculations:

Therefore, Gross Profit = $10,000 – $7,500

=$2,500

Example #2

A company involved in a trade of goods managed to earn a revenue of $12,000 during the year. The company's books of accounts list the following.

- Opening stock: $300

- Closing stock: $250

- Purchases: $3,000

- Wages: $5,000

- Salaries: $4,000

- Interest: $1,000

- Freight: $500

Solution:

Calculation of Cost of Goods Sold can be done as follows.

COGS = Raw material + Labor cost + Freight

COGS = (Opening Stock + Purchases – Closing Stock) + Labor Cost + Freight

= ($300 + $3,000 – $250) + $5,000 + $500

= $8,550

It is to be noted that salaries and interest expenses will not form part of COGS as these are not directly related to the production of goods.

Calculation

Thus, Gross Earnings = $12,000 – $8,550

= $3,450

Example #3

Gary Bowser, an individual with a pivotal role in selling Nintendo switches through a hacking-scheme admitted his role in the crime in November 2021. The court had instructed Bowser to pay a hefty sum of $10 million to Nintendo for damages caused.

Out of the amount owed to the victim, only $175 had been paid until 2023. However, the accused agreed to pay 25-30% of his gross income to settle the large sum owed to the victim. Following health issues, the accused was released early and instructed to continue paying the fines on a monthly basis.

Importance

Gross earnings adjustments are a vital piece of information for the parties looking forward to associating with a new entity and for regulators to scrutinize the information provided by individuals and entities during yearly filing of taxes. It serves the following purposes for an individual:

- Computing Taxable Income: The first step of finding an individual's taxable income begins with gross earnings. After that, various deductions like expenses and exemptions are taken into account.

- Rental Housing: Whenever an individual searches a house for rent, the owner or landlord verifies the tenant's gross earnings for ensuring timely rent.

- Taking Loan: Lenders also go through the borrower's gross earnings before extending a loan. Lenders estimate risk levels, debt amount, and interest rates.

- Setting Credit Card Limit: Banks and credit companies study a user's gross earnings to set the credit card limit. Higher gross earnings naturally reflect a higher spending limit.

Knowing the gross profit of a business is equally essential for the following reasons:

- Reflects Business Efficiency: This metric is used to streamline business operations and corporate performance.

- Demonstrates Financial Health: A firm's financial standing is its ability to generate returns from its core business operations.

- Aids in Determining Profitability: The gross profit is crucial for interpreting the gross profit margin (i.e., percentage return) of any firm. Further, it is used for ascertaining the net profit of a business.

Gross vs. Net Income

Both annual gross income and net income play important roles in their own right. However, it is important to understand the differences in their fundamentals and implications. Let us understand the differences through the comparison below.

Net income represents the profit left after reducing the indirect expenses such as salary, rent, interest, and rent. Gross Earnings = Revenue – COGS.

Whereas, Net Income = Gross Earnings – Expenses.

The former represents the income earned from the main business. Whereas the latter reflects the net profit of the company after reducing all expenses. Thus, net income is not limited to direct expenses.

Income statements show revenue and cost of goods sold, followed by gross earnings. Net income is revealed after other expenses and is a bottom-line item in the balance sheet.

If a company's net income is less than the gross income, the company needs to cut other expenses (indirect costs). The net income recognizes other incomes, like interest income and dividend income. This is unlike gross earnings.