Table Of Contents

Gray Market Definition

Gray Market is a marketplace with unofficial distribution channels or sellers who sell goods, securities, or other commodities. It is a market where buyers and sellers meet as unregulated entities and transact business or information to benefit from low prices, no or little regulations, or profit through bargains.

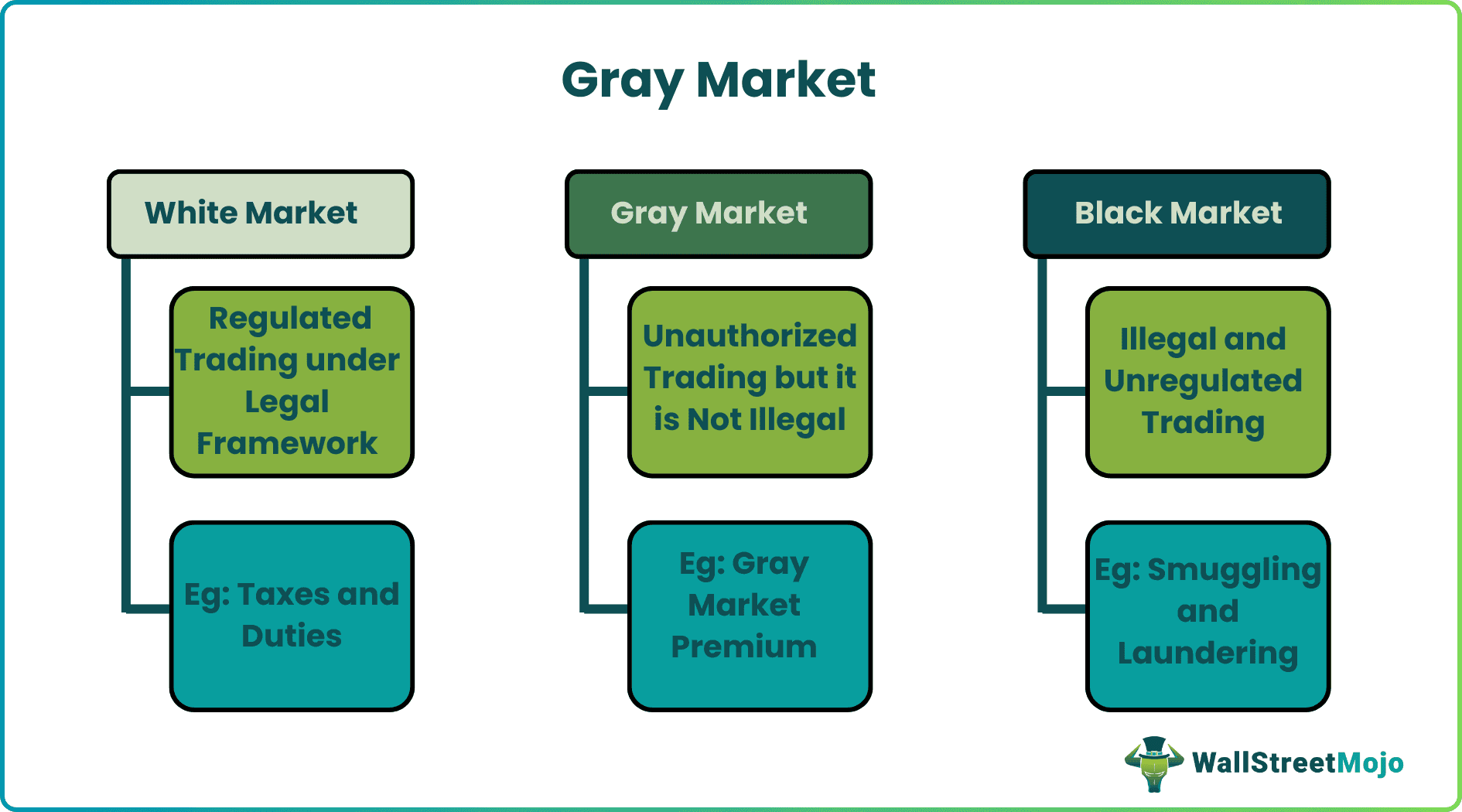

Gray Market is a middle market that gives access to both sellers and buyers through unofficial or unauthorized channels. However, it is not illegal when compared to black markets. In a black market, transactions are done through smuggling or escaping the legal systems of a country. In contrast, business in white markets progresses according to a jurisdiction's legal framework.

Key Takeaways

- Gray market or grey market refers to a marketplace where unauthorized sellers sell legal goods that may have high consumer demand.

- In such a market, the buyers or investors invest their money to get more than usual gains through special pricing of goods or securities in a grey market.

- In the securities grey market, investors usually interact with brokers, issuers, and underwriters who try to test and examine the demand for suspended stocks or IPOs of a company.

- A gray or grey market premium or GMP helps retail investors estimate their gains and losses.

Gray Market Explained

Gray market trading in finance refers to over-the-top securities trading through unofficial or unregulated sellers, brokers or traders. It is also known as a grey, middle, or parallel market. It refers to a market where buyers and sellers trade securities before their official release or post suspension.

For instance, issuers of securities or underwriters look for such gray market pricing for shares by selling a chunk of the IPO or initial public offering shares to high net worth individuals (HNIs) or qualified institutional investors. They do so to assure demand for these shares during the IPO and secure greater trust amongst other retail investors.

Thus, these grey market transactions take place in those securities that will be listed at the official exchanges soon. The transaction amount charged on these securities in a grey market is known as gray market premium or GMP.

The GMP is the rate at which a broker, issuer, or underwriter sells securities to investors in unregulated markets. Thus, investors might purchase securities in a gray market IPO because of a company's good reputation, high demand for a company's shares, and bull market effect.

Similarly, some investors consider gray market IPO and market pricing to ensure their investments in a company's IPO. Thus, it allows them to estimate or forecast the listing price of these shares and securities to evaluate their gains and losses.

However, in the case of securities transactions in a grey market, there are also overhanging risks and uncertainties due to market fluctuations or other factors. Thus, a gray market IPO can observe both bull or bear market conditions.

In a grey market, trade in securities is binding, but final settlement occurs only when the official trading starts and shares are listed.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Gray Market Goods

The gray or grey market is also a goods market where unauthorized distribution channels or sellers sell legal products. For example, this goods market may include electronics or gadgets that some unauthorized dealers import to resell outside the authorized territory.

These goods might be available at consumer-friendly prices or lower rates that attract buyers. However, these sellers may sell such goods without guaranteeing the product quality and servicing post-purchase. At the same time, these could be copies of the original product or technology.

Such sellers may route gray market goods without the permission of the original suppliers and sell these in small markets. Sometimes, small businesses might also procure goods via unauthorized importing routes. They do so to avoid certain overhead charges and sell them in domestic markets with or without value addition.

Additionally, these are known as gray market goods when an authorized merchant or manufacturer sells their goods without any legal agreement or over and above the contractual agreements.

Examples

Let us look at grey market examples to understand the pros and cons.

Example #1

Suppose a consumer buys a car from a grey market in another country and imports the car with minimal costs. The consumer imports a gray market vehicle due to the extremely low purchase and shipment cost when put together and compared with local retailers. However, when it comes to authorized servicing and repair of the gray market vehicle, the consumer faces problems.

It happens because the company to which the car belongs has not officially authorized the grey market seller. Thus, the buyer will require legal documentation and licenses from authorized dealers or sellers to put insurance claims, authorized car services, or meet other legal obligations. Additionally, gray market vehicle owners find it difficult to purchase suitable car parts.

Example #2

Suppose Mark is a retail investor looking forward to earning huge profits from an upcoming IPO of Ford Motor Co. At the same time, being aware of the high reputation and demand for the company's vehicles market, he goes ahead with investing in the grey market IPO of Ford Motor Co. A broker sells 50 shares at a gray market premium of $500.

However, when these shares go for listing, the price of one share increases to $15 per share from the estimated gray market pricing of $10 per share.

Thus, Mark was willing to take a risk by trading in the unregulated market. It was because he wanted to book high profits as a retail investor. But with high demand for Ford Company IPO shares, he sells these shares during the official IPO to another investor and books a profit of $250 ($750 – $500) by selling 50 shares. This profit is the difference between GMP – the IPO listing price shares.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

A GMP is the transaction amount or the rate at which the broker sells stocks to an investor. Thus, a broker or issuer may set GMP depending on estimated demand for shares, a company's reputation in the market, capitalization, etc.

It is an unregulated market where sellers sell legal products, like electronics, perfumes, watches, etc., or securities. But there are no legal monitoring agencies that regulate the market. For example, the U.S. government's Securities and Exchange Commission (SEC) is the regulating authority responsible for monitoring the securities markets and protecting investors' interests.

Investors can buy shares in the grey market if their brokers know of such transactions or issues. As it is an unregulated market, there are no agencies or regulating authorities that an investor can approach in case of a renege. Underwriters and issuers use these grey markets to check the demand for upcoming IPOs. Additionally, in a securities grey market, deals are binding but do not finalize until the release of an IPO officially.