Table Of Contents

What Is A Grantor Retained Annuity Trust (GRAT)?

A Grantor Retained Annuity Trust (GRAT) is a tax-efficient strategy, enabling individuals to pass their estate to beneficiaries without incurring taxes. Its primary aim is to facilitate the tax-free transfer of property or wealth to heirs or family members.

GRATs find extensive utility in estate planning, offering the advantage of transferring assets to heirs without triggering federal taxes. This method helps sidestep tax liabilities for the trustor and allows for potential asset appreciation. Nonetheless, executing a GRAT can be intricate and involves complex procedures.

Table of contents

- What Is A Grantor Retained Annuity Trust?

- Grantor retained annuity trust (GRAT) is an irrevocable trust in the United States that allows individuals to transfer assets to beneficiaries at no cost.

- According to the IRS, the grantor must create a trust with an annuity payment every year. Later, the trustee will transfer them to the beneficiary at maturity.

- On maturity, the grantor will receive the annuity at the IRS 7520 rate prevailing in that month. For example, 4% of $1 million for five years ($200,000).

- The fees involved in creating this trust are almost $2,000 to $20,000. However, it might differ as per the trust.

How Does A Grantor Retained Annuity Trust Work?

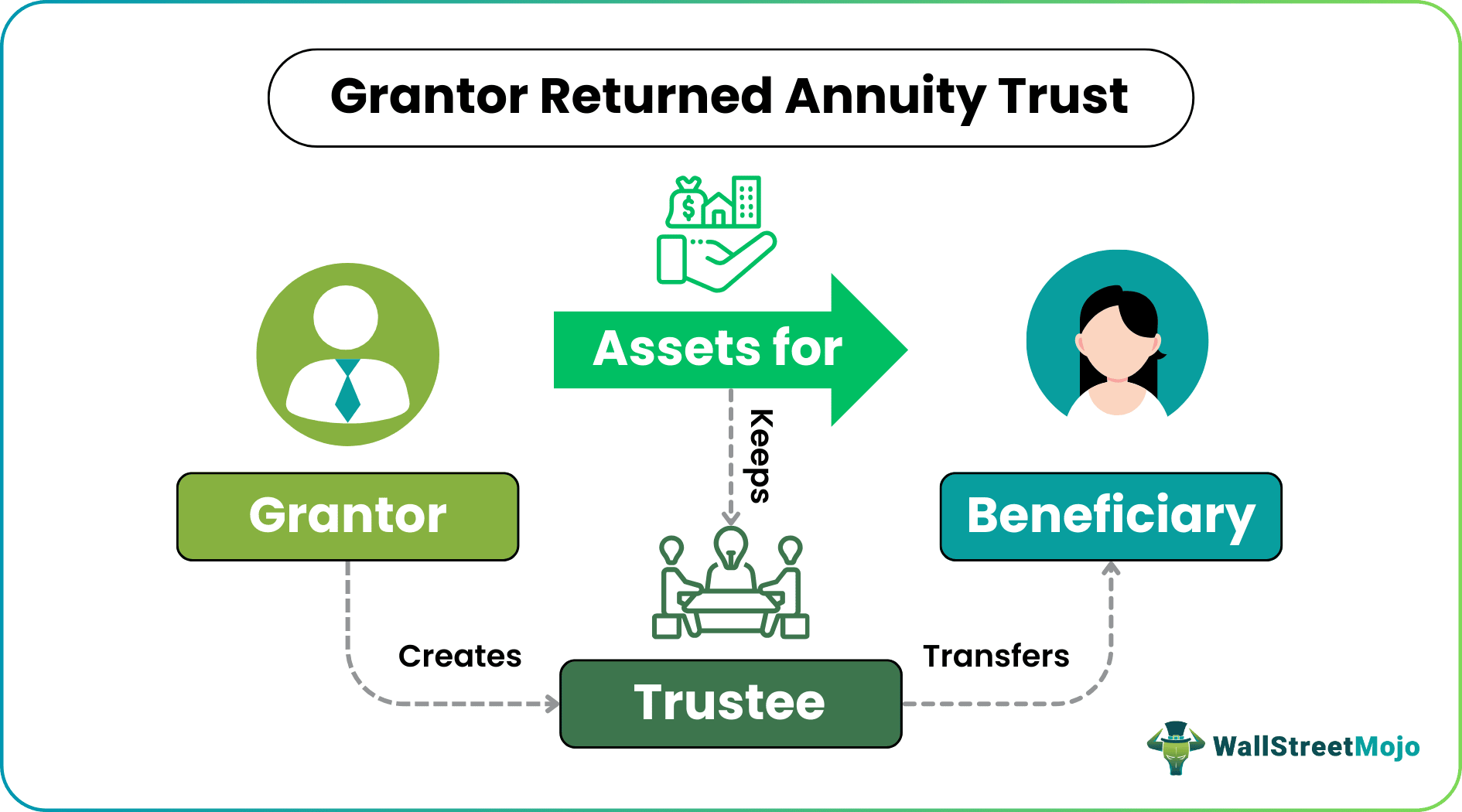

A grantor establishes a GRAT to retain assets while transferring them to heirs tax-efficiently. An irrevocable trust structure involves a grantor, grantee, and beneficiary. The grantor forms the trust, contributing assets like stocks or real estate, and commits to making annuity payments. The trustee oversees asset management and transfer. Upon maturity, designated beneficiaries receive the gifted value. The annuity amount is determined using IRS rates, usually section 7520 rates, and distributed annually.

Creating a GRAT involves specific steps:

- The grantor sets the annuity amount using a calculator, often spanning 2 to 10 years.

- The trustee receives assets, with the remaining value gifted to beneficiaries.

However, certain IRS regulations apply:

- The trust's interest rate must match or exceed the IRS rate.

- If the interest rate falls below a certain threshold, the trust terminates, with assets reverting to the estate.

- The trust must be irrevocable for federal tax benefits.

- Establishing a GRAT involves fees ranging from $2,000 to $20,000.

- The grantor maintains assets of comparable value to generate returns or interest within the trust.

History

The origins of the Grantor Retained Annuity Trust (GRAT) can be traced back to the early 2000s in the United States. The popularity of GRATs gained significant attention due to the landmark case of Audrey J. Walton v. Commissioner (Internal Revenue) in the year 2000. In this case, Audrey J. Walton established two GRATs, whereby annuity payments were to be deposited into Walton's account, while the remaining assets were designated for her heir, her daughter.

Notably, Walton claimed zero taxes on her filings, a contention contested by the Commissioner. Eventually, the US Court ruled in favor of Walton, leading to the recognition of this structure. Consequently, it became known as the "Walton Grantor Retained Annuity Trust" or "zeroed-out GRAT."

Under the Walton Grantor Retained Annuity Trust, the initial value of assets contributed to the trust is set at 0. However, if the assets experience appreciation, the beneficiary becomes entitled to the appreciated value. It's important to note that while the beneficiary stands to benefit from asset appreciation, the value of annuity payments remains deposited in the grantor's account.

Examples

Let us look at the examples of GRATs for a better understanding of the concept:

Example #1

Suppose Alfred is a corporate professional working for more than a decade. His main intention was to transfer his wealth to his children. To achieve this, he established a GRAT for 10 years.

Alfred contributes $30,000 in cash, $15,000 in stocks, and $100,000 in property to the trust. His child, Silin, is designated as the beneficiary. The trust's total value is $145,000, and he incurs $3,000 in grantor-retained annuity trust fees.

Upon creation, the prevailing IRS rate is 4%, which means Alfred will pay a 4% annuity for the ten-year duration. When the trust matures, he'll receive $58,000 (4% of the original value * 10 years). Any asset appreciation beyond the annuity payments benefits his children. Fast forward to the tenth year, and imagine the value has grown to $300,000. Consequently, Alfred's children are left with $242,000 in remaining value.

Example #2

Executives like Zuckerberg and Moskovitz used the grantor-retained annuity trust (GRAT) as a wealth-transfer strategy within the bounds of tax laws. They established separate annuity trusts funded with Facebook stock, allowing them to receive annual annuity payments for a fixed time while transferring assets to beneficiaries without gift tax liability. This technique, termed a zeroed-out GRAT, enables wealth transfers while using the lifetime gift tax exemption.

Pros And Cons

Let's explore the advantages and disadvantages of a Grantor Retained Annuity Trust (GRAT) to gain a deeper understanding:

Pros

- Tax-free: GRATs don't incur taxes.

- Annuity Payments: Grantors receive annuity payments upon maturity.

- Asset Appreciation: Beneficiaries benefit from increased asset values.

- Flexible Payments: Grantors can determine the annuity payments.

Cons

- Minimum Rate Requirement: A GRAT must outperform the IRS rate; otherwise, it might not function as intended.

- Loss of Control: These trusts are irrevocable, meaning the grantor loses control over the assets during the trust's duration.

- Complexity and Costs: The setup process can be intricate and costly.

- Tax Implications: Tax liability exists on the annuity payments received by the grantor, although the remaining amount is not taxable.

Taxation

Following are the steps to avail of tax benefits on the grantor retained annuity trust:

- The person planning to transfer assets (also grantor) should create a GRAT first under Internal Revenue Code Section 2702(a)(2)(B) and 2702(b).

- Throughout the term, the tax liability will flow from the grantor to the beneficiary. So, the former can claim estate and gift taxes on the amount.

- In businesses, if the grantor dies during the tenure, the assets are transferred back, and taxes occur.

Frequently Asked Questions (FAQs)

The main application of the GRAT is to shift the appreciation of the grantor's assets to a third person without incurring any tax liability. Individuals mostly use this GRAT for real estate matters. For example, former US president Donald Trump's parents used the GRAT.

GRAT is often considered a simple trust as it fulfills all the criteria of the IRS. The tax liability is passed on to the beneficiary in a simple trust. However, in this case, there is zero liability for gifts received. Besides, it does not make any charitable contributions. Plus, there are no multiple beneficiaries.

A GRAT (Grantor Retained Annuity Trust) and a GRUT (Grantor Retained Unitrust) are both estate planning tools, but they differ in how they distribute assets to beneficiaries. In a GRAT, the grantor receives fixed annuity payments; in a GRUT, the grantor receives a fixed percentage of the trust's value annually. While GRAT focuses on a fixed dollar amount, GRUT centers on a fixed percentage, impacting the timing and amount of distributions to beneficiaries.

Recommended Articles

This article has been a guide to what is Grantor Retained Annuity Trust. Here, we explain it with its pros, cons, examples, and taxation. You may also find some useful articles here -