Table Of Contents

What Is Graham Number in Stock?

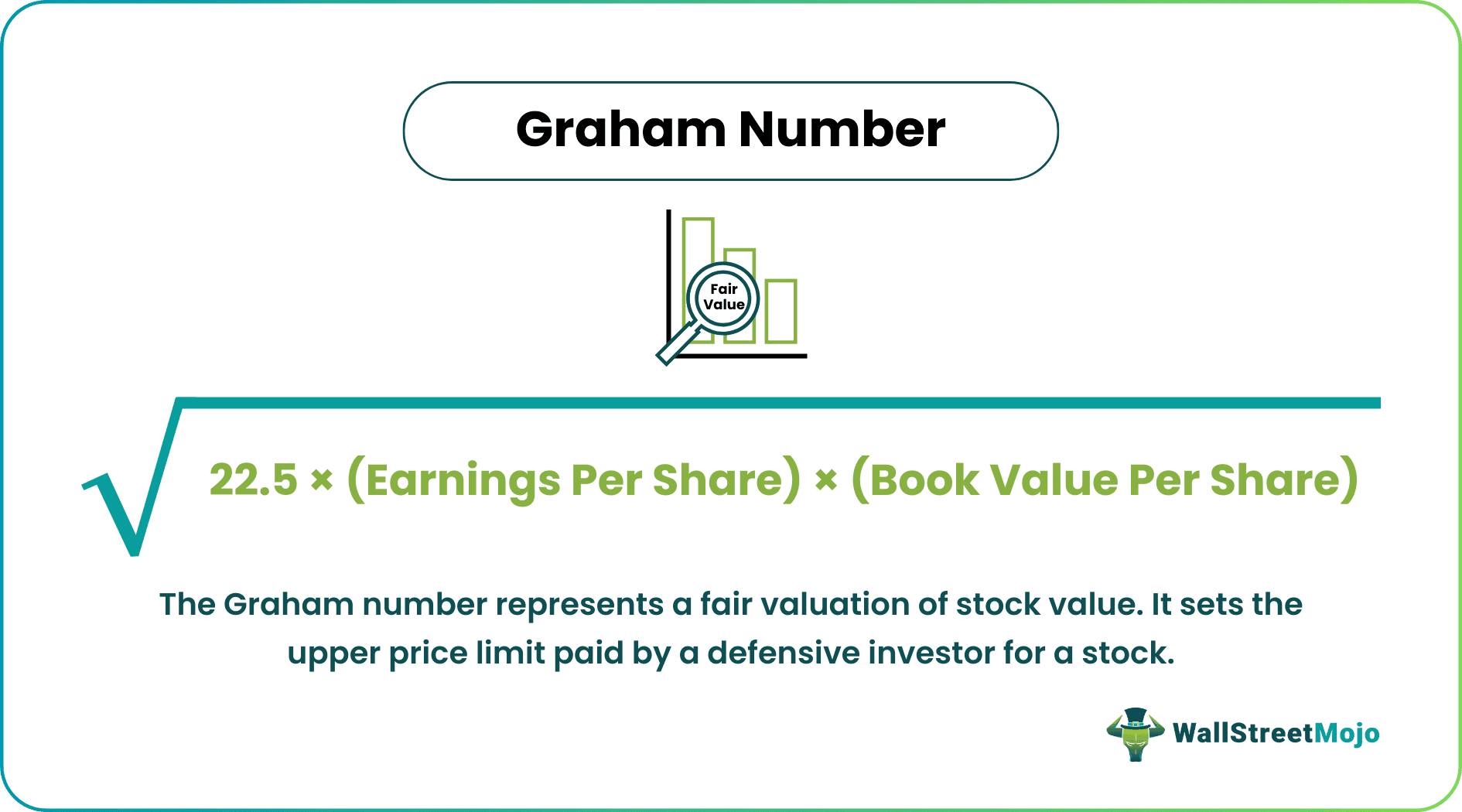

The Graham number represents the fair valuation of a stock. It sets the upper price limit paid by a defensive investor for a stock. It is calculated from the Employee Earnings Per Share (EPS) and Book Value Per Share (BVPS).

Commonly known as the Benjamin Graham number, this stock valuation measure was proposed by Benjamin Graham. He is recognized as the father of "value investing." Defensive investors use different metrics for screening, and the Graham Number is the best screener.

Key Takeaways

- Graham number is a method developed for the defensive investors. It evaluates a stock's intrinsic value by calculating the square root of 22.5 times the multiplied value of the company's EPS and BVPS.

- The formula can be represented by the square root of: 22.5 × (Earnings Per Share) × (Book Value Per Share).

- For applying this method, two conditions must be met. The Profit to Earning ratio (P/E) should be < 15. Also, the Price to Book ratio (P/B) should be < 1.5.

- This fundamental value formula does not apply to asset-light companies with more than 10% growth rate and companies with negative earnings.

Graham Number Explained

The Graham number is a helpful tool for defensive investors. A defensive investor is one who is willing to invest in the stock market using less time, effort, and management.

While talking about its application, this method effectively determines the maximum stock price of any company irrespective of its size and industry. Investors can find some of the best stocks at the lowest price if they employ this method. This is because the Graham number reveals undervalued stocks. Additionally, this valuation provides an opportunity to buy undervalued stocks at a lower trading price.

Formula

To compute the fundamental stock value, we can use the given formula: 22.5× (Earnings Per Share) × (Book Value Per Share)

Alternatively written as 15 Earnings Per Share × 1.5 (Book Value Per Share)

Here,

Earnings Per Share (EPS) = Net Income / Shares Outstanding

And,

Book Value Per Share (BVPS) = Shareholder's Equity / Shares Outstanding

Now, there are certain mandatory conditions for the application of Graham Number:

- The multiple of EPS, 15 used in the formula, denotes the Price to Earning ratio, which cannot exceed 15 in any case. This formula is inapplicable when the company's P/E ratio is more than 15.

- Similarly, the multiple of BVPS, 1.5, signifies the Price to Book ratio. The P/B ratio should be below 1.5. If a company’s stocks exceed the P/B ratio limit, it cannot be computed using this stock valuation tool.

Benjamin Graham never proposed this formula directly. Instead, he outlined a stock selection criterion for the defensive investors. This parameter was published in his book, The Intelligent Investor. The analysts narrowed down upon one particular criterion, the moderate price to assets ratio. Based on that, they further developed the Graham number formula.

The moderate price to assets ratio suggests defensive investors consider the following factors before investing.

- Up to 15 times the earnings, stocks can provide better returns from assets.

- The current price of the stock shouldn't exceed the book value multiplied by 1.5.

Calculation Example

Consider the following numerical. Zodiac wants to buy a stock of PQR Pharma Ltd, which is trading at $14. However, he is confused if it is a good deal. The company's net income is $1.8 million in the financial year 2020-21. Whereas the shareholder's equity values at $240000. Additionally, 200,000 shares are outstanding. Figure out the Graham number for Zodiac.

Calculation

Given:

- Net Income = $1800000

- Shareholder’s Equity = $240000

- Shares Outstanding = 200000

Earnings Per Share = Net Income/Shares Outstanding

Earnings Per Share = 1800000/200000 = $9

Book Value Per Share = Shareholder's Equity/Shares Outstanding

Book Value Per Share = 240000/200000 = $1.2

On applying the Graham number formula:

22.5 × (Earnings Per Share) × (Book Value Per Share)

22.5×9×1.2 = $15.59

The stock price is only $14. So, the fundamental value of $15.59 highlights that the stock is undervalued by 10.19%. Therefore, the investor should buy this stock.

Use

According to Benjamin Graham, the higher the investors pay for acquiring the stocks, the lower the returns. Thus, the concept of value investing is crucial for determining a fair deal whenever an investor plans to buy stocks.

Thus, this valuation metric saves the investors from paying beyond the actual value of a stock. It also helps investors discover undervalued stocks.

Some of the exceptions for using this technique in value investing are stated below:

- It is unsuitable for applying to the stocks of companies running in loss or have low earnings.

- If a company has a growth rate exceeding 10%, this technique renders an underestimated value.

- This formula determines incorrectly if the company is asset-light.

Therefore, we can say that this method is efficient in evaluating the stocks of companies with positive, tangible book value and have a growth rate below 10%.

According to Yahoo Finance, the large-cap stocks of Bank Bradesco SA, Allstate Corp, and Hartford Financial Services Group Inc. are a must-buy. In April 2021, they were undervalued, trading at a price below their Graham number.

This technique alone cannot be solely relied upon to determine the intrinsic value of stocks. To make a more sensible investment decision, the investor needs to consider the influencers behind the undervaluation as well. The alternative factors for stock value analysis include the company's return on equity, revenues, profit margin, cash flow analysis, return on capital employed, and debt analysis.