The Graduate’s Roadmap to Becoming an Accountant

Table of Contents

Introduction

If you are someone who has been searching for how to become an accountant, then you have arrived at the right place. Being an accountant requires you to take responsibility for all the financial transactions involving your employer. It is one of the most reputed and well-paid jobs in the world. Any business, irrespective of its nature, depends on an accountant for all its financial reports, statements, records and efficient recording of transactions for tax and reporting purposes.

It doesn’t matter how big or small a company is; either they have an accounts department or they outsource the work to an accountancy firm, and in both scenarios, an accountant is always in demand. In this article, we will provide a graduate’s roadmap to becoming an accountant.

Why Choose Accountancy as a Career?

Every business requires finance and accounting, so accountancy actually allows you to work for different companies operating in distinct industries and sectors. If you are good with numbers, have a knack for maintaining records and have an eye for detail, accountancy can take you to new heights and be highly rewarding. With just the right tools and a good accounting career guide, you can work from anywhere in the world and earn a great salary. Even if you choose to practice accounting independently, you can earn a significant amount of money by acquiring top-tier or well-established clients who want to work with you exclusively.

Essential Qualifications for Aspiring Accountants

Here are some essential qualifications that you must pursue and complete to become an accountant:

#1 - ACCA

ACCA stands for “Association of Certified Chartered Accountants,” and when a candidate completes it, they receive a ‘Certified Chartered Accountant’ validation, which is a global certification. ACCA courses are well-acclaimed and are typically comparable to a university degree.

ACCA Entry Requirements

The entry requirements for the ACCA exams are usually as follows:

- At least 18 years of age

- English proficiency

- 3 GSCEs and 2 A Levels or equivalent in 5 different subjects, including Mathematics and English

Note that the eligibility criteria vary across countries. Hence, ensure to check the requirements on the basis of your location. You might also be eligible for exemptions. To know whether you are, you may consider using an online exemption calculator.

Both finance professionals and commerce graduates can choose to pursue this course. The duration of the program spans from three to four years, and one needs to gain 36 months of work experience in a relevant role to meet the practical experience requirement or PER and obtain certification.

#2 - CFA

CFA is an abbreviation for Chartered Financial Analyst and is observed as a postgraduate professional qualification with global certification offered by the US-based CFA institute. To clear CFA, candidates must pass three levels of examinations that cover subjects such as money management, accounting, ethics, economics and security analysis. A CFA institute is a nonprofit organization that promotes and certifies candidates in finance education and accountancy.

CFA Entry Requirements

- A bachelor’s degree or any equivalent degree or at least 4 years of professional work experience or a combination of higher education/work experience that equals 4 years at least

- Fulfill the admission criteria concerning professional conduct

- English proficiency to take the exams

- A valid passport

The candidate must pass all three levels of the examination and meet the work experience requirement to obtain the CFA certification. The work experience criterion requires individuals to be a part of an organization’s investment decision-making process for a minimum of 36 months.

Practical Steps You Need to Take

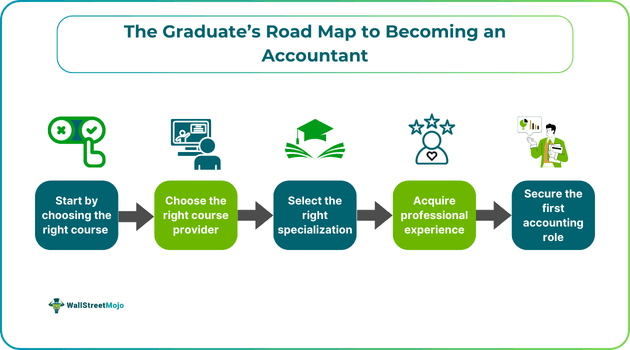

Alright, now that we have discussed two of the most pursued certification courses that can boost your career as an accountant, let us discuss an accountant career roadmap with some of the practical measures that you must take and have clarity about —

#1 - Begin by Researching the Right Course

In this graduate’s roadmap to becoming an accountant, the first step is to carry out research and find which course is the best for you. You can’t spend all your time studying and preparing for exams and tests. You want to become an accountant, and for that day, you will have to start working. You must conduct thorough research to identify the course that is in line with your strengths and will help you achieve your goals. Do not make the mistake of following the herd. Have a well-structured career plan and then enroll in the right course for yourself based on time, eligibility, expenses, experience, and skills required.

#2 - Select the Right Course Provider

Choosing the right college, university and course providers plays an essential role in your road to becoming a successful accountant. Every course provider has its reputation and employers do pay attention to it. It adds value to your education and overall profile as a budding professional and aspiring accountant. Often, there are times when employers and accounting firms give special attention to selective course providers and like to appoint candidates who have received a certificate from them only.

#3 - Choose Your Specialization

Yes, accounting does come with specialization and you must choose whichever area of expertise suits you or attracts your interest the most, but at the same time, you have to consider other factors that can affect your career plan. Indeed, from forensic accounting and external and internal financial reporting to tax accounting to auditing, there are multiple specializations that you can choose from. However, your choice does make a lot of difference to your professional journey.

#4 - Get Relevant Work Experience

We have already discussed how ACCA and CFA demand work experience, and that too for a specific period. That said, that’s an eligibility criterion you will have to fulfill not just because you want to appear and pass the certification exams but because you want to add knowledge, skills, expertise and value to your accountancy portfolio and resume. Learn every aspect of accounting and key strategies to improve efficiency, and try to acquire as much experience as possible. You never know what impact it has on your career.

#5 - Secure Your First Accounting Role

Yes, it is a well-heard quote that your first job teaches you a lot. But more importantly, your first job opens new opportunities to boost career growth. All the time you spend in your first job gives you a real and close experience of how things actually work and offers a glimpse into what happens in an office, how to interact with clients and host or take part in meetings. After you have gone through all the steps to become an accountant, it is not just important to secure your first accounting role but to secure the one that suits you the best.

Your first job speaks a lot about you in your career, resume and professional journey. The things you learn at your first job stick with you throughout your career and set the foundation for your professional personality. Of course, there are many other alternatives to reach your professional goals. That said, do follow the practical measures discussed in this graduate’s roadmap to becoming an accountant for building an illustrious career in accounting.