Table Of Contents

Meaning Of Going Public

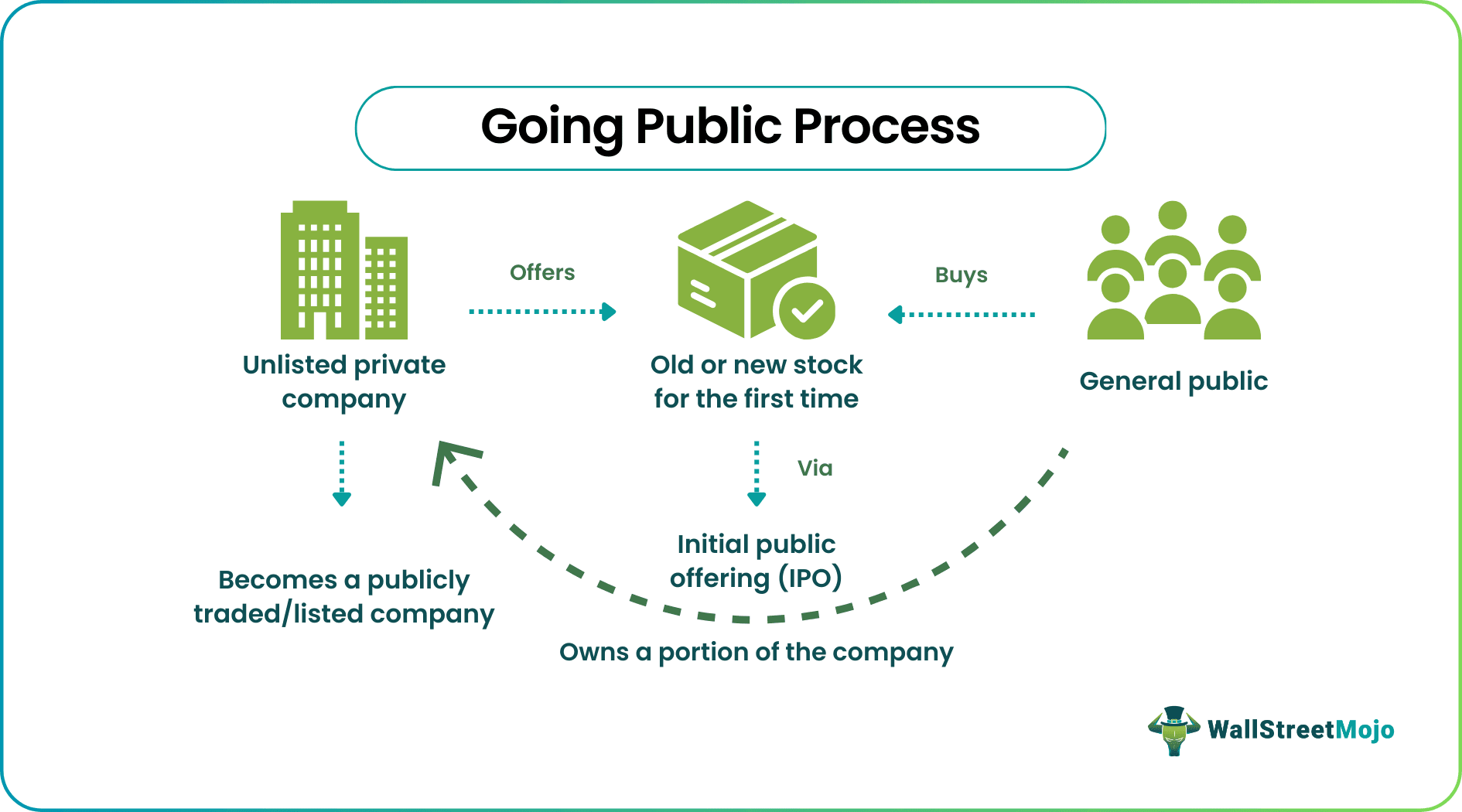

Going public is a corporate practice in which an unlisted, private company allows the public to purchase its old or new stock for the first time. This initial public offering (IPO) helps the general public to make a profit while assisting the corporation in raising capital and becoming a publicly traded firm.

Retail and institutional investors can become shareholders in the company going public and receive guaranteed dividends. If the company makes a profit, so do the shareholders based on the number of shares they own, or vice-versa. Even though it seems a money-making opportunity, IPO is also known for producing lower-than-expected long-term returns.

Key Takeaways

- Going public is a method of allowing the general public to own a portion of a private corporation by purchasing its first issue of shares at a pre-determined price.

- The corporation becomes a public company after the process completes. And investors can become shareholders in a public listed company and receive assured dividends.

- Going public company needs to contact an investment bank for business evaluation, advise on the share price, arrange and underwrite the IPO.

- As per the going public definition, a company receives a considerable amount of liquidity for different operations. But IPO comes at the expense of the company owners losing the company ownership to the shareholders.

How Does Going Public Work?

Going public is crucial for any business, especially a small or privately held one, that requires funding to expand and finance its various projects. And, via an IPO, they can raise the needed capital from new investors while also giving them part-ownership in the business. It is an invitation to the general public to purchase the company's stock at a pre-fixed price. Aside from that, a private shareholder's decision to sell its shares may be a factor in a company's decision to go public.

The process of going public is governed by the rules of the jurisdiction in which it occurs. It also has to be publicized, giving the public enough opportunity to participate in the IPO. It could range from a few weeks to several months. Companies that are appealing to investors have a target amount in mind when going public. And investors are more likely to make deals with companies that are considered to perform exceptionally well. However, in certain instances, this number is not made available to the public.

When a company performs well, it always sells more shares than it had planned. A variety of steps can alleviate this, including restricting the number of shares that each person can purchase. Putting a cap on the number of shares that a group can apply ensures that the company will not go public with just a few shareholders. Since the amount shareholders can purchase is restricted, the company ends up with more and more shareholders.

Once the IPO is completed and the shares are purchased, the company is listed on the Stock exchange. The share price would rise if the business is undervalued, resulting in gains for the shareholders. However, if the shares are overvalued, their value can fall before going up again in the future.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

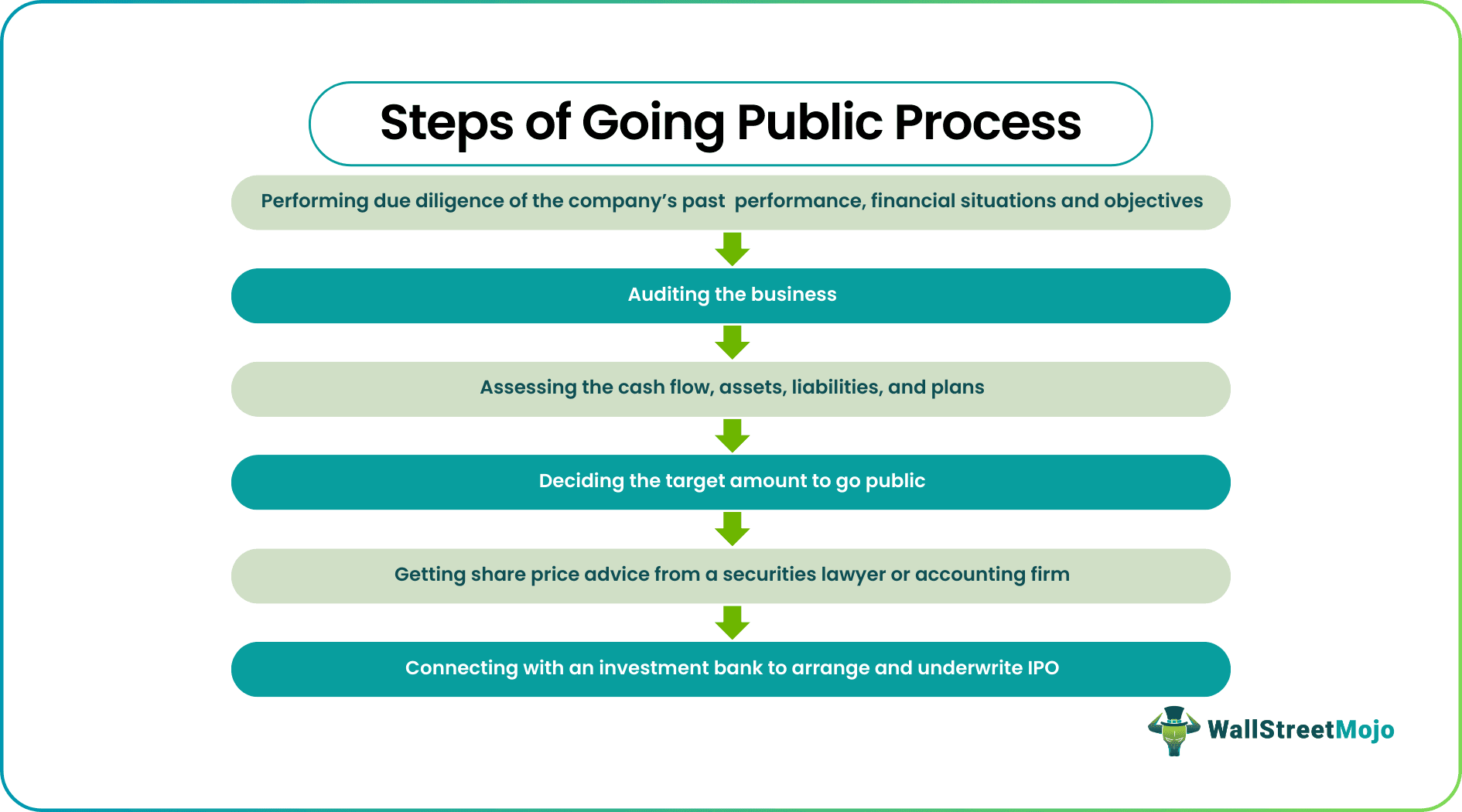

Steps Involved In Going Public

To offer an IPO, a company must conduct due diligence on several factors, including past performance, financial condition, and goals. It may also include auditing the business so that prospective investors can determine how much the company is worth before purchasing stock. Cash flow, assets, liabilities, and plans can all be included to provide a clear picture of the company's current state.

Experts such as managers, securities lawyers, auditors, and accountants would be required during the going public planning phase. They draft the prospectus and determine the optimal number of shares and the initial rate to sell to the public. Some companies often allow their employees to purchase stock before going public. It gives them a reason to work toward retaining or raising the value of the company's stock. While the US Securities and Exchange Commission reviews the company going public, the US Treasury Department scrutinizes the firm that has gone public.

Purchasing stock from a newly public company can necessitate the creation of a separate investment bank account. Although a broker may assist the investor in purchasing the shares, broker's fees may make the cost of going public stock more expensive.

Example

The owners of a telecommunications company decide to going public to raise funds for expansion or other business-related activities. To do this, they must conduct a comprehensive audit of their books internally. They can also ask a third party that is not associated with the company to do the audit.

The company then approaches an investment bank and the regulatory body controlling the country's stock market. It then issues a letter of intent. The investment bank will take on the role of the underwriter. Until selling the securities to the general public, the investment bank will own them and assume legal responsibility for them.

The investment bank will help the company figure out how many shares to sell and at what price. It then sells shares to the general public for a price higher than the company's original owners received. Usually, the company and the bank prefer to underprice the shares to attract investors.

Once due diligence has been completed and found to be satisfactory, shares are offered for sale to the general public. The business will be able to go public after all legal requirements have been fulfilled. Advertisements in the media can assist in the process.

Advantages

- Going public is a way to get a lot of money in a limited period, given the IPO and subsequent listing performs strategically.

- It brings higher market value and increases reputation and recognition of the company.

- The capital can be used to fund operations, acquire other businesses, or grow the company.

- It diversifies the company's ownership, protecting the original owners from losses.

- It simplifies activities requiring significant amounts of money, such as buying out the competition or implementing a strategic plan.

Disadvantages

- Buying a going public stock could be a risky investment compared to established public companies and has the potential to stifle short-term growth.

- It makes it more difficult for the company to make time-sensitive decisions because almost all shareholders must agree before a decision is made.

- Public corporations are subject to much stricter regulations, which can make management and trading more difficult.

- Going public can increase the cost of doing business depending on the company size and the majority shareholder, who can lose some of the company’s ownership to the general public.

- Disclosure of business and financial information to the public may benefit competitors.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Going public is a business activity in which an unlisted firm makes its existing or new stock available to the public for the first time. This initial public offering (IPO) allows the general public to profit while also helping the company raise funds and become a publicly listed company. Investors become shareholders in the public traded company and receive guaranteed dividends.

The going public company involves several steps:

1. Perform due diligence on the company's past performance, financial situation, and objectives

2. Conduct a business audit

3. Assess cash flow, assets, liabilities, and plans

4. Decide the target amount to go public

5. Connect with a securities lawyer, accounting firm, or investment bank

Going public is critical for any company, especially one that is small or privately held that needs money to expand and fund its many activities. It helps the company raise the required funds from new investors through an IPO and become a publicly traded company. It protects the original owners from losses by diversifying the company's ownership. Also, it makes buying out competitors much easier.