Table Of Contents

What is Going Concern Concept?

Going concern concept is one of the basic principles of accounting that states that the accounting statements are formulated so that the company will not be bankrupt or liquidated for the foreseeable future, which generally is for 12 months. It is an important function for a business as it makes it very clear how the business should manage its expenses or commitments to ensure its resources are efficiently managed.

The prime aspect of a business remains the capability and integrity of the management. Proper business foresight and operational efficiency are required for a company to sustain and stay profitable for a longer term. In addition, economic recessions are crucial, which determine management's ability when major firms fail to generate profits.

Key Takeaways

- The going concern concept is one of the fundamental accounting principles that shows that the accounting statements are organized so that the company cannot be bankrupt or liquidated for the foreseeable future, i.e., generally for 12 months.

- The prime business features are the capability and integrity of the management.

- Accurate business foresight and operational capability are necessary for a company's survival and to remain profitable for the longer term.

- Economic recessions are essential as it evaluates management's efficiency when major firms cannot create profits.

Going Concern Concept Explained

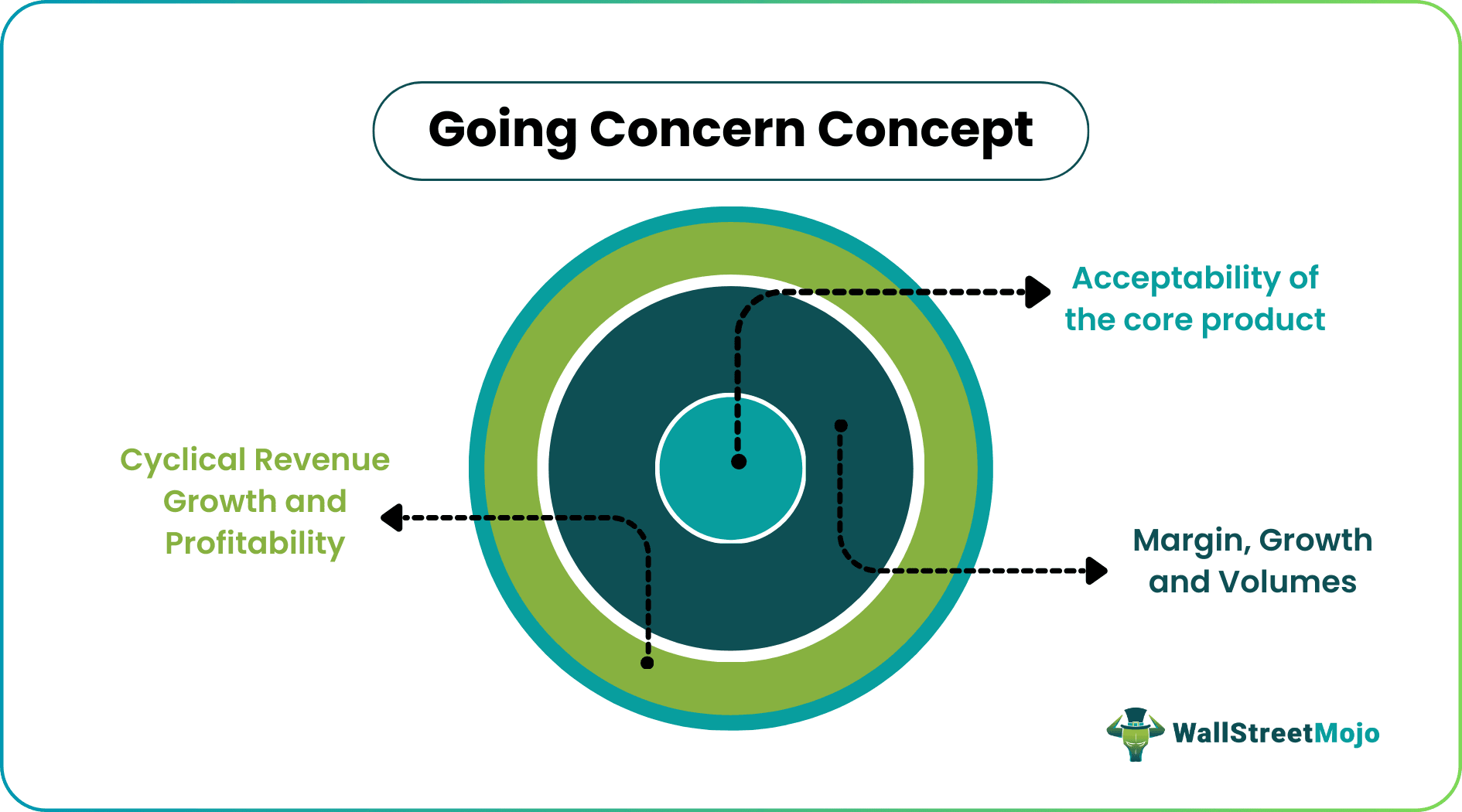

The going concern concept means a business can 'run profitable' for an indefinite period until the concern is stopped due to bankruptcy and its assets are gone for liquidation. For example, when a business ceases trading and deviates from its principal business, the concern would likely stop delivering profits in the near-term future. Thus, a company cannot bear losses for longer and erode shareholders' wealth. Conversely, a healthy business shows revenue growth, profitability growth with margin improvement, and growth in product sales.

Going Concern Explained in Video

Assumptions

The going concern concept accounting follows a few assumptions. Let us understand them to ensure we understand the concept in better depth.

The primary assumption is that the business will run forever until the company stops due to bankruptcy and liquidates assets. For this, the company needs to have the following: -

#1 - Acceptability of the core product

A business runs on the going concern basis of the products/services offered to the consumers. The pulse of an industry from a fruit seller to a multi-national company selling IT services will be the same. The owner or the top management has found new customers and maintained its existing ones to keep the company's organic and inorganic growth. Retention of old customers and expansion through recent customer acquisition would help make the business profitable and aids toward the volume growth of the product. The product should be reasonably priced and innovative to beat its peers and retain value for the customers.

#2 - Margin, Growth, and Volumes

The business's financials should speak about the industry's sustainability through top-line and bottom-line growth and higher operating and Net profit margin. An ideal growing concern should have more product sales compared to last year.

#3 - Cyclical Revenue Growth and Profitability

Another instance where there might not be constant top-line and bottom-line growth, and increased margin is when the demand for the product is 'cyclical' in nature. For example, the rise and fall of volume in steel products may affect revenue, hindering profitability due to fixed cost. But the exciting part of the business is that it still follows the fundamentals. Unfortunately, due to the nature of the industry, it is getting a hit.

Examples

Let us understand the concept better with the help of a couple of examples.

Example #1 - Page Industries (Jockey India)

Here is a snapshot of a company with a robust margin and growth.

From the above financials, we can derive that the revenue growth and the net profit growth have been consistent for Page Industries Ltd. (which manufactures apparel for the Jockey brand) from FY14 to FY17. The revenue has increased from ₹1194.17 Cr. in FY14 to ₹2152.88 Cr. in FY17. During this period, the net profit grew from ₹153.78 Cr. to ₹266.28 Cr. during this period. As a result, the Gross profit margin has been around (50%-60%), followed by a healthy EBIT margin (more than 20%) and a robust net profit margin (12% -13%). That shows business sustainability due to higher product acceptability (evident from revenue growth) and operational efficiency (visible from sustainable EBIT margin).

Example #2 - Tata Steel

Below is the snapshot of another example wherein the revenues are cyclical.

Due to the Cyclicality demand of steel across the Globe, the Revenue has gone down Due to the cyclical demand for steel across the Globe, the revenue has decreased from ₹149130.36 Cr in FY14 to ₹112826.89 Cr in FY17, and so has the profitability (from ₹3663.97 Cr in FY14 to a net loss of ₹ -4176.22 Cr). However, the margin has remained robust, but the bottom line got slashed due to higher Finance costs (INR 4336.83 Cr in FY14 to INR 5072.2 Cr.) and specific exceptional loss.

Significance

The going concern concept accounting reveals the true financial integrity of an organization. It is an action an organization conducts to ensure a clearer picture of their financial and growth related concerns.

- As per the going concern concept in accounting standards, financial statements reveal the business's 'true and fair value,' again when the sale of assets does not question the company's capability. Shut down of unprofitable branches, units, etc., does not imply that the concern has stopped performing well until and unless there has been a net loss and reduction in Shareholders fund. Thus, the red flags can be summed up as follows: -

- The inability of a business organization to pay its obligations despite sufficient restructuring. Despite several steps taken by the management, if the business fails to drive profits and there has been the exclusion of top-level management, shareholders might think of an exit.

- Audited reports with full financial statements are published yearly, whereas only income statement data are published quarterly. When accountants and Auditors questions about the operational efficiency of its Long-term assets, while to meet its dues, the Assets are being sold.

- Unable to report financials within a stipulated time frame is a question for the management. There must be instances where the administration has not given the business the 'true and fair value to the auditors. The auditors generally examine the profitability, loan-paying ability, operating and non-operating profits, and company losses. Continuous losses (where other firms are generating profits in the same segment), loan defaults, and lawsuits against the company raise questions regarding the company's performance.