Table Of Contents

What Is The Go-Shop Period?

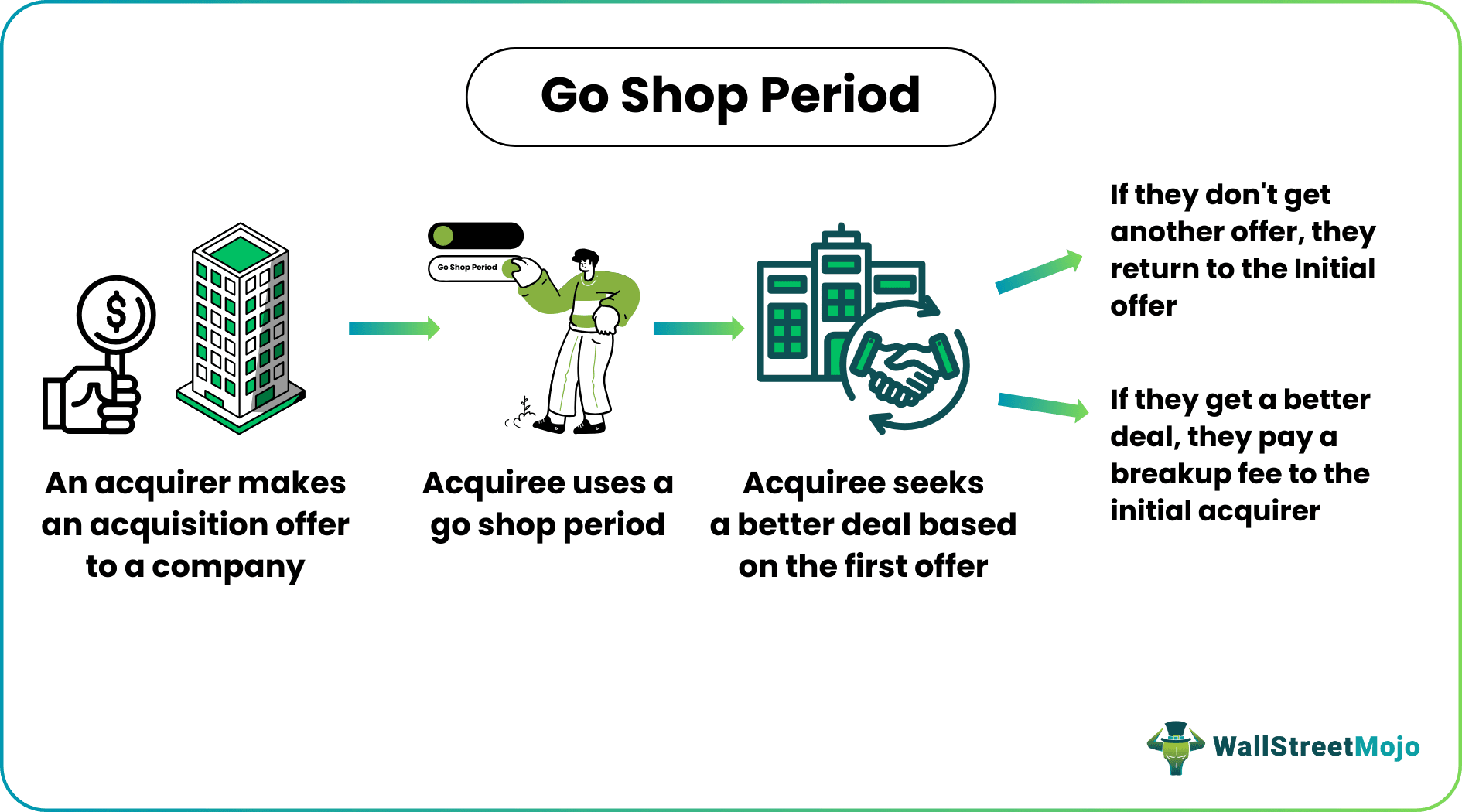

The Go-Shop Period is a time bracket in which a company that has received a purchase offer or has been acquired seeks better offers than the one in hand. This provision allows companies to take time and choose the best option they can receive from potential buyers.

When a company seeks other options and buyers, the initial offer plays a vital role as a base or floor price on which the entity hopes to strike a better deal. Simply put, the company will not accept any of the below mentioned offers and is looking for more. The initial buyer is provided a breakage fee if they find a better offer.

Table of contents

- What Is The Go-Shop Period?

- The go-shop period is a provision allowed to a public company when it receives a purchase offer to seek a better deal from other potential buyers.

- It is rare for any target company to receive a second or better deal during this period, but it is done to complete a fiduciary duty.

- A break-up and termination fee are involved, and the initial bidder may be paid by the target company in case a better offer is found.

- No other buyer may be interested in making a purchase offer higher than the first bid. The opposite of it is the no-shop period.

Go-Shop Period Explained

The go-shop period is a provision under the board of director’s fiduciary duty to seek the best deal possible from potential buyers, starting when an acquirer’s side has made an initial offer. In simple terms, when a company receives an acquisition offer from another company, the board of directors uses this period to seek another better acquisition offer from the market while holding the initial bid.

The company uses the initial offer to show openness, welcoming any higher bids from potential buyers. Technically, the first offer is used as a floor price for other buyers to bid better. The provision is allowed under the mergers and acquisitions (M&A) agreement. If, during this period, the target company comes across a better offer and decides to take it, they have to pay a termination and break-up fee to the initial bidder. Both parties comply with well-drafted terms in the M&A go-shop period agreement.

The process may sound simple, but it has many drawbacks and limitations, such as a short duration, other buyers’ interest in the acquisition, and prevailing market conditions. As per the historical data, only a tiny fraction of companies receives a better or new deal during this period.

Examples

Here are two examples, one hypothetical and the other from a real-world situation:

Example #1

Suppose Victor runs a healthcare company and has recently received an acquisition offer for $90,000. He wants this acquisition to happen but is not happy with the bidder’s initial offer. He used the provision of the M&A agreement, which allowed him 54 days to seek another buyer who expressed an interest in giving him a better offer for his company.

During this period, he received multiple offers, and in the end, he decided to choose one of them, offering $135,000 for his company acquisition. In this process, Victor used the offer of $90,000 as a floor price to attract new buyers, and due to the prior arrangement, he will pay a break-up and termination fee to the first bidder. It typically varies from 2% to 4% of the transaction value.

Example #2

Home Capital Group, a Canadian trust company listed on the Toronto Stock Exchange, announced the expiration of its agreement. During this period, the company was allowed to find new bidders, negotiate, and evaluate third-party offers from other potential buyers.

As a result, 38 new buyers were contacted. Out of them, three entered into confidentiality agreements and permitted non-public information access. Still, they did not receive any acquisition proposals during the period. As a result, Smith Financial Corporation, the initial buyer, agreed to acquire the outstanding and issued common shares of Home Capital.

Importance

The importance of this period is as follows:

- It helps in additional value generation.

- Works as a possession right for the target company to ensure they have the best deal.

- It helps in maximizing the bid value of shareholders.

- The board of directors sometimes treats them as a formality under their fiduciary duty.

Criticisms

Along with the above advantages, this period also has certain drawbacks:

- It rarely leads to another buyer, thus wasting time and documentation.

- If a deal has already been offered, it isn't certain for another to be made by new bidders.

- Critics question the efficacy of this period based on how they write, initiate, and conclude it.

- Though it favors the seller but is from the first bidder’s perspective, it uses the initial offer as leverage.

Go-Shop Period vs No-Shop Period

Go-shop period and no-stop period are two terms that define the options that the acquiree has when an M&A deal cracks. Listed below are the differences between the two:

| Go-Shop Period | No-Shop Period |

|---|---|

| It refers to a time provision allowing companies to seek better deals. | No such option is provided to a company. |

| A company gets to choose its buyer based on the price offered. | A company has only the first bidder's offer. |

| If the company chooses another offer, they have to pay a small break-up fee to the initial bidder. | The company is not allowed to make such a move; if the company decides to take another offer, they have to pay a hefty break-up and termination fee to the first bidder. |

| Companies can share information with potential buyers | Companies are not allowed to share any information. |

Frequently Asked Questions (FAQs)

The general time duration of this period varies between one and two months. More precisely, a time bracket of 20 to 55 days maximum after the company has signed a contract with the primary buyer. During this period, the company seeks potential buyers and market interest.

The company pays a fee to the initial bidder if they find a better deal and want to get out of the primary offer. The fee generally amounts to 2% to 4% of the transaction’s equity value. It compensates the primary bidder and maintains the first offer as the floor price to attract other offers.

Although they cannot directly influence the decisions made during this period, shareholders can voice their objections or points of view by voting or interacting with the board.

Recommended Articles

This has been a guide to what is Go-Shop Period. We explain its examples, importance, criticisms, and differences with no-shop period. You can learn more about financing from the following articles –