Table Of Contents

Who Are General Partners?

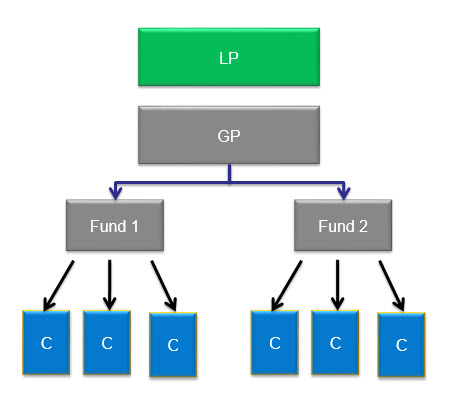

A private equity fund that is created needs to be managed. A general partner (GP) refers to the private equity firm responsible for managing a private equity fund. The private equity firm acts as a GP, and the external investors are LPs.

The investors who have invested in the fund would be known as Limited Partners (LP), and the PE firm would be known as General Partner (GP).

Table of contents

What is the Role of a General Partner?

source: forentis.com

The general partner is responsible for making all decisions related to the management of the private equity fund. In addition, there are other specific functions that the general partner carries out. For instance, a General Partner must manage the private equity fund's portfolio, consisting of all funds invested by LPs.

In simple terms, the General Partner is responsible for the private equity fund's administration, management, and operation.

PE firms function and operate under the guidance of a general partner who sources capital from various investors and manages the fund by investing in this capital.

- Hence, first in the order of responsibility is to raise funds, followed by administering the day-to-day operations of the private equity fund. These day-to-day operations include identifying the investment opportunities, maximizing the value of the investment, and liquidating investments so that distributions can be made to LPs.

- The main objective of the GPs is to manage the private equity fund for the benefit of the LPs that have invested in it and act in the interest of the LPs.

- Given that LPs commit their funds to private equity firms and expect a positive return on their investments, the GP is entrusted with managing their funds to meet this objective.

- Additionally, unlike LPs, the GPs have legal liability for the actions carried out by the fund.

General Partner in Private Equity Video

Compensation of General Partner

source: forentis.com

- The compensation of GPs is designed so that it aligns with the financial objectives of LPs. The GPs are either paid through a management fee or compensation.

- The general partner earns an annual management fee of up to 2%, which is used to carry out admin duties, covering expenses like overhead and salaries.

- GPs can also earn a proportion of the private equity fund’s profits, and this fee is carried interest. The investments made by the fund earn profits, and GPs receive a share of these profits in the form of carried interest. The carried interest is usually in the range of 5% to 30%.

To get a better understanding, let us look at an example.

Let us say that a particular fund and its assets earn a return of 100 billion US dollars. The management fee received by the GP would then amount to 2 billion. Similarly, if the return on investment is 50 billion, the carried interest would be 20% of 50 billion in return on investment.

Recommended Articles

This article has been a guide to the General Partners in Private Equity, the role of General Partners, and the compensation structure, including the management fees and carried interests. You may have a look at these articles below to learn more about Private Equity –