Table Of Contents

What Is Gas Guzzler Tax?

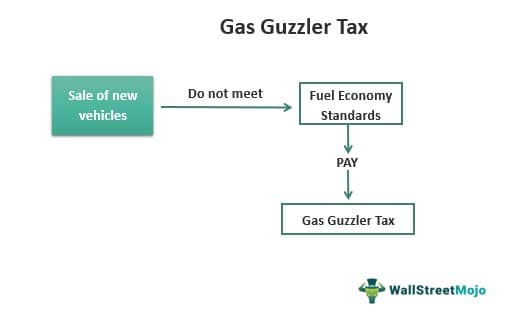

The term “gas guzzler tax”, which was introduced under the provisions of Energy Tax Act 1978, is a federal excise tax applied only on the sale of new passenger vehicles that do not meet certain fuel economy standards (i.e. vehicles which have potential to consume more fuel than the standard requirement).

It excludes trucks, SUVs and Minivans which are used for commercial purpose only. IRS is responsible for monitoring the gas guzzler program & collection of the tax for sale, use, or lease of cars. It is recovered from the car manufacturer or the importers and not from the ultimate buyers.

Gas Guzzler Tax Explained

The dictionary meaning of the word “guzzler” is a person who eats or drinks something greedily. Gas is a term used instead of various fuels across the world. Gas guzzler, thereby, means a car that consumes the fuel greedily. More consumption for a mile means low efficiency. It means gas guzzler tax on used cars will be more.

The federal gas guzzler tax is a tax on the sale of vehicles that have low fuel efficiency. It was introduced in the year 1978 by congress, with the primary purpose of discouraging the purchase of fuel-inefficient cars.

It applies to only passenger cars, and it is levied and collected by the Internal Revenue Service (famously known as “IRS”). The vehicle is subject to tax if it scores less than certain numbers of miles per gallon. Manufacturers are required to submit the details in Form no—6197 to compute the gas guzzler tax payable.

The concept goes with the proverb “lower the fuel economy, higher the gas guzzler tax to be paid.” Now, fuel economy means the average number of miles an automobile travels on a gallon of gasoline or any other equivalent amount of other fuel, as determined by the Environmental Protection Agency (EPA).

Calculation

- The levy of federal gas guzzler tax is determined based on two values calculated by the Environmental Protection Agency (EPA). Gas guzzler tax states pay the tax which is computed as the car’s fuel economy based on 55% city driving estimate combined with the 45% highway driving cycles.

- The vehicles that get 22.5 miles per gallon or more, of the combined highway to city mileage, do not have to pay such tax at all. It means if the vehicle runs a smaller number of miles for a given quantity of fuel, it consumes more fuel. More consumption means more pollutants evacuated into the environment. Hence, the term gas guzzler is used.

Example

The information is required to be submitted in Part I of the form number 6197 of the IRS. This form 6197 is attached to form 720. Part II of the form requires the manufacturer to submit details regarding the identification of the models which are subject to the said tax. Like in our example, the manufacturer in gas guzzler tax states should specify the exact model name, make, and model year of the 8 cars sold underline number 5 having a rate of tax $ 2100. The exact format is as below:

| Line Number from above | Fuel Company Rate (i.e. mpg) | No of Vehicles | Make, Model name & Model Year |

|---|---|---|---|

Criticism

The most significant criticism is that the giant gas guzzler does not apply to light trucks. The reason is that the law was enacted way back in 1978, wherein light trucks & SUVs comprised a mere 25% or even less than that. However, things changed with time. The use of SUVs has changed substantially over the past decades. But the law has not yet changed—the Older the law, the greater the problems. A decade ago, an amendment was made to the law which exempts limousines, and SUVs were kept exempt.

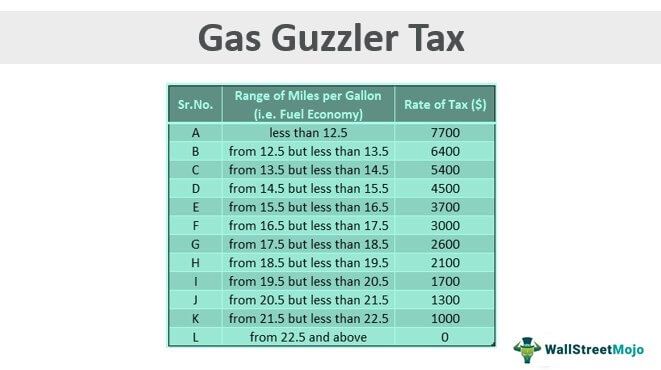

Rates Of Gas Guzzler Tax

If the mileage is at least 21.5 miles per gallon, then the rate of tax starts from $ 1000. However, if the mileage is less than 12.5 miles per gallon, the highest tax rate applies here is $7700. Also, for the buyer’s information, the said amount of tax required for a vehicle is posted on the window stickers of the said vehicle.

The tax rates are based on the range of miles per gallon. The rates are as follows:

| Sr No | Range of Miles per Gallon (i.e. Fuel Company) | Rate of Tax($) |

|---|---|---|

| A | Less than12.5 | $7,700 |

| B | From 12.5 but less than 13.5 | $6,400 |

| C | From 13.5 but less than 14.5 | $5,400 |

| D | From14.5 but less than 15.5 | $4,500 |

| E | From 15.5 but less than 16.5 | $3,700 |

| F | From16.5 but less than 17.5 | $3,000 |

| G | From 17.5 but less than 18.5 | $2,600 |

| H | From 18.5 but less than 19.5 | $2,100 |

| I | From 19.5 but less than 20.5 | $1,700 |

| J | From 20.5 but less than 21.5 | $1,300 |

| K | From 21.5 but less than 22.5 | $1,000 |

| L | From 22.5 and above | - |

So, if we just observe the above table, the rate is highest for a lower number of miles per gallon (i.e., $ 7700) per vehicle, and it is NIL for the highest possible miles per gallon. It proves the term “lower the fuel economy, higher the tax we have to pay.” Thus, gas guzzler tax on used cars, which consumes more fuel, is more.