Table of Contents

What Is F&O Trading?

F&O trading stands for futures and options trading. Futures and options are two types of derivatives, which are basically financial contracts signed by two parties to buy and sell a stock asset on a predetermined date at a preset price. Parties have the obligation to buy or sell the underlying asset in the case of a futures contract. On the other hand, in the case of options, there is no obligation to purchase or sell.

Individuals involved in F&O trading hedge market risk by trying to lock in the price beforehand.

The price of futures and options contracts is derived from the underlying asset, for example, stocks, commodities, indices, etc. Although investors try to reduce their risk through F&O, the associated financial risk is very high because the price prediction can go wrong and lead to enormous losses.

How Does Futures Trading Work?

Let's concentrate on futures trading first. A futures contract requires individuals to sell or buy a particular quantity of the underlying asset on a certain date in the future. Now, this underlying asset can be of any type, for example, commodities, securities, indices, or exchange-traded funds or ETFs. The parties who enter into the financial agreement must trade the underlying asset at the predetermined price irrespective of what the actual market price of the underlying asset is on the expiration date.

How Does Options Trading Work?

Now, when we talk about options trading, it is quite similar to futures trading. Options are, again, derivative contracts that grant the holder the right to buy or sell an underlying financial instrument, for example, a stock or a commodity at a preset price on a certain future date. One can trade options by opening a trading account with a brokerage firm. Both futures and options are derivatives.

The prime distinguishing factor between the two is that options give the holder the right to buy or sell the underlying asset. However, traders do not have the obligation to carry out the trade in this case. On the flip side, when it comes to futures, there is an obligation to trade the underlying asset on the expiration date.

Advantages Of F&O Trading

The following are the key advantages of futures and options trading -

#1 - Risk Management And Hedging

The main advantage of F&O trading is that it helps derivative traders hedge positions and manage portfolio risk based on price predictions and shifts in market volatility. For instance, let us say that a trader named Jack holds 1,000 shares of XYZ stock, and the price of each share is $1. Thus, the total value of the portfolio is $1,000.

Now, let us say that geopolitical tensions are on the horizon, which can severely impact the stock’s price. In that case, Jack can hedge his position by entering a short position in the futures market. In other words, he can purchase a futures contract agreeing to sell a certain number of XYZ shares on a specific date in the future.

#2 - High Leverage

With leverage in F&O trading, one can earn higher returns. Also, it provides an opportunity to generate gains faster. As a result of even a minor upward or downward price movement, leverage can deliver significant profits. Leverage investors require less capital, and it allows them to control larger positions. That said, one must also note that the associated risk is also higher when using leverage. Even a small price movement in the opposite direction can result in substantial losses.

#3 - Profit Potential In Rising And Falling Markets

With F&O trading, investors can book high profits or expect a greater profit potential when compared to trading in the spot market, even when there is high volatility. Yes, there are high risks involved, but at the same time, it works on the principle of high risk, high rewards.

#4 - Flexibility And Diversification

F&O trading comes with the flexibility to capitalize on market movements no matter whether the market is bullish, bearish, or neutral. At the same time, one can carry out F&O trading using different assets such as commodities, indices, ETFs, and stocks. This means you can diversify your portfolio to reduce risk exposure.

Risks Involved In F&O Trading

Let us look at the risks involved in F&O trading:

#1 - High Volatility

Volatility, in simple language, refers to the fluctuation of asset price around the mean price. It tells us of returns dispersion and is either measured through standard deviation or variance of the returns. In a nutshell, the higher the volatility, the riskier the underlying asset or security. This directly plays a key role in F&O trading.

#2 - Time Decay In Options

Time decay represents the rate of change in an options contract’s price as it comes close to its expiry date. The time left until expiry is directly proportional to the slowness of the time decay and vice versa, meaning as the options contract is getting close to its expiry date, the time decay increases. It assists in deriving the options contract’s premium or fair value, and as it decreases, it results in a lower premium value.

#3 - Margin Requirements

Investors can only engage in futures and options trading by fulfilling the margin requirements. The main upfront requirements in the case of F&O trading for beginners are as follows:

- The futures trades require upfront SPAN and exposure margins. The exchange defines these.

- When we talk about options buy trades, it does not mandate any margin requirements, but a 100% premium in cash has to be maintained in the trading account.

- When it comes to options sell trades, again, the exchange sets SPAN and exposure margins. The margin requirements vary on a daily basis, and buying stock options will require a higher margin in the last week of the monthly expiry.

#4 - Potential For Unlimited Losses

One of the core risks of F&O trading for beginners is that it is exposed to the possibility of unlimited loss. Yes, it does offer higher returns. However, because of the unlimited loss potential, experts recommend that only advanced traders with a high-risk appetite engage in it. Strategies For Beginners In F&O Trading

Here, in the last part, let us focus on some of the strategies from F&O trading for beginners’ standpoint that you can apply —

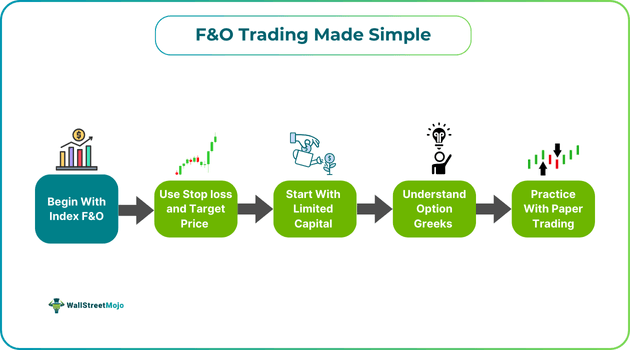

#5 - Start With Index Futures And Options

From the perspective of F&O trading for beginners, you should start with futures and options that have indices as underlying assets. An index tracks the prices of a group of securities, such as currencies, commodities and equities. There are many different types of indices that you can explore, such as the S&P 500 index, the DAX stock index, and the Swiss market index.' Such derivatives do not require the buyer to produce the contract's entire value when entering a trade.

#6 - Use Stop-Loss And Target Price

Just like in simple stock or commodities trading, F&O traders can implement stop-loss orders in derivatives trading to formulate a better risk management strategy. Using a stop-loss is essential, as there remains a chance of incurring substantial losses. Deriving the stop loss and target price depends on multiple elements like market conditions, the trader's strategy, and risk appetite. By using stop-loss orders and setting target price orders, one can limit losses and lock in gains when the price reaches specific levels.

#7 - Trade With Limited Capital

If you are new to F&O trading, do not go all in with your entire capital. You need to understand that derivatives trading can lead to unlimited losses. Hence, at the beginning, try to trade F&O using limited capital while keeping your portfolio separate from other investments.

#8 - Understand Option Greeks

Option Greeks are measures used to define the sensitivity of the option's price to its underlying asset. They are Delta, Gamma, Theta, Vega and Rho. Each of these measures defines different aspects, such as the option's price sensitivity, relative price change, price sensitivity to the asset's volatility, and so on. If you are pursuing F&O trading, you must have a good understanding of these measures, as they help derivatives traders make informed decisions.

#9 - Practice With Paper Trading

Paper trading is also known as simulated trading. Many online platforms offer paper trading services. New investors and traders can take advantage of these platforms to start learning how to trade without risking actual money. The process is similar to actual trading. Paper trading is a powerful tool to develop and enhance skills especially if you are trying to focus on futures and options derivatives. Traders can practice their skills using real-time market data and conditions. Once you know how to trade F&O by practicing with paper trading, you can take your chances with real money.

Conclusion

So, to sum it up, F&O trading for beginners involves buying or selling financial contracts with an underlying asset on a future date and at a particular price to make a profit. Generally, advanced and seasoned traders who know how to read charts and conduct proper technical and fundamental analysis engage in it.

One needs to have a high risk-bearing capacity to trade these financial contracts. After all, F&O trading can be highly profitable, but is equally risky. If you are planning to become a derivatives trader, we would suggest you go through all the benefits and risks we discussed in this beginner’s guide to F&O and then make the decision that is right for you.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.