The Future Of Homeownership: 5 Innovations Reshaping India’s Home Loan Landscape

Table of Contents

Introduction

Buying a home and not having to pay rent is a major goal people wish to fulfill at some point in their lives. But when we talk about India, this is not just a goal but a dream, the dream of millions of people to at least buy a home by the time they are 40, 50, or retired. Homeownership is an emotional decision in India. Of course, some people read finance books, study markets, and often tell you that it is better to live on rent and never to buy a house, but that is something Indian people never really subscribe to. For them, home ownership is a necessity, and they work really hard to achieve the objective.

A traditional and yet effective way to buy a home in India is to take a home loan from a bank and pay the EMIs for the next fifteen to twenty years to finally own it. However, with innovations and market trends, there has been a major shift in the home loan landscape in the country. In this article, we are going to discuss five trends that have brought a major change in the future of homeownership in India.

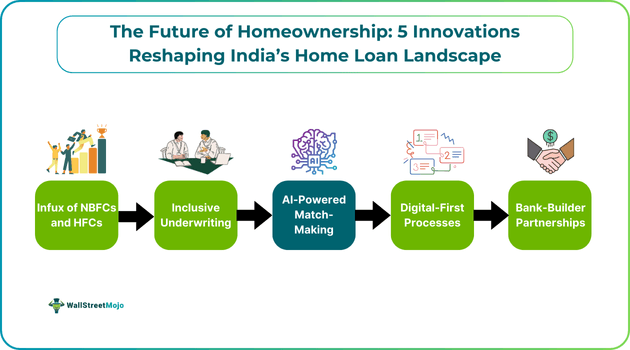

Top 5 Innovations

Here are the top five innovations that you must know of when dealing with the whole premise of home loans, real estate, and property ownership:

#1 - The Influx of NBFCs and HFCs: Democratizing Access to Loans

NBFC stands for non-banking financial company, and HFC is the acronym for housing finance company. With new-age lending techniques, such companies offer improved loan accessibility. Earlier, a borrower had to go through a time-consuming and tedious process of home loan application in traditional banks.

That said, with the influx of NBFCs and HFCs, people can avail of different types of financial assistance to fund the purchase of a new house. This has democratized loan accessibility as now the borrower can choose from different lenders to get favorable terms and conditions for their home loans. Earlier, the options were limited to banks and specific financial institutions.

#2 - Inclusive Underwriting: Empowering Self-Employed and Small Businesses

Underwriting refers to individuals or firms taking financial risks for a fee. Typically, these risks are loans, investments, and insurance. With inclusive underwriting, some firms help people establish their businesses or run their self-employed operations through which they make money. This empowers small business owners and people with creative mindsets to take calculated risks and grow their businesses across different markets, channels, and platforms. The more they grow, the more cash flow increases in the market. This increase in cash flow positively impacts different sectors, especially real estate, with an increase in the purchase of commercial properties and home ownership.

In India, there is a large community of people who operate small and medium-sized businesses and like to start their own enterprises; inclusive underwriting facilities are a boon to them.

#3 - AI-Powered Match-Making: Finding Your Perfect Home Loan Fit

Believe it or not, artificial intelligence (AI) has penetrated the Indian housing market as well to contribute to the future of homeownership in India. There are various online platforms and financial services firms that use AI to help you find the perfect home loan fit. Nowadays, companies understand that one loan structure cannot fit all; every borrower has their own needs and loan requirements.

This home loan innovation has practically changed the home loan landscape. It not only saves you time, effort, and money but keeps the entire framework streamlined and hassle-free.

In an exclusive interview with Credit Dharma — a pioneering home loan company — co-founder Rishu Garg discussed their home loan AI matchmaking tool.

“Imagine an advisor who never sleeps, remains completely unbiased, and knows every lender’s fine print — that’s our AI,” he explained. He added that this tool simplifies the home loan process by removing the guesswork, helping borrowers get loans with competitive EMIs, rapid approvals, and minimal paperwork.

#4 - Digital-First Processes: Speed, Transparency, and Convenience

Back in the day, if people ever visited a bank to enquire about a home loan, the bank personnel not only kept them waiting, but there were many cases where the potential customer felt unattended. Additionally, the lengthy paperwork drained applicants physically as well as mentally. They needed to keep visiting the bank several times, and it often happened that one had to roam from one counter to another just to get a simple signature or approval. These were the typical mortgage trends in India.

The worst part was that even after putting in all this effort, there was no surety that the bank would sanction your loan, and they could reject your loan application at any time. Having said that, with digitalization in the banking industry, mobile banking and smartphone applications have made the loan application, sanction, and disbursal process easy and transparent. Now, you can fill out forms, submit all necessary documents online, and complete the application process. You can also track the application status online. Moreover, the lender keeps you updated via SMS and email. This ensures more convenience for borrowers in the Indian housing market.

#5 - Bank-Builder Partnerships: Simplifying the Homeownership Journey

Nowadays, builders and banks partner on construction projects and collaborate on different housing loan schemes to offer tailor-made and simplified financing solutions to borrowers. This partnership helps reduce the entire process to just a series of easy steps, and since the collaboration is in order, most of the procedures get done quickly and efficiently without having to wait for weeks. Such partnerships where builders and banks come together to make your dream of owning a home true have opened doors for a promising future of homeownership in India.

Conclusion

In the end, we can safely say that the future of homeownership in India looks bright, with significant growth potential. Earlier, people used to feel insecure about taking loans and getting involved in a time-consuming application process. That said, with all the above-mentioned innovations in the real estate and banking industry, people can actually have the flexibility to choose from a wide range of lenders and negotiate favorable terms.

Moreover, they can also take advantage of AI-powered solutions to find the best home loan fit. All these powerful innovations are the future of homeownership and have a lot to offer to people seeking home loans to finance the purchase of a new house.