Table Of Contents

What Is Futa Tax?

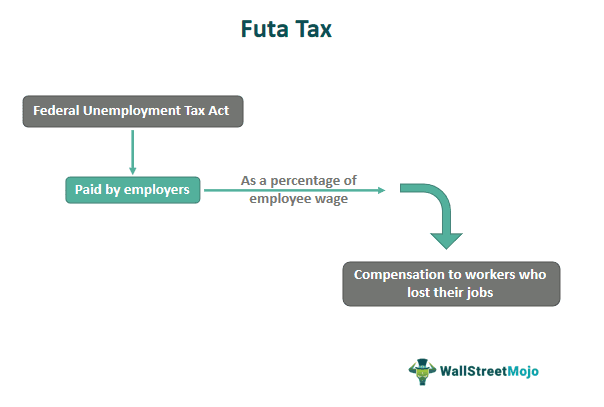

FUTA tax or federal unemployment tax act is a payroll tax wherein the employers pay such tax on the wages that they pay to their employees. The Federal unemployment tax act is legislation passed by the Federal government wherein all employers have to pay taxes on wages they pay to employees.

The amount collected is utilized for financing job service programs for every state and administers the unemployment insurance scheme for the eligible population of the unemployed workforce. As of the calendar year 2020, the applicable FUTA tax rate is at 6 percent levied on the first $7,000, and such payments are made annually.

Futa Tax Explained

Federal Unemployment Tax Act is basically a variant of payroll tax wherein the government collects taxes from the business that has employees. The main intent behind this revenue collection is to allocate the collected amount under the state unemployment agencies who then pay money to those workers that are unemployed and are eligible to take up insurance on unemployment. It is collected under the legislation of this tax act that mandates business and employers to file internal revenue service Form 940 on a yearly basis in line with the paying up for this payroll tax.

The federal unemployment tax is basically a provision of the federal type whose broad intent is towards the regulation of the cost allocation, which in turn is then utilized to monitor and administer job service programs and unemployment insurance. As per the directives of this act, the employers are mandated to submit state and federal unemployment taxes that are then utilized effectively to finance the accounts of unemployment of the federal government.

How To Calculate?

The following will list the steps of how to calculate FUTA tax.

- The employer determines an effective percentage over the whole employee’s wages.

- Basis the percentage determined; the employers submit taxes to the government.

- The employees are not required to deduct any amount from their income to calculate FUTA tax.

- The employer has to ensure that it pays such taxes on both state and federal levels.

- The employers are therefore mandated to file Form 940 on an annual basis that lists down the amount paid as the FUTA tax.

- The amount deposited is collected in a federal government fund.

- The fund is then utilized to compensate employees who have been laid-off and are currently unemployed and at the same time qualify for unemployment insurance.

How To Pay?

The process of FUTA tax filing requires the following steps.

- The internal revenue service is authorized to tax collection agencies under Congress, and it has the critical role of monitoring the internal revenue code as formulated by Congress.

- The employer, therefore, should determine the FUTA tax liability for each and every payroll he is maintaining.

- The employer has to keep the provision and set aside some amount that equals the FUTA tax liability.

- The employer has to make periodic payments to the internal revenue service and that it has to be further supplemented by the submission of an annual report by FUTA tax filing Form 940.

- Form 940 is federal unemployment tax returns to be filled by the employer to avail the FUTA tax credit.

Who Pays?

After knowing the steps of how to file FUTA tax, let us learn who is eligible to pay it.

- The internal revenue service lists down three basic tests for the business to determine whether they should pay FUTA tax or not.

- As per the first test, the employer has to check whether he is paying wages of $1,500 or higher to their employees for any financial year.

- The business should have one or more than one employee for any financial or calendar quarter.

- Lastly, in order to be eligible for this tax, the business has to determine the full time, part-time, and temporary employees’ basis their involvement during the course of the day in 20 or more weeks.

- However, it should be noted that wages, as compensated by the employer to the spouse of employees and for children under the age of 21, are not identified as FUTA tax.

FUTA Tax Rate

The current FUTA tax rate is 6 percent. The tax is applied to the Federal or FUTA wage base. The current Federal or FUTA base wage is $7,000. Therefore, the tax is applicable to the first $7,000 that is compensated towards the wages of each hired employee for a calendar year.

Example

Let us assume ABC Ltd is a cosmetics company have 10 empoyees. Each employee get $10000 as salary. So the total taxable salary in this case is $10000 multiplied by 10, which amounts to $100,000. Now the tax is currently 6% per employee. In this case the tax amount fro each will be 6% of $10000, which is $600. The total tax liability will be $600 each multiplied by 10 employees, which comes to a total of $6000. Now, if the tax is paid on time, them the company will be eligible for a tax credit where the tax payable will be reduced to of 5.4% on $6000, which will be an tax liability of $324.

The above example makes the idea of this type of tax every clear.

Exemptions

The employer receives FUTA tax credit of 5.4 percent if he has made payments to state unemployment taxes in a timely manner. The following information is to be disclosed in form 940, which is to be submitted to the internal revenue service. IF the service finds that the business is entitled to full FUTA tax credit of 5.4 percent, the IRS revises the tax rate to 0.6 percent. However, the state should not be under a credit reduction state. A state is said to be a credit reduction state if the state had borrowed funds from the federal government to finance the unemployment benefits but has failed to repay back. Therefore, if the employer pays for state unemployment tax for a credit reduction state, the employer won’t receive any credit; rather, the employer would be subject to a greater amount of FUTA tax.

Benefits

Let us look at some of the advantages of the tax.

- Unemployemnt benefit - This tax collected by the internal revenue service is used to finance the job service programs. It is additionally used to make premiums on the unemployment insurance scheme. This ensures that the unemployed labor workforce is benefited until the time they find a new job for themselves.

- Federal law compliance – Employers who pay this tax are obeying the law and thus they are able to avoid any kind of fine or penalty. It also helps in maintaining a good reputation an keep a good public image.

- Tax credit - An employer also enjoys the benefits of FUTA credit if he makes payment to states’ unemployment taxes, which are not under credit reduction. There are also incentives for making timely tax payments in the form of a tax credit. The employees are never subjected to taxes, and such taxes have to be entirely borne by the employers themselves.

- Reduction of liability – Employers participating in the unemployment insurance program can reduce their unemployment liability claim. Since they are paying this tax, they can reduce the risk off claims for unemployment and avoid possible legal problems.

Thus, even though there is no direct advantage of this tax, it helps the employers in many other ways as given above.

Limitations

A few limitations of the tax are as follows:

- Additional payroll – It is an additional cost that employers need to maintain. Thus, it is a separate administrative work.

- Tax payment – Employers need to pay this tax. In case of non- payment, they might be subject to penalties of legal issues businesses with limited funds may face financial crunch

- Complex process – The process, rules and regulations of the payment is not very simple. Companies need to hire experts and use special softwares to handle the procedure.

- Change in rules – There may be changes in the tax rules which employers need to keep track of. It is not only time consuming, but also requires special knowledge regarding how to file FUTA tax and follow the latest procedures and rules.

Thus, the above are some limitations of the tax.