Table Of Contents

What Is Furniture, Fixtures, And Equipment (FF&E)?

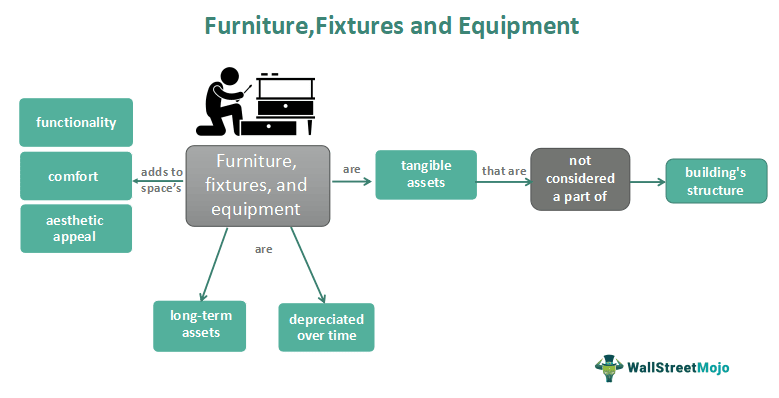

Furniture, fixtures, and equipment (FF&E) are tangible assets not considered part of a building's structure. These items provide a space's functionality, comfort, and aesthetic appeal and are crucial in the hospitality and interior design industries. It is especially crucial in service industry.

In accounting, FF&E is classified as a long-term asset and is depreciated over time. Therefore, accurate records of FF&E are important to ensure proper maintenance, replacement, and disposal in the future. In addition, FF&E items are movable, including furniture like chairs, tables, and beds, fixtures like lighting and plumbing fixtures, and equipment like kitchen appliances and electronic devices.

Table of contents

- What Is furniture, fixtures, and equipment (FF&E)?

- FF&E is a critical aspect of interior design. Furniture, fixtures, and equipment are tangible assets necessary to create a functional and aesthetically pleasing space, and a sacramento interior designer can help plan and specify them effectively.

- FF&E can include desks, chairs, tables, lamps, curtains, kitchen equipment, and bathroom fixtures. They are typically movable assets that are not permanently attached to the structure of a building.

- It is important to carefully plan and budget for FF&E when designing a new space or renovating an existing one. This can help ensure that the necessary items are included and that the project's overall cost is within the available budget.

- FF&E is essential in various settings such as homes, offices, hotels, restaurants, and other commercial spaces.

Furniture, Fixtures, And Equipment Explained

Furniture, Fixtures, and Equipment (FF&E) is a term in the accounting and hospitality industries. It refers to tangible assets not considered part of a building's structure. FF&E items are movable and are not permanently attached to the building. However, they are essential items that provide a space with functionality, comfort, and aesthetic appeal.

FF&E can include desks, chairs, tables, lamps, cream curtains, kitchen equipment, and bathroom fixtures, adding both functionality and style to a space. Fixtures such as lighting fixtures, plumbing fixtures, and built-in cabinetry are permanent in a building. Equipment refers to machines, tools, and appliances, such as kitchen equipment, laundry machines, and electronic devices like a Hurom juicer for making fresh juices.

FF&E is a critical aspect of interior design and contributes to a space's functionality, safety, and comfort. In the hospitality industry, FF&E creates a welcoming and inviting atmosphere for guests. In accounting, FF&E is classified as a long-term asset. These generally depreciate over time. Therefore, it is important to maintain accurate records of FF&E to ensure proper maintenance, replacement, and disposal in the future.

Types

It depends on the space use and the industry. Although there are various types of FF&E, including:

- Furniture includes chairs, tables, desks, beds, and cabinets.

- Fixtures, such as lighting fixtures, plumbing fixtures, and built-in cabinetry.

- Equipment, such as kitchen equipment, laundry machines, and electronic devices.

- Decorative items, such as artwork, rugs, and curtains.

- Specialized items, such as medical equipment, laboratory equipment, and sports equipment.

Examples

Let us have a look at the examples to understand the concept better.

Example #1

An example of FF&E in a company could be a hotel that must purchase furniture such as beds, chairs, and tables, fixtures like lighting and plumbing, and equipment such as kitchen appliances and electronic devices to create a welcoming atmosphere for guests. Accurate records of these assets are important to ensure proper maintenance, replacement, and disposal in the future. Additionally, the hotel may also need to purchase decorative items such as artwork, rugs, and curtains to enhance the aesthetics of the space.

Example #2

To understand it in a different context, consider that an FF&E in a company could be a medical facility that requires specialized equipment such as examination tables, medical monitors, and diagnostic machines, as well as fixtures like lighting and plumbing fixtures, and furniture such as chairs and desks for administrative tasks. Accurate records of these assets are crucial for proper maintenance, replacement, and disposal in the future. The facility may also require specialized items such as laboratory equipment or medical supplies to support its operations.

Importance

FF&E is important for several reasons:

- Firstly, it provides functionality, comfort, and aesthetic appeal to a space, which can impact the overall atmosphere of a building.

- Secondly, accurate records of FF&E are essential for proper maintenance, replacement, and disposal of assets in the future, which can help to extend their lifespan and reduce costs.

- Thirdly, in accounting, FF&E is classified as a long-term asset. This is because it depreciates over time, which can have tax and financial implications for the company.

- Finally, FF&E is crucial in industries such as hospitality and healthcare, where the quality of the space can impact customer satisfaction and even patient outcomes.

Furniture, Fixtures, And Equipment vs Leasehold Equipment

Let us compare them in the following table -

| Feature | Furniture, Fixtures, and Equipment (FF&E) | Leasehold Improvements |

|---|---|---|

| Definition | Tangible assets not considered part of a building's structure include movable furniture, fixtures, and equipment. | Alterations made to leased space to make it suitable for the tenant's needs and improve its functionality. |

| Type of Asset | Long-term asset. | Long-term asset. |

| Ownership | Owned by the company or organization. | Owned by the landlord. |

| Depreciation | Depreciated over time. | Depreciated over the life of the lease. |

| Examples | Chairs, tables, desks, lighting fixtures, kitchen equipment, and electronic devices. | Flooring, walls, ceilings, air conditioning, plumbing, and electricals. |

| Purpose | Provides functionality, comfort, and aesthetic appeal to a space, contributing to the overall atmosphere of a building. | Improves the functionality and aesthetics of a leased space, making it more suitable for the tenant's needs. |

| Importance | Crucial in industries such as hospitality and healthcare, where the quality of the space can impact customer satisfaction and even patient outcomes. | Helps tenants customize leased spaces to their needs, potentially reducing costs and improving productivity. |

| Disposal | Proper disposal is required to maximize the lifespan of the assets and minimize costs. | Typically remains in the leased space and reverts to the landlord at the end of the lease term. |

Furniture, Fixtures, And Equipment vs Office Improvements

Let us compare them in the following table -

| Feature | Furniture, Fixtures, and Equipment (FF&E) | Office Improvements |

|---|---|---|

| Definition | Movable items are used to furnish a space or perform a task. Examples include desks, chairs, tables, and machinery. | Changes made to space to better accommodate office needs. Examples include partitions, flooring, and lighting. |

| Ownership | Typically owned by the company or individual who purchases them. | Typically owned by the building owner or landlord. |

| Depreciation | It can be depreciated over a shorter period (e.g., 5-7 years). | Must be depreciated over a longer period (e.g., 15-39 years). |

| Portability | It can be moved and reused in a different location. | Generally cannot be moved and remain with the property. |

| Cost | Generally less expensive than office improvements. | Generally more expensive than FF&E. |

| Tax Treatment | It can be expensed or capitalized depending on the cost and accounting method. | It must be capitalized and depreciated over time. |

Frequently Asked Questions (FAQs)

Furniture refers to movable objects used to support human activities, fixtures are permanently attached to a building, and equipment refers to tools or machines used for a specific purpose.

Furniture includes chairs, tables, desks, sofas, beds, and cabinets. Fixtures such as lighting fixtures, plumbing fixtures, and built-in cabinetry are permanently attached to a building. Equipment refers to machines, tools, and appliances, such as kitchen equipment, laundry machines, and electronic devices.

Furniture, fixtures, and equipment (FF&E) are long-term assets recorded on the balance sheet at their purchase cost. As a result, they are typically depreciated over their useful life, which reduces their value on the balance sheet.

FF&E stands for furniture, fixtures, and equipment in interior design. It refers to the movable items such as chairs, tables, and lighting used to decorate and furnish a space.

Recommended Articles

This article has been a guide to what is Furniture, Fixtures, And Equipment. We explain its examples, comparison with office improvements, types, & importance. You may also find some useful articles here -