Table Of Contents

What Is Funding Liquidity?

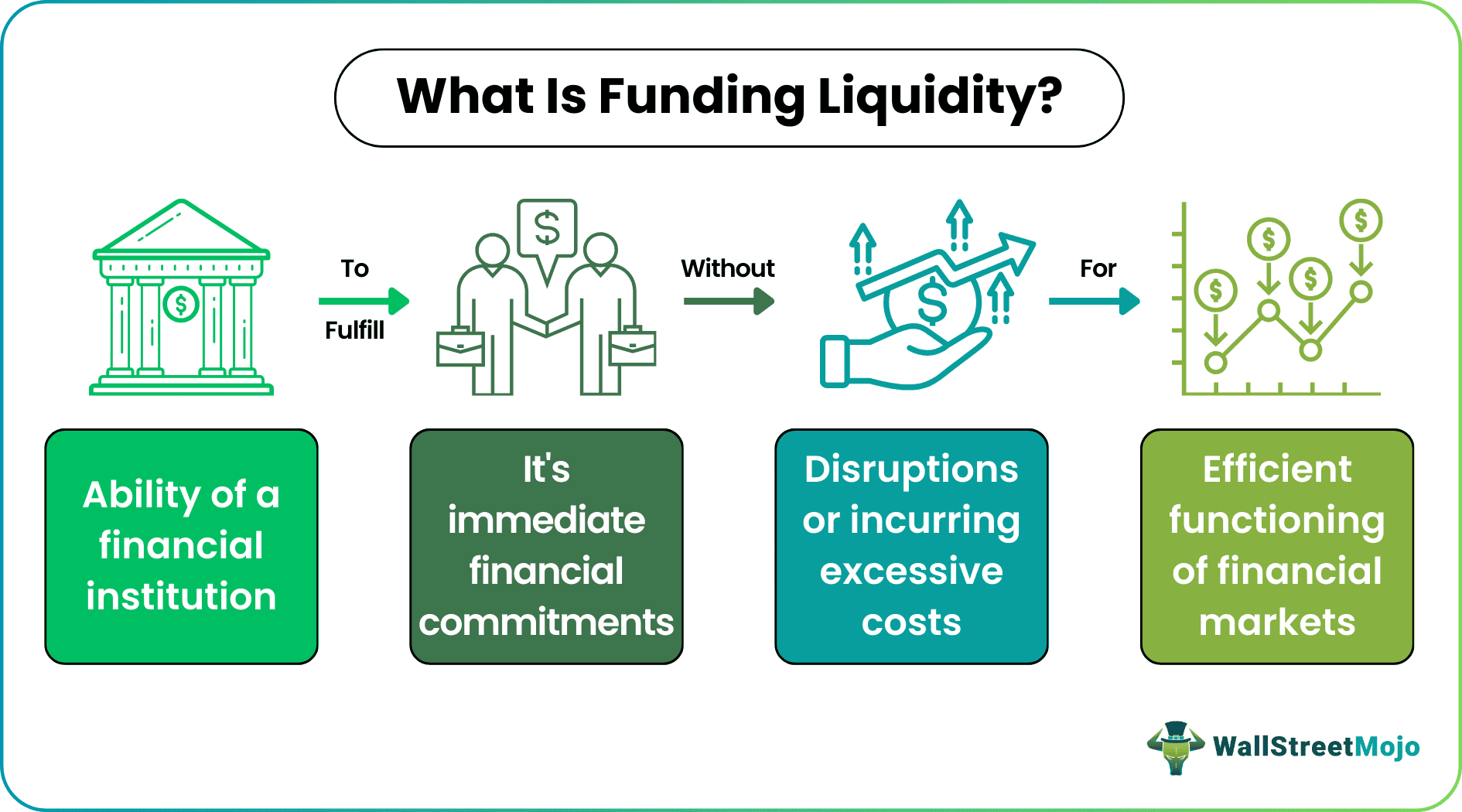

Funding Liquidity denotes a financial entity's capacity to fulfill short-term funding commitments without facing high costs or operational disruptions. It gauges the accessibility and ease of acquiring funds to sustain business operations and fulfill financial obligations promptly.

It helps in maintaining confidence in the financial system. Adequate liquidity enables businesses to seize opportunities, withstand unexpected shocks, and sustain operations during periods of stress. Its presence fosters resilience, stability, and trust, crucial elements for the smooth functioning of economies and markets.

Key Takeaways

- Funding liquidity definition refers to the ability of a financial institution or entity to quickly and effectively access the necessary funds to meet its short-term financial obligations as they become due.

- It encompasses the availability of liquid assets and funding sources that can be readily converted into cash to cover expenses such as operating costs, debt repayments, and other immediate financial commitments.

- It refers to easy cash accessibility without incurring high costs, while market liquidity pertains to the ease of buying and selling assets without significantly affecting their prices.

Funding Liquidity Explained

Funding liquidity is the cornerstone of financial stability, ensuring that institutions can effectively fulfill their short-term financial commitments without disruptions. At its core, this process involves assessing the imminent financial obligations, ranging from payroll and supplier payments to settling transactions and evaluating available funding sources. Institutions carefully weigh the costs and risks associated with different funding avenues, considering factors such as interest rates, fees, and potential impacts on their balance sheets and profitability.

To manage it effectively, institutions continuously monitor cash flows, balances, and the accessibility of funding sources. They employ various liquidity management strategies, such as cash reserves and contingency plans, to mitigate risks and maintain adequate funding levels. Regulatory compliance also plays a significant role, with institutions adhering to standards like the liquidity coverage ratio (LCR) and net stable funding ratio (NSFR), which aim to bolster their liquidity buffers and resilience to market stress.

Ultimately, this process underscores the importance of proactive management and risk mitigation in maintaining financial stability. By ensuring institutions can readily access funds to meet their short-term obligations, it promotes confidence in the financial system, fosters market resilience, and contributes to the smooth functioning of economies worldwide.

Factors

Factors influencing it encompass a broad range of internal and external elements that impact a financial institution ability to access and manage funds efficiently. These factors include:

1. Asset quality: The quality and liquidity of a financial institution's assets play a crucial role in determining its liquidity position. Highly liquid and marketable assets can be easily converted into cash to meet short-term obligations, whereas illiquid or impaired assets may hinder liquidity.

2. Funding structure: The composition of a financial institution's funding sources influences its liquidity profile. Institutions relying heavily on short-term funding, such as wholesale funding or deposits, may face greater liquidity risk during periods of market stress compared to those with more stable funding sources, such as long-term debt or equity.

3. Market conditions: Fluctuations in financial markets, including changes in interest rates, credit spreads, and overall market liquidity, can significantly impact funding liquidity. Adverse market conditions may limit access to funding sources or increase the cost of obtaining funds, affecting a financial institution's liquidity position.

4. Regulatory requirements: Regulatory standards, such as LCR and NSFR, impose liquidity requirements on financial institutions to ensure they maintain adequate liquidity buffers and stable funding profiles.

Examples

Let us look at the examples to understand the concept better.

Example #1

Imagine a small community bank facing an unexpected surge in withdrawal requests from depositors due to a local economic downturn. The bank must quickly access funds to meet these withdrawal demands while maintaining its day-to-day operations.

In this scenario, the bank taps into its cash reserves and also utilizes its available lines of credit with other financial institutions. By doing so, it ensures that it has the necessary liquidity to honor the withdrawal requests without disrupting its operations or causing panic among depositors. This example illustrates how funding liquidity enables financial institutions to respond to unexpected events and fulfill their short-term obligations promptly, thereby preserving stability and confidence in the banking system.

Example #2

The Bank of England urged money market funds (MMFs) to hold significantly higher levels of liquid assets to better handle market volatility, particularly in light of challenges faced during the COVID-19 pandemic. The recommendation suggested that assets maturing within seven days or less should constitute at least 50% to 60% of a fund's total assets, up from current levels of 45% to 55%.

The purpose of this initiative was to bolster the resilience of MMFs and mitigate risks to financial stability. MMFs are integral to providing daily funding for businesses and managing cash, hence the importance of strengthening their ability to withstand market volatility. Additionally, regulators were increasingly concerned about the opacity and liquidity vulnerabilities within the non-bank sector, including MMFs, prompting a need for stricter oversight and cooperation between regulatory bodies.

Funding Liquidity Risk

Funding liquidity risk is a critical aspect of financial risk management, encompassing the potential inability of a company to fulfill its short-term financial commitments promptly. This risk arises from various factors, including mismatches between cash inflows and outflows, reliance on unstable funding sources, and unexpected disruptions in the financial markets.

Companies facing funding liquidity risk may need help to settle their current outstanding bills, such as payments to suppliers, wages for employees, and other operational expenses. Failure to meet these obligations can lead to damaging consequences, including supplier disruptions, employee dissatisfaction, and reputational damage.

To mitigate funding liquidity risk, companies employ various strategies, including maintaining adequate cash reserves, establishing backup lines of credit, diversifying funding sources, and closely monitoring cash flows and liquidity metrics. Additionally, stress testing and scenario analysis help companies assess their resilience to adverse market conditions and develop contingency plans to address potential liquidity shortfalls.

Funding Liquidity vs Market Liquidity

Funding liquidity

- Funding liquidity, on the other hand, refers to the availability and ease of obtaining financing or funding in the financial markets. It involves the ability of institutions to access capital and credit to meet their short-term obligations.

- Funding liquidity deals with the availability of funds for borrowing or lending purposes. It involves accessing short-term funding or credit facilities to support ongoing operations or investment activities.

Market liquidity

- Market liquidity pertains to the ease and efficiency with which assets can be bought or sold in the market without significantly impacting their prices. It focuses on the ability to execute transactions quickly and at a reasonable cost.

- Market liquidity relates to the trading of securities or assets in the market. It concerns the ability to buy or sell assets in large volumes without substantially affecting their prices.