Table of Contents

Funding Gap Meaning

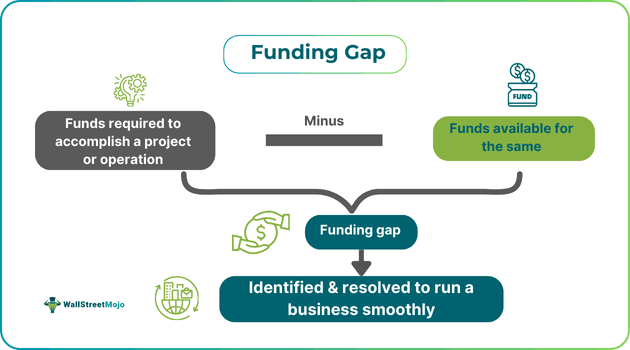

Funding Gap refers to the difference between the available funds in the form of debt, cash, and equity and the financial resources still needed to carry out a project or perform a company operation. The identification of this gap brings to notice the lack of funds, which requires immediate resolution to ensure continuous business growth.

It has significant relevance in finding and strategizing solutions like bridging shortfalls and securing investors or loans. It helps to scale operations, meet sudden expenses, like education & infrastructure development, in industries, and address cash flow problems. It helps policymakers prioritize investments and resolve inequalities, leading to better results in backward communities.

Key Takeaways

- The funding gap represents the difference between the available financing sources, such as debt, cash, and stock, and the resources required to maintain project development or business operations.

- It aims to highlight the financial deficiencies that must be fixed right away to support ongoing expansion and operational operations.

- The common causes of such gaps include mistimed cash outflows, underfunded companies, inefficient inventory handling, seasonal fluctuations, lack of financial planning, and external factors like inflation, interest rates, and wars.

- It can be closed by managing cash flow, using working capital, streamlining inventory, attracting investors, adopting sustainable funding methods, and improving efficiency.

Funding Gap Explained

A funding gap is the amount that individuals and entities lack with respect to the funds made available to them to carry out a certain project or business operation. It is recorded as a result of insufficient outside finances or a mismatch in cash flows.

It can be understood in the form of a funding gap (FG) formula as shown below:

FG = Total Financial Requirements−Available Funds

For companies, it means the discrepancy between current liabilities and assets, particularly when operational expenses go beyond the income generated. Such gaps have become a common scenario in sectors, like public services, education, and business, wherein the available capital is often unable to fulfill the projected expenses.

It has various implications, like difficulty in paying salaries to staff, pursuing growth avenues, and investing in essential resources. As such, it results in operational challenges, as seen in the education sector where the gap in funding leads to widened inequality and minimized services among students of schools. It may enhance the reliance of businesses on outside funding like equity investment or loans. It can decrease the competitiveness and impact stakeholder confidence for startups.

It helps organizations secure extra funding using investments, grants, or loans as part of their financial planning. They can do it by employing a proactive approach of seeking bridge loans and restructuring budgets, maintaining sustainability, and achieving long-term goals.

In the financial horizon, it impacts micro along with macroeconomic environs and the investment decisions of investors. Hence, it affects the creditworthiness and project viability at corporate levels. This is because investors evaluate the ability of a company to close the gap in funding and then invest. An ongoing or continuous gap in funding may result in pushing away investors as it indicates inefficiency and potential instability.

Causes

There can be distinct causes for gaps in funding:

- Mistimed outflows and inflows of cash lead to delayed revenue while expenditure is imminent.

- The underfunded and rapid growth of companies strain resources, resulting in organizations outdoing their available funding.

- Unprofessional and inefficient inventory handling, like slow turnover and overstocking, holds cash that could be utilized somewhere else.

- Seasonal fluctuations in business could lead to gaps in funding during off-peak seasons when revenue minimizes but expenditures don't.

- Lack of adequate financial planning, like wrong cash flow estimation, may create shortages and operational barriers.

- Outside economic elements like inflation, increased interest rates, war, and pandemics can accelerate gaps in funding by enhancing borrowing expenses and operating costs.

Examples

Let us use a few instances to understand the topic better.

Example #1

An online article published on 4 November 2024 discusses the challenges being faced by Colombia in deciding on the mobilization of $200 billion yearly in conservation funding by 2030. The discussion came following the Kunming-Montreal Global Biodiversity Framework agreement whereby nations agreed to contribute financially to taking care of nature.

According to the report, only $163 million could be committed at COP16 in Colombia, which was far short of the target of $30 billion from wealthy nations. This reflects the decline in public funding with international aid for environmental preservation dropping to $3.8 billion in 2022 from $4.6 billion in 2015.

Wealthy nations like the Netherlands and Germany have cut aid, while powerful nations like the USA have not contributed at all, causing a huge funding gap. Therefore, discussions are going on for leveraging private financing through mechanisms, like green bonds and genetic data charges to overcome this gap.

Example #2

Let us assume that a mobile retail network- Mobimart, suffers a gap in funding related to its ambitious expansion goal in Old York City. The said project needs $5 million to open 10 new stores having state-of-the-art technology, eco-friendly designs, and training centers. The CEO obtains funding of $4 million from internal sources and local investors with $1 million still remaining to be covered. Hence, to make up for the gap, Mobimart prepares a partnership plan and proposes to Finanto Capital a profit-sharing model.

Nevertheless, the proposal fails to gain steam as Finanto Capital asks for a 25% equity share beyond the budget limitations of Mobimart. More importantly, the construction timeline of stores remains on hold due to delays in funds, leading to a further increase in costs to $60,000. As a result, while trying to cope and fill up this gap, Mobimart loses market share to its rivals, which disrupts the business growth and strategic objectives.

How To Close?

As per the situation, there could be multiple ways to close the gap. Let us have a look at some of them below:

- Monitor and manage cash flow so as to determine risks and decrease potential gaps in funding.

- Use working capital funding, like accounts receivable or supply chain financing to increase liquidity and end the working capital funding gap.

- Streamline and optimize inventory management to reduce shortages or overstocking.

- One must try to attract more investors like angel investors, equity stakeholders, and venture capitalists.

- Other than these, one can also use debt offerings, bank loans, and equity sales for additional funding.

- Adopt sustainable funding methods along with ESG practices in emerging markets to close the infrastructure funding gap.

- Improve efficiency and maximize impact using effective resource utilization and decreasing harmful investment.