Table Of Contents

What is Funded Debt?

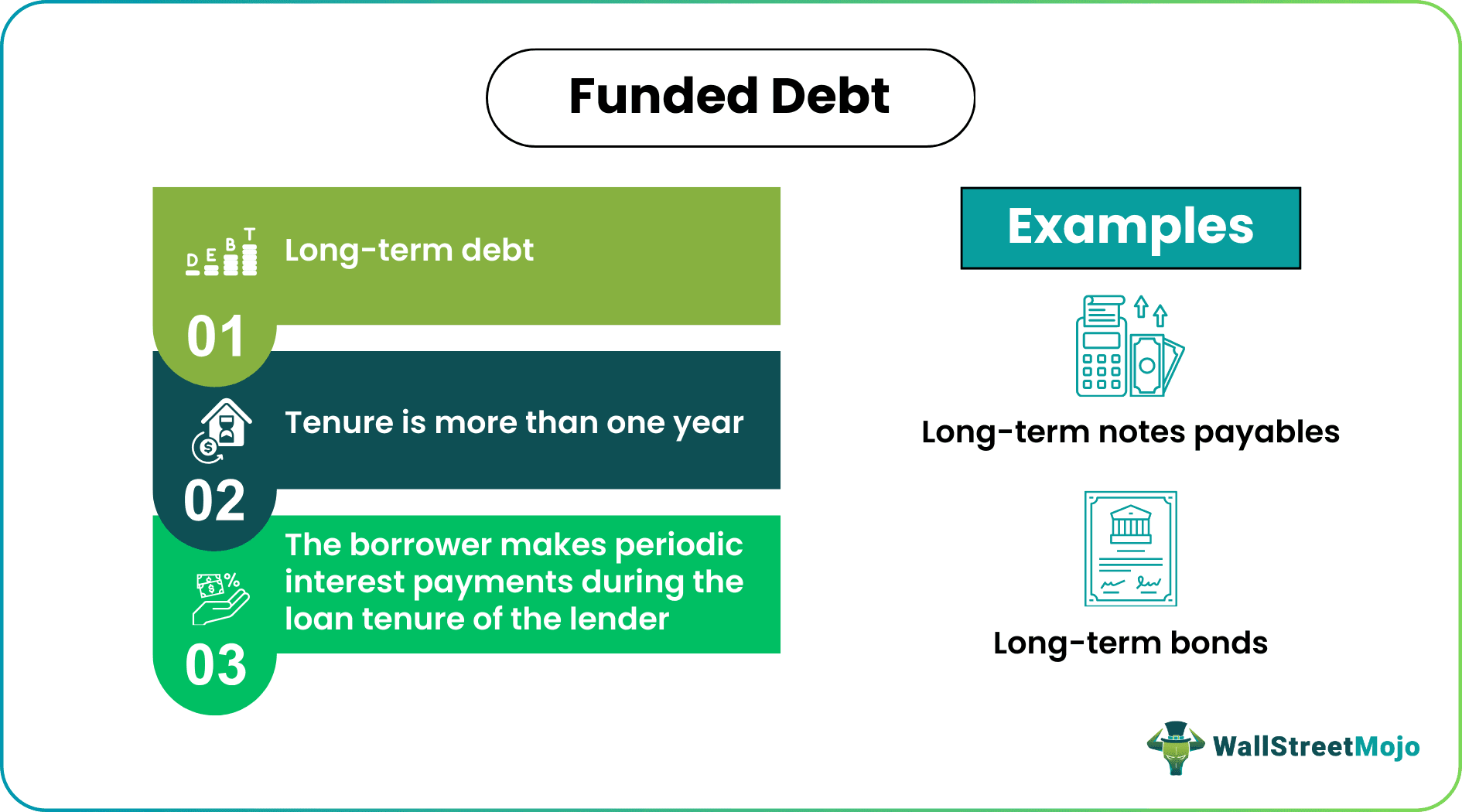

Funded debt refers to a firm’s debt with tenure or maturity period greater than one year. Moreover, they are also explained in terms of debt with a maturity period exceeding one operating cycle. Therefore, the capital raised through it does not have to be repaid within a year.

Examples include long-term bonds, long-term loans, debentures, and mortgages. The lenders get regular periodic income in the form of interest payments from the debtor until maturity. It comes with predetermined maturity periods, which are always more than a year or one business cycle, and interest rates in the case of fixed-income securities.

Key Takeaways

- Funded debts definition implies it as a firm’s debt that does not mature in less than a year. Instead, the tenure is more than one year. Hence it is also referred to as long-term debts.

- The borrower is liable to make periodic interest payments to the lenders.

- Entities usually raise it to finance large projects or long-term goals. For instance, governments collect it to increase infrastructure spending to spur economic development.

- The lower funded debt to EBITDA ratio indicates the adequate repayment capacity of the entities, and the higher ratio means the bad health of the entities.

- Capital leases exhibit different attributes compared to the funded category instruments.

Explanation

Funded debt falls into the category of debt financing, where firms add loans by borrowing from lenders such as banks or entities issuing securities in an open market. A firm can have more than one interest-bearing long-term debt, and its details reflect majorly in the long-term liabilities section of the balance sheet and disclosures. They usually take long-term debt to finance long-term projects, invest in research and development, or any other need that requires extra funding than what they might currently afford. The cost of debt should not disrupt the firm's working capital management.

In the government's case, they collect and use it for social infrastructure development or additional spending to boost the economy during the financial crisis. However, increasing the national debt is like leveraging the future to stimulate the present economic scenario of the nation.

For the risk-averse lenders, factors like the assurance of regular interest income and low volatility compared to equity investments attract them towards debt funds. However, performance and return may vary with funds types. Furthermore, investors should pay attention to details like risk factors, historical data analysis, interest rate regime, and taxation, along with investment capacity and goals. For instance, if investors expect the interest rate to rise shortly, they should consider investing in floating rate bonds rather than fixed-rate bonds.

Funded Debt to EBITDA

The Funded Debt/EBITDA ratio is derived by dividing the value of funded one's category by the Earnings before Interest, Taxes, Depreciation, and Amortization (EBITDA) at the end of an accounting period.

Funded Debt/EBITDA = Funded Debt / Earnings before Interest, Taxes, Depreciation, and Amortization (EBITDA)

The ratio between them measures an entity's capacity to meet its funded category obligations before attending to obligations such as tax, depreciation, interest, and amortization expenses. When this ratio is high, it indicates that the business is heavily leveraged, has a debt load that is too heavy. It may lead to future insolvency and declaration of bankruptcy. A lower ratio is favorable, indicating that the company has sufficient funds to meet its financial obligations when they fall due. Therefore, it is an important metric used by credit rating agencies, and the entities should be careful to maintain the optimum ratio.

Funded Debt vs Unfunded Debt

Funded debts are debts that last more than one financial year and are used to fund a firm's long-term goals. On the other hand, an unfunded debt lasts less than a year and is used to cover the short-term financial obligations of the firm.

Cash is collected through unfunded debt flows to working capital or long-term operations. Examples include treasury bills and bonds that mature in a year. When government obtains funded ones, they will maintain a separate fund for its repayment, whereas, for unfunded debt, no separate fund is maintained for repayment.

Are Capital Leases Funded Debt?

Capital leases have features that make them different from funded ones. First, since the leased item is not returned to the lessor at any instance in the future and ownership can be transferred to the lessee at the end of the lease term, it is like an asset acquired using the fund from the lender for which the repayment may take years.

In essence, according to GAAP, a capital lease is considered a fixed asset of the entity, and it depreciates over time. Therefore, the initial journal entry starts with debiting capital lease asset and crediting capital lease liability account. The lease interest expense and depreciation expense are also recorded in the profit and loss account, also known as the income statement.