Table Of Contents

What are the Functions of Financial Markets?

There are different functions that the financial markets perform, which includes determination of the prices where financial markets help in price discovery of various financial instruments, mobilization of the funds, providing an opportunity to different investors to buy or sell their respective financial instrument at the fair value that is prevailing in the market, providing the various types of information to traders, and the sharing of the risk, etc.

Key Takeaways

- The financial markets perform various functions, including price determination, price discovery, fund mobilization, enabling buying and selling financial instruments at fair values, providing information to traders, and sharing risk.

- Its analysis describes how traders buy and sell financial assets such as shares, bonds, derivatives, commodities, and currencies.

- The most important function of a financial market is to facilitate the exchange of financial instruments and securities, allowing investors to buy or sell assets at a fair price and providing access to capital for businesses and governments.

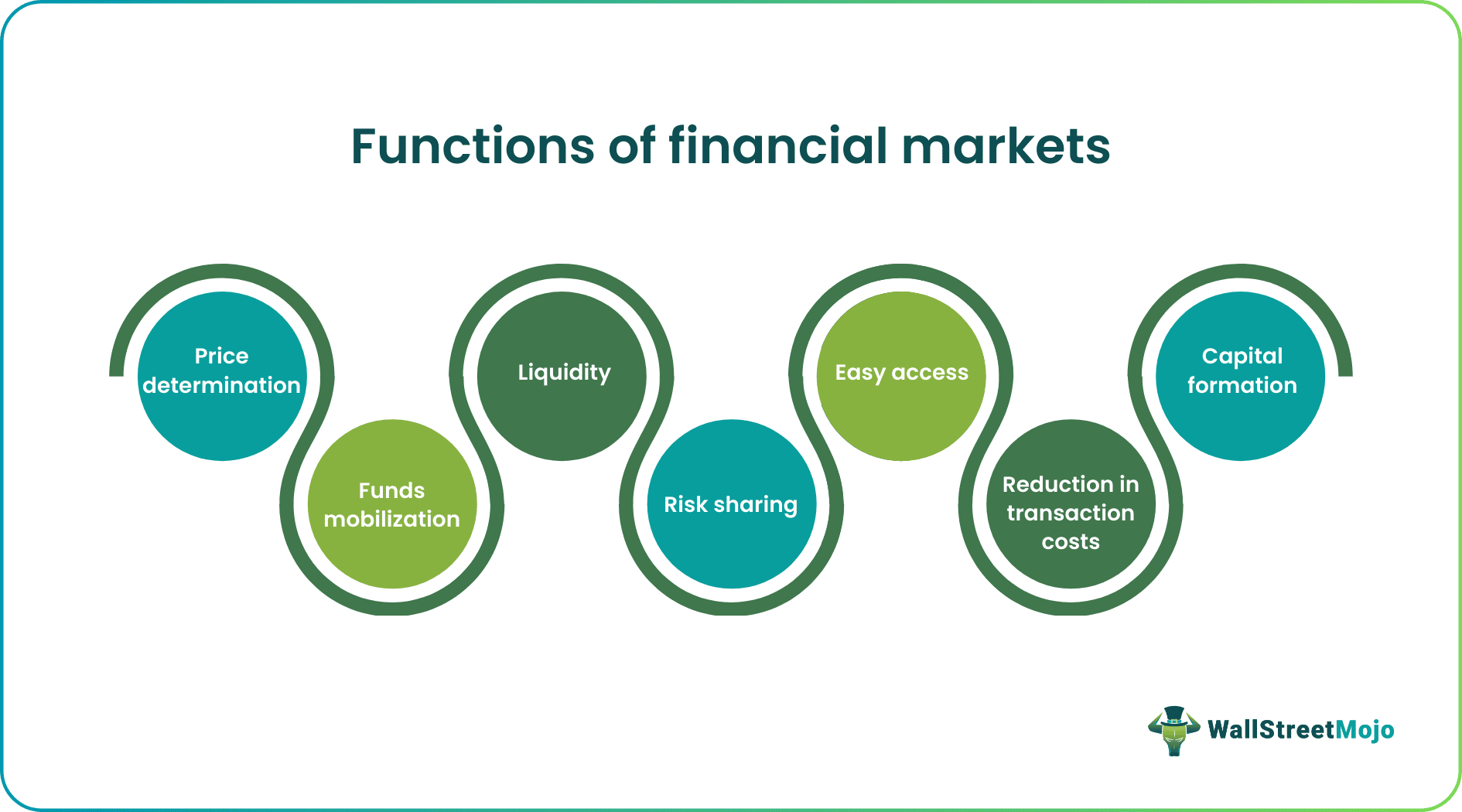

List of Top 7 Functions of Financial Markets

- Price Determination

- Funds Mobilization

- Liquidity

- Risk sharing

- Easy Access

- Reduction in transaction costs and provision of the Information

- Capital Formation

Let us discuss each of the financial market functions in detail -

#1 - Price Determination

The financial market performs the function of price discovery of the different financial instruments traded between the buyers and the sellers on the financial market. The prices at which the financial instruments trade in the financial market are determined by the market forces, i.e., demand and supply.

So the financial market provides the vehicle by which the prices are set for both financial assets which are issued newly and for the existing stock of the financial assets.

#2 - Funds Mobilization

Along with determining the prices at which the financial instruments trade in the financial market, the required return out of the funds invested by the investor is also determined by participants in the financial market. The motivation for persons seeking the funds is dependent on the required rate of return, which the investors demand.

Because of this function of the financial market only, it is signaled that funds available from the lenders or the investors of the funds will get allocated among the persons who need the funds or raise funds through the means of issuing financial instruments in the financial market. So, the financial market helps in the mobilization of the investors' savings.

#3 - Liquidity

The liquidity function of the financial market provides an opportunity for the investors to sell their financial instruments at their fair value prevailing in the market at any time during the working hours of the market.

In case there is no liquidity function of the financial market. The investor forcefully have to hold the financial securities or the financial instrument until the conditions arise in the market to sell those assets or the issuer of the security is obligated contractually to pay for the same, i.e., at the time of maturity in debt instrument or at the time of the liquidation of the company in case of the equity instrument is until the company is either voluntarily or involuntarily liquidated.

Thus, investors can sell their securities readily and convert them into cash in the financial market, thereby providing liquidity.

#4 - Risk sharing

The financial market performs the function of risk-sharing as the person who is undertaking the investments is different from the persons who are investing their fund in those investments.

With the help of the financial market, the risk is transferred from the person who undertakes the investments to those who provide the funds for making those investments.

#5 - Easy Access

The industries require the investors to raise funds, and the investors require the industries to invest their money and earn the returns from them. So the financial market platform provides the potential buyer and seller easily, which helps them save their time and money in finding the potential buyer and seller.

#6 - Reduction in Transaction Costs and Provision of the Information

The trader requires various types of information while doing the transaction of buying and selling the securities. For obtaining the same time and money is required.

But the financial market helps provide every type of information to the traders without the requirement of spending any money by them. In this way, the financial market reduces the cost of the transactions.

#7 - Capital Formation

Financial markets provide the channel through which the new investors' savings flow in the country, which aids in the country's capital formation.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Example

Let’s consider an example of the company XYZ ltd, which requires the funds to start a new project, but at present, it doesn't have such funds. On the other hand, some investors have spare money and want to invest in areas where they can get the required rate of expected returns.

So, in that case, the financial market will function where the company can raise funds from the investors, and the investors can invest their money through the help of the financial market.

Important points of the Functions of Financial Markets

- Financial Markets is the market, an arrangement or institution where the traders are involved in the buying and selling of financial assets like shares, bonds, derivatives, commodities, currencies, etc.

- It facilitates the exchange of financial instruments and financial securities.

- Different types of the financial markets can exist in any country that includes, Money Markets, Over the Counter Markets, Derivatives Market, Bonds Market, Forex Market, and commodities markets.

- Financial Markets have different roles to play, including price determination, funds mobilization, risk sharing, easy access, liquidity, capital formation, reduction in transaction costs, provision of the required information, etc.

- Concerning the size of the financial market, many financial markets are very small in size, facilitating very little activity, and many of the financial markets trade huge amounts of securities daily.

- The financial market may have or not have the physical location, and the exchange of the financial instruments and the financial securities may be exchanged between the parties over the phone or the internet. Concerning the size of the financial market, many financial markets are very small in size, facilitating a very small amount of the activity, and many of the financial markets trade huge amounts of securities daily.

Conclusion

Financial Markets perform various functions in any country, allowing companies and traders to buy and sell the different financial instruments and financial securities. It acts as an intermediary between savers and the investors by mobilizing the funds between them and helps determine the prices of securities. It plays a crucial role in allocating the limited resources available in the economy of any country.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions

The functions of financial markets play a crucial role in the economic development of a nation by facilitating the flow of capital, mobilizing savings, and providing businesses with access to funding. In addition, financial markets can stimulate investment, innovation, and economic growth by enabling efficient allocation of capital and risk-sharing.

Several factors can affect the normal functioning of a financial market, including economic and political instability, changes in government policies, market sentiment and confidence, global events, and technological advancements. These factors can impact investor behavior, market liquidity, and pricing mechanisms, ultimately affecting the overall efficiency and effectiveness of the financial market.

Yes, technological advancement has brought significant changes to the functions of financial markets, such as the introduction of electronic trading, algorithmic trading, and the use of big data and artificial intelligence for investment decision-making.