Table Of Contents

What Is Full Reserve Banking?

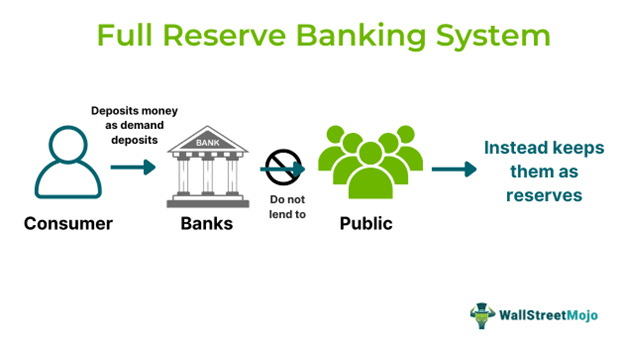

Full-reserve banking, often known as 100% reserve banking, is a banking system in which banks are not permitted to lend any money received from consumers in the form of demand deposits. Banks are required to store all money received as demand deposits from consumers in their vaults at all times.

Under this approach, banks merely operate as custodians of depositors' funds and collect fees for safeguarding services. This ensures that banks can meet redemption demands from their depositors, preventing a bank run even if all depositors attempt to withdraw their funds simultaneously. This is, in contrast, to the current banking system, where banks pay interest on demand deposits that are lent out. This offers depositors greater security. Understanding this banking system is critical to preserving financial stability.

Key Takeaways

- Full-reserve banking, also known as 100% reserve banking, is a banking system where banks store all money received as demand deposits in their vaults.

- This approach maintains financial stability by removing bank-run risks and producing money through lending.

- It offers benefits like creating a safer public money system, reducing risks from banking crises, improving monetary control, and mitigating speculative risks.

- However, there are concerns about whether a publicly controlled system offers better stability and money allocation compared to market-controlled systems.

Full Reserve Banking Explained

Full-reserve banking is a banking system that requires banks to have reserves in the form of demand deposits that cover 100% of their liabilities. Demand deposits are those deposits that the customers can withdraw from the bank at any moment without prior warning. This ensures that banks can meet redemption demands from their depositors, preventing a bank run even if all depositors attempt to withdraw their funds simultaneously. This is in contrast to the current banking system, where banks pay interest on demand deposits that are lent out.

Under the system, banks can only lend money to customers who have made time deposits. Time deposits are deposits that consumers may withdraw from their bank only after a predetermined length of time specified between the bank and the customer. This structure allows banks to lend these deposits to borrowers who are in need, make interest, and collect repayments from the borrowers. The collected amount is eventually used to repay depositors' money plus a fixed amount of interest after taking a profit for them.

Here, the money generation is concentrated at an independent public entity, and banks do not have the authority to alter the government-guaranteed money stock. The payment system is, hence, different from credit generation. The public institution's reserves must completely guarantee bank current accounts. Alternatively, these current accounts are moved from banks to the central bank. Current accounts do not earn interest and are constantly available, but they cannot be used to fund loans. Deposit insurance can eventually be eliminated. It shall be placed in an investing account with a bank that can lend it out to earn interest on a depositor's money. Creditors and banks bear the risk of this.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Examples

Let us look at a few examples to understand the concept better.

Example #1

Imagine, Country XYZ, grappling with financial turmoil and unstable banking institutions, has opted to introduce a full reserve banking system to tackle these issues. The government anticipates that this system will bolster financial stability by eradicating the risk of bank runs, reinstating public confidence in the banking sector, and ensuring depositors always have access to their funds.

Moreover, they seek to address concerns regarding excessive risk-taking by banks and curb the practice of money creation through lending. They aim to foster a more cautious banking environment and reduce the probability of asset bubbles and financial crises. The elimination of fractional reserve lending is expected to result in a more transparent and regulated money supply.

Authorities perceive full reserve banking as a strategy to safeguard depositors' interests and offer heightened financial security, encouraging saving and investment. Although it may restrict credit availability and impede economic growth, the advantages of financial stability and depositor protection outweigh its drawbacks. The government of XYZ aimed to establish a robust banking system prioritizing stability and safeguarding citizens' interests.

Example #2

In the 19th century, trials of full-reserve banking occurred, primarily in response to the prevalence of privately issued banknotes as the main payment method. The National Acts of 1863 and 1864 introduced full-reserve banking in the US. Although these experiments were not formally abandoned, banks found ways to evade regulations by shifting from issuing notes to deposits, ultimately undermining the reform and leading to the establishment of our current monetary system.

Despite this, the government, including the central bank, has managed to maintain a monopoly on issuing notes ever since. It is noteworthy that macroeconomic indicators generally trended upward following the implementation of the reforms. While it is challenging to attribute these positive developments to the full-reserve banking experiments directly, it is evident that they did not have a destabilizing impact on the economy.

Full reserve banking UK:

In the United Kingdom, the Bank Charter Act of 1844 outlawed private money creation by mandating bank-issued notes to be completely insured by government money or gold.

Pros And Cons

Some of the pros and cons of full reserve banking are given below:

Pros:

- The banking system creates a safer public money system and a more diverse and resilient private financial sector, reducing the risks associated with banking crises and financial instability.

- Money becomes independent of interest-bearing bank credit, through which the levels of public and private debt are expected to decrease. It helps in alleviating the pressure of reduced growth imperative.

- It ensures improved monetary control. A central institution has more direct control over the money supply in a full reserve system. This can lead to better regulation of the business cycle and more accurate targeting of desired inflation rates compared to current monetary policies.

Cons:

- There are existing concerns regarding whether a publicly controlled system would offer better stability and money allocation compared to market-controlled systems. Uncertainty surrounds the containment of financial innovations like near-monies in a full reserve system. Critics feel that these remain better controlled under the current system.

- Money is multifaceted and influenced by factors like market demand, circulation velocity, and consumer saving behavior. Defining money becomes challenging in a full reserve system due to its dynamic and endogenous nature. Hence, the allocation of money becomes a complex topic.

- Implementation of a full reserve system due to credit scarcity may lead to reduced utility and economic growth. It may lead to reduced financial system flexibility and variety. These factors could hinder economic progress and innovation.

Full Reserve Banking vs Fractional Reserve Banking

The differences between both the concepts are given as follows:

- A full-reserve system is one in which each deposit is 100% backed by reserves. The deposits are not lent out. A fractional-reserve bank invests its depositors' capital in more risky, non-zero-maturity assets, such as loans, while holding a mere fraction of zero-maturity assets in reserve.

- Since full reserve banks have to hold depositor's money, they have to bear the cost of storage of these reserves. In a frictional reserve bank system, banks do not hold much money in reserves. Hence, the storage costs are much lower comparatively.

- Full reserve banks make money through the fees they charge on the depositors for their deposits. Fractional reserve banks, however, make money through their lending actions and profit from them. Additionally, they also give out bonuses or interest for the lent amount to the depositors.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.