Table Of Contents

Full Form of LIC - Life Insurance Corporation of India

The full form of LIC stands for Life Insurance Corporation of India. Life Insurance Corporation of India is a government company in the field of insurance and investment that is an outcome of the Life insurance of India Act, which brought the insurance sector under the government’s control through nationalization. Thus, LIC came into existence in 1956.

Mission of LIC

As per the LIC website, the mission is to provide the people financial security through products and services at a higher return than other investment players in the market and thus help them maintain a particular standard of living and provide economic development.

Objectives of LIC

- Help penetration of LIC to rural and backward areas and provide affordable death cover to the maximum number of people.

- Channelization of savings to investment for economic development and providing attractive growth opportunities.

- The fund raised through such policies is invested in the best interest of the policyholders and the sectors of national importance in alignment with the country’s goals.

- Act as trustee of the insured.

- Cater to the sector's changing needs and the economy's evolution.

- Bring out the best in the employees in terms of capability in the best interest of the policyholders.

History of LIC

In pre-independent India, the first company to provide life insurance services was Oriental Life Insurance Company, which focused more on the European population and charged higher premiums to Indians. After that, Surendranath Tagore started the Hindustan Insurance Society. And till 1956, many other players had sprung up in the industry. However, due to increasing fraud in the sector, in 1956, the Parliament passed the act of nationalizing the sector.

In this period, the industrial policy resolution of 1956 came into force, nationalizing 17 sectors, one of which was the insurance sector. As an outcome of nationalization, the 254 private players in the insurance sector merged into the Hindustan Insurance Society and formed the LIC of India.

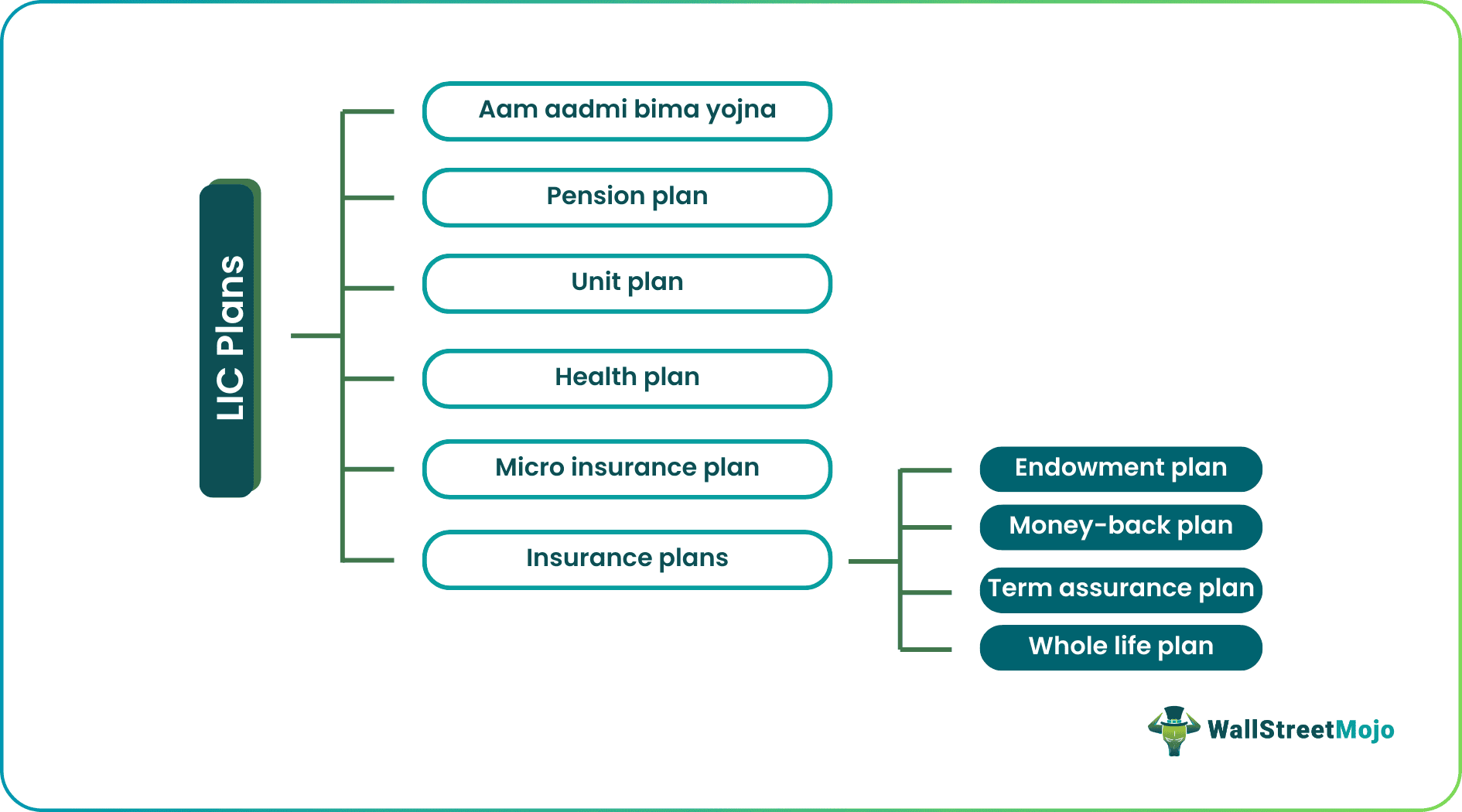

Types of Plans in LIC

The following are the available plans of LIC:

#1 - Aam Aadmi Bima Yojna

- Age should be between 18 and 59 years

- Head of a family below the poverty line or slightly above the same

- The initial premium is ₹200 p.a. for a policy having a cover of ₹30,000

#2 - Insurance Plans

Endowment Plan

- Combination of savings and protection

- The minimum death benefit is ₹50,000, and there is no maximum limit

- Some policies require monthly premium payments

- One can secure a loan against the policy

- At the time of maturity, the money is paid up as a premium return along with a bonus if the death of the holder or other triggers event doesn't occur

Whole Life Plan

- Combination of income and protection

- Annual benefits from the time when premium payments stop until the maturity of the policy

- Lump-sum payout at maturity or death

- One can take the loan can be taken against the policy

Other Insurance Plans

- Money-Back plan

- Term Assurance Plan

- Rider

Apart from these, LIC also has the following plans:

- Pension Plan

- Unit Plan

- Health Plan

- Micro-insurance plan

Structure of LIC

The LIC committee comprises 15 members appointed by the Central Government of India. Following is the structure of this committee:

- There are currently 4 Managing Directors, 4 members, and 3 non-official directors on the LIC Board of Directors.

Further, the responsibilities divide into 4 tier offices as follows:

- Central Office: There is only one central office located in Mumbai. It takes up the following.

- Investment responsibility

- Formulation of regulations and their administering

- Zonal Offices: There are 8 Zonal offices in different geographies

- These divisional offices carry the central office policy down to the branch offices.

- Divisional Offices: There are 113 divisional offices to traction greater penetration into India

- Branch Offices:

- These carry out all the front-end roles between the policyholders and the LIC.

- There are a total of 2,048 such offices.

- Satellite offices: There are a total of 1,048 such offices

Below is the typical hierarchy of the LIC and all its offices-

International Operations of LIC

LIC has international operations in Fiji, Mauritius, United Kingdom, Bahrain, Nepal, Sri Lanka, Dubai, Abu Dhabi, Oman, Qatar, Saudi Arabia & Kenya

Benefits of LIC

Being part of the LIC team has several benefits:

- Work Satisfaction: Helping people achieve their financial goals is rewarding in itself and gives the employee a great deal of work satisfaction

- Success: LIC is the team of the best in the insurance industry. Therefore, there are great peer learning opportunities and a successful career path.

- Lucrative Salary and Perks: Takes care of current and future income and the employees’ targets as it has the best investment research team at its disposal.

- Global Exposure: As LIC is operating at an international level, the corporation's training is of a very high standard and at a world-class level.

- Wide Range of Products: LIC has a wide portfolio of products and services. Therefore, the employee gets exposure to all these products throughout his career with LIC.

- Established Brand: LIC is known in every household, so there is less effort required to sell the brand. The effort is required in selling the products only, while in the case of other players, selling the brand in itself is a task leave alone selling the products.

Conclusion

So, in the end, LIC, as a whole, is an institution not just for insurance but for various services such as investments, pensions, and health benefits, among others. It is a one-stop solution for all kinds of financial services required by any individual or institution and has a team of close to 1 million employees as on 31-3-2018

A career in LIC is a launchpad in the India and abroad insurance sector, and it can bring out the best in the employees through its world-class training and infrastructural support.