Table Of Contents

What is the Full Form of IPO?

The Full Form of IPO is an Initial Public Offering. The term “Initial Public Offering” refers to when a firm offers its shares to the public for the first time. For going public, the company must list its shares on a stock exchange, as investors can only purchase shares listed on a stock exchange.

By listing shares on a stock exchange and issuing an IPO, a private limited company can convert into a public limited company. Companies issue IPOs to raise funds from the market, and in return, the investors benefit from appreciation in share price and dividend/bonus post the IPO result.

Key Takeaways

- IPO stands for Initial Public Offering, which is the process of a company offering shares to the general public for the first time.

- To go public, the company must list the shares on a stock exchange because investors purchase the shares listed on a stock exchange.

- It provides company benefits such as increasing the company’s valuation and market shares, liquidity, and product awareness among the people.

- Companies opt for IPOs to raise funds from the market. In return, the investors get an advantage from in the appreciation of share price and dividend/bonus.

Initial Public Offering Explained

An Initial Public Offering (IPO) refers to the process through which a privately held company becomes publicly traded by offering its shares to the general public on a stock exchange for the first time. This milestone enables the company to raise capital from public investors to fuel its growth and expansion or to pay off existing debts.

During an IPO, the company typically collaborates with investment banks to underwrite and facilitate the offering, setting the IPO price and determining the number of shares to be issued. Once the IPO is completed, the company's shares are listed and traded on the stock exchange, allowing investors to buy and sell them freely post the IPO allotment.

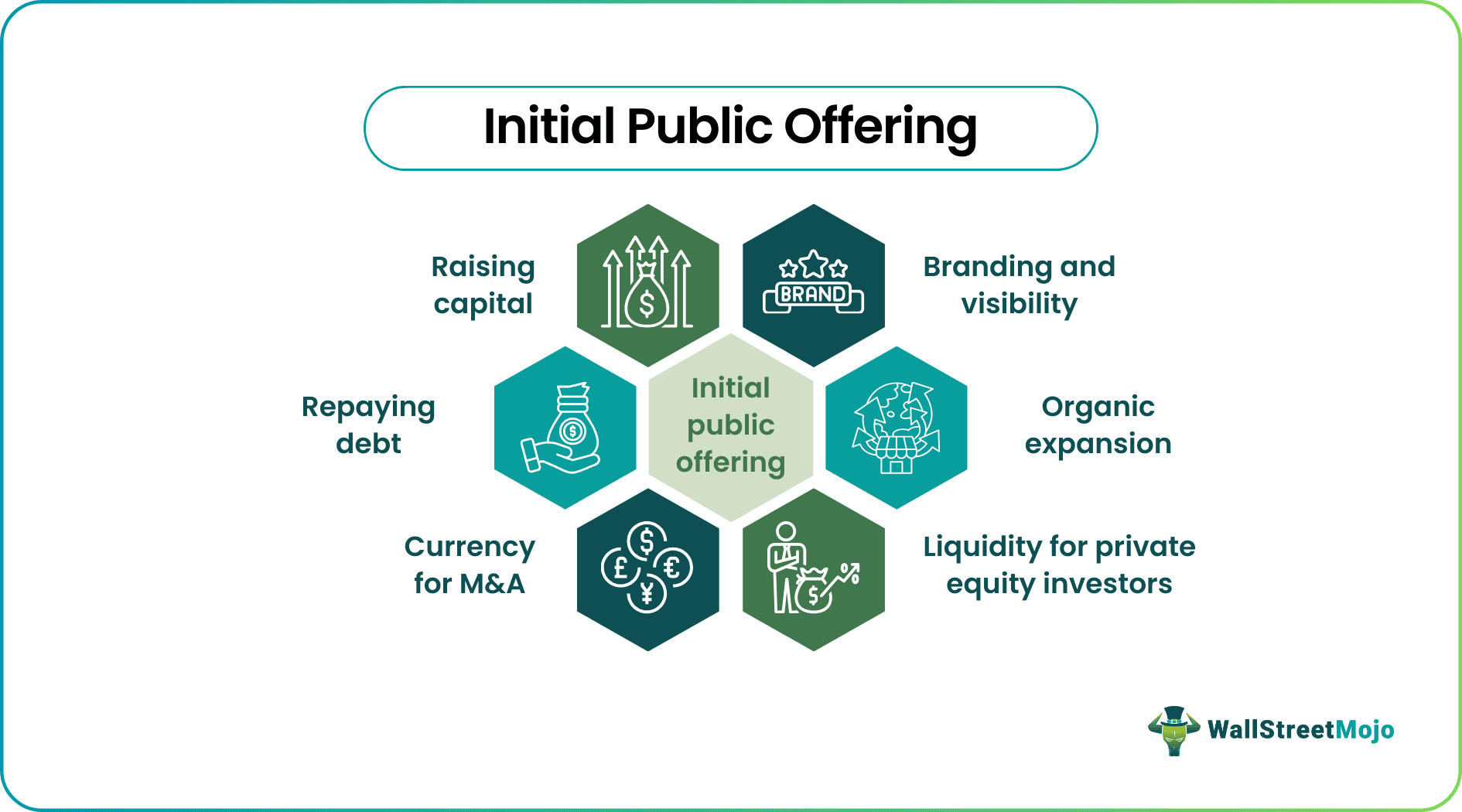

Companies are going for Initial Public Offering to raise funds from the public. It provides various benefits to the company, like increasing the company’s valuation, increasing their market shares, liquidity, and product awareness among the people. However, at the same there are some disadvantages of IPO also like owners/promoter does not have complete control over the company because after a board of directors and shareholders will manage the listing company is the owner of the company, and they can choose the directors who will run the company.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Video Explanation Of IPO

Process

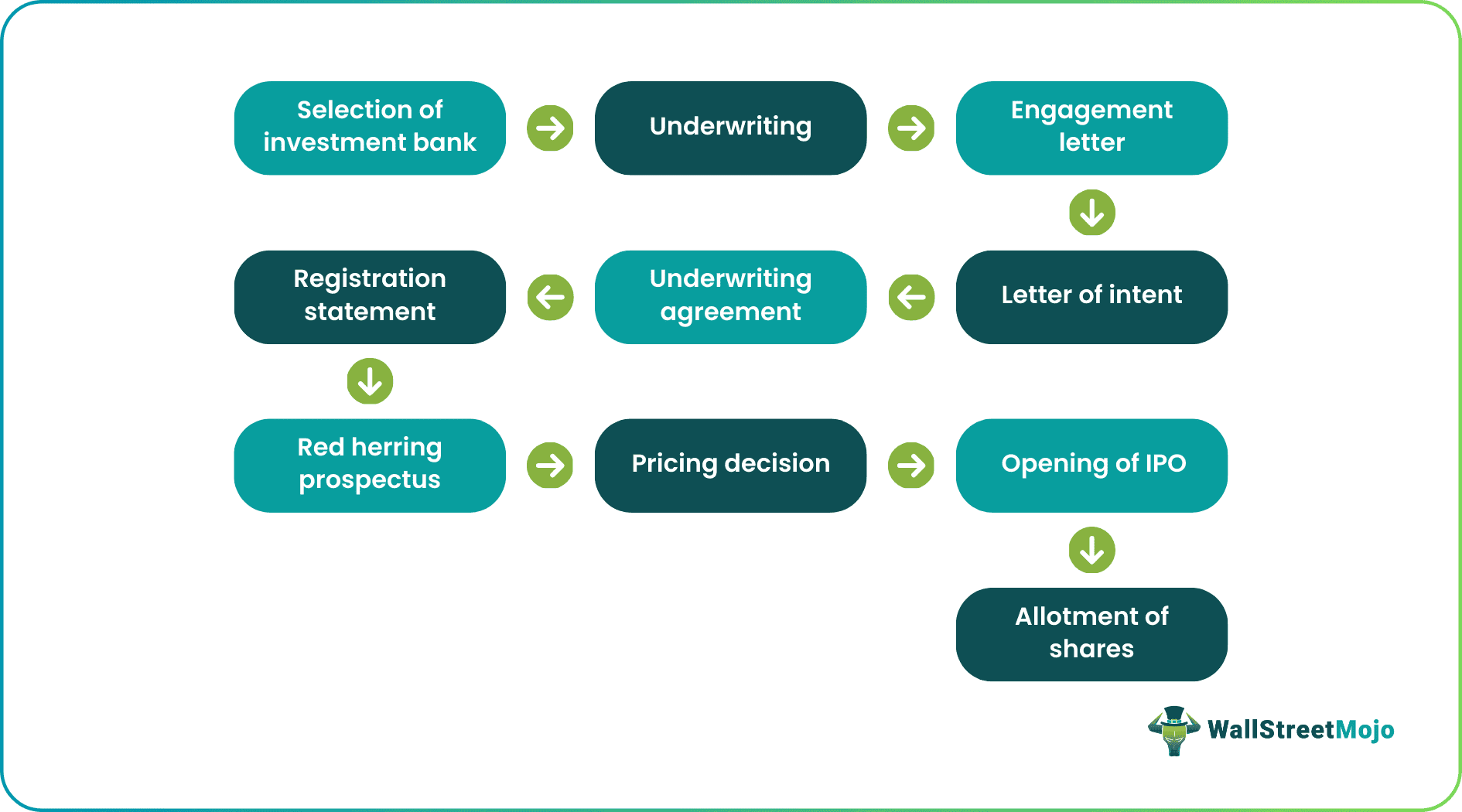

Let us understand the process right from applying to getting an IPO allotment through the detailed explanation below.

#1 - Selection of Investment Bank

It is the first step of any IPO to choose a bank that will guide & advise them on their IPO and provide an underwriting service. The underwriter works as a broker between company and investor and helps the issuing company sell its share in the initial stage.

#2 - Types of Underwriters

A - Firm Commitment

In this arrangement, the underwriter guarantees the company that the agreed sum of money will be raised if there is any shortfall in raising funds through public investors. The underwriter will buy the remaining shares and fulfill his commitment.

B - Best Effort Commitment

In this arrangement, the underwriter does not guarantee to the issuing company; instead, the underwriter only helps sell the company’s securities.

C - Syndicate of Underwriters

In this arrangement, more than one investment bank is involved in selling the company’s shares. Out of these banks, one will lead and form a syndicate, as well as form a mutually beneficial alliance with others.

#3 - Engagement Letter

After selecting the investment bank, an engagement letter will be prepared by both the party in which all the terms and conditions are mentioned like all the out of pocket expenses incurred by the underwriter will be reimbursed by the issuing company, underwriter discount, which is the difference between the sale price of the share to the public and purchase price of the underwriter from the company.

#4 - Letter of Intent

Letter of intent includes the underwriter’s commitment as per the arrangement to the issuing company and dedication given by the company to an underwriter that the company will provide all the relevant information relating to this IPO.

#5 - Underwriting Agreement

After completing all the above things, an underwriting agreement will be executed between the company and underwriter by which both parties will be contractually bound.

#6 - Registration Statement

The issuing company and underwriter will prepare a registration statement in which company history will be mentioned, like a financial statement of an earlier period, management details, promoters holding, legal issues, and any other information which may influence the investors. This registration statement needs to file to SEC (US Security and Exchange Commission)

#7 - Red Herring Prospectus

It is the company’s first prospectus prepared by the underwriter and includes all the company information. This document is ready for investors who are willing to buy stocks.

#8 - Pricing Decision

After getting approval from the SEC company, an underwriter will decide the price of a share and the lot size offered to the public.

#9 - Opening of IPO

After finalizing the price, the company opens the IPO for the public, and generally, it will run 4 – 5 days.

#10 - Allotment of Shares

Allotment of shares will be allotted to the investor as per their bidding. It may be fully subscribed/undersubscribed/oversubscribed. In case of oversubscribing, claims will be allocated to the investor on a pro-rata basis.

Eligibility Criteria

Let us understand the eligibility criteria that plays a pivotal role in IPO result through the points below.

- The company must have 400 or more shareholders holding 100 or more shares.

- There should be 1.10 million publicly traded stocks.

- At the time of listing, the share price should be at least $4 per share.

- The market value of shares should be at least 40 million.

- Aggregate profit before tax earnings of the last three should be $ 10 million, out of which the previous two years pre-tax earnings should not be less than $ 2 million, and there should not be lost in any of the last three years.

- Market capitalization must be at least $ 550 million.

- The previous year's revenue must be at least $ 100 million.

Why Does a Company Offer IPO?

Let us understand the very set of reasons why companies opt for IPO allotments through the discussion below.

- It helps raise the funds because a large number of the public will invest in the company by buying shares.

- It increases its reputation, brand reputation, and market opportunity because more people will know about it.

- It helps in getting the loan with lesser interest costs.

- It increases the liquidity because any time shareholders can sell their shares, management/promoters can also quickly sell their shares.

- It attracts employees also, and they will also get motivated.

Prospectus

The IPO prospectus is a detailed document that provides potential investors with comprehensive information about the company going public. Therefore, it is important for us understand the contents of a typical prospectus before an IPO result. Let us do so through the explanation below.

- It includes details about the company's history, management team, business model, industry overview, and competitive landscape.

- The prospectus contains financial statements, including income statements, balance sheets, and cash flow statements, offering insights into the company's financial performance, revenue sources, and profitability.

- It outlines potential risks and uncertainties associated with investing in the company, such as market risks, regulatory risks, competition, and operational challenges.

- The prospectus specifies the number of shares to be offered, the IPO price range, underwriting arrangements, and any lock-up periods for existing shareholders.

- It includes legal disclosures regarding pending litigation, regulatory investigations, intellectual property rights, and any other legal matters that could impact the company's operations or financial performance.

- The prospectus may feature management's discussion and analysis (MD&A) section, offering insights into the company's strategic priorities, growth plans, and outlook for the future.

- Potential investors can use the information in the prospectus to assess the company's prospects, risks, and valuation before deciding whether to participate in the IPO.

Things to Remember Before Investing in an IPO

Let us understand the points that any investor must consider before investing and hoping for an IPO allotment through the discussion below.

- The Company's past performance and when the company has been established.

- How much stocks are going to the public, and how much they will keep with themselves.

- Who will be the managing director and top management of the company, and how much is the experience to them.

- What is the vision & mission of the company from the red herring prospectus? How will the company increase its profitability and share price of the company?

- What are the company product and consumption capacity of that product?

- What is the market share of the company?

Examples

Now that we understand the intricacies of IPOs and IPO results, let us also understand the practicality of the concept through the examples below.

Example #1

Tech Innovations Inc. had developed groundbreaking technology but was burdened with a significant amount of debt incurred during its research and development phase. To alleviate this financial strain and enable further growth, Tech Innovations decided to go public through an initial public offering (IPO).

By offering its shares to the public, Tech Innovations aimed to raise capital, enabling it to pay off its existing debt and invest in scaling its operations, expanding its product lines, and capturing market share. Going public not only provided the company with access to a broader pool of capital but also enhanced its visibility and credibility in the market and attracted new customers, partners, and talent. Through the IPO, Tech Innovations can strategize growth and innovation while addressing its financial obligations.

Example #2

On 15th May 1997, Amazon went for an IPO and filed the registration statement to the SEC. At that time, Amazon was in the business of online retailers of books.

In that year, Amazon had around 250 employees, and their yearly revenue was $ 16 million.

The initial public offering share price of Amazon was only $ 18 per share, and after nearly three decades, Amazon’s share price is upwards of $ 100. If we compare from IPO, we will find that who has invested in IPO has got 100 times the invested money.

IPO Vs FPO

Let us learn the distinctions between IPO allotments and FPOs through the comparison below.

Initial Public Offering (IPO)

- IPO refers to the process of a private company offering its shares to the public for the first time.

- It typically occurs when a company seeks to raise capital to fuel growth, expansion, or pay off existing debts.

- The company collaborates with investment banks to underwrite and facilitate the offering, setting the IPO price and determining the number of shares to be issued.

- IPOs provide an opportunity for retail and institutional investors to invest in the company's stock and become shareholders.

Follow-on Public Offering (FPO)

- FPO, also known as a secondary offering, occurs when a company that is already publicly traded issues additional shares to the public.

- Unlike IPOs, FPOs do not involve the company raising capital for the first time; instead, they are used to raise additional funds for various purposes, such as financing acquisitions, expanding operations, or reducing debt.

- FPOs may dilute existing shareholders' ownership stakes if the new shares are issued at a lower price than the current market price.

- FPOs offer existing shareholders an opportunity to sell their shares to the public, providing liquidity and potentially unlocking value for early investors or insiders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

1. Why do IPO?

An IPO, i.e., Initial Public Offering, helps a company to elevate equity capital from public investors. It is a crucial period for private investors to fully realize gains from the investment as it generally involves a share premium for current private investors.

2. Where do IPO proceeds go?

The IPO proceeds are to broaden the business, conduct the fund research and development or settle the debt. The other options through venture capitalists, private investors, or bank loans may cost too much. Therefore, opting for an IPO can enable companies with enormous publicity.

3. What is the benefit of an IPO?

IPO helps companies to obtain funds even during economic and financial crises, even when banks refuse to lend money. In addition, it helps companies get listed on essential stock exchanges, attracts more potential investors, and increases transparency in business dealings.

4. Can an IPO be shorted?

When a private company goes public for the first time, sells its stock on an exchange, and suffers after an IPO, it can be shorted upon initial trading.