Table Of Contents

Full Form of Inc - Incorporated

The full form of Inc is Incorporated. Incorporated can be defined as a process of incorporating or separating the business from its owners or, in other words, vesting the business with the status of a separate legal entity to safeguard its owners from the liabilities of the same and, if such, an Inc. organization suffers a setback. The assets of the equity holders and the owners of the same cannot be claimed for the purpose of settlement of liabilities.

Key Takeaways

- "Inc" stands for "Incorporated," meaning a company is a separate legal entity from its owners to protect them from liabilities. Owners' assets cannot be used to settle debts or liabilities.

- When a company becomes incorporated, it is recognized as a separate legal entity.

- It means that in the event of financial hardship or inability to pay debts, the personal finances of the owners and shareholders cannot be claimed by creditors.

- Incorporation offers many benefits, including legal status, limited liability, share transfers, flexibility, legal action, personnel hiring, fundraising, and potential mergers/acquisitions.

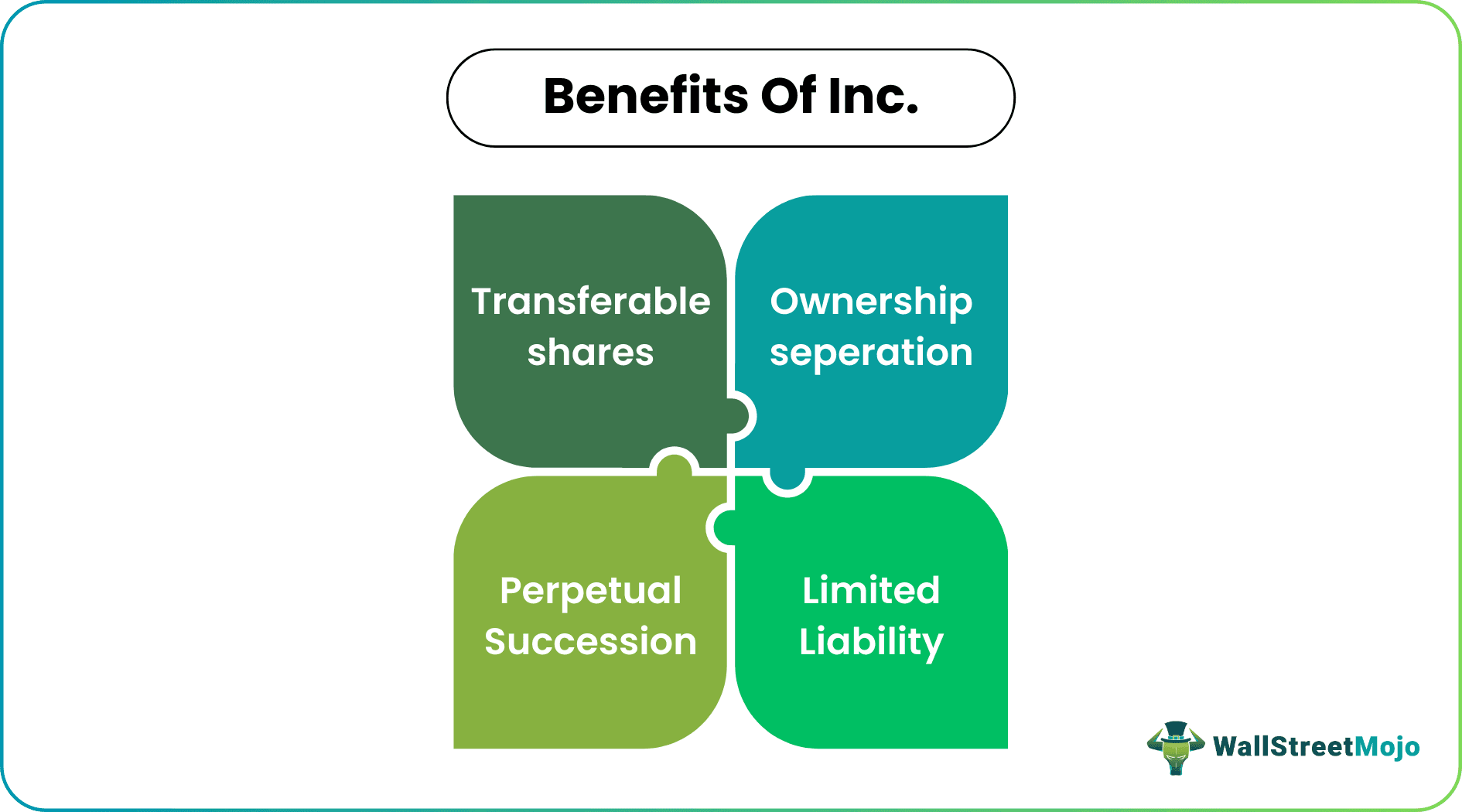

Benefits of Inc.

The benefits of Inc are provided as follows:

- Ownership Separation: The best advantage of having a business get incorporated could be the fact that it separates ownership. An incorporated entity is recognized as a separate legal entity in the eyes of the law. In other words, the owners and equity holders of the incorporated entity will be held separate from the same.

- Limited Liability: Incorporating a business also limits the liability of its owners and equity holders. This means that if the entity suffers a crisis in the future, its owners and equity holders will not be held responsible for clearing the creditors’ dues. The creditors cannot claim the company’s equity holders and owners’ personal financial assets for clearing off the company’s existing liabilities.

- Perpetual Succession: An Inc. entity enjoys perpetual succession. This means that the entity shall remain unaffected by the entry or exit of any of its members. The entity will continue to have the same privileges, estate, possessions, and immunities despite any alterations in the members of the same.

- Transferable Shares: An Inc. entity has transferable shares, which means that the members of the same are free to transfer their shares in a manner provided in the articles.

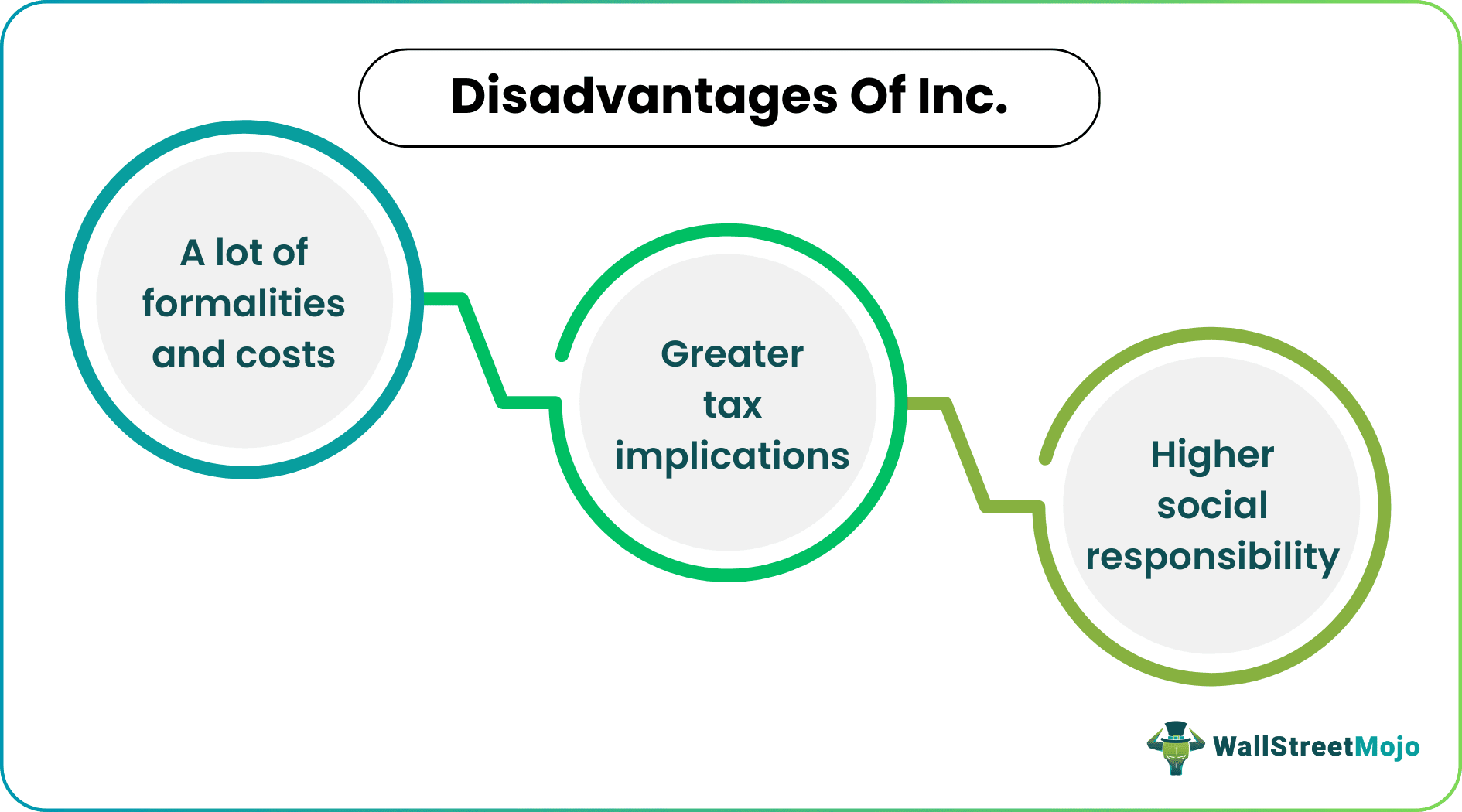

Disadvantages of Inc.

The disadvantages of Inc are provided as follows:

- A lot of Formalities and Costs: Incorporating a business can be really tiring and exhausting at the same time since it is time taking and there are a lot of costs and formalities that one needs to take care of during the execution of the whole process.

- Greater Tax Implications: Inc. entities are required to pay a greater amount of tax than other forms of entities. Such an entity hardly gets any discount and minimum taxable limits.

- Higher Social Responsibility: Inc. entities can have a huge impact on society. This is why such entities are required to follow certain types of norms and contribute to society’s wellness to ensure that it is fulfilling all its corporate social responsibilities.

Incorporated vs Corporation

Incorporated and corporation are way different from each other, and these two terms must not be confused with each other. The contrast between incorporated and corporation is provided as follows:

- Meaning: Incorporated is the process of separating the identity of the business from its owners. Incorporation is an act of incorporating a new or ongoing business. An Inc organization is vested with legal status or, in other words, regarded as a separate legal entity in the eyes of the law, and it can raise funds, hire personnel, choose to get into acquisitions and mergers in its own name using its cash reserves and assets. The personal assets of the owners and equity holders of the incorporated organization cannot be claimed for the settlement of the liabilities of the organization if, in any case, the same goes into turbulence. On the other hand, the corporation can be defined as an entity formed merely to carry out business operations. It can be formed only when one or more equity holders choose to pool their financial resources to attain a mutual goal, such as profit-making.

- Significance: Incorporated is a legal process whereby a business is vested with the status of a corporation. This means that an organization caters to the status of a corporation after the same gets Inc. In other words, the incorporation of a business takes place before the corporation.

- Process: The process of incorporating a business will differ from nation to nation depending on the local laws, whereas the corporation’s process is almost uniform in most countries.

- Status: Incorporated is merely a series of lawful steps to incorporate a new or ongoing business. This helps protect the interests of the business’s owners and its equity holders by ensuring that their personal financial assets are not claimed during the time the Inc. organization suffers a crisis. On the other hand, once a business gets incorporated and finally earns the status of a corporation, it is more likely to deal in carrying out the daily business activities and designing strategies to ensure that the entity goes a long way and gets to fulfill all its long term and short term goals such as profit-making, competitive advantage, positive reputation, etc.

- Lifecycle: Incorporated begins as soon as the certificate of incorporation is issued and ends as soon as the business is vested with a corporation’s status. On the other hand, the corporation will continue to exist until it does not get diluted. This majorly happens on account of not being able to pay off liabilities with the existing assets.

Conclusion

An incorporated entity is vested with a separate legal status, which means that it has a legal existence in the law’s eyes. The owners and the equity holder’s personal financial assets cannot be claimed by the creditors during the time the organization suffers a crisis or, for any given reason, is unable to pay off its current liabilities with the existing financial assets. The advantages of incorporation are endless. An Inc. entity has a separate legal entity, perpetual succession, transferable shares, limited liability, flexibility, the right to sue, hire personnel, raise funds, and can even go for M&A (mergers and acquisitions), etc.