Table Of Contents

What Is The Full Form of ESI - Employees' State Insurance

The full form of ESI is the Employees' State Insurance. It was founded on 24 February 1952 to function as a health insurance scheme for Indian employees, and this fund is solely managed by the ESIC (Employees' State Insurance Corporation) as per the rules and regulations provided in the Employees' State Insurance Act, 1948 (also known as ESI Act, 1948).

The Act takes into account any contingency related to health issues which may be sickness, disability, or death due to injury, leading to a loss of earning capacity either partially or totally. The provisions help in balancing the resulting distress and aim to preserve the dignity of workers during such a crisis. This helps the productive labor force to participate confidently and continue their effort for productive purposes.

Full Form Of ESI Explained

The full form of ESI is Employee State Insurance. It is a corporation that is regulated by the ESI Act of 1948 and looks into proper implementation of the rules, policies and benefits that are mentioned in the act.

It is a system in which all workers are protected and financially secured through some welfare schemes and financial benefits. These schemes provide medical care and financial benefits to the insured and their spouse or dependent family members so that workers get the motivation to continue with their work in spite of facing various forms of risks. It has many types of benefits and insurance schemes that are given out under it to the workers registered under it. It is a genuine program in our country which helps in unleashing the potential of workforce. The Act ensures that the scheme is implemented in various parts of India in a smooth manner. The scheme covers various establishments and Municipal Bodies and Corporations in some selected states and Union Territories.

History

The Government of India appointed Professor B.N. Adarkar in March 1943 to make a report on HIS (health insurance scheme) for Indian industrial workers. The report later became the basis for the formation of the Employees' State Insurance Act, 1948, which highlighted the need to safeguard Indian employees from contingencies like illness, physical disablement (temporary/permanent), maternity, the death that take place due to the injury at the workplace that ultimately impacted their earning capacity.

The Employees’ State Insurance Scheme was implemented initially in Kanpur on February 24, 1952. by our then Prime Minister, Pandit Jawaharlal Nehru. It was started at the same time in Delhi. Pandit Jawaharlal Nehru was the first honorary person to be insured in the scheme and his signed declaration is a valuable possession for the Corporation.

The Employees' State Insurance Act was initially only for factory workers, but as time passed, the Act became applicable for all establishments that employ a minimum of 10 workers. On March 31, 2016, the overall beneficiaries of Employees' State Insurance were approximately 82.8 million.

Objectives

Let us try to understand what the Corporation aims for in its approach.

- ESI Act, 1948 has been formed solely to offer financial relief during contingencies like maternity, temporary or permanent disablement, sickness, death due to workplace injury, etc.

- The Employees' State Insurance Act, 1948, offers medical benefits to Indian workers employed in factories and establishments with a minimum of 10 employees and their dependents.

Entities Covered

The Employees’ State Insurance Scheme is implemented nationwide and in every state except Manipur and Arunachal Pradesh. The Employees' State Insurance Scheme is now extended to cinemas, preview theaters, hotels, restaurants, shops, newspaper establishments, etc. The Employees' State Insurance Scheme is also applicable in medical and Private educational institutions with a minimum of 10 employees.

Documents Required For Registration

The documents required for Employees’ State Insurance Registration are provided below -

- Pan Card of the company or business establishment.

- Address proof documents of the company or business establishment.

- If the company is Private Limited, then it must submit copies of the Certificate of Registration.

- Registration Certificate or License that can be easily obtained under the Factories Act or Shops and Establishment Act.

- Certificate of Registration for every company.

- List of workers in detail along with the monthly salary they receive.

- List of company’s partners, directors, and shareholders.

- The company's bank statements, along with shreds of evidence, state when the same commenced its operations.

Process And Procedure After Form Verification

The following procedure must be followed by an individual to get approved for ESI registration of an establishment or a company -

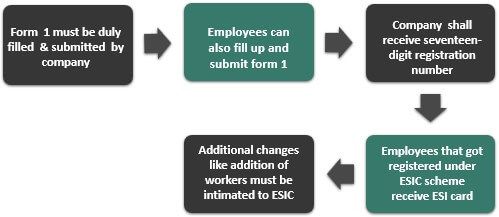

- Form-1 (Employees’ Registration Form) must be duly filled and submitted by the company or a business establishment to apply for Employees’ State Insurance registration.

- The employees can also fill up and submit Form-1 on the official website of ESIC.

- The company or a business establishment shall receive a seventeen-digit registration number after its application, and all the documents are duly verified and approved. After receiving this number, the company or business establishment can file for their filings.

- Employees registered under the ESIC scheme shall receive an ESI card once they have submitted their forms along with their details and photographs.

- Any changes, like the addition of workers, etc., must be intimated to the ESIC.

Note

The documents required for claiming Employees' State Insurance returns are the attendance register, register for Form-6, register of wages, inspection book, register of accidents, and returns and monthly invoices submitted for ESI.

Benefits

Employees' State Insurance offers medical treatment during any injury, disablement, illness, maternity, or even death (due to injury at the workplace), etc., and financial benefits during unemployment to Indian workers and their dependents. The benefits of the ESI scheme are discussed in detail below -

#1 - Medical Benefits - The ESIC provides required reasonable medical care to Indian employees and takes care of their overall medical expenses. Employees will qualify to claim medical benefits from ESIC from the first day of their employment. There is no ceiling on the level of expenditure of the insured and their family members. The insured who may be retired or has a disability will receive medical care along with their spouse.

#2 - Maternity Benefits - ESIC ensures that a female employee receives benefits during her maternity period. The female employee shall receive 100 percent of the average daily salary for not less than 26 weeks from the time she goes into labor, six weeks in case of a miscarriage, and 12 weeks if she opts for adoption.

#3 - Physical Disability Benefits - ESIC ensures that the employee who has a physical disability receives their monthly salary for the overall injury period if the disability is temporary and for the entire life if the same is permanent.

#4 - Unemployment Allowance - ESIC offers a monthly cash allowance for not less than 24 months in cases of permanent invalidity arising from involuntary employment loss or a non-employment injury.

#5 - Sickness Benefit - Employees' State Insurance Corporation ensures that employees receive cash payment even during medical leave. As a compensation, which is 70% of their wage during the sickness period, which can extend upto a maximum of 91 days in a year. However, to qualify for the same, the insured should contribute for 78 days in a 6 months contribution period.

#6 - Dependent Benefit - ESIC even provides monthly payments to surviving dependents if the Indian employee dies due to a workplace injury.

This amount is 90% of the wage which the dependant gets as a monthly payment, ensuring a regular income.

There are some other expenses also that are given out as a benefit. They are in the form of funeral expense of the insured who has expired or support for medical expenses for the spouse in case the insured is confined at a place where important medical benefits are not available.

ESI was founded on February 24, 1952. ESI is mandatory for employers who fall under the eligibility criteria of the Employees' State Insurance scheme. ESI's other benefits are funeral expenses, confinement expenses, vocational training, physical rehabilitation, and skill up-gradation training provided under RGSKY (Rajiv Gandhi Shramik Kalyan Yojana).

The benefit an employee is entitled to receive from ESI shall be passed on to his dependents if he meets with an untimely death due to any mishap at his workplace. An establishment registered with Employees' State Insurance is entitled to receive its benefits for the rest of its life. All the contributions that are required to be made must be made within a maximum of twenty-one days from the end of the previous month.