Table Of Contents

Front Running Definition

Front running, referred to as tailgating, is prohibited. A broker trades the security using his pre-existing knowledge of non-public information regarding a large transaction that can potentially change the price of assets, equity, or derivative with the motive of gaining economic advantage.

Key Takeaways

- Front running, referred to as tailgating, is prohibited. A broker trades the security utilizing his pre-existing non-public information concerning a significant transaction that may change the asset's price, equity, or derivative to obtain economic benefits.

- The advantages of front running are that it helps mass security transactions, provides immense benefits to small investors, offers commission to brokers, and does not consider illegal once the more significant transaction is made public.

- The disadvantages of front running are that it is considered illegal and unethical. Moreover, in case of an orderly withdrawal, the broker may face a considerable loss. In addition, it is a disadvantage for the early investor clients who requests the transaction when the share price increases and if the broker publicly reveals this news.

- If it comes under the scrutiny of the exchange commission, a broker or trader may face an enormous penalty and severe punishment for involving in such practices.

How Does it Work?

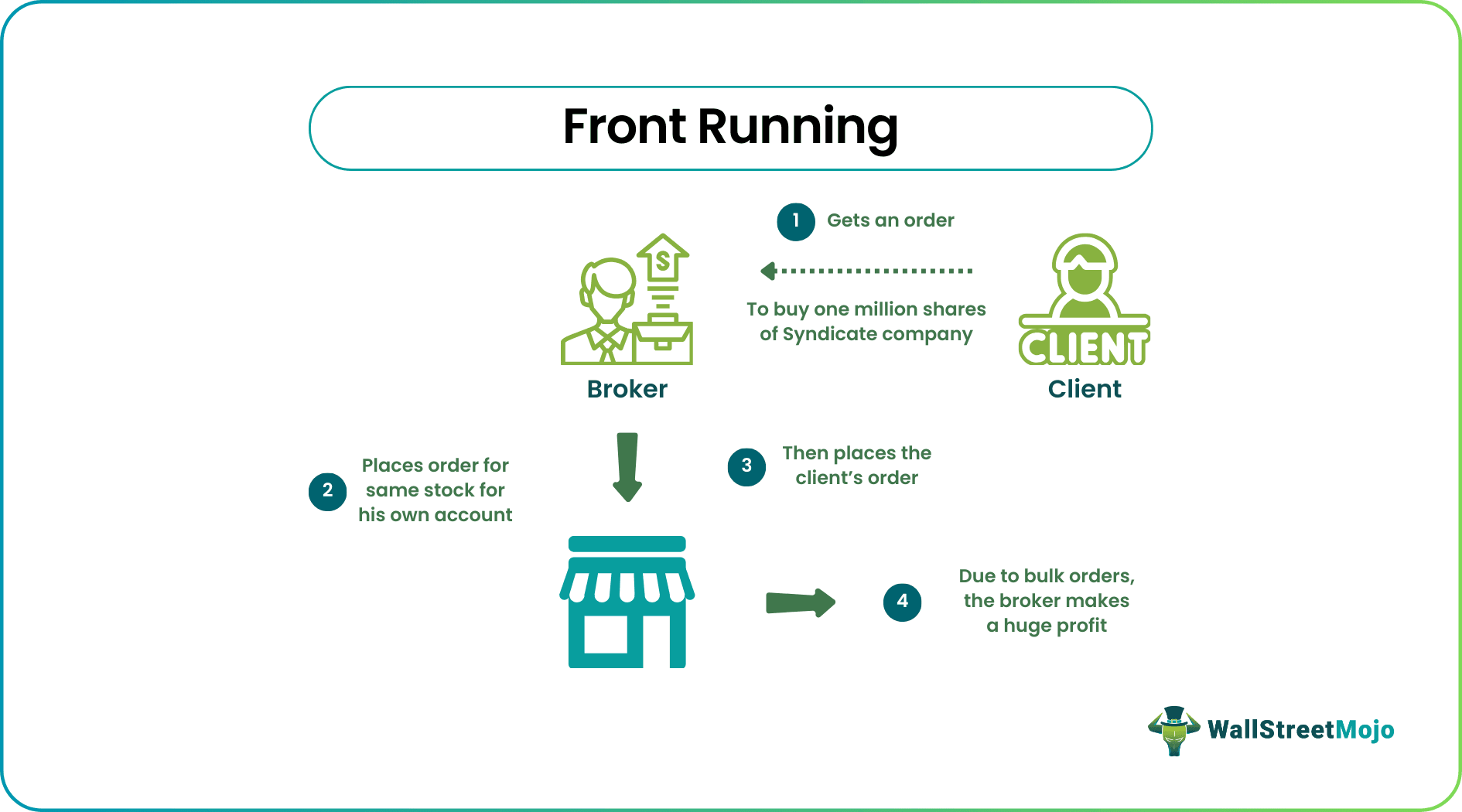

With the motive of gaining an economic advantage, when a broker or trader trades before a large non-published order, such practice is front running. For example, a broker gets an order from a client to buy one million shares of a Syndicate company. Before executing the client’s request, the broker places an order for the same stock for his account. Then places, the client’s order, which makes the stock price rise sharply due to the client’s bulk order, creating a huge instant profit for the broker. An illegal trade practice provides unfair gains to a broker or trader.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples of Front Running

Let us discuss the following examples: -

Example #1

Suppose a broker receives an order to sell the market five million shares of SAMCO Inc. As an outcome of the sale, the prices are likely to fall. The broker sells 1,000 shares of SAMCO Inc. from his market account before executing the received sales order. As planned on sales of five million shares of SAMCO Inc., the prices fell. The broker covers his short position by buying 1,000 shares and earning the difference amount’s profit.

Example #2

An expert has made a report regarding investment in VOYAGE Inc. At the same time, the information still needs to be circulated among investors, which clearly shows buying opinion for VOYAGE Inc. Keeping in mind after the report’s circulation, many investors will purchase the shares of VOYAGE Inc., the stock price will rise. The expert buys 500 shares of VOYAGE Inc. before the information reaches the investors and earns the profit when the report circulates, and there is a huge buying of shares of VOYAGE Inc.

How to Prevent it?

The only way to prevent such an act is to monitor transactions strictly and maintain high ethical standards in dealings. They can be curbed by securities exchange commissions only if they are internally vigilant and committed. Therefore, strictly punishing such actions is the most important component for preventing front running. Lack of care or strictness in internal control is the real cause of the losses suffered by investors. A person who manages others’ money has a finite amount of trust; if this trust is lost once, it is hard to earn back.

Front Running Video Explanation

How do Traders Use Front Running?

A trader will use the information of a non-published order for his interest to gain a monetary advantage. For example, the trader uses the client’s information about dealing in a particular company before placing their order; the trader or broker will place the order on his account.

It results in a broker or trader earning a huge profit when placing the client's order, and that particular company's share price will experience heavy momentum henceforth. In case an analyst sells or purchases the shares ahead of releasing, buying, and selling recommendations of their firm to the public with the motive of earning huge profit is also a way of front running used by the broker.

Front Running vs. Insider Trading

- Insider trading is malpractice, where any stakeholder takes advantage of any price-sensitive information about the company, which is insider information at large, to earn huge profits. It is strictly discouraged by exchanging the commission and heavily penalized as other stockholders are at a great disadvantage since they lack important insider information.

- Front running is an illegal act of using information by a broker for trading in securities to obtain profit under his account. Here, brokers have pre-existing details on investors' orders. As a result, he misuses ahead of trading on behalf of his client investors and gains profit once the investor influences the security price.

Advantages

- Front running helps mass security transactions without big bull institutional traders impacting price movement.

- Small investors benefit immensely from such trading activity. Although illegal, they earn huge profits within a limited time and with no extra cost.

- The brokers also get a commission if they provide this advice to other clients.

- It is difficult to get traced as it is free from the scrutiny of the exchange commission because it shows a normal trading mechanism.

- Once the bigger transaction is made public, buying or selling before the client's transaction is not considered illegal.

Disadvantages

- The whole process is considered illegal and unethical.

- If the client suddenly decides to withdraw the order, the order placed by the broker might seek either a huge loss or no profit at all.

- It may prove disadvantageous for the early investor clients who requested the transaction if the share price increases if the broker publicly reveals this news.

- If it comes under the scrutiny of the exchange commission, a broker or trader may attract a huge penalty and severe punishment for getting involved in such practice.

Conclusion

Front running is a form of market manipulation done in almost every market worldwide. Such trading is considered illegal and majorly undertaken through individual brokers or brokerage firms to earn profits.

Mostly, it is used as brokers' tactics related to the transactions done before placing the client's order or publicizing relevant information. However, it is evident that such an act is illegal and can lead to severe punishments and penalties. Therefore, one should maintain high ethical standards in their dealings/ transactions.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

1. Is front running illegal?

Front running is the purchasing security illegally based on advance non-public information concerning an expected significant transaction that may influence the security price.

2. Why is front running illegal?

Front-running is illegal and unethical if a trader responds to inside information. For example, if a broker exploits market-moving knowledge that has yet to be public. In addition, there are gray areas. For example, an investor must buy or sell a stock and then publicize the reasoning.

3. How to detect front running?

For detecting any potential front running, firms must look out for proprietary buy/sell orders near a client buy/sell order in the same instrument affecting the share price.

4. What is front running in mutual fund?

Front-running refers to the trading stock or any financial asset by a broker who possesses future transaction inside knowledge that is about to influence its price substantially.