Table Of Contents

FRM Exam (Financial Risk Management Certification)

FRM exam (Financial Risk Management) is a part of tests conducted by the Global Association of Risk Professionals to issue an FRM certification to the person who passes the exam recognizing candidate's eligibility to work in an economic environment as they possess a strong knowledge and sound understanding of financial risk, analysis, and management.

This comprehensive financial risk management article will give you nuts and bolts of FRM certification examination, pattern, study tips, exam resources, etc.

Note that, like the FRM certification exam, various other credentials you may choose in the area of finance, want to specialize in. You should choose carefully as every certificate is exclusive and provides convincing paybacks. If not, then it will not count. If confused about which one to go for, look at a comparative analysis on CFA vs. FRM. For a deeper understanding of the CFA examination, you can look at the Beginner's Guide to CFA Examination.

Table of contents

- FRM Exam (Financial Risk Management Certification)

- What is the FRM Exam (Financial Risk Management Certification)?

- Why Pursue the FRM Exam?

- FRM Exam Format

- FRM Exam Weights / Breakdown

- FRM Certification Exam Fees

- The FRM Results & Passing Rates

- The FRM Exam Study Material

- FRM Exam Strategies: before the Exam

- The FRM Exam Strategies: During the exam

- FRM Exam Scholarship Opportunities

- The FRM Exam Deferral policy

- Conclusion

- Recommended Articles

What is the FRM Exam (Financial Risk Management Certification)?

The Global Association of Risk Professionals (GARP®) evolved Financial Risk Manager (FRM®) for those interested in getting certified and dedicated to managing risks. Financial Risk Management is an esteemed certification that helps you enhance your career, dominate and get recognized among employers, and improve your knowledge and expertise in financial risk management.

- Roles: Financial Risk Consultant, Risk Management, Credit Management, Asset Liability Management, Risk Appraisal, Risk Assessment. FRM may not be useful for those looking for Investment Banking or Equity Research careers.

- Exam: The FRM certification program consists of FRM exam Part I and Part II, pencil, paper due to the multiple-choice exams.

- FRM Exam dates: The FRM exam Part I and Part II are conducted twice a year, in May and November (usually the third Saturday). Also, it can take both levels on the same day at once.

- The Deal: The two-part FRM exam analyzes advanced, cumulative knowledge, and the concepts are tested on the FRM exam Part I needed for Part II. The FRM certification program's two parts conclude with a four-hour examination each where one may take both FRM Part I and Part II exams the same day. Therefore, although you do not have financial risk management certification Part I and cleared Part II, you may still appear for both exams next time.

- Eligibility: Anyone can enroll to take the FRM exams.

FRM Certification Program completion criteria

- Pass the FRM Exam Part I and Part II within four years.

- Candidates must take the FRM exam Part I before taking Part II.

- Demonstrate two years of relevant work experience. This work experience cannot be more than ten years before passing the FRM exam Part II. Also, school work experience is not considered, including internships, part-time jobs, or student teaching. A candidate must have five years to submit their work experience. After five years, the candidate is liable to re-enroll in the FRM certification program and re-pay the required fees.

- Certified FRMs are firmly encouraged to earn 40 hours of Continuing Professional Development (CPD) every two years to retain the latest best practices in risk management.

Recommended study hours: GARP recommends FRM candidates must dedicate around 200 hours of study to prepare for each part of the FRM exams.

What do you earn? You become a certified Financial Risk Manager (FRM®)

Why Pursue the FRM Exam?

FRM certification is elected and pursued since required in the current economic and finance industry. But simultaneously, you need to consider your career prospects that may vary according to your interests and recent professional experience, if any.

- Though FRM Certification does not guarantee a job or a salary hike, it gives an edge over your counterparts and provides a good advantage over your colleagues at the workplace.

- Employing this certification widens the opportunity to prove your worth, may help you with the salary hike and not just being the certificate.

- Moreover, the focused knowledge, and skills achieved in financial risk management, the opportunity to network and access financial risk professionals can provide you tremendous exposure to the industry.

- This certification will also give you a chance to show a high-value skill set in a niche fragment of the finance domain.

Look at the top 10 companies and the top 10 global banks employing the most FRM’s.

| Top 10 Companies | Top 10 Global Banks |

|---|---|

| ICBC | ICBC |

| Bank of China | China Construction Bank |

| HSBC | Agricultural Bank of China |

| Agricultural Bank of China | Bank of China |

| Citigroup | JP Morgan Chase |

| KPMG | Wells Fargo |

| Deutsche Bank | HSBC |

| Credit Suisse | Citigroup |

| UBS | Bank of America |

| PwC | Banco Santander |

FRM Exam Format

| FRM Exam | Financial Risk Management Certification – Part I Exam | Financial Risk Management Certification – Part II Exam |

|---|---|---|

| Focus on | Essential tools and techniques used in risk management and various theories that utilize them. | Application of the tools and techniques studied during the exam Part I and deeper insights into significant risk management branches. |

| Exam format | Multiple Choice Questions (MCQ) | Multiple Choice Questions (MCQ) |

| Questions | Equally-weighted 100 questions | Equally-weighted 80 questions |

| Duration | 4 hours | 4 hours |

Key highlights of the FRM exam format

FRM Certification Exam - Part 1

- The FRM exam-Part 1 focuses on critical tools and theories required to gauge financial risk.

- The broad study area would include the foundation of risk management, quantitative analysis, financial markets and products, valuation, and risk models.

- The exam is conducted in a multiple-choice format that makes it easy, but the candidate gets around 2.4 minutes per question on average, considering the time aspect.

- The questions are related to theory to practical, real-world problems to understand risk management.

- No penalties for incorrect answers.

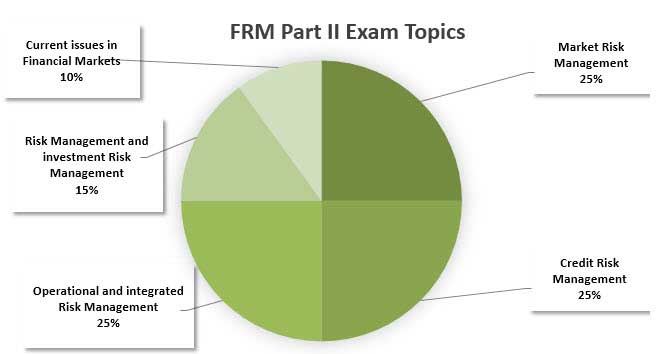

FRM Certification Exam - Part II

- The second part of the FRM certification exam is a notch up from the Part I exam. It focuses on market risk management, credit risk management, operational and integrated risk management, investment risk management, and current issues in financial markets.

- This exam is in a multiple-choice questions format, and the exam taker gets around 3 minutes per question.

- The questions are practical, where the candidates are expected to behave as risk managers and deal with risk management.

- No negative marking for the incorrect answers.

FRM Exam Weights / Breakdown

FRM Certification Exam - Part I

- Every aspect of financial risk management weighs differently in the exam (break-up provided below). To pass the Part I exam, you must demonstrate extensive knowledge of all the areas introduced by the FRM curriculum.

- You must practice well for the quantitative section, especially if you have a commerce background and have not worked on quantitative problems before.

- The more encouraging part is that there are NO SECTIONAL CUT-OFFS! You can pass the exam though you scored the 4th quartile in one of the sections. However, it is highly advisable not to blunder the high-weight sections you see below.

FRM Certification Exam Fees

The following is the information for FRM certification Part I, May 2022: -

- The candidates are liable to pay a one-time enrollment fee of $400. Another aspect that needs to be considered is the time of payment. If early registration for the exam is made, the more inexpensive it will be. For instance, during the third deadline, the fees may be worth $950, while the first deadline may outlay $300 less than the $650.

- The FRM certification program enrollment fees are valid for four years. They are required to appear for the Financial Risk Management Certification – Part I & II exam within the period.

The following is the information for returning candidate FRM certification Part 1 & Part II

source - GARP

The FRM Results & Passing Rates

The FRM results are declared through an email, generally, six weeks after the exam is conducted. You are also provided with the quartile results that allow you to understand how you scored on the broad areas of the exam concerning other participants. Also, they do not reveal passing scores determined by the FRM committee.

The passing rates fall within around 30%-60% for both parts of the FRM exam. Let us look at the passing rates for each of the levels: -

FRM Exam Part I Passing Rates

- For the last five years (2016-2020), the pass percentage for the Part I exam varied in the range of 42% to 50%, with an average passing rate of 44%.

- The pass rate of Part I for Nov 2020 was 45%.

| FRM Part 1 Exam Pass Percentage | |

|---|---|

| May 2016 | 45% |

| Nov 2016 | 45% |

| May 2017 | 42% |

| Nov 2017 | 42% |

| May 2018 | 41% |

| Nov 2018 | 50% |

| May 2019 | 42% |

| Nov 2019 | 46% |

| May 2020 | 44% |

| Nov 2020 | 45% |

The FRM Exam Part II Passing Rates

- For the last five years (2016-2020), the pass percentage for the Part II exam varied from 50% to 62%, with an average passing rate of 56%.

- The pass rate of Part II for Nov 2020 was 59%.

| FRM Part 2 Exam Pass Percentage | |

|---|---|

| May 2016 | 50% |

| Nov 2016 | 54% |

| May 2017 | 54% |

| Nov 2017 | 52% |

| May 2018 | 53% |

| Nov 2018 | 56% |

| May 2019 | 60% |

| Nov 2019 | 59% |

| May 2020 | 62% |

| Nov 2020 | 59% |

The FRM Exam Study Material

Here, we have brought a comparison between the study material used to prepare for your FRM Certification Part I &II exams. It includes the study material available on the GARP site and Schweser.

| Study Material | GARP | Schweser |

|---|---|---|

| 2022 FRM Exam Part I eBooks | As part of the registration | |

| 2022 FRM Exam Part I Books | $300 + shipping | $399 |

| 2022 FRM Exam Part II eBooks | $250 | |

| 2022 FRM Exam Part II Books | $300 + shipping | $399 |

Also, note that several packages are available with Schweser. Therefore, you may choose the features that suit your requirement. Although for comparison, we have included the price and attributes of the essential self-study package. Further, deciding whether to opt for the FRM curriculum notes or the prep material depends on your time preparing for the FRM exam.

FRM Exam Strategies: before the Exam

There is no magic nor shortcuts, but only dedicated efforts that will help you through. Let us look at a few points you could consider in preparing for the FRM-Part I exam.

- Understand the curriculum- The utmost important thing is understanding the entire syllabus. Therefore, make efforts to understand it.

- Go through the GARP readings- It is essential to analyze the core GARP readings at least once and the FRM handbook.

- Find a study partner- If you find a study partner. Look out for someone in a similar situation as per you and your schedule. That can prove to be an excellent help to each other in case of doubts and each partner's strength in a particular subject.

- Start early- Understand that these are not your college exams, and last-minute study could get you through. To prepare well, start early and plan the preparation schedule, deciding how much time to dedicate for each day. Especially, if you are not someone from a finance and quants background, may have to devote sufficient time for preparation.

- Stipulate your study hours- Though the recommended hours are somewhere around 200 hours, it does not imply you will pass the exam. These criteria are entirely subjective and require sincere efforts ranging between 100 hours-500 hours.

- Prepare well for formulas and calculations- The important consideration for the exam takers is that there is a fair amount of quantitative aspect in the subject matter. Therefore, the mathematical difficulty of the exam is similar to that of a graduate-level finance course. Moreover, one must know essential formulas and calculations and their correct application.

- Prepare your quick sheet- The syllabus involves many formulas (find them at the end of every chapter) and methods to various measurement types. Remember, formula sheets are not provided with the exam. So, it would be best if you memorized them. One way is to prepare your formula quick sheet and refer to it whenever you have free time during your work or traveling.

- Practice, Practice, and Practice! – Going through the notes, reading up formulas is only a part of the preparation. The key will be the amount of practice you devote to solving the problems. It might also happen that today's practice can make you forget after a week. So you cannot do much here except KEEP PRACTICING! Solve as many practice exams, which would give you a hang of the real thing and make you confident in the final match.

- The course is not a novel- You should not be reading whenever you get time, only for 15-20 minutes. Create a habit of studying for hours at a stretch for 2-3 hours. Learn the concepts and practice them immediately. If you do that right from day 1, you will not need to read the ideas again and again.

- Solve sample papers by GARP- Going through the GARP core readings appropriately and solving their practice exam (available for free once you register for the exam) will boost good confidence to pass the exam. Even, a few more practice exams, Schweser is never harmful. However, do not expect the same level of questions in your form. Anticipate that the GARP will take you for a ride. Prepare for the worst!

- Prepare every section- Do not eliminate a few concepts and topics, thinking unimportant. Such decisions may backfire. You cannot afford to ignore any formula from any corner of the book. STUDY EACH AND EVERYTHING.

- Dedicate at least one week before the exam- If working, try and take a week off from before the exam and keep other commitments to the minimum. Use it to stuff yourself with some concepts for that extra edge. Devote this time practicing and rereading your material.

The FRM Exam Strategies: During the exam

If you are prepared and do your homework well, there will be no problem on the exam day. However, we have listed down a few essential suggestions that could be important.

- Keep difficult questions for the last- Most exam takers have observed that the final ten questions were low-hanging fruits that could solve quickly. That can be unfortunate for those who cannot get that far and are forced to guess the answers because of lack of time. So it is always better to come back to the difficult questions later and keep answering the ones you know quickly.

- Be quick and alert- Although you might feel you have enough time for each question. Do not forget; the Financial Risk Management questions are generally tricky and challenging, so you need to be alert and save time to solve the difficult ones.

- Look for easy pickers- You may come across questions where you could quickly find solutions. Look out for them as you can solve them correctly within no time. That will help you save time for other questions and increase your chances of clearing the sections.

- Watch out for lengthy questions- The other types of questions that could be seen in the exam are the ones that are quite lengthy in both words and the number of steps that are required to chalk out a solution. Plan out for them if you want to take it at the beginning of the end.

FRM Exam Scholarship Opportunities

- Candidates that cannot afford and self-fund the FRM exam can access the scholarship provided by GARP.

- This scholarship can cover only the FRM Exam Part I registration fee.

- Note that the scholarships are not available for the FRM Exam Part II.

- The decision of whether the scholarship has to be awarded to a particular candidate is at the discretion of GARP, and a candidate may be allocated to only one scholarship with no exceptions.

Although to avail of the scholarship, the candidate must qualify the following guidelines laid down by GARP: -

- The student must validate full-time enrollment in a graduate degree program at the exam. So, if the student has currently enrolled in an undergraduate or certificate program, they may not qualify for the scholarship.

- Faculty members would be eligible to validate full-time employment at their institution. A complete application form, which can be found on the GARP website, must be submitted along with the documents.

The FRM Exam Deferral policy

There could be situations where you cannot take the exam you have been enrolled for. In such cases, you may consider a deferral. Here, you can defer the exam registration once to the next exam date. Although there are a few conditions: -

- One must submit the deferral by the last day of registration.

- You may have to pay an administrative processing fee of $100.00 to defer your exam.

- You may automatically re-enroll in the next exam cycle, and in case you decide not to appear in the next exam, you will lose your exam registration fee.

Conclusion

One should choose FRM certification if keen on learning and pursuing a career in financial risk management. Financial risk management also allows to network with like-minded people and help gain exposure in the risk industry. Although financial risk management does not guarantee a job or a salary hike, it may give you an edge over your counterparts. It provides a good advantage over your colleagues at your workplace. Choose this credential, thinking about the cost-benefit for yourself. It demands a fair amount of commitment, discipline, and hard work to earn success. So, all the best!

Recommended Articles

This article has been a guide to FRM Exam. We discussed the financial risk management certification exam, FRM results, pass rates, exam strategies, deferral policy, and scholarship opportunities. You may also refer to the following resources to learn more about FRM: -