Table Of Contents

Free Riding Meaning

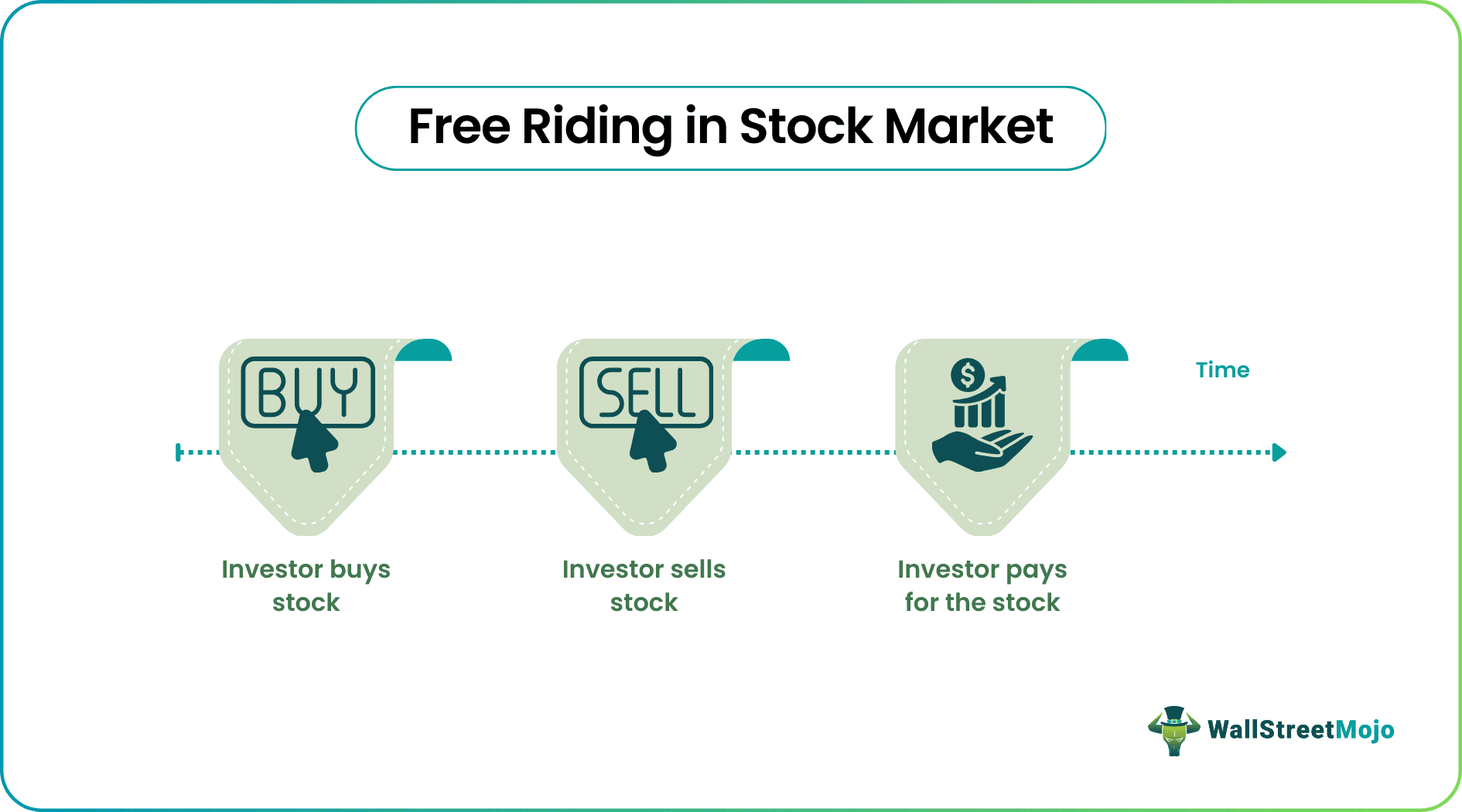

Free riding refers to the trading practice where investors sell a security before the purchase transaction is complete. Hence, they would be paying for the purchase of an asset with the amount earned by selling it instead of from the cash available in their account.

It is considered illegal by the Federal Reserve, the Securities and Exchange Commission (SEC), and the Financial Industry Regulatory Authority (FINRA). Since it violates Regulation T, when the broker or the dealer detects an investor's free riding, their account should be suspended for 90 days.

Key Takeaways

- Free riding can be referred to as the case where investors pay for the purchase of an asset with the amount received from selling it. That is, the sales amount is used to finance the purchase. This allows them to earn a profit without having any capital.

- It also occurs when underwriter syndicates of companies issuing IPOs set aside some shares and sell them later for a higher price.

- In a strictly economic sense, free riding means using public resources without paying for them.

Free Riding In Economics Explained

Free riding in an economy usually refers to using public resources without paying for them, while everyone else is mandated to do so or pays less. The term implies 'riding for free,' i.e., using for free. A perfect example would be tax evasion. It shows market failure and has many adverse effects on the economy.

Similarly, the problem of free riding in the stock market is considered undesirable as it confers an unfair advantage to many. Moreover, it is a situation where those who do not have sufficient funds can still profit from trading. Thus, if every investor turned into a free rider, the stock market would turn into a jungle, and the whole system would get disrupted. This is why stringent free riding restrictions are necessary for the stock market.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Here are some examples to understand the concept better.

Example #1

Alex bought the stock of company X for $12 on September 12, 2022, at around noon. The stock prices rose to $18 until the market closed that day. The next day, he waited till noon and decided to sell the stock. Alex received $20 from the sales of the stock. He settled the purchase of the stock by paying $12. Thus, he could make an $8 profit without investing anything out of his pocket. Here, Alex is a free rider.

Example #2

Consider the example of an investment bank, P. The bank is the underwriter syndicate for company A, planning to go public and offer an IPO. The company was to issue 700 shares for $2 each. The bank set aside 50 shares at the time of the IPO, and only 650 shares were issued. Later, A's stock started performing well and reached $24. Then, the bank sold the rest 50 shares and made a profit.

Free Riding Stocks

The problem of free riding is more prevalent in the stock market, especially with day traders. Let's look at why this happens. The main reason would be the intentional practice on the trader's part due to a lack of capital. When traders don't have enough funds, they might resort to fraudulent practices.

But the possibility of such malpractice exists because of the transaction settlement dates, known as 'T plus' days. For instance, stocks have a transaction settlement period of two working days. The same goes for exchange-traded funds (ETFs). Hence, T+2 days. For mutual funds and options, it takes T+1 days. So, this is the gap where free riding occurs.

It can also occur when an underwriter syndicate, i.e., the broker or dealer involved in an initial public offering (IPO), sells a part of the shares at a later date, at a higher cost. But, of course, this accompanies many other violations like misrepresentation, etc.

Nevertheless, it is essential to understand that not all free riders practice it deliberately. Especially day-traders are more prone to free-ride unintentionally, given the short time frame in day trading. Therefore, the investor might become guilty without being aware of violating the law.

But how can investors avoid becoming unintentional free-riders? The most obvious way is to maintain sufficient funds in the account when purchasing an asset. Another method is to use a margin account in which the broker or dealer provides a loan to the investor to trade. The assets and the cash deposited will act as collateral in the margin account. These methods can reduce the possibility of accidental free riding.

Free Riding Regulation

Now, let's move on to understanding the Federal Reserve's free riding restrictions. The Fed's Regulation T (Reg T) governs the practices concerning securities and related credit options. For example, Reg T dictates that an investor can borrow up to 50% of a stock or security's purchase price.

Hence, the investor must pay at least 50% of the purchase price from their cash account. However, this is not the case when investors free-ride in the stock market. Instead, almost 100% of the purchase price is paid from the sales proceeds of the same asset. This is the reason behind the illegality of free riding.

Usually, when the broker or dealer encounters a free-rider, they are mandated by the law to freeze or suspend the investor's account for 90 days. The investors can still buy and sell during this time, but the purchase should be settled on the same day.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

There are two ways to avoid the problem of free riding – first, investors should ensure a minimum balance in their account before making any purchase. So it would be evident that the investor wasn't trying to free-ride. Second, the use of a margin account can be helpful too. In a margin account, the broker/ dealer allows the trader to borrow and invest with the securities and cash deposited as collateral.

Usually, people are more likely to free-ride public goods. In such a case, people do not pay or pay relatively less for the usage of public commodities.

To free ride means to not pay or underpay for the use of public goods. In stock markets, it means using the sales proceeds from selling a stock to pay for its purchase.