Table of Contents

Free Float Meaning

Free float is a metric that allows investors and other market players to gauge the number of shares available for the public to trade in the secondary market. Therefore, it is also referred to as public float. A free float calculation is considered a better way to calculate market capitalization as it gives a clearer picture of share ownership.

It accurately represents the quantum of ownership of public investors instead of company “insiders” such as promoters, controlling-interest investors, company officers, or, in some cases, the government. Events such as stock splits, secondary offerings, reverse stock splits, or share buybacks can adversely affect the metric and investors' decision-making regarding investments.

Key Takeaways

- The free float or public float of a listed company refers to the number of shares that can be freely traded by investors in the secondary market.

- Investors and indexes consider this one of the more accurate ways of calculating market capitalization. The S&P 500 index is a more renowned free-float capitalization index example.

- A high float indicates that the stock will experience less volatility, while a low float indicates higher volatility.

- Companies must work towards striking a balance between control of decision-making and freedom to trade for investors.

Free Float Explained

Free float or public float is a stock market concept that signifies the number of shares that are available for the general public to trade on secondary markets. It shows the most accurate picture of the company's ownership, so a free float equation is considered a more accurate metric to determine the market capitalization of a listed company.

A company with a low percentage of public floating might not be traded as often as a company with the opposite end of the spectrum. Companies with low free-floating percentages tend to be more volatile, and hence, investors seldom venture into trading with such companies. Moreover, since the bid-ask spread is wider due to a limited number of shares available for trading, it further adds to lower trading volume.

Decisions from the board of directors or management can change the percentage of free float. A listed company’s outstanding shares can experience an increase by further diluting the equity through secondary offerings or stock splits. On the other hand, the public float can shrink due to share buybacks and reverse stock splits.

Public float provides companies with fantastic access to funds for development. It also decreases the need to raise funds through debt and reduces debt obligations for companies that already have excessive debts.

However, it is not free of challenges. First, a significant cost is attached to the fact that a significant percentage of outstanding shares are traded in the secondary market. Second, the company’s value will be subject to market fluctuations and speculations. All these factors attract more public attention, and the pressure to outperform the market is higher.

Ultimately, like most facets of business, even with public float, companies must exercise caution and work towards finding the right balance of debt and equity, of free float and restricted float.

Formula

The formula for calculating the free float market cap is:

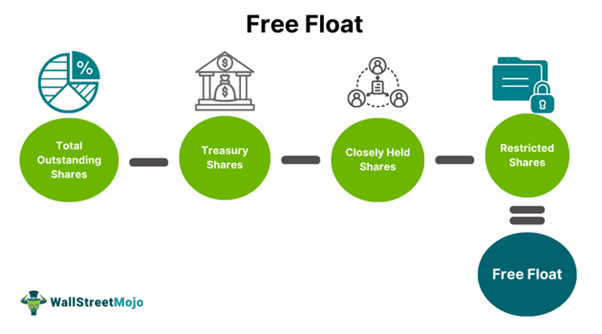

Free Float = Outstanding Shares – Closely-held Shares – Restricted Shares

Examples

Now that we understand the basics of the concept, it is time to address the free float calculation and its practical implications through the examples below.

Example #1

CDE Enterprises is a listed company with 100,000 authorized shares. It is shown on the company’s balance sheet that out of the total outstanding 60,000 shares, 10,000 shares are restricted (cannot be traded). The remaining shares of the authorized capital are held in the treasury of the company.

Therefore, their public float is:

Free Float = Outstanding Shares – Closely-held Shares – Restricted Shares

= 60,000 – 10,000

=50,000

Example #2

In 2024, Trump Media & Technology Group was listed on exchanges. The stock went on a bullish run that boosted the company’s valuations by $9 billion before the shares tumbled down dramatically. The former president of the United States of America was the primary stakeholder in the underlying company.

When the stock hit an all-time high and traded at close to $80 per share, his share in the company was estimated at around $6 billion. However, after the downward slide started, the value of his share was reduced to approximately $2.6 billion.

Experts say such dramatic events caused short sellers to rush to capitalize on the bullish trend. According to a Reuters report, about 16% of the company’s free float was bid in “short orders.”

How to Increase or Decrease the Free Float Volume?

Only management decisions or time-related factors can alter the company’s free float equations. These factors can either increase or decrease the number of shares traded in the open or secondary market.

Increasing Public Float

- Stock split

- Secondary issues

- Employees exercising their stock options

Decreasing Public Float

- Reverse stock split

- Share buyback

Importance

The importance of a free-float market cap for investors and the market, in general, is significant. A few of the most crucial points are:

- It is a metric that investors, market experts, and analysts monitor while picking stocks for investment, as stocks with higher public floats tend to be more stable.

- A reasonable float rate signifies stability in the stock and encourages investors to rely on such investments.

- Due to the volume of high free floats, manipulation becomes difficult for seamsters and individuals looking to defraud the system.

- High float shares attract investors with a medium to low-risk appetite who prefer to gain stable long-term returns rather than short-term unpredictable profits.

- However, a low number of restricted shares due to insider ownership can also be a cause of concern, as it might show that management is not very optimistic about the company's prospects. Therefore, a balanced float of shares is a metric that can answer multiple vital questions for the investor.

Free Float Vs Total Float

The distinctions between free float equations and total float are:

Free Float

- The free float or public float refers to the shares that investors can trade in the secondary market. Investors consider this metric when picking stocks.

- It does not include restricted shares, significant investments, or long-term holdings of the company.

- A company's high float percentage indicates less volatility and long-term stability in its stock performance.

- However, a very low public float can indicate that the business's promotors or owners need to believe in the company's future significantly.

Total Float

- A total float includes all outstanding common shares.

- It also includes the shares that the company executives hold.

- Total float provides insights into the company's significant investments and long-term holdings as well.

- Total float is the complete picture of the company's outstanding shares.