Table Of Contents

What is Free Cash Flow from EBITDA?

To calculate free cash flow from EBITDA, we must understand what EBITDA is. A firm's earnings are received before paying interest, taxes, depreciation, and amortization expenses. Thus,

EBITDA = Earnings + Interest + Taxes + Depreciation & Amortization

Note that the earnings used for this calculation are net profit after tax or the income statement's bottom line. So let us now look at calculating Free Cash Flow to Equity and Free Cash Flow to Firm from EBITDA.

Key Takeaways

- A firm’s earnings are the one that is received before paying interest, taxes, depreciation, and amortization expenses.

- During utilizing Free Cash Flows, one must discreetly consider capital expenditure.

- If the expenditure is more from the previous year, they are deducted from EBITDA after-tax earnings.

- The first three quantities give EBITDA change into earnings before taxes.

- Next, one must add the depreciation and amortization expense to the profits as it is non-cash. Finally, the working capital is fed to operations returns and added to the free cash flows.

Calculation of Free Cash Flows from EBITDA

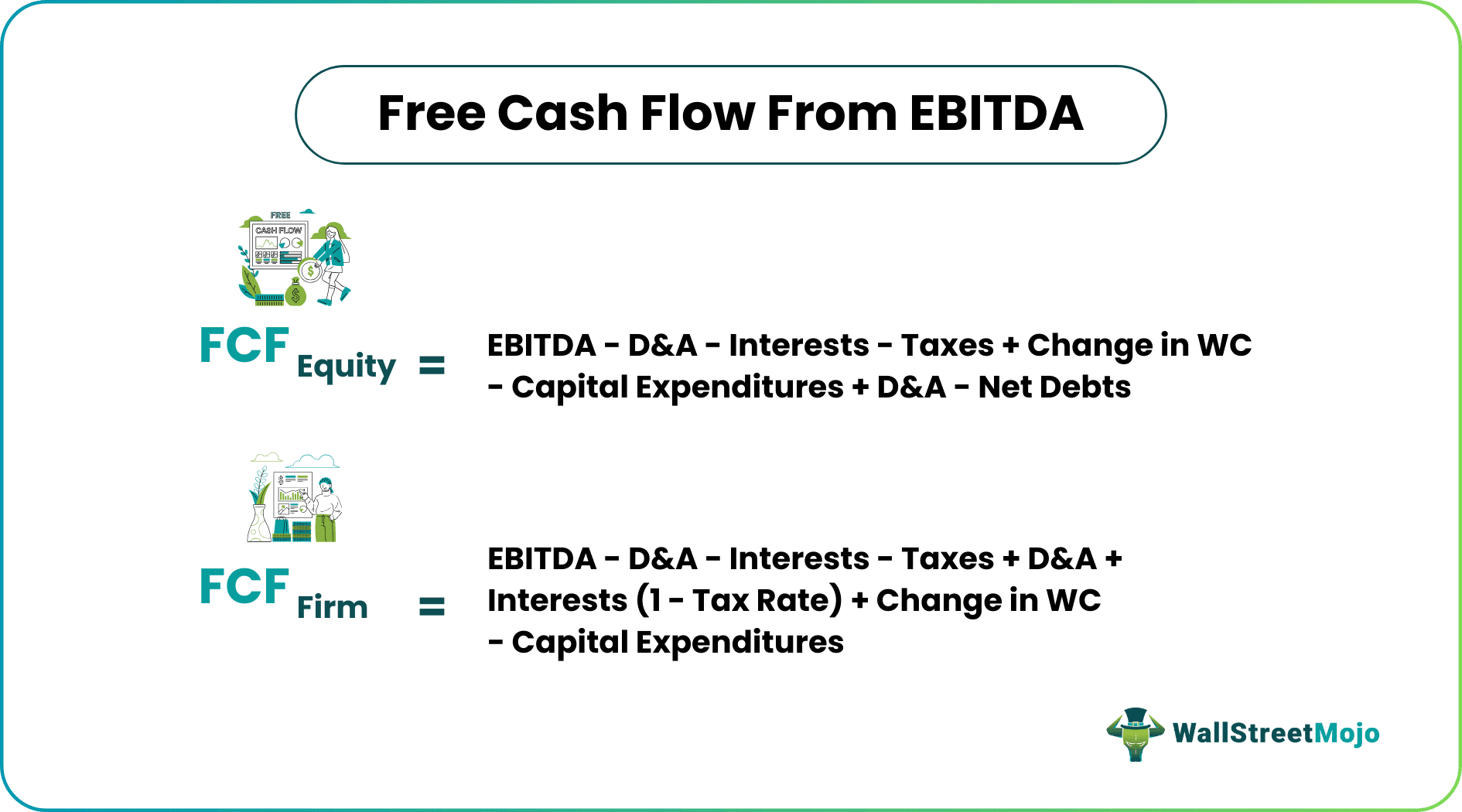

When we have EBITDA, we can arrive at the free cash flows to equity by performing the following steps: -

To arrive at free cash flow to the firm from EBITDA, we can perform the following steps:

Note: The firm's free cash flows represent the claim of debtors and shareholders after all expenses and taxes have been paid. On the other hand, free cash flows to equity assume that debtors have already been paid off.

The first three quantities make EBITDA change into Earnings before taxes. Next, we add the depreciation and amortization expense to the earnings because it is non-cash expense. Finally, the working capital initially fed to operations is eventually gained back, causing it to be added to the free cash flows.

Locating these items on the company’s financial statements is simple. On the income statement, you get interest expense and taxes. One can trace the capital expenditure from the cash flow statement, and the depreciation and amortization expense. At the same time, the changes in working capital can either be obtained from the supporting schedule of working capital or the cash flow statement. The net borrowings, being a function of issued debt and repaid debt, can be deduced from the cash flow statement.

Video Explanation Of Free Cash Flow

Examples of Free Cash Flow from EBITDA (with Excel Template)

Given below are some examples of free cash flow from EBITDA.

Example #1

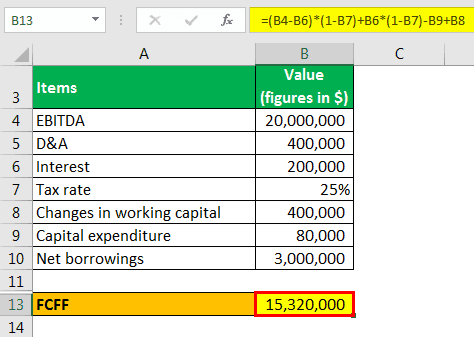

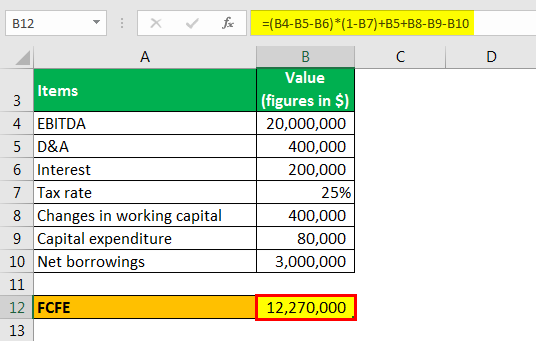

Consider a tea company with $400,000 in depreciation, amortization, and an EBITDA of $20 million. It has $3 million in net debts and pays $200,000 as interest expenses. The capital expenditure for the year is $80,000. Also, consider $400,000 to be the change in its net working capital. What are its free cash flows to equity if a tax rate of 25% is applicable?

Solution:

We should always list out the item required to be calculated in terms of given variables.

- EBITDA: $20,000,000

- D&A: $400,000

- Interest: $200,000

- Tax Rate: 25%

- Changes in working capital: $400,000

- Capital expenditure: $80,000

- Net borrowings: $3,000,000

Free Cash Flows to Equity = (EBITDA – D&A – Interest) – Taxes + D&A + Changes in Working Capital – CapEx – Net debts

When we substitute values, we get

FCFE = $12.27 million

And,

Free Cash Flows to Firm = (EBITDA – Interest) *(1 – Tax rate) + Interest*(1 – Tax rate) – Capex + Changes in Working Capital

- FCFF = $15.32 million.

Note that the free cash flows available to the common stockholders are less than those accessible before paying the debtors.

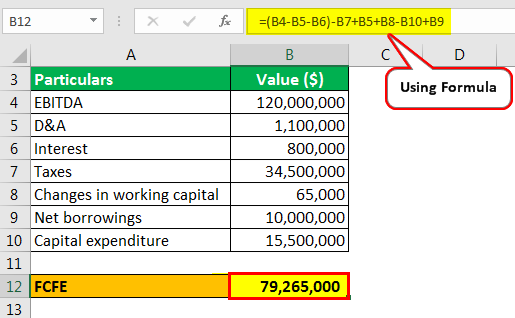

Example #2

Jim, an analyst in a sports apparel producing company, wants to calculate free cash flows to equity from the company's financial statements, an excerpt of which is provided here. Also, comment on the company's performance visible from the required calculations.

- EBITDA: $120,000,000

- D&A: $1,100,000

- Interest: $800,000

- Taxes: $34,500,000

- Changes in working capital: $65,000

- Net borrowings: $10,000,000

- Capital expenditure: $15,500,000

Solution:

In calculating free cash flows to a firm, we must start from EBITDA and subtract depreciation and amortization expense and interest to arrive at earnings before taxes, which takes the following mathematical form.

EBITDA – depreciation & amortization – Interest expense

Further, we account for the taxes and arrive at after-tax earnings represented by: -

Earnings before-taxes – taxes = After-tax earnings

In the final step, we subtract capital expenditure. Add the interest tax shield. We also add back depreciation and amortization, the non-cash part of financials, and changes in working capital.

Free Cash Flows to Equity (FCFE) from the EBITDA will be: -

Free Cash Flows to the Firm (FCFF) from the EBITDA will be: -

Some points to consider:

- In calculating free cash flows to equity from the EBITDA as the starting point, we can ignore depreciation and amortization expense in our equation as it occurs twice, canceling its effect whatsoever.

- In these calculations leading up to free cash flows, we come across an important parameter of the company's financial health, the after-tax earnings.

- When using free cash flows, one must carefully consider capital expenditure. If the expenditure has increased from the previous year, they are subtracted from EBITDA, precisely after-tax earnings.

- Net borrowings are the net effect of debt issued and debt repaid by a company. One must use this with proper conventions.

- To firms, free cash flows enjoy the benefits of tax shields on interest, whereas free cash flows to equity do not.

Example #3

Can you calculate the free cash flows to the firm and equity from the information provided below?

- EBITDA: $100

- Interest: $5

- Tax rate: 25%

- Cahnegs in working capital: $15

- Capex: $20

There are no net borrowings in the books

Solution:

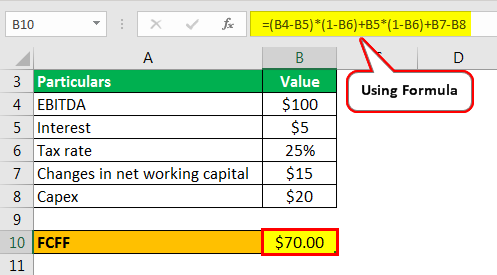

The calculation of Free Cash Flow to the Firm (FCFF) is as follows: -

- FCFF = (EBITDA - Interest)*(1-T) + Interest*(1-T) + NWC - Capex

- FCFF = (100 – 5) * (1 – 0.25) + 5 * (1 – 0.25) + 15 - 20

Note: The terms in the parentheses can be solved further as:-

- FCFF = (100 – 5 + 5) * (1 - 0.25) + 15 – 20

- = $70

The calculation of Free Cash Flow to Equity (FCFE) is as follows: -

- FCFE = (EBITDA - Interest)*(1-T) +NWC - Capex

- FCFE = (100 – 5) * (1 – 0.25) + 15 – 20

- = $66.25

The formula does not account for depreciation charges as it cancels out.

The claim of debt shareholders can be on $70 of the firm’s capital in the case of liquidation or sale. The equity shareholders have a lesser amount to claim for, $66.25.