Table Of Contents

What is the Free Cash Flow Formula (FCF)?

Free cash flow can be defined as cash in hand of a company after paying all the expenses. Cash is an important element of business. It is required for business functioning; some investors provide more to cash flow statements than other financial statements. Free cash flow is a measure of cash a company generates after paying all expenses and loans. It helps find an actual financial condition of free cash flow reflected in the cash statement. The Free Cash Flow (FCF) formula is operating cash flow minus capital expenditure.

Free Cash Flow Formula = Operating Cash Flow – Capital Expenditure

The free cash flow equation helps to find the true profitability. It also helps to calculate the dividend payout available to distribute to a shareholder. Through this, investors get clarity about the company's financial condition, which provides details about a company's liquidity.

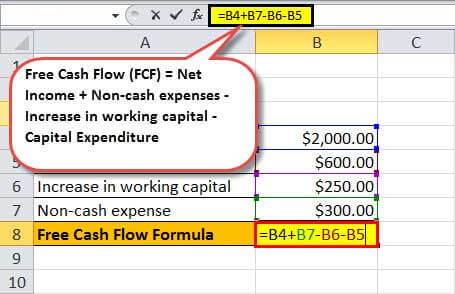

There is another formula to calculate free cash flow: net income plus non-cash expense minus the increase in working capital minus capital expenditure.

The formula for calculating Free Cash Flow (FCF) is as follows: -

Key Takeaways

- Free Cash Flow (FCF) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric.

- The formula for FCF is operating cash flow minus capital expenditure, providing insight into a company's ability to generate cash.

- FCF helps assess profitability, evaluate dividend potential, determine a company's liquidity and financial position, and make informed investment decisions.

- An alternative FCF formula is net income plus non-cash expenses minus the increase in working capital and capital expenditure, offering an additional perspective on cash flow dynamics and financial health.

Calculate FCF using Free Cash Flow Formula - Step by Step

Using the PPE approach, one can calculate capital expenditure: property, plant, and equipment. One can calculate the formula for the same, given below: -

Now, let us see the steps to calculate FCF and formula components.

To Calculate Cash from Operations and Net income

Cash from the operation is net income plus non-cash expense minus an increase in non-cash working capital.

Cash from Operations = Net income + Non-Cash Expense Increase in Non-Cash Working Capital.To Calculate Non-Cash Expense.

It is a sum of depreciation, amortization, share-based compensation, impairment charges, and gains or losses on investments.

Non-Cash Expense = Depreciation + Amortization + Stock-based compensation + Impairment Charges + Gains or losses on InvestmentsCalculate Non-Cash Net Working Capital Changes or Increases in Working Capital

One can calculate changes in working capital by comparing current year inventory, account receivable, or account payable with previous year values. They can write the formula as -

Change in Working Capital = (AR2018 - AR2017) + (Inventory2018 - Inventory2017) - (AP2018 - AP2017)

When,

AR = Account Receivable

AP = Account PayableCalculate Capital Expenditure.

Using the PPE approach, one can calculate capital expenditure: property, plant, and equipment. One can calculate the formula for the same, given below: -

CapEx = PPE2018 - PPE2017 + Depreciation + Amortization

When,

PPE = Property, Plant, and EquipmentCalculate the FCF Formula.

Now as we know, the formula for FCF is:-

Free Cash Flow (FCF) Formula = Net Income + Non-cash expenses + Increase in working capital - Capital Expenditure

Putting the value calculated in step 1 to step 4 in the above.

FCF = Net Income + Depreciation + Amortization + Stock based compensation + Impairment Charges + Gains or losses on Investments + {(AR2018 - AR2017) + (Inventory2018 - Inventory2017) - (AP2018 - AP2017)} - {PPE2018 - PPE2017 + Depreciation + Amortization}

Simply,

Free Cash Flow Formula = Cash from Operations - CapEx.

Video Explanation Of Free Cash Flow Formula (FCF)

Examples of FCF Formula (with Excel Template)

Let us see some simple to advanced examples to understand the free cash flow formula calculation better.

Example #1

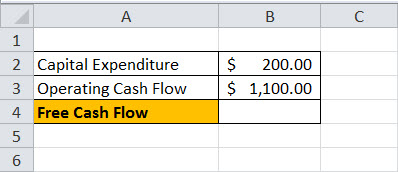

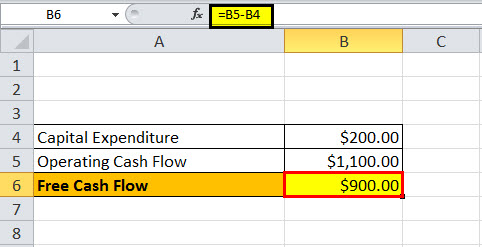

Greenfield Pvt. Ltd., which deals with organic vegetables, has a capital expenditure of $200 and an operating cash flow of $1,100. Now, calculate the free cash flow for the company.

The below-given template is the data for calculating the free cash flow equation.

So, the calculation of free cash flow will be:-

Free Cash Flow Formula = $1,100 - $200

So, Free Cash Flow will be:-

Free cash flow for Greenfield Pvt. Ltd is $900.00 after reducing capital expenditure.

Example #2

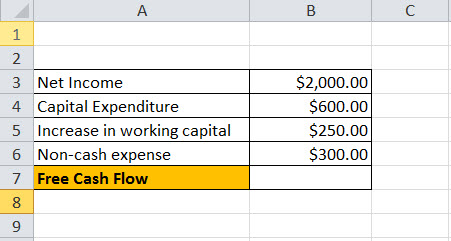

Let us see an example to calculate free cash flow with another formula.

Suppose a company with a net income of $2,000, capital expenditure of $600, non-cash expense of $300, and an increase in working capital of $250.

The below-given template is the data for calculating the free cash flow equation.

So, the calculation of free cash flow will be: -

FCF = 2000 + 300 – 250 – 600

Free Cash Flow will be: -

Free Cash Flow, i.e., FCF of a company, is $1,450.00.

Other Free Cash Flow Formulas

There are two types of free cash flow- FCFF and FCFE.

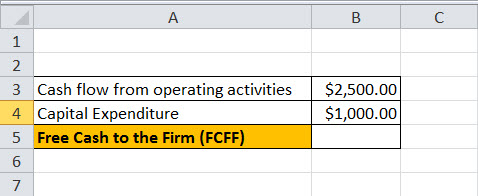

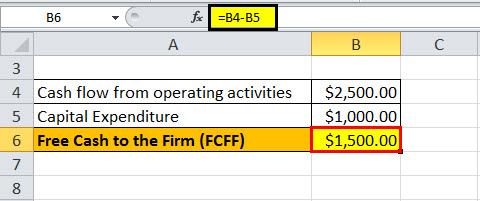

#1 - Free Cash to the Firm (FCFF) Formula

FCFF is also called unlevered. Therefore, a company can generate cash for its capital expenditure. FCFF is cash flow from operating activities minus capital expenditure.

Example of FCFF

Suppose a company with a capital expenditure of $1,000 and cash flow from operating activities is $2,500. Now, let us calculate FCFF.

The below-given template is the data for the free cash to firm calculation.

So, the calculation of FCFF will be -

FCFF = 2500 – 1000

Therefore, FCFF will be:-

So, FCFF for company is $1,500.00

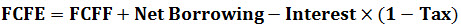

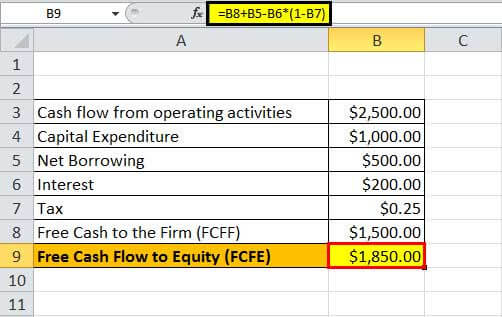

#2 - Free Cash Flow to Equity (FCFE) Formula

FCFE is cash available for a company shareholder to distribute a dividend. It helps to calculate the dividend payout available to distribute to a shareholder.

FCFE is a sum of free cash to the firm plus net borrowing minus interest multiplied by one minus tax.

Example of FCFE

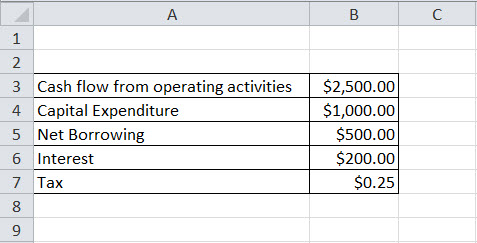

Let us take an example where a company with a capital expenditure of $1,000, net borrowing of $500 with an interest of $200, tax of 25%, and cash flow from operating activities is $2,500. Now, let us calculate FCFF.

The below-given template is the data for calculating Free Cash Flow to Equity (FCFE).

FCFF -

FCFF Formula= 2500 – 1000

FCFF = $1,500.00.

So, the calculation of FCFE will be -

FCFE Formula = 1500 + 500 – 200 * (1-.25)

Therefore, FCFE will be:-

So, FCFE for a company is $1,850.00

Relevance and Use

There are multiple uses of the free cash flow equation. They are as follows: -

- To calculate the profitability of a company.

- To get a financial position in a company.

- The free cash flow formula helps a company decide on new products, debt, and business opportunities.

- The free cash flow formula helps to know the cash available, which has to be distributed among company shareholders.

Suppose the FCF of a company is high. It means a company has sufficient funds for a new product launch, business expansion, and growth. Still, sometimes if a company has a low FCF, it may be possible to have a huge investment, and the company may grow in the long run. That is because FCF helps an investor to calculate their profitable returns on investment in a particular company.