Table Of Contents

What Are Franking Credits?

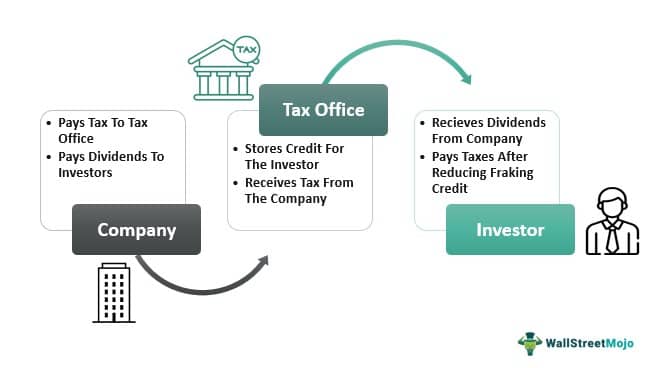

The franking credit is essentially a tax that is being paid by the companies or corporations before distributing the dividend payments, so the shareholders receive a tax credit and they depend on their tax structure they can get a refund or proportionate reduction in their income taxes.

Franking credit refund also helps to avoid double taxation as the companies already pay the taxes before distributing the dividend. The investors can benefit from reducing their taxable income as the company has already paid the taxes on their behalf. Moreover, the investors might also be entitled to a refund or a rebate depending on their eligibility.

Franking Credit Explained

Franking credits promote long-term equity investment, since the shareholders get the leverage of such credits and dividends it encourages them to invest in the company for the long term in equity, and in turn, the company can use those funds for further expansion.

It was developed way back in 1987 and is very familiar in the Australian tax system. This concept is also known as imputation credit, the company distributes profits as dividends among the shareholders, and the profit is taxable, so the company pays the taxes beforehand, and shareholders receive a tax rebate if the individual tax rate differs from the company.

The dividends distributed are known as Franked dividends, and there is Franked credit attached to the dividends. Since it depends on the individual tax rate, it reduces with the increase in the individual tax rate—the higher the individual tax rate lesser the franking credits and vice versa. Then there is another concept known as the Holding period, which means that the shareholders must hold the shares for a minimum amount of time to get the franking credit refund assigned to them.

Formula

The franking credit depends on the individual tax rate and differs from person to person; however, we have a standard formula for the franking credit calculator, which helps to understand the tax rebate amount.

Franking Credits = (Dividend Amount / (1-Company Tax rate)) – Dividend amount

- Here, the Dividend amount is the amount paid by the company as dividends.

- The company tax rate refers to the rate which the company is entitled to pay as per the tax bracket.

- So, first, when we divide the Dividend amount by (1- Company tax rate), we get the pre-tax dividend. Then, in the second part of the calculation, when we subtract the dividend amount, we finally get the Franking Credits for any individual.

How to Calculate?

Not being dependent on anyone to calculate taxes or refunds is a feeling of power for most taxpayers. To attain that position of power, it is important to understand how to calculate using the franking credit calculator. The three major steps are discussed below.

- Step 1: The company pays out the dividend in the first stage, as the dividends are paid from the profits tax has been already paid by the company as per their tax bracket.

- Step 2: The individual tax rate and the company tax rate may not be the same, so depending on the difference, the shareholder receives franking credit.

- Step 3: The individual shareholder can claim those credits while filing his individual tax in the form of a tax refund or reduction in his income tax amount.

Process

Tax filing and maintaining personal accounts is by far the most stressful task for the majority of the population in any country. Let us understand the process of franking credit calculator to make the stressful task significantly simpler through the discussion below.

- Dividends are a form of profits, and profits are taxable as per the taxation system under the head of corporate tax, and the corporate tax rate is higher than the individual tax rate.

- So, when the company, for instance, pays 30% taxes on dividends and distributes them among the shareholders.

- However, the shareholder’s individual tax rate is 20%, so the difference is 10%, which comes to the shareholders in the form of franking credits.

- The exact amount to be received can be calculated using the formula we discussed above; the refundable amount can be defined as a tax rebate or imputation credits.

Examples

Let us understand the concept of franking credit refund in depth with the help of a couple of examples.

Example #1

Martin lives in Sydney and has a diversified portfolio into equities and bonds, but all the investments are domestic, meaning all are Australian companies. Out of the many companies, Martin has invested in Kookaburra, which is an Australian sports company that manufactures cricket equipment like gloves, pads, helmets, bats, and so on. Kookaburra earned handsome profits in the year 2019 and decided to distribute a portion of it amongst the shareholders in the form of dividends. Since Martin is a shareholder, he receives an AUD 700 as dividends after the tax paid by Kookaburra of 30%. However, Martin’s comes in the tax bracket of 15%, so the difference amount he received as Franking credits.

So, as per the calculation, Martin is entitled to pay only AUD 150 as his taxes on dividend. However, the company has paid AUD 300. Hence, the company gives Martin Franking credit of AUD 300. Martin can claim those credits after deducting his individual taxes of AUD 150; in this way, he can either get a tax refund of AUD 150 or get that deducted in his personal income tax amount.

Example #2

In March 2023, the Albanese government hinted that franking credit refunds might be discontinued. The government had received the support of the coalition and crossbench senators.

This proposal is estimated to save roughly $600 million in the budget over the next four years by curtailing franking credits through buybacks and raising capital.

Experts and analysts claim that this move will ultimately affect the investor who does not have any control over the company’s functioning or the government’s rules. As a result, serious demotivation from the end of retail investors can be expected if these rules are implemented.

Advantages

Let us understand the advantages from the perspective of taxpayers, companies, and the economy at large as a result of using a franking credit calculator through the discussion below.

- Out of many advantages, what the Australian government found most beneficial is to avoid double taxation. If the company has already paid taxes on the dividends, then there is no need for any shareholder to pay the same.

- Also, it creates uniformity to distribute genuine returns among the shareholders so that nobody pays more than their tax bracket.

- Lastly, it encourages long-term investment with the clause of the holding period, which motivates the shareholder for positive returns in the long run.